Muscat Advisory: Understanding the Role of Feasibility Studies in Mitigating Investment Risks

Defining Feasibility Studies in the Muscat Business Context

Why Feasibility Matters Before Investment

Muscat Advisory plays a critical role in ensuring investment success by using feasibility studies as an essential pre-investment tool to examine the viability of proposed business ventures or projects. In Muscat’s rapidly evolving economic landscape, marked by growing SME activity and shifting regulations, conducting a thorough feasibility study is indispensable. It offers entrepreneurs and business owners detailed insights into market conditions, financial requirements, operational challenges, and potential returns on investment tailored specifically to Oman’s environment. Unlike generic business plans, feasibility studies focus deeply on identifying and mitigating risks. By evaluating local market trends, competition, consumer behavior, and regulatory compliance—including VAT and Corporate Tax considerations—a well-executed feasibility study helps decision-makers determine if an investment aligns with their strategic objectives and risk appetite. For SMEs in Muscat, this targeted knowledge is vital to prevent costly errors and protect their capital.

The Components of an Effective Feasibility Study for Muscat SMEs

Critical Areas Assessed for Business Success

A comprehensive feasibility study in Muscat typically includes several key components that collectively minimize investment risk. First, the market analysis evaluates demand and customer segments within the Omani context, highlighting cultural preferences and purchasing power. Next, the technical feasibility assesses the operational and logistical requirements—such as local sourcing, labor availability, and infrastructure—that impact project execution. Third, the financial feasibility focuses on detailed cost projections, revenue estimates, and cash flow analysis, integrating Oman-specific factors like VAT compliance and corporate tax liabilities. The legal and regulatory feasibility examines licenses, permits, and local business laws to ensure smooth operations. Leaderly’s advisory experience emphasizes that only by thoroughly reviewing these elements can SMEs anticipate obstacles and plan accordingly. This approach provides a realistic picture, enabling better budgeting, compliance, and resource allocation ahead of any financial commitment.

Feasibility Studies as a Risk Management Tool in Muscat

Preventing Financial Losses and Operational Failures

Risk is inherent to any business venture, but in Muscat’s dynamic market, the stakes are heightened by regulatory changes and economic diversification efforts. A feasibility study acts as a frontline defense by identifying risks before capital is deployed. For example, it reveals if the project is susceptible to fluctuations in supply chain costs or if market demand projections are overly optimistic. Moreover, it assesses financial risks associated with taxation and compliance, helping SMEs avoid penalties or unexpected expenses. Beyond finances, feasibility studies highlight operational challenges, such as hiring qualified personnel or adapting to evolving consumer preferences in Oman. This preemptive analysis ensures that entrepreneurs make data-driven decisions and reduces the likelihood of project failure. Leaderly’s advisory teams often stress that this risk-focused perspective is key to sustainable growth and long-term profitability in the Muscat SME ecosystem.

Integrating Feasibility Studies with Leaderly’s Advisory Services

Holistic Support for Investment Decisions

Muscat SMEs benefit significantly when feasibility studies are conducted alongside professional advisory services. Leaderly’s expertise in financial advisory, including due diligence and valuation, complements feasibility assessments by offering actionable insights into investment readiness and strategic fit. For instance, after establishing market and financial feasibility, Leaderly’s team can guide SMEs on corporate tax optimization strategies and VAT structuring to improve cash flow and compliance. Additionally, advisory support can help interpret feasibility findings, tailor business models, and prepare clients for audit readiness. This integrated approach not only reduces risks but also enhances investor confidence by demonstrating thorough preparation. For business owners and entrepreneurs in Muscat, combining feasibility studies with expert advisory ensures that decisions are backed by both analytical rigor and practical financial guidance.

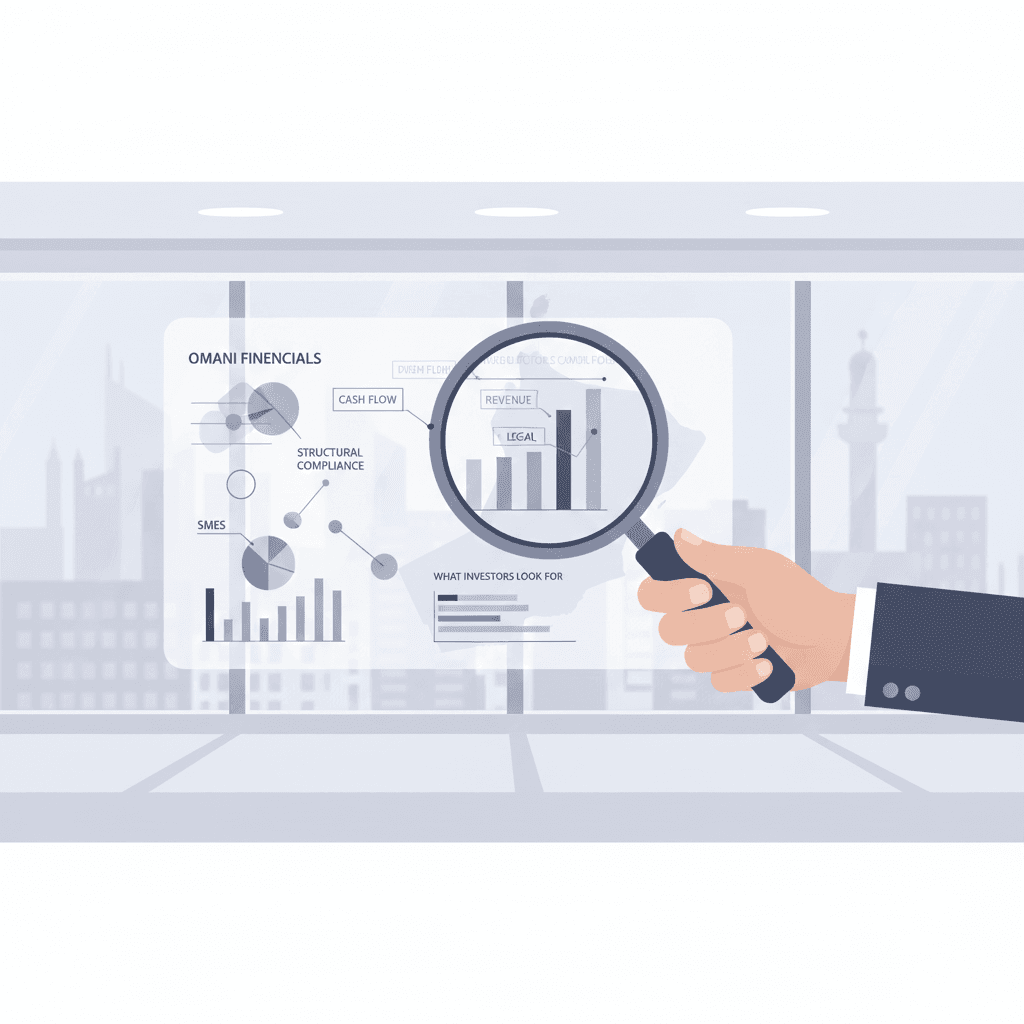

How Feasibility Studies Influence Financing and Investor Confidence in Muscat

Building Trust with Banks and Investors

Access to finance remains a critical challenge for many SMEs in Muscat, with lenders and investors increasingly demanding proof of viability before committing funds. A well-prepared feasibility study serves as a credible document that validates the business concept, financial projections, and operational plans. It reassures banks and investors that the risks have been carefully assessed and mitigated, increasing the likelihood of securing loans or equity investment. Furthermore, feasibility studies provide transparency around taxation and compliance risks, which are common concerns for funding institutions in Oman. Leaderly’s experience shows that SMEs presenting detailed feasibility reports position themselves as serious contenders in a competitive financing environment. This confidence-building role of feasibility studies ultimately facilitates smoother funding processes and better terms, enabling businesses to execute their growth plans with assurance.

Common Pitfalls in Feasibility Studies and How Muscat SMEs Can Avoid Them

Ensuring Accuracy and Local Relevance

While feasibility studies are powerful, their effectiveness depends on accuracy and contextual relevance. Many SMEs in Muscat fall into traps such as relying on outdated market data, underestimating costs, or overlooking regulatory changes, especially related to Oman’s evolving VAT and corporate tax frameworks. Overly optimistic revenue forecasts or ignoring local competition can lead to flawed conclusions and investment failures. To avoid these pitfalls, SMEs should engage experienced advisory firms like Leaderly, which have deep knowledge of the Omani market and legal environment. Using precise, up-to-date information and incorporating detailed financial modeling tailored to Muscat’s economic conditions strengthens the feasibility analysis. Additionally, periodic reviews of feasibility studies ensure they remain relevant as market dynamics shift. This diligence is essential for protecting investment and ensuring sustainable business growth in Oman.

In conclusion, Muscat advisory services centered on feasibility studies provide an indispensable framework for reducing investment risk and enhancing decision-making quality. By thoroughly analyzing market conditions, financial viability, operational capabilities, and regulatory compliance, feasibility studies equip business owners and SME founders with clear, actionable insights specific to the Omani business environment. When combined with expert advisory support from firms like Leaderly, these studies form a robust foundation for sound financial planning and risk mitigation.

For SMEs and entrepreneurs in Muscat, embracing feasibility studies is not merely a procedural step but a strategic imperative. It strengthens investor confidence, facilitates financing, and ultimately safeguards capital by identifying challenges before they escalate. This proactive approach to investment readiness positions Muscat’s business community for sustainable growth, profitability, and resilience in an ever-evolving market.

#Leaderly #MuscatAdvisory #Oman #Muscat #SMEs #Accounting #Tax #Audit