Muscat Internal Controls: Essential Policies Safeguarding Business Owners

Understanding Muscat Internal Controls and Their Importance

Why Robust Controls Are Critical for SMEs in Oman

Muscat internal controls represent the backbone of effective governance and risk management for SMEs and business owners operating within Oman’s dynamic market. These controls are systematic policies and procedures designed to protect company assets, ensure the accuracy of financial reporting, and promote operational efficiency. For business owners, especially those managing SMEs, these internal policies help mitigate the risks associated with fraud, errors, and non-compliance with Omani laws. Given the evolving economic landscape in Muscat, characterized by increased regulatory scrutiny and the introduction of corporate tax regimes, the importance of having well-structured internal controls cannot be overstated. Without them, owners risk facing costly financial discrepancies, legal penalties, and damage to their business reputation.

Internal controls tailored for Muscat’s business environment focus not only on compliance but also on fostering transparency and accountability throughout the organization. For example, proper segregation of duties prevents one employee from having unchecked control over financial transactions, thereby reducing the risk of fraud. Similarly, regular reconciliations and verifications ensure that financial data is accurate and timely. These controls empower business owners to make informed decisions, safeguard their investments, and build trust with stakeholders, including investors, banks, and tax authorities. Understanding the specific context of Oman, where SMEs are increasingly subject to VAT and corporate tax compliance, reinforces why internal controls must be adapted to local regulatory requirements.

Leaderly’s advisory approach highlights that Muscat internal controls are not static documents but dynamic frameworks that evolve with the company’s growth and regulatory shifts. Business owners who invest time and resources in designing, implementing, and regularly reviewing these policies set a foundation for sustainable success. Internal controls are an integral part of financial governance that align with broader advisory services such as feasibility studies, business valuations, and due diligence processes. Ultimately, these controls create a protective shield around owners’ interests and help businesses thrive amid Oman’s competitive and regulatory landscape.

Key Policies Shaping Muscat Internal Controls for SMEs

Segregation of Duties and Authorization Protocols

One of the cornerstone policies within Muscat internal controls is the segregation of duties. This policy ensures that critical business processes, such as payment approvals, bank reconciliations, and procurement activities, are divided among different employees. This division prevents conflicts of interest and lowers the risk of fraud or unintentional errors. For SMEs in Muscat, adopting clear authorization protocols tailored to the company’s size and complexity helps balance control and operational efficiency. For example, limiting transaction approvals to designated managers helps maintain oversight without slowing day-to-day business functions.

Another fundamental policy revolves around authorization limits. In Muscat, businesses must define thresholds that specify which financial transactions require higher-level approvals. These thresholds must be reasonable and clearly documented to avoid ambiguity. When combined with segregation of duties, authorization limits create a dual layer of oversight that protects company funds and assets from misuse or mismanagement. Business owners benefit from this structured approach as it enables them to delegate responsibilities confidently while maintaining control over significant expenditures.

The effectiveness of these policies depends heavily on consistent enforcement and training. SME leaders in Muscat should ensure that employees understand the rationale behind these controls and are equipped to follow them diligently. Regular internal audits, whether conducted internally or with Leaderly’s advisory support, help identify gaps and improve policy adherence. This proactive approach to control policies helps Muscat SMEs safeguard against operational risks and regulatory non-compliance, especially in an environment where VAT and corporate tax compliance increasingly demand detailed financial records.

Monitoring and Reporting: Vital Muscat Internal Control Practices

Continuous Oversight Through Reconciliation and Audits

Effective monitoring is a critical component of Muscat internal controls that protects owners from financial discrepancies and regulatory pitfalls. Regular bank reconciliations and detailed financial reviews are essential practices that ensure recorded transactions match actual cash flows and bank statements. For SMEs in Oman, where banking relationships and financial transparency influence creditworthiness and investor confidence, maintaining up-to-date reconciliations is non-negotiable. These checks help identify errors, unauthorized transactions, or fraudulent activities early on before they escalate into major issues.

Internal and external audits further strengthen the control environment by providing independent verification of the company’s financial integrity. Muscat business owners benefit from audit processes that highlight weaknesses in controls and offer actionable recommendations for improvement. Engaging a reputable advisory firm like Leaderly ensures audits are conducted with local regulatory expertise and a deep understanding of SME challenges in Oman. Through audits, businesses not only comply with Oman’s legal framework but also enhance internal accountability, fostering trust among stakeholders.

Beyond audits, regular financial and operational reporting to management creates transparency and facilitates strategic decision-making. Muscat internal controls emphasize timely, accurate reporting that enables owners and finance managers to monitor performance indicators, detect irregularities, and respond to emerging risks swiftly. This culture of continuous oversight aligns with best practices in corporate governance and is increasingly vital for SMEs navigating Oman’s competitive market and evolving tax landscape.

Risk Management and Compliance in Muscat Internal Controls

Aligning Policies with Oman’s Regulatory Framework

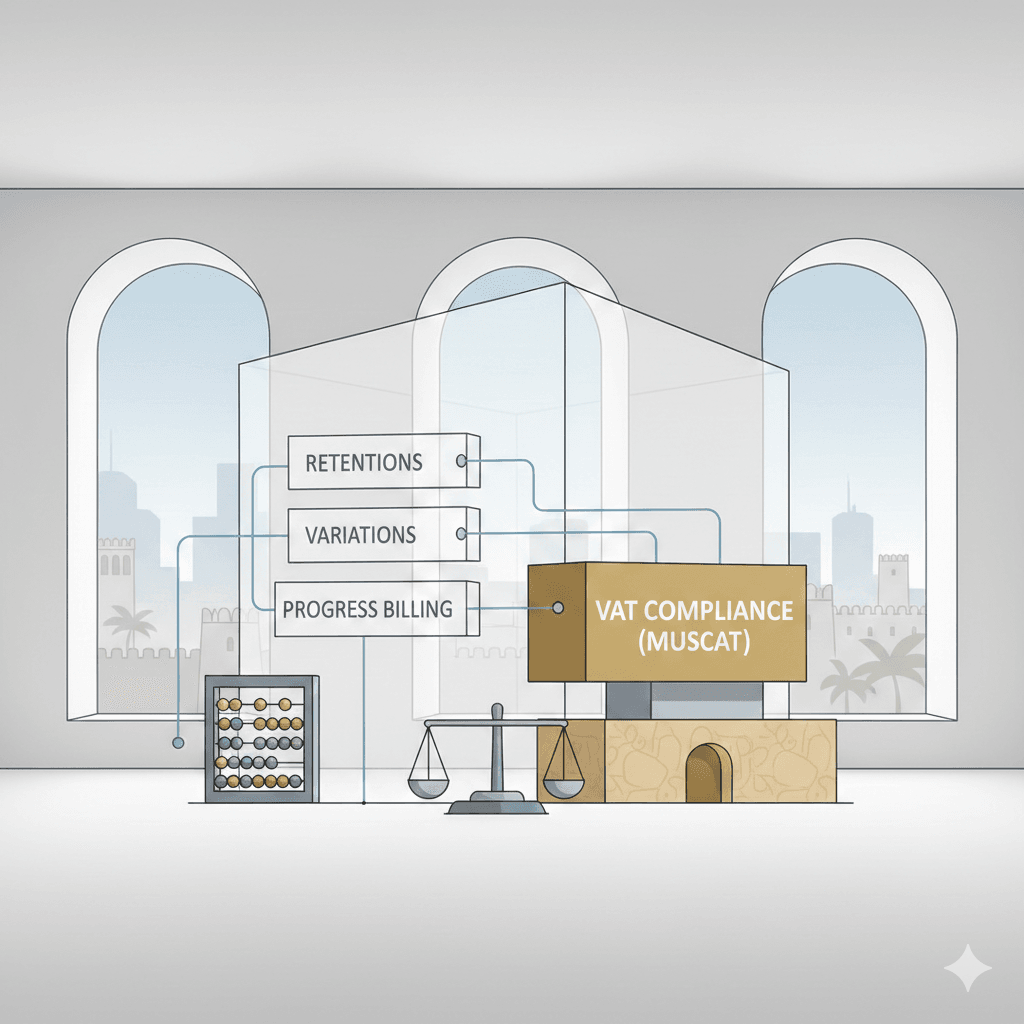

Risk management is a critical aspect of Muscat internal controls, particularly in ensuring that SMEs remain compliant with Oman’s growing regulatory demands. With the introduction of VAT and the planned implementation of corporate tax, businesses face heightened scrutiny on financial records, tax filings, and compliance documentation. Internal controls that focus on risk identification and mitigation help SMEs anticipate regulatory challenges and implement corrective measures before violations occur. For business owners, this means reduced exposure to fines, penalties, and reputational harm.

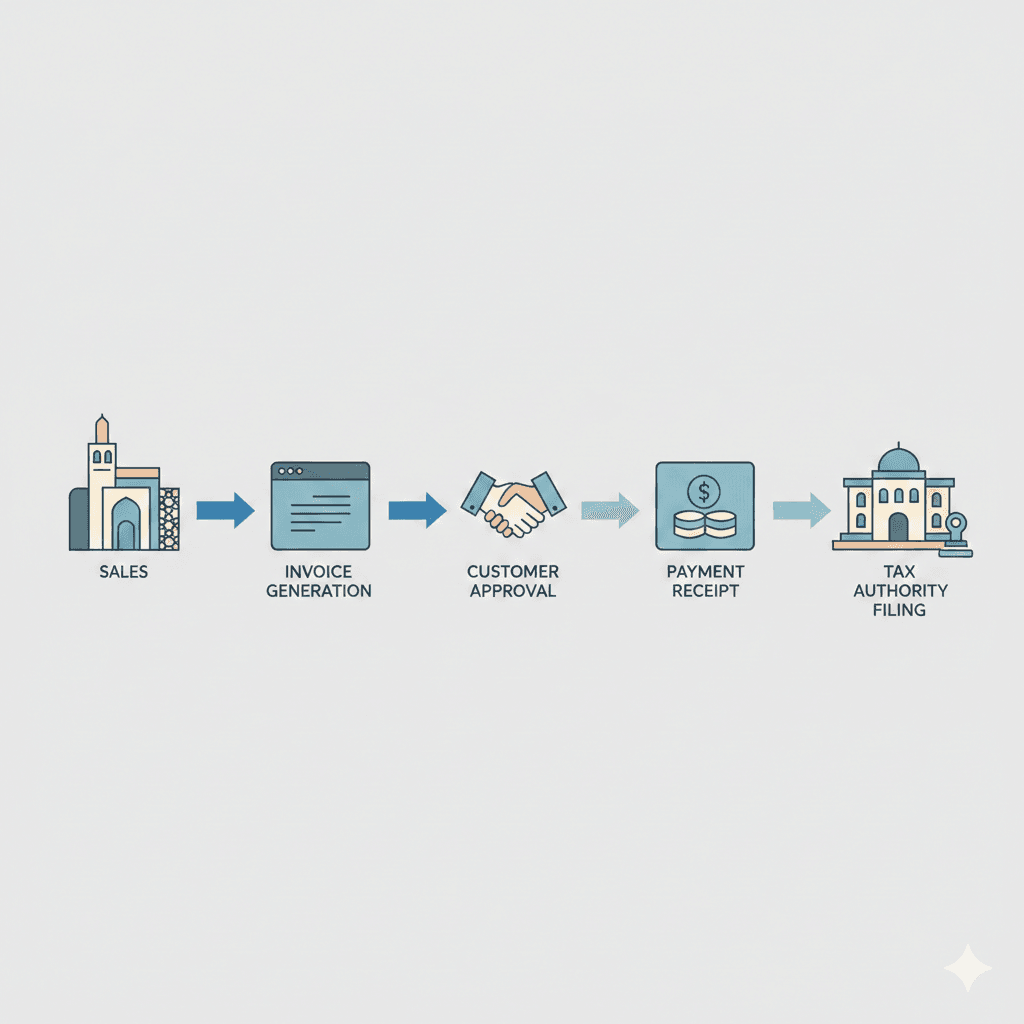

One practical policy is the regular review of compliance status, which includes tracking VAT registrations, corporate tax obligations, and adherence to labor and commercial laws. Leaderly’s advisory expertise highlights the importance of embedding compliance checks into everyday operations, such as verifying invoices for VAT correctness or maintaining accurate employee records. This integration minimizes the risk of last-minute tax surprises and creates a culture of compliance within the organization.

Additionally, contingency planning forms an essential part of risk management in Muscat internal controls. SMEs must prepare for unforeseen events like market shifts, supplier disruptions, or changes in regulations. Policies that mandate scenario planning, periodic risk assessments, and clear escalation paths ensure that business owners can respond effectively to risks without compromising operational continuity. By incorporating risk management into internal controls, Muscat SMEs strengthen their resilience and position themselves for long-term growth.

Technology and Automation in Muscat Internal Controls

Leveraging Digital Tools for Stronger Control Frameworks

In Muscat’s fast-paced business environment, integrating technology into internal controls is no longer optional—it’s essential. Automation of routine tasks such as invoicing, payroll, and financial reporting enhances accuracy and reduces human error, which is a common source of control failures. For SMEs, adopting digital accounting systems tailored to Oman’s regulatory requirements ensures compliance with VAT filings and corporate tax calculations, while simplifying audit processes.

Moreover, technology enables real-time monitoring and alerting systems that notify management of unusual transactions or breaches in authorization protocols. This immediate visibility is invaluable for Muscat business owners who need to maintain tight control without micromanaging daily operations. Cloud-based platforms further provide secure access to financial data from anywhere, enabling timely decision-making and collaborative oversight.

However, implementing technology within Muscat internal controls requires careful selection of tools that align with the SME’s scale and industry. Leaderly’s advisory service supports businesses in identifying and deploying appropriate software solutions, ensuring they complement existing policies rather than complicate workflows. When integrated effectively, technology not only strengthens internal controls but also boosts operational efficiency and strategic agility.

Embedding a Control Culture for Sustainable Growth

Leadership’s Role in Fostering Accountability and Transparency

Ultimately, the success of Muscat internal controls hinges on cultivating a culture of control throughout the organization. Leadership commitment to transparency, accountability, and ethical behavior sets the tone for employees to follow established policies diligently. For SME owners in Muscat, embedding these values is a strategic priority that supports sustainable business growth and stakeholder confidence.

Training programs and clear communication about internal controls empower staff at all levels to understand their roles in risk mitigation and compliance. This shared responsibility reduces dependency on manual oversight and enhances the effectiveness of control frameworks. Furthermore, periodic reviews and updates of policies, aligned with changes in Oman’s regulatory environment, demonstrate an ongoing commitment to governance excellence.

Leaderly’s holistic advisory approach emphasizes that internal controls are not merely procedural checklists but living systems that evolve with business needs. By fostering a control culture, Muscat SMEs can navigate challenges proactively, safeguard their assets, and create a competitive advantage in Oman’s marketplace.

In conclusion, Muscat internal controls are indispensable policies that protect business owners by ensuring financial integrity, regulatory compliance, and operational resilience. Implementing well-designed controls such as segregation of duties, authorization limits, and regular reconciliations helps SMEs mitigate risks that could otherwise threaten their stability and growth.

By embracing technology, fostering a culture of accountability, and aligning controls with Oman’s specific regulations, business owners can confidently steer their companies toward sustainable success. These internal control policies are not only safeguards but strategic tools that empower SMEs in Muscat to build trust, improve efficiency, and navigate the complexities of the local business environment with assurance.

#Leaderly #MuscatInternalControls #Oman #Muscat #SMEs #Accounting #Tax #Audit