Why a Muscat monthly bookkeeping close checklist is the missing control in many growing businesses

Understanding why month-end discipline matters in Muscat businesses

In many small and medium-sized businesses across Muscat, bookkeeping is treated as a background task rather than a core management control. Transactions are recorded, invoices are filed, and bank statements are downloaded, but the process often stops there. What is missing is a disciplined monthly close that converts raw data into reliable financial information. A proper close is not about perfection; it is about consistency and decision readiness. In Oman’s regulatory environment, where VAT filings, supplier documentation, and cash flow discipline matter, informal bookkeeping creates blind spots that only surface when problems become expensive. Business owners often believe they understand their numbers because sales are growing or cash is moving, yet without a structured close, they are relying on assumptions rather than evidence. The monthly close acts as a pause button, forcing the business to reconcile activity, validate balances, and confirm that financial records reflect reality. This is particularly critical in Muscat, where SMEs frequently juggle multiple revenue streams, extended payment terms, and cross-border suppliers. A working close process turns bookkeeping from a compliance task into a management tool that supports pricing, hiring, and expansion decisions with confidence.

Defining what “closed books” actually mean for SMEs

Moving beyond data entry to financial clarity

Many finance managers and founders use the phrase “the books are closed” without a shared understanding of what that means. In practical terms, closed books mean that all transactions for the month have been recorded, reviewed, and validated, and that the balances make sense in the context of the business. This includes reconciling bank and cash accounts, confirming that customer invoices and supplier bills are complete, and ensuring that VAT entries align with Omani regulations. For Muscat-based SMEs, this clarity is essential because delayed corrections often spill into later months, distorting trends and making tax reporting more complex. Closed books also mean that management reports can be trusted. When profit figures fluctuate unexpectedly or expenses seem inconsistent, the issue is often not performance but incomplete closing. By defining closure as a checklist-driven process rather than a vague endpoint, businesses reduce dependency on individual staff memory and create resilience. This approach is especially valuable for owner-managed companies, where founders need clear numbers without spending hours reviewing transaction-level detail every month.

How a Muscat monthly bookkeeping close checklist supports smarter decisions

A well-designed Muscat monthly bookkeeping close checklist does more than tidy up accounts; it creates a rhythm of review that improves decision quality. When financials are closed within a defined timeframe, management discussions shift from guesswork to analysis. Cash flow projections become more accurate because receivables and payables are current. Margin discussions become meaningful because costs are matched to the correct period. This is particularly important in Muscat’s competitive SME landscape, where small pricing or cost-control decisions can significantly affect profitability. The checklist approach also supports accountability. Tasks are completed in sequence, reviewed, and signed off, reducing the risk of missed entries or duplicated work. Over time, this consistency builds historical data that can be used for feasibility studies, valuation discussions, or due diligence preparation. Rather than scrambling to assemble information when an opportunity or audit arises, businesses with a disciplined close are always ready. This readiness is often what differentiates stable, scalable SMEs from those that remain operationally busy but financially unclear.

Structuring a practical close process that fits Muscat SMEs

The most effective close processes are designed around the realities of the business, not copied from large corporate templates. For Muscat SMEs, this means acknowledging limited staff capacity, overlapping roles, and tight timelines. A practical structure starts with transaction cut-off, ensuring that all invoices, expenses, and receipts for the month are captured by a defined date. This is followed by reconciliations that confirm bank balances, petty cash, and key control accounts. The goal is not excessive documentation but confidence that balances are complete and accurate. Timing matters as well. Closing within seven to ten days after month-end allows issues to be addressed while details are still fresh. When the process is stretched across several weeks, errors multiply and accountability fades. Importantly, the structure should include a review stage, where numbers are questioned, not just accepted. This review is where finance managers or advisors add value by interpreting results and highlighting risks or anomalies relevant to the Omani business environment.

Common breakdowns and how to prevent them

Lessons from real Muscat bookkeeping challenges

In practice, most monthly close failures stem from the same issues: incomplete source documents, unclear responsibility, and last-minute adjustments. In Muscat, delayed supplier invoices and informal expense claims are frequent causes of distortion. When these items are pushed into the next month, financial results lose meaning. Prevention starts with clear internal deadlines and simple documentation standards that staff can follow. Another common breakdown is over-reliance on one individual’s knowledge. If the close depends on memory rather than process, continuity is at risk when staff change or take leave. A checklist mitigates this by making expectations explicit. It also creates a trail that supports external review, whether for VAT audits, financing discussions, or shareholder reporting. By addressing these breakdowns proactively, SMEs reduce stress at month-end and avoid the cycle of reactive corrections that undermine confidence in the numbers.

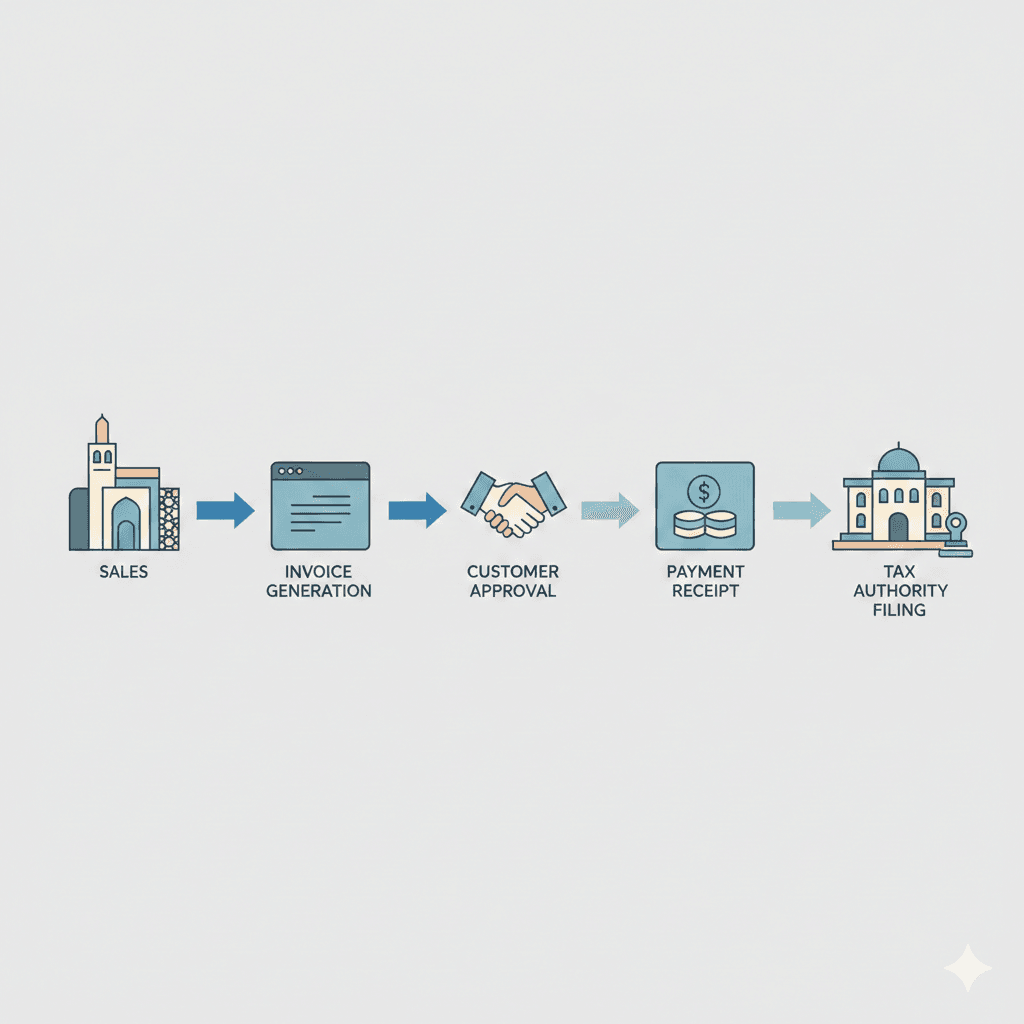

Linking the monthly close to advisory and compliance readiness

A disciplined monthly close creates a natural bridge between bookkeeping, compliance, and advisory support. When records are accurate and timely, VAT returns are easier to prepare and less likely to trigger queries. Corporate tax planning becomes more effective because profit trends are visible throughout the year, not only at year-end. For Muscat SMEs considering expansion, valuation, or restructuring, closed monthly accounts provide credible evidence for discussions with banks, investors, or regulators. This is where the role of experienced advisors becomes strategic rather than corrective. Instead of fixing past errors, advisory input can focus on improving margins, assessing feasibility, or managing risk. The monthly close thus becomes a foundation for informed growth. Businesses that treat it as a core management process, supported by the right accounting and advisory expertise, are better positioned to navigate Oman’s evolving regulatory and economic landscape with confidence.

The discipline of a structured monthly close is not about adding bureaucracy to a growing business. It is about creating a reliable source of truth that owners and managers can trust. For Muscat SMEs, where operational demands are high and margins often tight, this reliability translates directly into better decisions, stronger compliance, and reduced financial stress. A clear checklist turns bookkeeping into a predictable process rather than a recurring crisis, allowing management to focus on strategy rather than corrections.

By embedding a practical monthly close into routine operations, businesses build financial maturity incrementally. Over time, this maturity supports everything from smoother audits to more credible advisory conversations. The result is not just cleaner books, but a business that understands its numbers and can act on them with clarity and confidence, month after month.

#Leaderly #Muscatmonthlybookkeepingclosechecklist #Oman #Muscat #SMEs #Accounting #Tax #Audit