Muscat Receivables: Effective Strategies to Manage Late Payments While Preserving Client Relationships

Understanding the Impact of Late Payments on Muscat Receivables

Cash Flow Challenges in Omani SMEs

Late payments present a critical challenge for businesses managing Muscat receivables, especially SMEs operating in Oman’s dynamic market environment. When customers delay payments, the business experiences interruptions in cash flow, which can hamper daily operations and limit the capacity for growth or reinvestment. For SMEs, which often operate on tighter margins and limited capital reserves, these delays can escalate quickly into liquidity crises. Beyond the financial impact, late payments can strain internal processes and force management to divert valuable time and resources toward chasing receivables rather than focusing on core activities. Understanding the unique payment behaviors in Muscat’s market and adapting credit control policies accordingly is vital to safeguarding your company’s financial health without damaging essential client relationships.

The Legal and Cultural Context Surrounding Muscat Receivables

Balancing Compliance and Relationship Management

In Oman, late payments are not only a business inconvenience but also a regulatory concern under evolving tax and corporate frameworks. With the introduction of VAT and corporate tax compliance, transparent and timely invoicing and collections have gained added importance. However, Omani business culture highly values personal relationships and trust, making aggressive debt collection practices counterproductive. Navigating this environment requires a nuanced approach that respects local customs while enforcing credit terms firmly. Adhering to legal requirements related to receivables and payment timelines, while maintaining open communication channels with clients, is key to minimizing disputes and fostering long-term partnerships. SMEs that strike this balance effectively position themselves as reliable, professional, and considerate business partners in Muscat’s competitive marketplace.

Establishing Clear Payment Terms for Effective Muscat Receivables Management

Setting Expectations Upfront

A fundamental step in reducing late payments within Muscat receivables is the establishment of clear, unambiguous payment terms before the commencement of any contract or transaction. This includes specifying payment due dates, accepted payment methods, and consequences of late payments. SMEs should ensure that these terms are communicated in writing and agreed upon by all parties, ideally integrated into contracts or purchase orders. Transparent terms reduce misunderstandings and provide a basis for consistent follow-up. Moreover, leaders in Oman’s SME community can benefit from tailoring payment terms to align with industry standards while considering the cash flow cycles of their customers, which often vary. This practical foresight creates a mutual understanding and enhances the likelihood of timely payments, setting a professional tone that supports sustained business relationships.

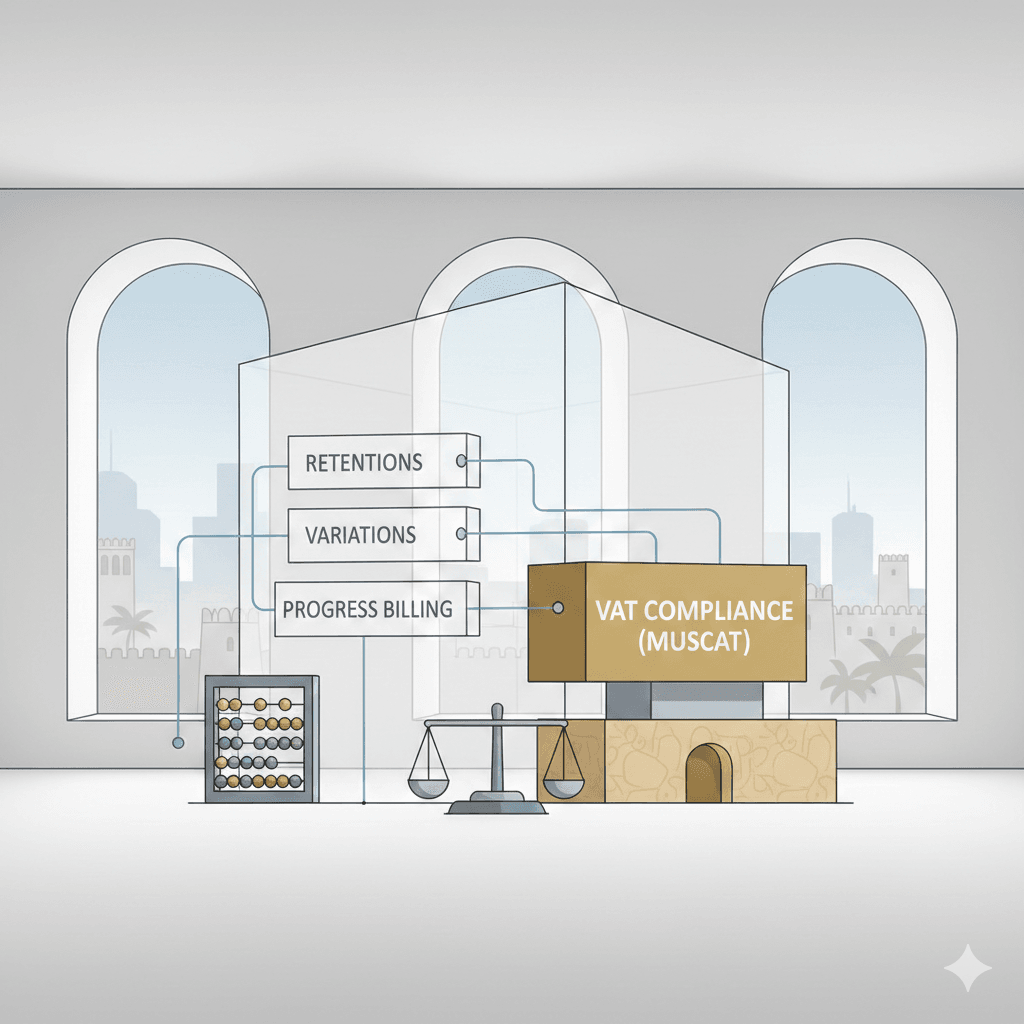

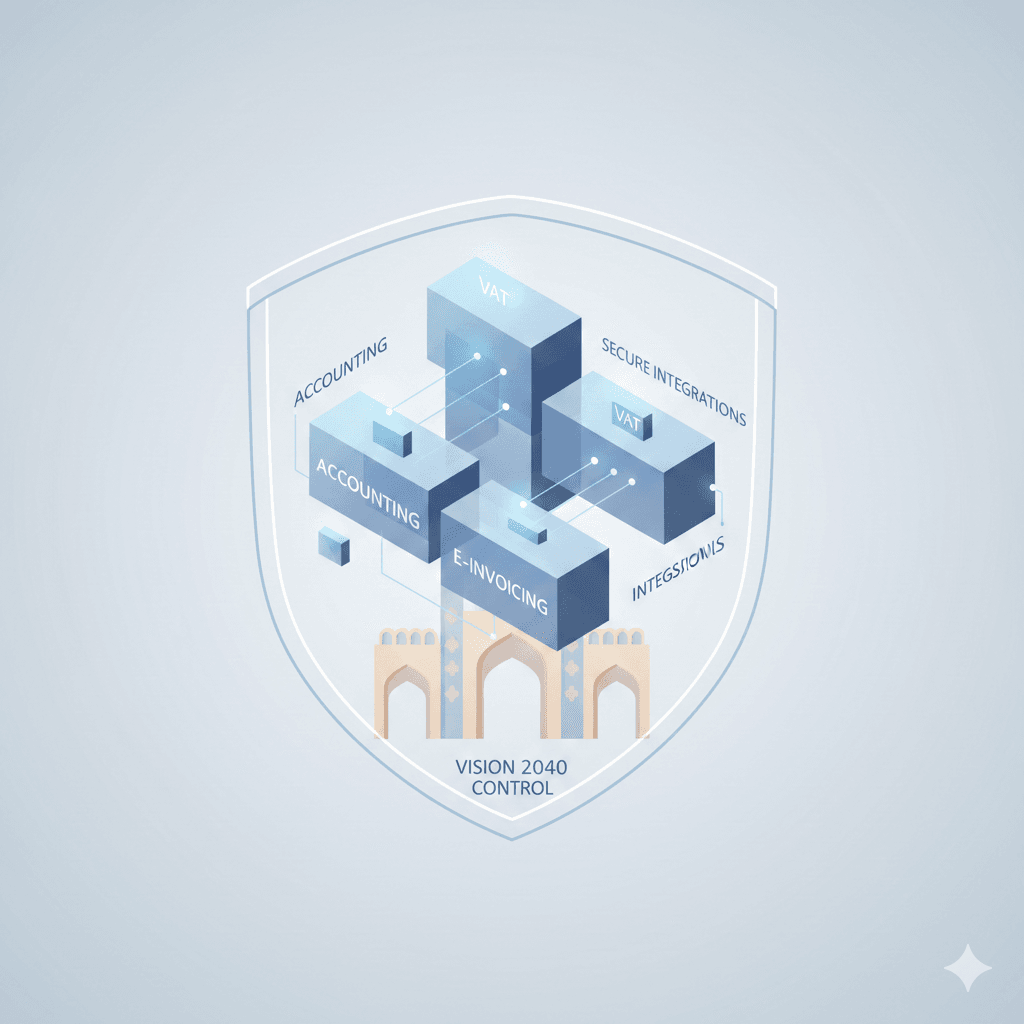

Leveraging Technology to Streamline Receivables in Muscat

Automation Tools to Improve Payment Timeliness

Modern financial management software and cloud-based solutions are increasingly accessible to SMEs in Muscat, offering powerful tools to reduce the incidence of late payments. Automated invoicing, payment reminders, and real-time tracking of receivables can greatly improve the efficiency and accuracy of credit control processes. These technologies help businesses maintain visibility over outstanding amounts and proactively engage clients before payments become overdue. Furthermore, integration with accounting and taxation systems ensures that financial records remain compliant with Oman’s VAT and corporate tax regulations. The use of technology aligns well with advisory services that help Muscat businesses evaluate the feasibility and benefits of digital transformation in their financial operations, ultimately promoting a healthier cash flow and more predictable financial planning.

Building Collaborative Client Relationships to Mitigate Late Payments

Communication as a Preventative Strategy

Successful management of Muscat receivables goes beyond enforcing terms; it requires cultivating a collaborative dialogue with clients. Open, respectful communication fosters trust and enables businesses to identify potential payment issues early. In Muscat’s SME landscape, this human-centered approach is critical, as clients often appreciate flexibility and transparency in resolving payment difficulties. Finance managers and business owners should proactively discuss payment schedules and offer reasonable alternatives when clients face temporary cash flow problems. This approach not only reduces the risk of strained relationships but also enhances customer loyalty and reputation in the local business community. Maintaining a balance between assertiveness and understanding is an essential skill for SMEs aiming to reduce late payments without jeopardizing future business opportunities.

Implementing Incentives and Penalties to Encourage Timely Payments

Motivating Prompt Settlements with Fair Policies

Another effective tactic within Muscat receivables management involves introducing well-structured incentives and penalties linked to payment timeliness. Offering early payment discounts can motivate clients to prioritize your invoices, improving cash flow predictability. Conversely, applying reasonable late payment fees—clearly outlined in contracts—signals the importance of adhering to agreed terms. SMEs must ensure these policies comply with Omani regulations and are communicated transparently to avoid misunderstandings. Such financial motivators are best combined with respectful negotiation to preserve business goodwill. When thoughtfully designed, incentive and penalty schemes help align client behavior with your company’s financial goals, ensuring that receivables are managed more effectively and relationships remain constructive.

Conclusion

Managing Muscat receivables effectively requires a combination of strategic foresight, cultural sensitivity, and practical financial controls. SMEs and business owners operating in Oman benefit from clear payment terms, the adoption of modern financial technology, and communication strategies that prioritize relationship-building alongside firm credit control. Balancing legal compliance with an understanding of local business practices helps reduce late payments without compromising client trust.

By implementing incentives and maintaining open dialogue, businesses can foster a payment culture that supports healthy cash flow and operational stability. Ultimately, a proactive, respectful approach to receivables management strengthens both the financial foundation and reputation of SMEs in Muscat, positioning them for sustainable success in a competitive marketplace.

#Leaderly #MuscatReceivables #Oman #Muscat #SMEs #Accounting #Tax #Audit