Muscat Audit Questions: Essential Insights for SME Readiness

Understanding the Importance of Muscat Audit Questions

Why anticipating audit inquiries matters for Omani SMEs

Muscat audit questions form the foundation of every financial audit for SMEs and businesses operating in Oman’s capital region. For many business owners and finance managers, audits evoke uncertainty and concern due to the perceived complexity and rigor involved. However, understanding these initial audit questions and preparing thoughtful responses can dramatically streamline the audit process, reduce disruptions, and build confidence with regulators and stakeholders alike. In Oman’s evolving regulatory environment—marked by VAT and corporate tax implementation—being audit-ready is not optional but critical for sustainable business growth.

These questions typically focus on verifying the accuracy, completeness, and compliance of financial records. They serve to assess a company’s internal controls, accounting policies, and overall readiness for statutory compliance. By anticipating these questions, businesses in Muscat can avoid last-minute scrambles, reduce the risk of non-compliance penalties, and foster a more collaborative relationship with auditors. Importantly, it also allows companies to demonstrate transparency and commitment to sound governance—attributes increasingly valued by investors and partners.

At Leaderly, we see firsthand how proactive preparation around Muscat audit questions empowers SMEs to confidently navigate audits. This preparation spans beyond financial documents to include understanding tax compliance, validating internal processes, and readiness for advisory support if needed. The goal is to transform audits from a stressful obligation into a strategic management tool, reinforcing operational integrity and financial credibility.

Common Muscat Audit Questions and What They Reveal

Identifying the key areas auditors scrutinize first

The first set of Muscat audit questions generally revolve around the company’s organizational structure, accounting system, and financial controls. Auditors start by asking for organizational charts, lists of authorized signatories, and policies regarding financial transactions. These questions reveal how well-defined and robust a company’s governance is, which is fundamental to audit reliability. For SMEs, especially those scaling rapidly, maintaining updated documentation and clear authority lines ensures smooth responses and fewer follow-up queries.

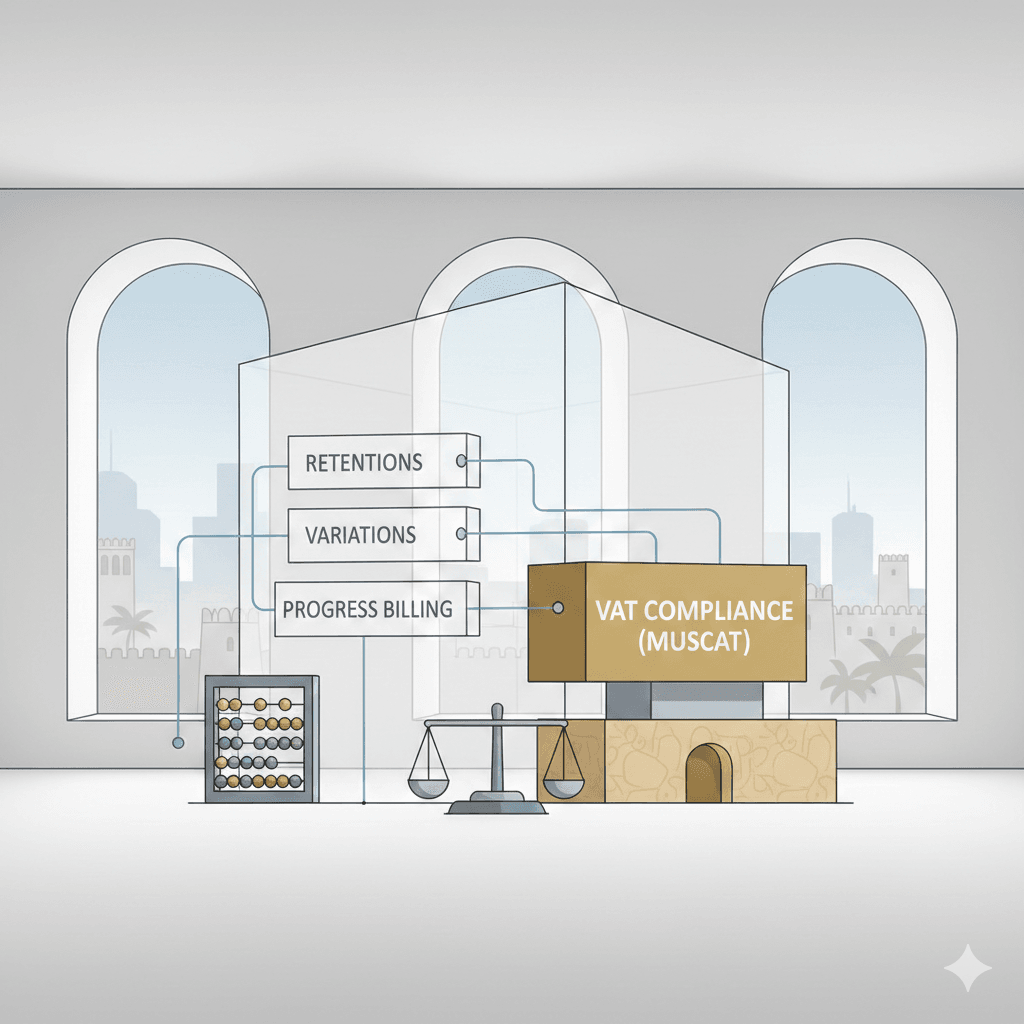

Next, auditors focus on transaction accuracy and completeness. Questions about how sales, purchases, payroll, and expenses are recorded help auditors assess the integrity of accounting entries and detect potential misstatements or omissions. In Oman, this often ties into VAT compliance, making it essential for SMEs to keep detailed tax invoices and supporting documents readily available. This phase also touches on bank reconciliations and cash handling procedures, where gaps can signal control weaknesses or risk areas.

Finally, auditors inquire about policies on asset management, liabilities, and provisions. They seek explanations for fixed asset registers, depreciation schedules, loan agreements, and outstanding liabilities. These questions aim to verify the existence and valuation of company assets and obligations. For Muscat businesses, such clarity supports accurate corporate tax computations and avoids disputes with tax authorities. Leaderly’s advisory expertise in valuation and due diligence helps SMEs maintain these records efficiently, ensuring quick, confident audit responses.

Preparing Your Team for Initial Auditor Interactions

Building internal readiness to handle audit inquiries effectively

Preparation for Muscat audit questions starts with internal communication and training. SME leaders must ensure that finance managers, accountants, and relevant staff understand the audit scope, key documents, and the types of questions auditors will ask first. A well-briefed team reduces response times and minimizes errors, projecting a professional image that fosters auditor trust. Training should emphasize accurate document retrieval, clear explanation of accounting treatments, and awareness of tax compliance requirements.

Designating a primary audit liaison within the organization is a practical step. This individual acts as the point of contact for all auditor communications, organizing documents, and scheduling meetings. In Muscat’s busy SME environments, having a clear audit coordinator prevents confusion and avoids delays caused by fragmented responses. Additionally, documenting all communications during the audit process protects the company by ensuring transparency and traceability of any issues discussed or resolved.

Leveraging external advisory services, such as those provided by Leaderly, can further enhance team readiness. Experienced auditors and financial advisors offer mock audits, review internal controls, and advise on best practices to pre-empt common audit questions. This guidance is especially valuable for SMEs encountering formal audits for the first time or expanding their operations. Ultimately, a prepared and informed team helps transform the audit experience into an opportunity for operational improvement.

Key Documentation to Have Ready for Muscat Auditors

Essential records that support quick and thorough audit responses

When preparing for Muscat audit questions, assembling a comprehensive and well-organized documentation package is critical. Auditors will expect ready access to financial statements, trial balances, ledgers, and bank statements covering the audit period. SMEs should ensure these documents are complete, accurate, and reconciled to avoid unnecessary queries or adjustments. Oman’s business regulations also require proper tax filing and supporting VAT returns, so these must be available alongside accounting records.

Supporting documents such as invoices, contracts, payroll records, and expense receipts provide the audit trail auditors rely on to verify transaction authenticity and compliance. For SMEs in Muscat, it is important these documents align with local tax laws and company policies. Missing or inconsistent documentation not only prolongs the audit but increases the risk of penalties. Maintaining digital records with backups is a practical safeguard that also facilitates remote audits, which are increasingly common.

Lastly, companies should prepare documents relating to asset verification, such as fixed asset registers, depreciation schedules, lease agreements, and loan documents. These records assist auditors in confirming asset existence and valuation, essential for accurate financial reporting and corporate tax obligations. Leaderly’s advisory expertise can support SMEs in structuring and maintaining these documents to meet audit standards efficiently and confidently.

How Leaderly Supports SMEs with Muscat Audit Questions

Providing seamless audit preparation and advisory services in Oman

Leaderly understands the specific challenges faced by SMEs in Muscat when responding to Muscat audit questions. Our approach goes beyond traditional audit and accounting services to include proactive advisory on tax compliance, financial controls, and business valuation. This holistic support equips SMEs to not only answer auditors promptly but also optimize their financial processes for long-term resilience and growth. By partnering with Leaderly, businesses gain access to tailored solutions that align with Oman’s regulatory landscape.

Our audit preparation services focus on readiness assessments, document review, and pre-audit consultations that identify and resolve potential gaps before the official audit begins. This reduces the risk of surprises and costly rework. Additionally, Leaderly’s taxation experts ensure VAT and corporate tax obligations are met accurately, minimizing audit risks and penalties. For SMEs considering mergers, acquisitions, or liquidation, our due diligence and valuation advisory provide added assurance and clarity during audits.

Ultimately, Leaderly aims to empower SME leaders and finance teams in Muscat to approach audits with confidence and clarity. By demystifying Muscat audit questions and providing expert guidance, we help companies convert audits from mere compliance exercises into strategic opportunities that reinforce governance, enhance financial credibility, and support sustainable business success.

Conclusion

Mastering Muscat audit questions is a critical step for SMEs seeking to build trust with regulators, investors, and partners in Oman’s dynamic business environment. By anticipating the initial audit inquiries, preparing robust documentation, and fostering an informed team, SMEs can streamline audits and reduce the stress commonly associated with financial scrutiny. This proactive approach not only ensures compliance with VAT and corporate tax regulations but also strengthens internal controls and governance—cornerstones of sustainable business growth.

Engaging expert advisory services like Leaderly further enhances audit readiness by offering tailored guidance, mock audits, and comprehensive support throughout the audit lifecycle. Together, these strategies empower Muscat-based SMEs to transform audits into constructive experiences that bolster financial credibility and operational excellence. In today’s evolving regulatory landscape, such preparation is not merely best practice—it is essential for thriving and scaling confidently in Oman’s competitive market.

#Leaderly #MuscatAuditQuestions #Oman #Muscat #SMEs #Accounting #Tax #Audit