Mutrah Traders’ Guide: VAT Records and Cash Controls for Busy Shops

Understanding VAT Records for Mutrah Traders

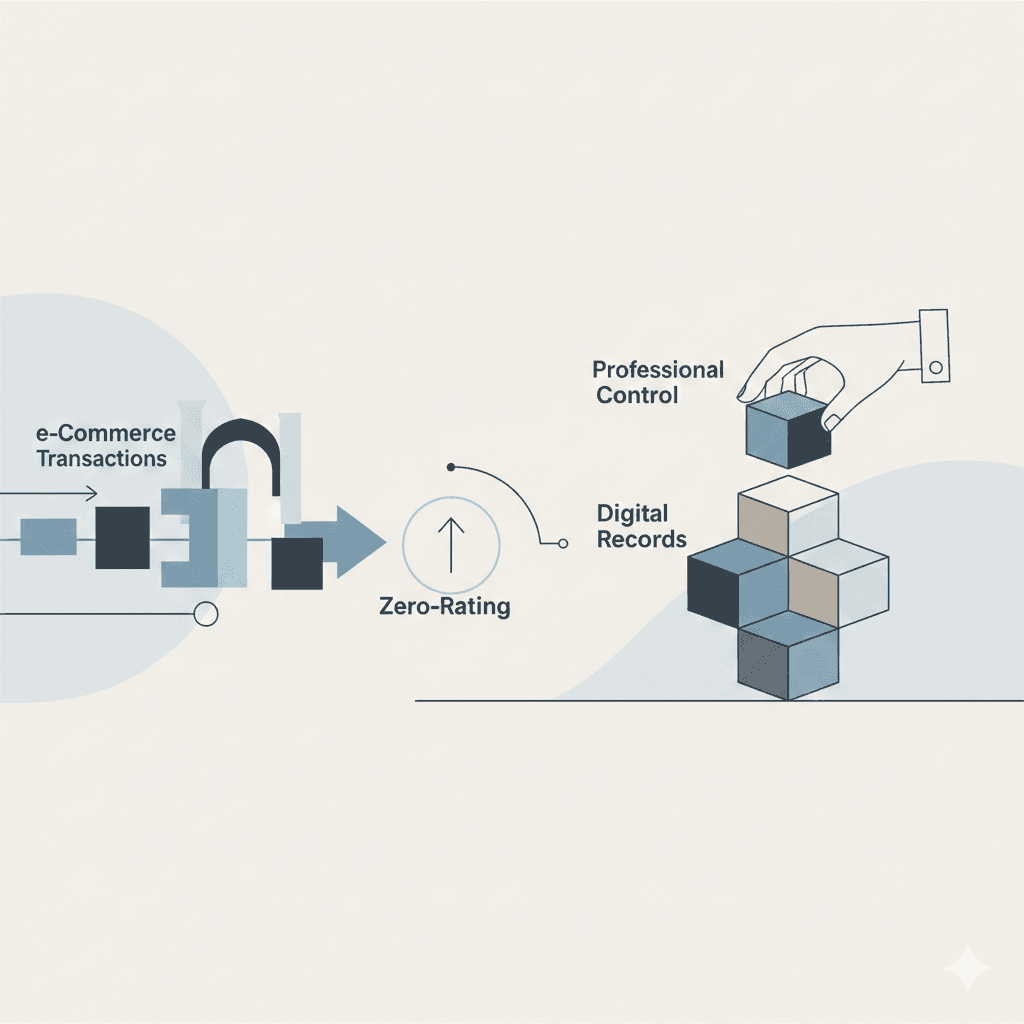

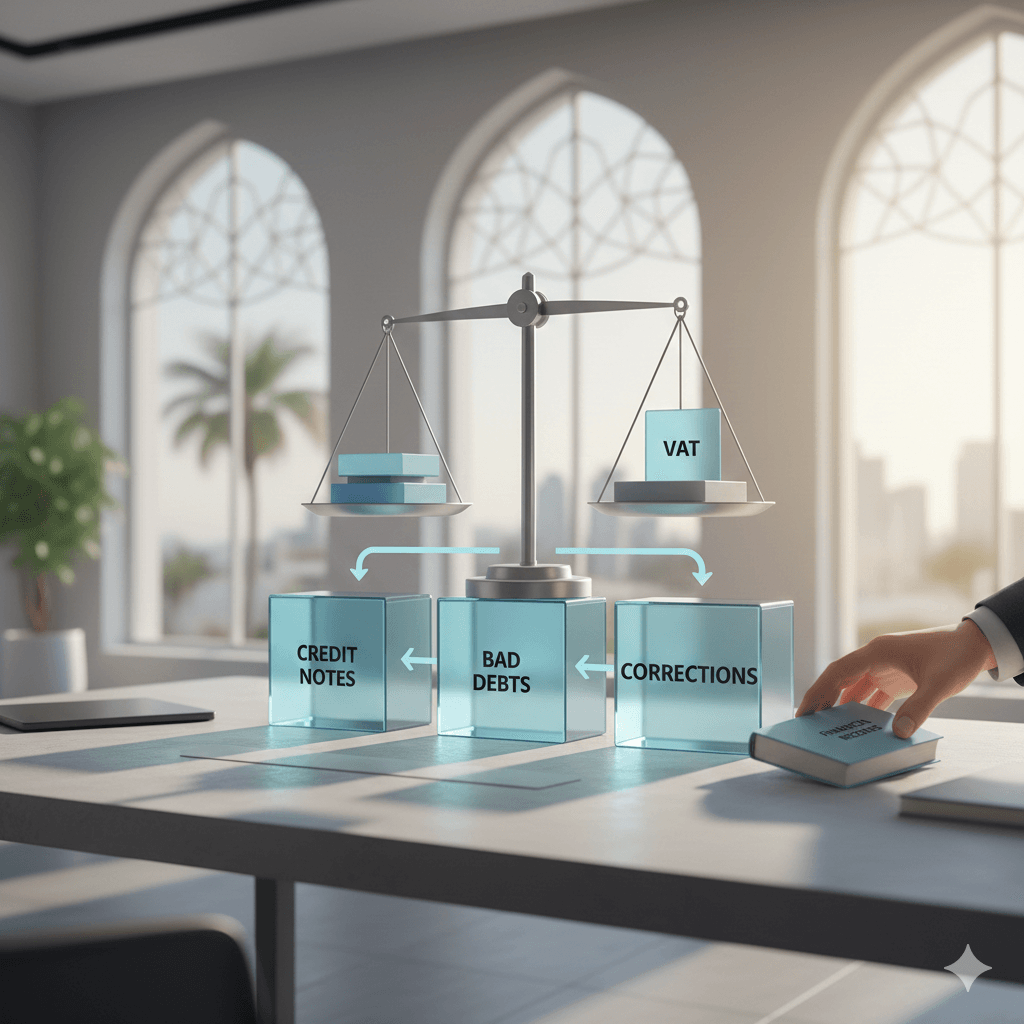

Mutrah Traders’ Guide to VAT compliance begins with one non-negotiable discipline: accurate and well-organised record-keeping. For traders operating busy shops in Mutrah, managing VAT records correctly is fundamental to meeting Oman’s tax regulations. Since VAT was introduced as part of Oman’s broader revenue-diversification strategy, businesses are required to maintain detailed documentation covering all taxable supplies and purchases. Proper records not only enable smooth and timely VAT filing but also provide essential evidence during audits or inquiries by the Oman Tax Authority (OTA). Every invoice, credit note, and receipt linked to sales and purchases must be documented, stored systematically, and kept readily accessible at all times.

The complexity of maintaining VAT records increases in fast-paced retail environments like Mutrah’s bustling marketplaces. Shops often handle numerous daily transactions, making manual record-keeping prone to errors and omissions. To counter this, traders are encouraged to use digital accounting systems designed to track VAT automatically. Such systems reduce human error, speed up the preparation of VAT returns, and improve overall financial accuracy. Besides compliance, accurate VAT records provide traders with insights into cash flow and profitability, essential for managing their businesses efficiently.

Moreover, Mutrah traders should be aware of the timeframes stipulated by Oman’s VAT law for record retention. Typically, records must be kept for at least ten years, reflecting the OTA’s right to review transactions retrospectively. Failure to retain these documents properly can lead to penalties, increased scrutiny, or even legal consequences. Therefore, developing robust internal processes for VAT record-keeping is not just a regulatory obligation but a strategic business decision, safeguarding traders from unnecessary risks while optimizing their tax management.

Implementing Effective Cash Controls in Mutrah Shops

Cash control is a critical aspect of financial management for busy shops in Mutrah, where daily cash transactions dominate. Proper cash control systems help mitigate risks such as theft, misappropriation, and errors, while ensuring all cash inflows and outflows are accurately recorded for VAT purposes. Traders must establish clear procedures for handling cash, including segregation of duties, daily cash reconciliations, and secure storage of cash in safes or lockboxes. These controls create a transparent financial environment essential for maintaining trust with customers and tax authorities alike.

Given the fast turnover and the high volume of sales in Mutrah’s retail sector, it is common for shops to face challenges such as cash shortages or overages. Implementing regular cash counts and surprise audits can significantly reduce these discrepancies. Additionally, training staff on cash handling protocols and the importance of accurate documentation supports a culture of accountability. When cash controls are integrated with electronic point-of-sale (POS) systems, shops benefit from automated tracking and reporting, which further reduces human error and provides real-time cash flow visibility.

Cash controls are also important from a VAT compliance perspective. Since VAT is charged on sales, any mismanagement of cash can lead to inaccuracies in VAT reporting, exposing traders to fines and penalties. Mutrah traders must ensure that cash sales are promptly recorded and reflected in their VAT returns, aligning with OTA requirements. Through robust cash control practices, shops not only protect their financial assets but also uphold their reputation and legal standing within Oman’s competitive commercial landscape.

Optimizing VAT Records Management for SME Growth in Mutrah

Effective management of VAT records is a cornerstone for SMEs in Mutrah aiming to scale their operations and attract investment. Well-maintained VAT documentation demonstrates financial discipline and regulatory compliance, which are critical factors for securing loans, partnerships, or government incentives. SMEs that invest in modern accounting technologies tailored for Oman’s VAT framework can streamline their bookkeeping processes and minimize costly errors or omissions. Such investments also free up time for business owners to focus on growth-oriented activities.

Leaderly’s advisory services emphasize the importance of integrating VAT compliance with broader financial management strategies. For instance, combining VAT record accuracy with periodic financial reviews allows SMEs to assess profitability and identify cost-saving opportunities. Moreover, reliable VAT data aids in preparing feasibility studies or valuations for future business expansions or restructuring. This holistic approach ensures that VAT compliance supports overall business health, not just fulfills a legal requirement.

Traders should also consider ongoing staff training to keep pace with VAT regulation updates in Oman. Changes in tax law, filing deadlines, or electronic invoicing requirements can significantly impact compliance efforts. Engaging with professional advisors or audit services helps SMEs stay informed and prepared, avoiding costly compliance gaps. In a competitive marketplace like Mutrah, sound VAT record management serves as a foundation for long-term sustainability and business resilience.

Enhancing Cash Controls to Support Financial Stability in Mutrah SMEs

Robust cash control mechanisms play a pivotal role in safeguarding the financial stability of SMEs in Mutrah’s vibrant retail sector. Financial irregularities caused by weak cash management can jeopardize not only VAT compliance but also the business’s operational continuity. By implementing standardized cash handling procedures and leveraging technology, SMEs can reduce the risks of theft or fraud and improve the accuracy of their financial reporting. This strengthens trust among stakeholders, including suppliers, customers, and tax authorities.

Leaderly advises SMEs to adopt integrated cash management solutions that align with their scale and complexity. For small shops, this might include detailed cash logs and regular reconciliations, while larger establishments may benefit from comprehensive POS systems linked to accounting software. These systems provide audit trails that are essential for due diligence and liquidation processes if needed. Such transparency is increasingly important as Omani authorities intensify their focus on financial integrity across all business sectors.

Furthermore, well-executed cash controls support VAT compliance by ensuring that all taxable transactions are recorded accurately and promptly. This alignment simplifies the VAT return process and reduces the likelihood of errors that attract penalties. Traders in Mutrah who prioritize cash control are better positioned to maintain consistent cash flow, optimize tax liabilities, and create a stable financial foundation for their SMEs amid Oman’s evolving economic landscape.

Leveraging Leaderly’s Expertise for VAT and Cash Management in Mutrah

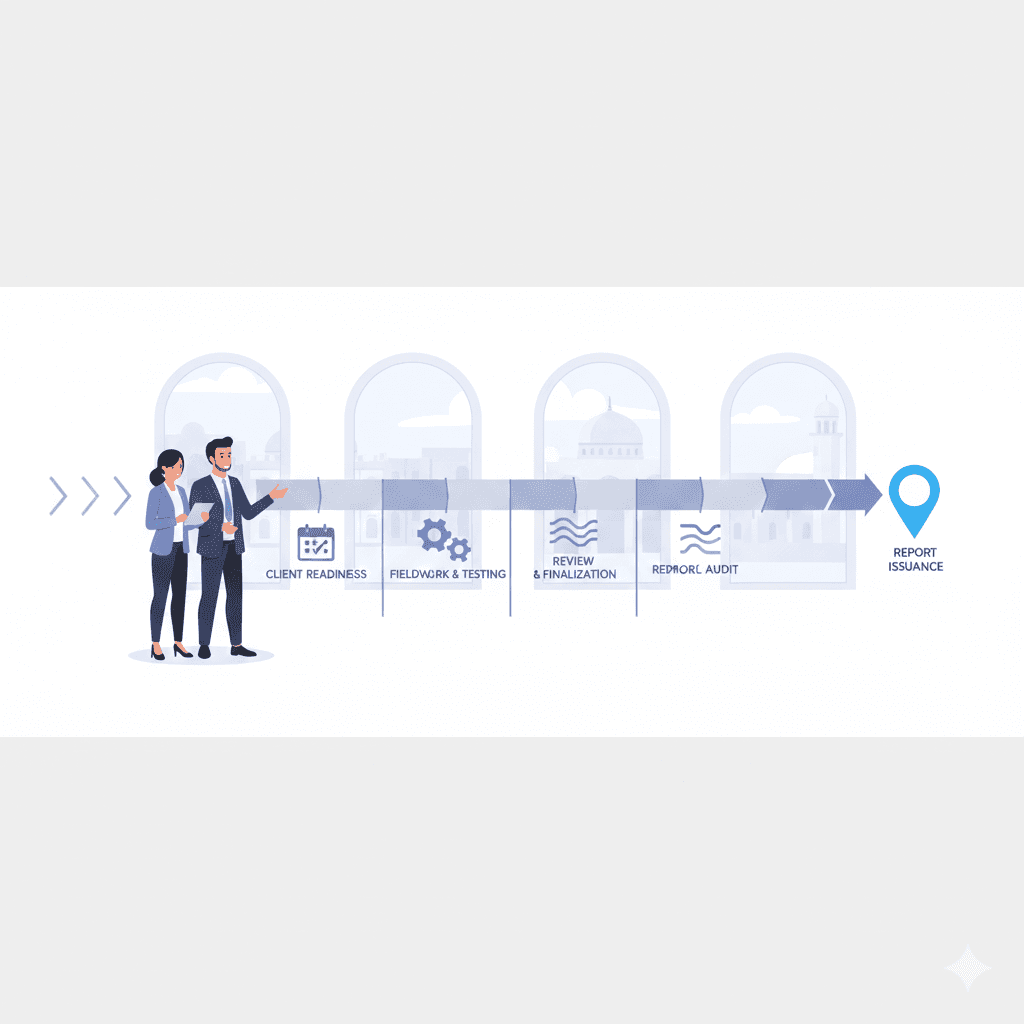

Partnering with experienced advisory and accounting professionals is invaluable for Mutrah traders seeking to enhance VAT record-keeping and cash control systems. Leaderly provides tailored services that help SMEs navigate the complexities of Oman’s tax environment, ensuring compliance while optimizing financial processes. Their audit services can identify gaps or risks in current practices and recommend actionable improvements aligned with local regulations and international best practices.

Leaderly’s tax advisory expertise is particularly useful for managing VAT obligations efficiently. From VAT registration to preparing accurate returns and handling disputes, their guidance ensures traders avoid common pitfalls. Additionally, Leaderly supports due diligence and valuation activities that depend on reliable VAT and cash records, facilitating smoother business transactions or financing arrangements. This holistic approach gives Mutrah traders confidence in their financial controls and compliance posture.

In the dynamic market of Mutrah, where busy shops face unique challenges, leveraging specialized expertise translates into practical advantages. Leaderly’s advisory services empower SMEs to build resilient financial systems that comply with VAT laws and implement effective cash controls. This partnership ultimately contributes to sustainable business growth, protecting traders from regulatory risks while enhancing operational efficiency in one of Oman’s most commercially active districts.

Conclusion

Maintaining accurate VAT records and implementing stringent cash controls are essential practices for traders operating busy shops in Mutrah. These measures not only ensure compliance with Oman’s evolving tax framework but also provide critical financial insights that support informed decision-making and long-term business success. By embracing technology, adopting clear procedures, and engaging expert advisory services like those from Leaderly, SMEs can navigate the complexities of VAT management and cash handling with confidence.

Ultimately, the integration of effective VAT record-keeping and cash control systems strengthens the financial foundation of Mutrah’s SMEs, helping them remain competitive and compliant within Oman’s dynamic commercial environment. This proactive approach mitigates risks, enhances transparency, and fosters sustainable growth, empowering business owners to focus on expanding their enterprises with clarity and assurance.

#Leaderly #MutrahTradersGuideVATRecordsAndCashControls #Oman #Muscat #SMEs #Accounting #Tax #Audit