Mystery Audits in Muscat: Strategic Insights for SMEs and Business Owners

Understanding Mystery Audits in Muscat

Definition and Purpose

Mystery audits in Muscat refer to a specialized form of audit where an independent party examines specific aspects of a business’s operations, financial controls, or compliance without prior notice or detailed disclosure to the company’s management. Unlike traditional scheduled audits, these are designed to assess the integrity of financial reporting, internal controls, or adherence to regulatory requirements in real-time and under natural operating conditions. For SMEs and entrepreneurs in Muscat, mystery audits can serve as a powerful tool to detect fraud, evaluate operational efficiency, and ensure compliance with Oman’s evolving tax and corporate regulations. These audits are not routine but triggered by specific concerns, irregularities, or strategic decisions. Understanding when mystery audits are appropriate helps business leaders maintain transparency and mitigate potential risks before they escalate.

When Mystery Audits Are Recommended for Muscat SMEs

Mystery audits are most beneficial in situations where there is suspicion of financial misreporting, inconsistent operational practices, or potential non-compliance with Oman’s VAT and corporate tax laws. SMEs operating in Muscat may face complex regulatory environments that require rigorous internal checks, especially if they handle cash-intensive operations or have a history of control weaknesses. Business owners should consider mystery audits if they observe unexplained discrepancies in financial records, receive complaints regarding unethical practices, or plan to undergo external due diligence for mergers, acquisitions, or financing. Additionally, these audits help verify the reliability of internal control systems, providing reassurance to stakeholders and business partners. By implementing a mystery audit, companies can proactively identify vulnerabilities that might not be evident during standard audit procedures.

The Unique Benefits of Mystery Audits for Muscat Entrepreneurs

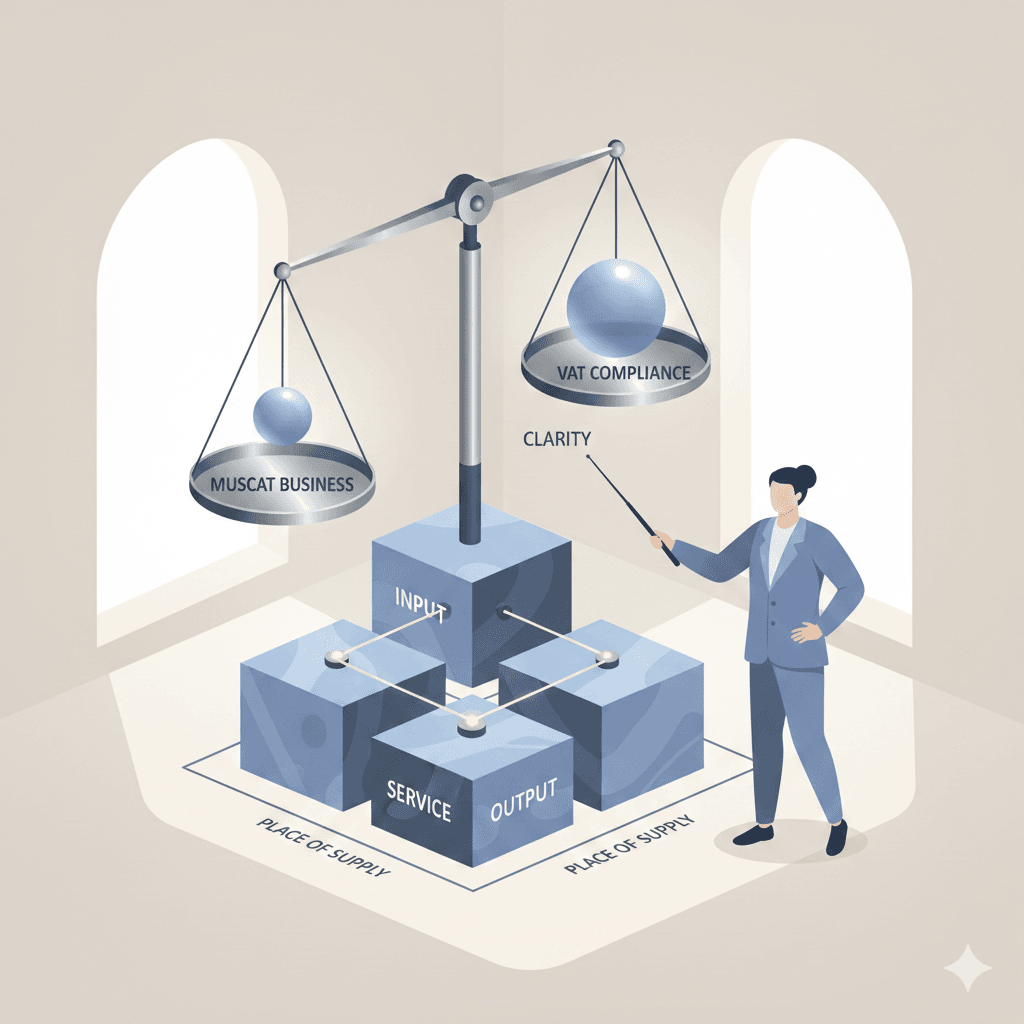

Mystery audits offer several advantages tailored to the local business environment in Muscat. Firstly, they create an authentic snapshot of daily operations, free from the influence of pre-audit preparations, revealing hidden inefficiencies or fraud risks. Secondly, these audits foster a culture of accountability and continuous improvement, encouraging employees to adhere to compliance and ethical standards consistently. Thirdly, they provide concrete evidence to support tax filings, minimizing the risk of penalties from Omani tax authorities. For entrepreneurs, this means gaining clarity on areas requiring process enhancements or compliance adjustments, ultimately strengthening business sustainability. The insights gained from mystery audits align naturally with Leaderly’s advisory expertise, guiding SMEs through complex regulatory landscapes and enhancing their financial integrity.

Common Findings and Revelations from Mystery Audits in Muscat

Mystery audits often uncover patterns that traditional audits might miss. In Muscat SMEs, these findings can range from minor procedural lapses to significant control failures affecting financial accuracy and tax compliance. Typical revelations include undisclosed revenue streams, improper VAT application, inaccurate inventory management, or payroll discrepancies. These insights shed light on operational blind spots and help business owners understand the root causes of inconsistencies. Furthermore, mystery audits can reveal the effectiveness of staff training and adherence to internal policies, highlighting the need for targeted improvements. For finance managers, these revelations are crucial in strengthening financial reporting reliability and preparing for more formal statutory audits.

Integrating Mystery Audits with Leaderly’s Advisory Services

Leaderly’s approach to mystery audits in Muscat is not simply about uncovering problems but enabling SMEs to turn audit findings into actionable improvements. Through detailed feasibility studies and valuation advisory, Leaderly helps business owners prioritize audit findings and implement risk mitigation strategies that align with Oman’s tax and corporate frameworks. Moreover, Leaderly supports clients in preparing for regulatory scrutiny, ensuring that mystery audit outcomes feed into robust accounting practices and transparent tax submissions. This integration ensures that SMEs benefit from a seamless advisory experience where mystery audits become a proactive component of ongoing business health checks rather than reactive investigations.

Future Trends in Mystery Audits and SME Compliance in Muscat

As Oman continues to enhance its regulatory environment, including the expansion of corporate tax rules and digitization of tax filings, mystery audits will become increasingly relevant for SMEs in Muscat. Businesses can expect more frequent and sophisticated audit methodologies driven by technology, such as data analytics and AI-assisted risk detection. Staying ahead requires SMEs to invest in strengthening internal controls and financial governance. Mystery audits will evolve to become a strategic tool that not only ensures compliance but also drives operational excellence and investor confidence. Leaderly’s forward-looking advisory services position Muscat’s SMEs to adapt proactively to these changes, leveraging audit insights to foster sustainable growth and regulatory resilience.

Mystery audits in Muscat serve as a vital mechanism for uncovering hidden risks, enhancing transparency, and ensuring compliance with Oman’s dynamic business regulations. By understanding when these audits make sense and what they reveal, SME founders, business owners, and finance managers can better prepare their organizations for a complex regulatory landscape. This approach not only minimizes potential liabilities but also builds a stronger foundation for long-term business success.

Integrating mystery audits with expert advisory support transforms them from mere compliance checks into strategic tools that empower businesses to improve operational integrity and financial reporting. For SMEs in Muscat, embracing this proactive mindset around audits is essential in navigating tax, accounting, and corporate governance challenges confidently and effectively. Ultimately, mystery audits reveal more than discrepancies; they uncover opportunities for growth, trust-building, and sustainable performance in Oman’s competitive market.

#Leaderly #MysteryAuditsInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit