Muscat mobile app security compliance as a growth pillar for Omani SMEs in the Vision 2040 economy

Muscat mobile app security compliance and the new trust economy

Muscat mobile app security compliance is rapidly becoming a defining factor of commercial credibility for businesses operating in Oman as Vision 2040 accelerates digital adoption across every sector. For many SMEs in Muscat, customer engagement now happens primarily through mobile apps and online portals rather than face-to-face transactions. This shift places unprecedented responsibility on business owners and finance managers to understand how digital trust is built and protected. In practice, this is no longer a purely technical concern reserved for IT teams. It is a governance and financial risk issue that directly affects cash flow, customer retention, regulatory exposure, and long-term valuation. Oman’s regulators are steadily aligning local expectations with international data protection standards, which means that weak security controls now translate into tangible compliance risks. When customer login systems, payment gateways, or document upload portals are compromised, the resulting financial and reputational damage can cripple small and mid-sized firms that lack the capital buffers of larger corporations. Under Vision 2040, digital confidence is treated as economic infrastructure. Businesses that fail to demonstrate structured approaches to mobile and portal security increasingly find themselves excluded from government contracts, strategic partnerships, and sophisticated financing opportunities. For SMEs, understanding Muscat mobile app security compliance is therefore not about achieving theoretical perfection but about embedding disciplined processes that protect both customers and balance sheets.

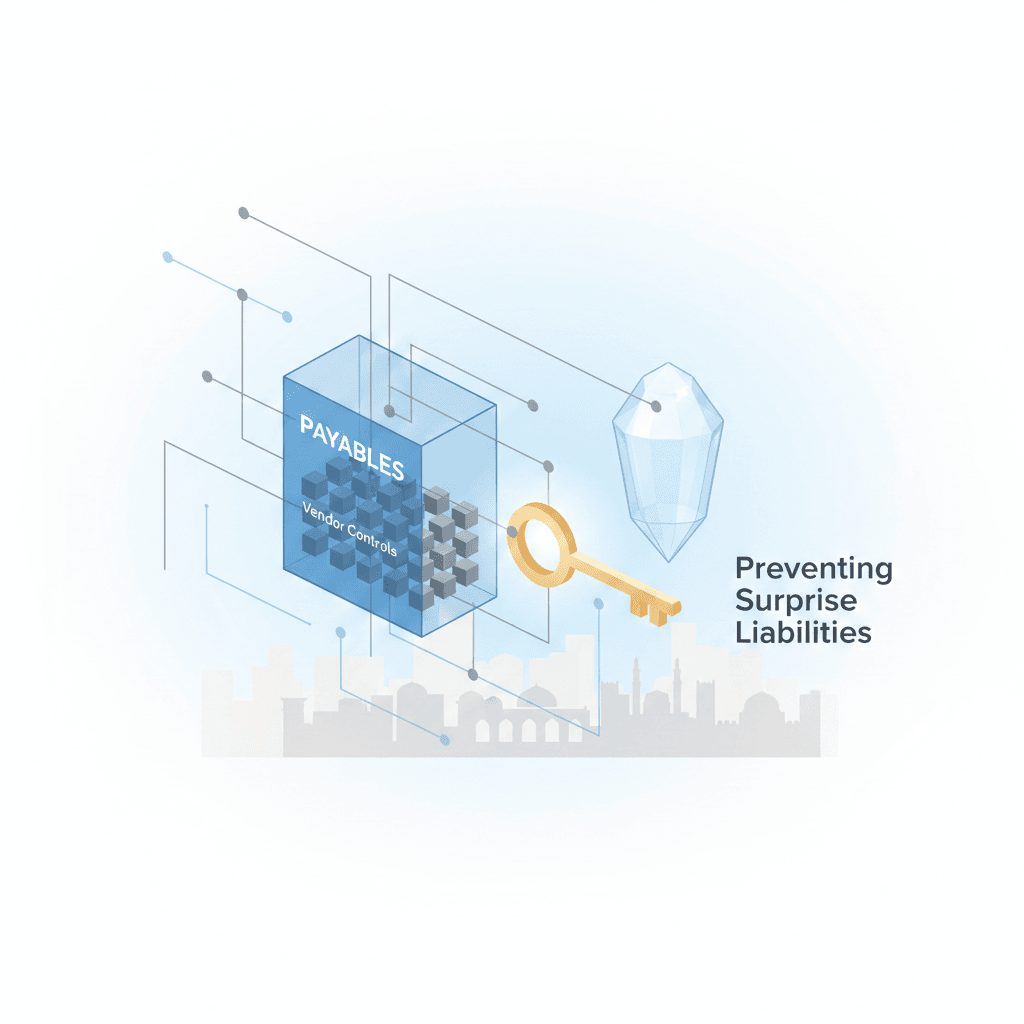

Why Muscat mobile app security compliance reshapes financial risk management

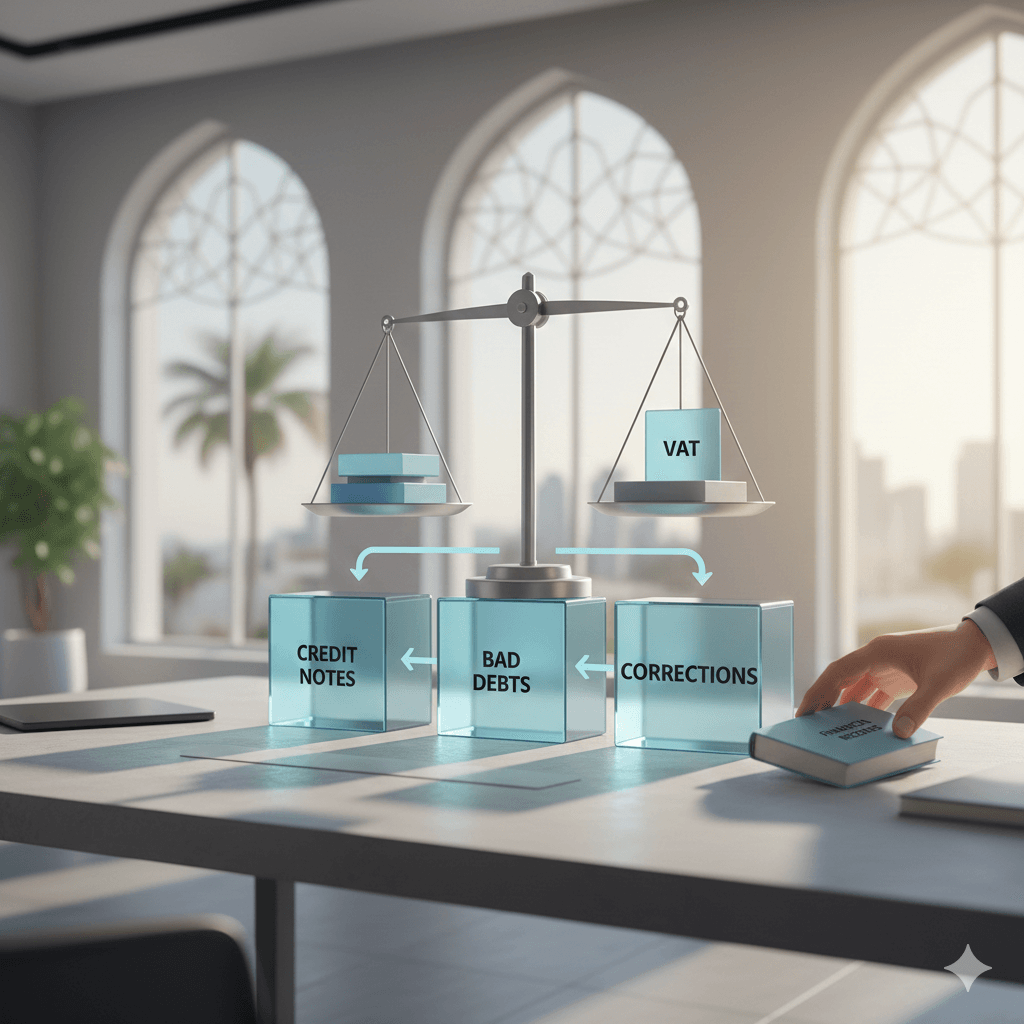

In many Omani SMEs, financial risk management has traditionally focused on liquidity, receivables, and tax exposure, while digital risks remained largely invisible in formal planning. Muscat mobile app security compliance is changing this equation by forcing finance leaders to recognize cyber threats as balance-sheet threats. A data breach, service outage, or unauthorized transaction now triggers direct remediation costs, potential regulatory penalties, compensation claims, and extended business interruption. These consequences rarely appear in standard financial forecasts, yet they materially affect profitability. Banks and investors in Muscat increasingly request evidence of digital governance before extending credit or funding, because security failures undermine the reliability of reported financial performance. Even routine VAT compliance and corporate tax filings are now intertwined with digital data integrity. If transaction records are compromised through weak application security, the credibility of tax reporting collapses. From a practical standpoint, SMEs that integrate Muscat mobile app security compliance into their financial controls are better positioned to demonstrate operational maturity during audits, due diligence processes, and advisory engagements. This alignment supports more accurate valuations, smoother financing negotiations, and stronger long-term planning. For business owners, the message is clear: cybersecurity discipline is now an extension of financial stewardship, not a separate technical afterthought.

Operational foundations of Muscat mobile app security compliance for SMEs

Building Muscat mobile app security compliance begins with operational clarity rather than expensive technology. SMEs must first map how customer data flows through their mobile applications and online portals, identifying where sensitive information is collected, processed, stored, and transmitted. This exercise alone exposes hidden vulnerabilities that often exist in payment processes, document uploads, and customer communication channels. Once data flows are visible, internal policies can be aligned with Oman’s regulatory expectations for confidentiality, accuracy, and availability of information. Clear access controls, segregation of duties, and incident response procedures create a governance framework that supports both security and financial accountability. Importantly, these controls should be documented and regularly reviewed, as they become part of the evidence base during audits and regulatory reviews. Many Muscat-based SMEs underestimate how quickly informal digital practices become liabilities. Employees sharing passwords, unsecured third-party integrations, and undocumented system changes quietly accumulate risk until a breach forces management into costly crisis mode. By contrast, SMEs that treat Muscat mobile app security compliance as a routine operational discipline experience fewer disruptions and stronger customer confidence. Over time, this discipline becomes a competitive advantage that supports sustainable growth in Oman’s evolving digital economy.

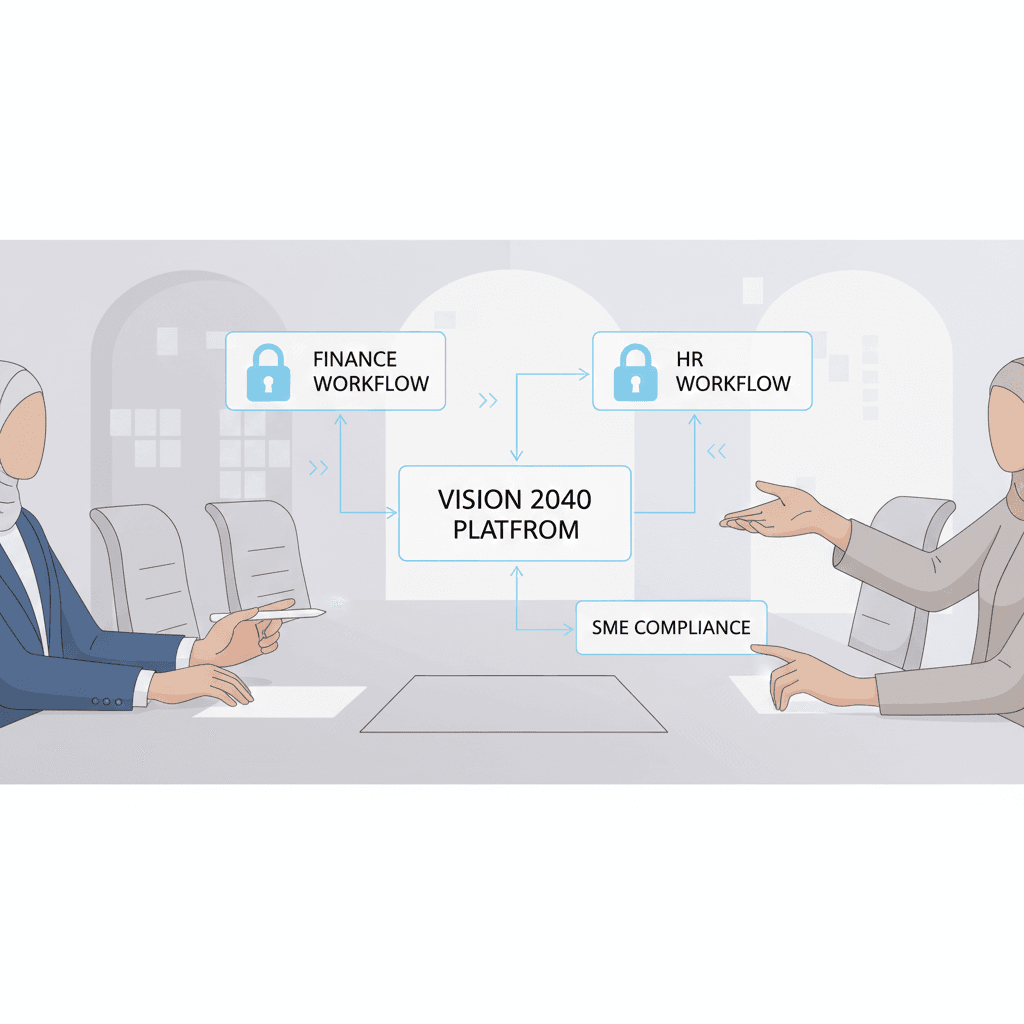

Muscat mobile app security compliance in customer portal governance

Customer portals now serve as the financial and operational nerve centers of many Omani businesses, giving clients access to invoices, contracts, support tickets, and sensitive personal information. Muscat mobile app security compliance therefore extends deeply into portal governance, where every design decision carries financial implications. Weak authentication processes expose businesses to fraud and identity misuse, while inadequate encryption compromises confidentiality and regulatory standing. For SMEs, the challenge is to balance usability with protection, ensuring customers can transact efficiently without exposing the company to unacceptable risk. Portal governance also influences dispute resolution and legal defensibility. When transaction logs, consent records, and communication histories are securely preserved, businesses are better equipped to defend themselves in commercial disagreements or regulatory inquiries. This is particularly relevant for finance managers overseeing receivables, contract enforcement, and revenue recognition. Effective Muscat mobile app security compliance transforms customer portals into trusted financial instruments rather than potential liabilities. It also reinforces transparency, which strengthens relationships with auditors and advisors who rely on accurate digital records during financial reviews, due diligence assignments, and business valuations.

Strategic implications of Muscat mobile app security compliance under Vision 2040

Oman Vision 2040 positions digital transformation as a cornerstone of national competitiveness, and Muscat mobile app security compliance sits at the heart of this strategy. SMEs are not merely adapting to new technologies; they are participating in a systemic shift toward data-driven governance and accountable enterprise management. Companies that embed security into their digital expansion plans demonstrate alignment with national priorities, which enhances their credibility with public and private stakeholders. From a strategic perspective, secure mobile platforms enable scalable growth by supporting new business models, cross-border partnerships, and innovative service delivery. Without strong security foundations, however, these opportunities collapse under operational risk. In advisory engagements, experienced financial consultants increasingly examine digital governance when assessing feasibility, restructuring options, or expansion strategies. A business that cannot demonstrate Muscat mobile app security compliance will struggle to justify optimistic growth projections or attract strategic partners. In this sense, cybersecurity readiness becomes a measurable component of strategic fitness within Oman’s evolving business landscape.

Financial leadership and Muscat mobile app security compliance culture

Ultimately, Muscat mobile app security compliance succeeds or fails based on leadership behavior rather than technical tools. Business owners and finance managers set the tone by integrating security discussions into budgeting, performance reviews, and strategic planning. When cybersecurity investments are evaluated alongside capital expenditures and working capital needs, they become part of disciplined financial governance rather than discretionary IT spending. This cultural shift encourages accountability across departments, ensuring that operational teams, finance staff, and external advisors operate from a shared understanding of risk. Over time, such alignment simplifies audits, strengthens internal controls, and enhances confidence in financial reporting. SMEs that cultivate this culture are better prepared for complex corporate events such as mergers, acquisitions, liquidations, or succession planning, where digital records and compliance histories carry significant weight. In Oman’s increasingly sophisticated business environment, Muscat mobile app security compliance therefore becomes both a protective mechanism and a strategic asset that supports long-term enterprise value.

As Oman advances toward Vision 2040, the practical reality for SMEs is that digital trust has become inseparable from financial performance. Muscat mobile app security compliance provides the framework through which businesses convert technological capability into sustainable commercial advantage. When mobile apps and customer portals operate within disciplined governance structures, SMEs reduce hidden financial risks, improve regulatory standing, and strengthen their appeal to investors, lenders, and strategic partners. The integration of security with accounting integrity, tax accuracy, and advisory insight creates a resilient operating model suited to Oman’s rapidly modernizing economy.

For business owners and finance managers, the opportunity is not merely to avoid breaches or penalties, but to build enterprises that are structurally prepared for growth, valuation, and long-term succession. By treating Muscat mobile app security compliance as a core component of financial leadership rather than a technical obligation, Omani SMEs position themselves to thrive with clarity and confidence in the Vision 2040 era.

#Leaderly #Muscat mobile app security compliance #Oman #Muscat #SMEs #Accounting #Tax #Audit