Muscat KPI Dashboard Strategy as a Financial Command System for Business Owners

Strategic Foundations of the Muscat KPI Dashboard Strategy

Why Muscat businesses require structured performance intelligence

The Muscat KPI Dashboard Strategy is no longer a reporting luxury but a financial necessity for serious business owners navigating Oman’s competitive commercial environment. In Muscat, where operating costs, regulatory oversight, and customer expectations continue to rise, intuition-based management exposes SMEs to dangerous blind spots. A well-designed dashboard translates operational activity into financial intelligence, allowing owners and finance managers to detect performance deviations early and respond before small problems become structural failures. This strategic framework connects sales velocity, cash discipline, and profit sustainability into a single management cockpit. Unlike basic spreadsheets, the Muscat KPI Dashboard Strategy enforces consistent measurement across departments, ensuring leadership discussions are anchored in objective evidence rather than assumptions. It becomes the language through which sales teams, operations managers, and finance professionals align priorities. For Omani entrepreneurs, this integration is particularly critical because regulatory obligations such as VAT compliance, corporate tax preparation, and audit readiness all depend on data reliability. When metrics are fragmented, businesses struggle to maintain compliance, control risk, or plan growth confidently. A strong dashboard, implemented with financial discipline, transforms data into decision clarity, enabling owners to move from reactive firefighting toward proactive financial leadership. This shift is often the turning point between stagnation and scalable growth.

Designing a Muscat KPI Dashboard Strategy that reflects business reality

Customisation over templates for Oman’s operating conditions

Every effective Muscat KPI Dashboard Strategy must be designed around the specific commercial realities of the business rather than generic global templates. Muscat’s market characteristics, including seasonal sales cycles, payment culture, and sector-specific cost pressures, require KPIs that reflect real operating drivers. A retail distributor in Al Khuwair faces different performance stress points than a consulting firm in Madinat Sultan Qaboos or a construction contractor in Ghala. The dashboard must therefore incorporate carefully selected indicators that reveal what truly controls value creation. This often includes sales pipeline health, customer payment behaviour, working capital efficiency, overhead absorption, and gross margin stability. Financial advisors frequently observe that SMEs track too many irrelevant metrics while missing the handful that determine survival. A focused Muscat KPI Dashboard Strategy forces management to define success in quantifiable terms. It also builds a transparent accountability framework, where department heads clearly understand how their daily decisions influence the firm’s financial position. This alignment supports smoother collaboration with professional advisors when conducting financial reviews, preparing valuations, or performing due diligence, because leadership already speaks the language of disciplined financial measurement.

Sales Control within the Muscat KPI Dashboard Strategy

Transforming revenue growth into predictable performance

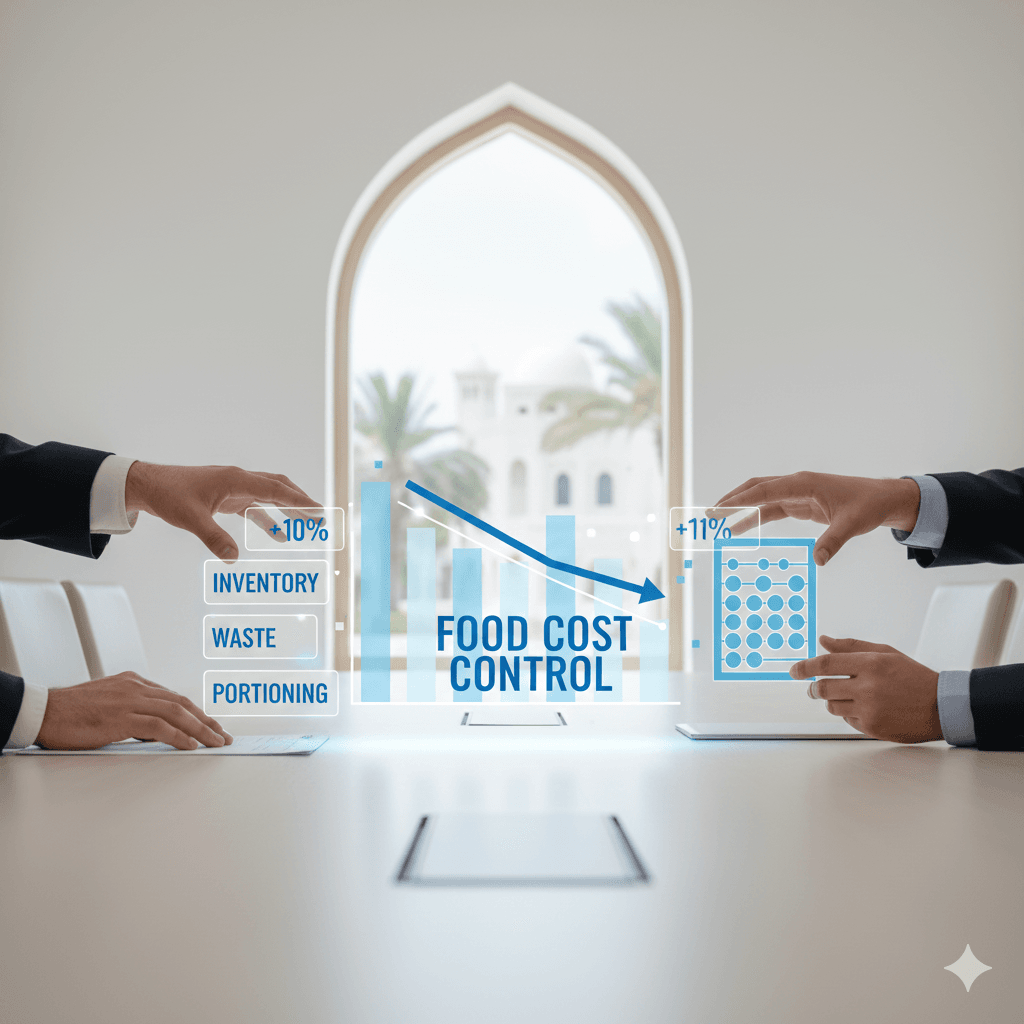

The sales dimension of the Muscat KPI Dashboard Strategy extends far beyond total revenue figures. For Muscat-based SMEs, revenue volatility often stems from inconsistent pipeline management, weak customer credit assessment, and overreliance on a limited number of clients. A well-structured dashboard decomposes sales into meaningful components such as lead conversion rates, contract size consistency, customer retention trends, and receivables aging. When these indicators are visible in real time, business owners can detect emerging revenue risks months before they damage profitability. For example, declining conversion ratios may signal pricing misalignment, while increasing receivables days may expose growing liquidity stress. This visibility allows leadership to intervene early through pricing adjustments, customer renegotiations, or tighter credit controls. Importantly, sales KPIs within the Muscat KPI Dashboard Strategy must be integrated with VAT monitoring to ensure that revenue growth does not inadvertently create tax compliance exposure. By connecting operational sales behavior to financial outcomes, the dashboard transforms revenue management from an optimistic pursuit of growth into a controlled system that protects both cash flow and long-term enterprise value.

Cash Discipline through the Muscat KPI Dashboard Strategy

Liquidity as the primary survival indicator

In Oman’s SME landscape, business failures rarely occur from lack of sales alone; they arise from cash mismanagement. The Muscat KPI Dashboard Strategy therefore places cash control at the center of financial governance. This includes monitoring operating cash flow, collections efficiency, supplier payment cycles, and short-term funding exposure. Many Muscat entrepreneurs are surprised to discover that strong revenue growth often coincides with worsening liquidity due to delayed collections and expanding overhead. A properly configured dashboard reveals these contradictions immediately. When management sees the direct relationship between sales expansion and cash strain, strategic decisions become more disciplined. Leaders begin negotiating better payment terms, adjusting inventory levels, and aligning expense commitments with actual cash capacity. These insights also support productive engagement with auditors and tax advisors, as accurate cash tracking is fundamental to audit integrity and corporate tax planning. Over time, consistent use of the Muscat KPI Dashboard Strategy cultivates a culture of financial prudence, where liquidity protection becomes embedded in operational decision-making rather than treated as an afterthought when problems emerge.

Profit Sustainability inside the Muscat KPI Dashboard Strategy

Moving beyond gross margin illusions

Profitability is often misunderstood by SME owners who focus on gross margin while ignoring overhead absorption, financing costs, and tax impact. The Muscat KPI Dashboard Strategy reframes profit as a multidimensional outcome that requires constant calibration. Core profit KPIs typically include operating margin trends, contribution margin by product or service line, overhead ratios, and break-even thresholds. When these indicators are tracked consistently, management gains an early warning system against silent erosion of enterprise value. In Muscat’s increasingly competitive sectors, price pressure and cost inflation can gradually compress margins without immediate visibility unless the dashboard is actively monitored. Integrating profitability KPIs with strategic advisory insights allows business leaders to evaluate expansion proposals, capital investments, and market diversification initiatives with clarity. This disciplined approach supports stronger outcomes in valuation exercises, liquidation planning, and investor negotiations. Profit, when properly governed through the Muscat KPI Dashboard Strategy, becomes not a historical figure but a forward-looking management tool that informs every major decision.

Implementation Governance of the Muscat KPI Dashboard Strategy

From reporting tool to executive operating system

The long-term effectiveness of any Muscat KPI Dashboard Strategy depends on disciplined governance rather than software sophistication. Dashboards that fail usually collapse under inconsistent data input, lack of leadership engagement, or absence of accountability structures. Successful implementation requires clearly defined data ownership, periodic performance reviews, and direct linkage between KPIs and managerial incentives. For Muscat SMEs, this governance model ensures that financial reporting remains reliable for external stakeholders such as auditors, tax authorities, and investors. Regular dashboard reviews also create structured dialogue between management and professional advisors, strengthening financial controls and strategic foresight. Over time, the dashboard evolves from a reporting instrument into the firm’s executive operating system, guiding daily decisions and long-term planning alike. When governance is maintained, the Muscat KPI Dashboard Strategy becomes self-reinforcing: better data leads to better decisions, which improve performance, further strengthening data integrity. This virtuous cycle is the hallmark of financially mature enterprises in Oman’s emerging economy.

The true value of the Muscat KPI Dashboard Strategy lies not in the numbers themselves but in the behavioral transformation it creates within SMEs. When leadership commits to disciplined measurement, decision-making becomes systematic, risk-aware, and opportunity-driven. Sales growth aligns with cash capacity, profitability reflects genuine value creation, and compliance obligations integrate seamlessly into operations. This clarity strengthens owner confidence and enhances credibility with financial institutions, investors, and regulators. Over time, the dashboard cultivates a culture of financial responsibility that protects the business through economic cycles and competitive disruption.

For Muscat’s entrepreneurs, adopting the Muscat KPI Dashboard Strategy is ultimately a declaration of long-term intent. It signals a shift from survival-driven management to structured financial leadership. With the support of experienced financial advisors who understand Oman’s regulatory environment, businesses can refine their dashboards to support sustainable growth, informed expansion, and resilient profitability. This approach empowers SMEs to build enterprises that are not only operationally successful but financially enduring within Oman’s evolving commercial landscape.

#Leaderly #MuscatKPIDashboardStrategy #Oman #Muscat #SMEs #Accounting #Tax #Audit