Muscat SME audit findings and what they mean for owners and finance managers in Oman

Muscat SME audit findings linked to weak financial controls

Muscat SME audit findings often begin with weaknesses in basic financial controls, especially in owner-managed businesses that have grown faster than their internal processes. Many SMEs in Muscat rely on small finance teams or outsourced bookkeeping, which can work well initially but becomes risky as transaction volumes increase. Auditors frequently encounter situations where the same individual is responsible for recording transactions, approving payments, and reconciling bank accounts. While this setup may feel efficient, it increases the likelihood of undetected errors and exposes the business to misuse of funds. In Oman’s increasingly regulated business environment, such gaps are no longer considered minor operational issues but material risks that affect the credibility of financial statements.

Another recurring theme within Muscat SME audit findings is the lack of documented procedures. Many businesses operate based on verbal instructions or long-standing habits rather than written policies. This creates inconsistencies in how expenses are approved, how revenue is recognised, and how supplier invoices are processed. During an audit, these inconsistencies make it difficult to demonstrate that transactions are treated consistently from one period to another. For SME owners, this can be surprising, as the business may appear profitable and stable on the surface, yet still fail to meet audit expectations.

From a practical perspective, these findings highlight the need for SMEs to view controls as enablers rather than obstacles. Strong controls help owners maintain visibility over cash flow, prevent disputes with partners, and build trust with banks and investors. Leaderly often advises Muscat-based SMEs to strengthen controls gradually, aligning them with business size rather than copying large corporate structures. This balanced approach reduces audit adjustments while supporting sustainable growth.

Muscat SME audit findings around record accuracy and documentation

Muscat SME audit findings frequently point to inaccuracies in accounting records caused by incomplete or poorly maintained documentation. In many SMEs, invoices, contracts, and delivery notes are scattered across emails, personal folders, or messaging apps. When auditors request evidence to support reported figures, finance teams struggle to retrieve consistent records. This issue is particularly visible in revenue recognition, where timing differences and missing contracts lead to adjustments that affect reported profits. For non-accountants, this can feel technical, but the underlying issue is simple: if a transaction cannot be supported, it cannot be relied upon.

Expense recording is another area where Muscat SME audit findings reveal common weaknesses. Personal and business expenses are often mixed, especially in family-owned enterprises. While this may seem harmless internally, auditors must assess whether expenses are genuinely related to business activities. Unsupported or misclassified expenses raise questions about governance and can trigger further scrutiny, including from tax authorities. In Oman, where VAT and corporate tax compliance are becoming more structured, these issues can extend beyond the audit itself.

Addressing documentation issues does not require complex systems. What auditors expect is consistency, traceability, and reasonable judgment. SMEs that invest time in organising records and training staff to understand why documentation matters tend to experience smoother audits. Advisory support from firms like Leaderly helps translate audit feedback into practical improvements, ensuring that record accuracy supports both compliance and decision-making.

Muscat SME audit findings related to VAT and corporate tax exposure

Muscat SME audit findings increasingly highlight VAT and corporate tax exposures, reflecting the evolving regulatory landscape in Oman. Many SMEs initially registered for VAT without fully understanding the operational impact. Auditors often identify incorrect VAT treatments, such as misclassified zero-rated supplies or unclaimed input VAT due to missing tax invoices. These issues may not appear significant individually, but over time they accumulate into material misstatements that require correction during the audit process.

Corporate tax considerations are also becoming more prominent in Muscat SME audit findings. As Oman strengthens its tax framework, auditors pay closer attention to provisions, related-party transactions, and the consistency between financial statements and tax filings. SMEs sometimes underestimate the importance of aligning accounting profit with taxable profit, leading to unexpected adjustments. These findings are not about penalising businesses but about ensuring that financial reporting reflects economic reality.

For SME owners, audit feedback in this area should be seen as an early warning system. Identifying tax-related issues during an audit allows businesses to correct processes before they escalate into disputes or penalties. Leaderly’s integrated approach to audit and taxation enables Muscat SMEs to address compliance holistically, reducing uncertainty and improving confidence when dealing with regulators.

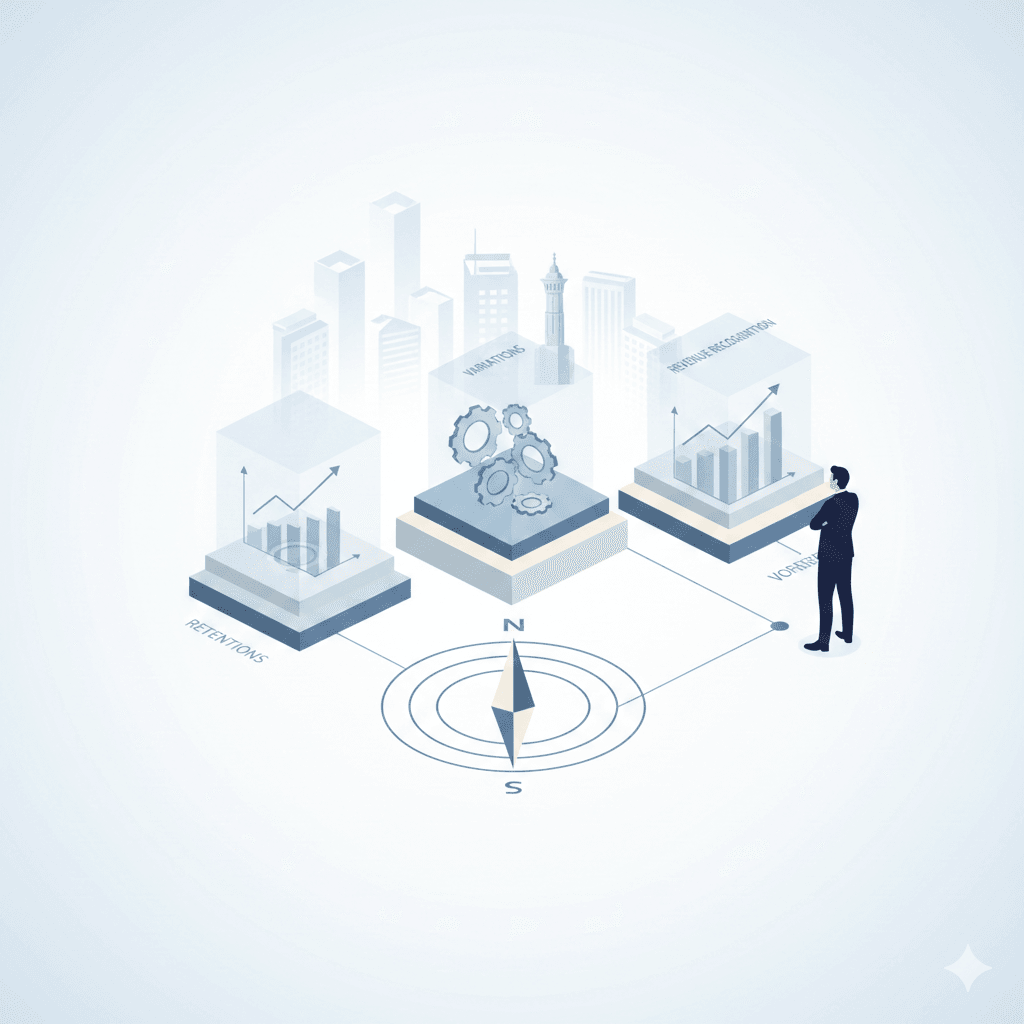

Muscat SME audit findings exposing cash flow and going concern risks

Muscat SME audit findings often reveal deeper concerns related to cash flow management and the business’s ability to continue operating smoothly. Auditors assess whether a company can meet its obligations over the next twelve months, a concept known as going concern. In Muscat, many SMEs operate on tight margins and depend heavily on a small number of customers. Delayed receivables, extended credit terms, or reliance on short-term financing frequently appear in audit observations.

These findings are not judgments on business viability but indicators of areas requiring attention. Auditors may highlight inconsistencies between reported profits and actual cash inflows, raising questions about sustainability. For example, a profitable SME may still struggle to pay suppliers on time due to weak collection processes. Such issues become visible during audits because financial statements must reflect not only performance but also financial resilience.

Responding to these findings requires more than accounting adjustments. SMEs benefit from advisory insights that connect financial data with operational decisions. Cash flow forecasting, customer credit policies, and realistic budgeting are practical tools that address audit concerns while supporting growth. In Muscat’s competitive market, SMEs that proactively manage cash flow are better positioned to withstand economic shifts.

Muscat SME audit findings on governance and owner oversight

Muscat SME audit findings frequently point to governance challenges, especially in businesses where owners are deeply involved in daily operations. While hands-on leadership can be a strength, it sometimes leads to blurred boundaries between management oversight and execution. Auditors may note the absence of independent review, formal approvals, or clear accountability structures. These observations are not criticisms of leadership style but reflections of risk exposure as the business scales.

Related-party transactions are a common focus within these findings. Loans to directors, advances from shareholders, or transactions with related entities must be properly disclosed and supported. In Oman, transparency in such matters is increasingly important for maintaining credibility with banks, investors, and regulators. Auditors assess whether these transactions are conducted on reasonable terms and accurately reflected in the financial statements.

Improving governance does not require complex boards or committees. Simple measures, such as periodic financial reviews and documented approvals, can significantly reduce audit issues. Leaderly often works with SME owners to design governance practices that respect entrepreneurial agility while meeting professional standards expected in Muscat’s business environment.

Muscat SME audit findings as a roadmap for improvement

Muscat SME audit findings should ultimately be viewed as a roadmap rather than a report card. Each observation highlights an area where the business can strengthen its foundation. SMEs that treat audits as compliance exercises often miss this opportunity. In contrast, those that engage with findings constructively use them to improve controls, clarify financial performance, and support strategic planning.

Auditors are required to remain independent, but their insights can still inform better decision-making. When combined with advisory support, audit findings translate into actionable steps aligned with business goals. This is particularly valuable for Muscat SMEs preparing for expansion, financing, or ownership changes, where reliable financial information is critical.

By addressing common issues identified in Muscat SME audit findings, businesses not only reduce future audit adjustments but also enhance trust with stakeholders. This trust underpins sustainable growth and positions SMEs to navigate Oman’s evolving regulatory and economic landscape with confidence.

The practical value of understanding audit findings lies in recognising that they reflect how a business operates, not just how it reports numbers. For Muscat SMEs, recurring issues around controls, documentation, tax compliance, and cash flow signal areas where attention can unlock resilience and clarity. When owners and finance managers engage with these insights, audits become part of a broader financial discipline rather than an annual disruption.

As Oman’s business environment matures, SMEs that respond proactively to audit feedback will stand out for their reliability and professionalism. With informed guidance and a clear focus on improvement, audit findings become tools for strengthening decision-making and long-term value, reinforcing confidence among partners, regulators, and the business community.

#Leaderly #MuscatSMEauditfindings #Oman #Muscat #SMEs #Accounting #Tax #Audit