Manufacturing in Muscat Costing Basics: A Guide to Smarter Pricing Strategies

Understanding the Importance of Costing in Manufacturing

For manufacturing businesses in Muscat, mastering costing basics is fundamental to making informed pricing decisions that sustain profitability and competitiveness. Costing involves accurately calculating all expenses involved in producing a product—from raw materials and labor to overhead costs—ensuring that every Omani rial spent is accounted for. This is especially critical in Muscat’s dynamic economic environment, where market conditions and regulatory requirements such as VAT and corporate tax continuously influence operational costs. Manufacturing SMEs must grasp these costing fundamentals to avoid underpricing products, which can erode margins, or overpricing, which may reduce market share.

Costing is not merely a financial exercise but a strategic tool that provides clarity on where efficiencies can be improved or costs reduced. By breaking down costs into direct and indirect categories, Muscat manufacturers can identify which parts of their process are cost drivers and focus efforts accordingly. For instance, understanding the weight of raw material costs versus labor costs helps in negotiating better supplier contracts or investing in automation technologies. These insights align with Leaderly’s advisory services, which support SMEs in Oman to optimize their cost structures in line with local tax and audit regulations.

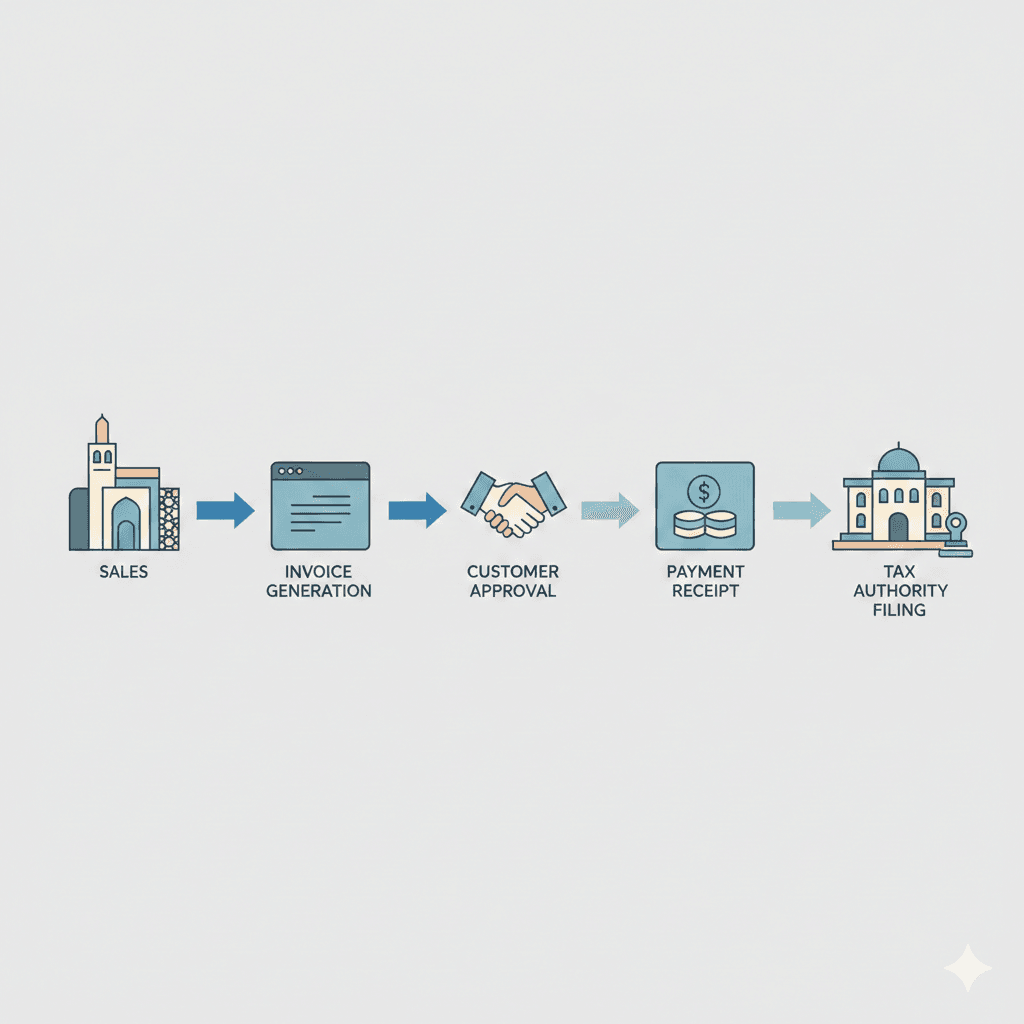

Moreover, accurate costing plays a vital role in compliance with Oman’s VAT and corporate tax regulations. With Oman’s tax environment evolving, maintaining detailed and transparent costing records aids SMEs in preparing accurate tax filings and reduces the risk of non-compliance penalties. Leaderly’s expertise in taxation and audit can guide manufacturing businesses in Muscat to embed costing processes that align with legal requirements while enabling robust financial planning and pricing strategies.

Key Cost Components in Muscat Manufacturing

Manufacturing in Muscat requires a detailed understanding of cost components unique to the local context. Direct costs, including raw materials sourced either locally or imported, can be affected by fluctuations in supply chain logistics and currency rates, impacting overall product cost. Labor costs in Oman, influenced by Omanisation policies and wage structures, form another significant element. Accurate tracking of these direct costs is crucial for SMEs to maintain a clear view of production expenses.

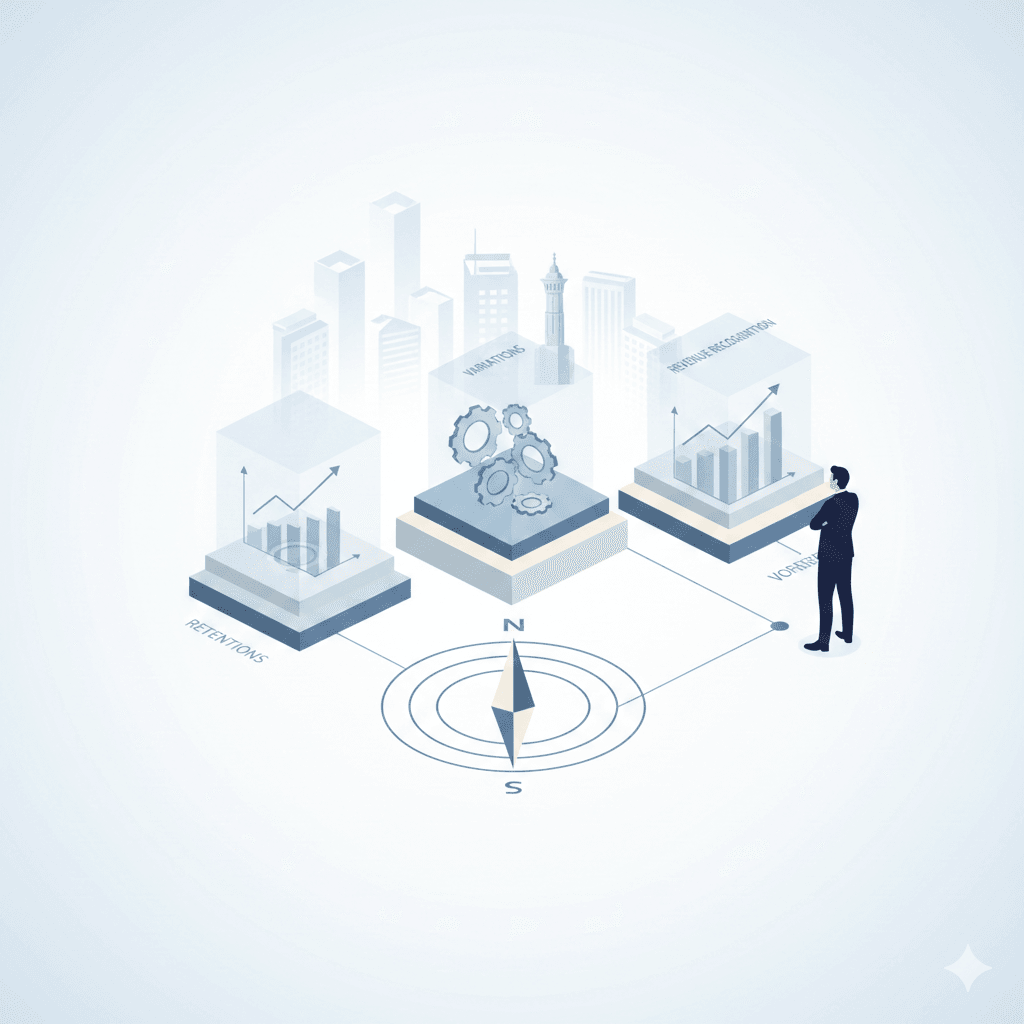

In addition to direct costs, indirect costs or overheads such as utilities, equipment depreciation, facility rent, and administrative expenses must be allocated properly. For manufacturing SMEs in Muscat, these overheads often vary with scale and production complexity. A precise overhead allocation method—whether activity-based costing or traditional absorption costing—helps in distributing these expenses fairly across products, which directly impacts pricing decisions.

Additionally, manufacturing businesses must consider compliance costs associated with taxation and regulatory audits in Oman. These costs, often overlooked, form part of the broader cost picture. Incorporating tax-related expenses such as VAT compliance and potential corporate tax liabilities into the costing model ensures pricing reflects the full cost of doing business in Muscat. Leaderly’s integrated audit and tax services provide valuable support for SMEs to understand and manage these indirect financial impacts effectively.

How Accurate Costing Enhances Pricing Decisions

In Muscat’s competitive manufacturing landscape, pricing decisions founded on precise costing data enable SMEs to position products optimally in the market. Accurate costing allows business owners to establish a price floor—covering all expenses and desired profit margins—ensuring financial sustainability. This precision helps prevent losses caused by underestimating production costs, which is a common risk when costing methods are rudimentary or incomplete.

Moreover, understanding the cost structure enables manufacturers to strategically apply pricing models such as cost-plus pricing or value-based pricing. SMEs in Muscat can leverage this data to respond swiftly to market changes, such as shifts in raw material prices or new taxation policies, recalibrating prices without sacrificing profitability. Leaderly’s advisory expertise helps manufacturing clients design flexible costing frameworks that adapt to these market dynamics and maintain competitive advantage.

Better pricing decisions also build trust with customers by reflecting transparent and justifiable cost structures. When pricing is aligned with accurate costing, manufacturers can confidently negotiate contracts and bids, enhancing their reputation and long-term sustainability in Muscat’s growing industrial sector. The integration of costing with tax compliance and audit readiness further strengthens the financial health and governance of manufacturing SMEs.

Costing Challenges Unique to Manufacturing SMEs in Muscat

Manufacturing SMEs in Muscat face distinct challenges in implementing effective costing systems. Limited resources often restrict access to sophisticated costing tools and skilled financial personnel. This gap can lead to oversimplified costing methods that miss important expense nuances, compromising pricing accuracy and business viability. Overcoming these hurdles requires tailored advisory and accounting solutions that fit the scale and maturity of each enterprise.

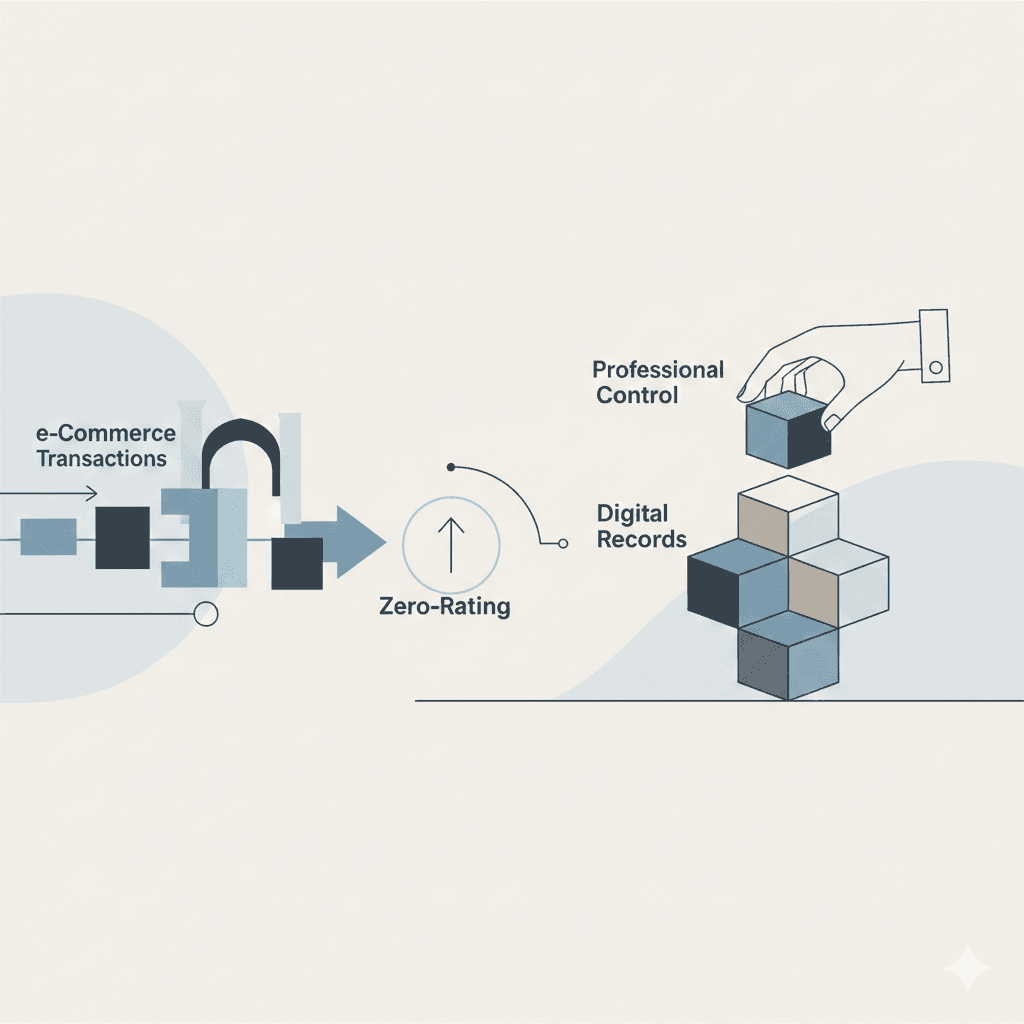

Additionally, fluctuating import costs and supply chain disruptions, common in the Gulf region, pose volatility risks that complicate cost forecasting. Manufacturing businesses in Muscat must incorporate buffer strategies within their costing to absorb such shocks without eroding margins. This involves close monitoring of supplier contracts, currency risks, and logistics expenses—areas where Leaderly’s comprehensive audit and advisory services can provide crucial insights and risk mitigation.

Compliance with Oman’s evolving tax landscape adds another layer of complexity. SMEs may struggle with integrating VAT and corporate tax implications into their costing and pricing models, risking errors in tax reporting and potential penalties. Ongoing professional support is vital for manufacturers to remain compliant while optimizing cost management. Leaderly’s combined expertise in taxation and accounting ensures that costing practices are both legally sound and financially strategic.

Implementing Costing Systems for Manufacturing in Muscat

Building an effective costing system starts with selecting the right approach tailored to the business’s size and complexity. Activity-based costing (ABC) is often recommended for manufacturing SMEs in Muscat due to its precision in allocating overheads based on actual activities. This method helps identify inefficient processes and opportunities for cost savings, directly supporting better pricing decisions and profitability.

SMEs must also invest in reliable accounting and ERP software capable of integrating cost data with sales, inventory, and tax compliance functions. The right technology solution reduces manual errors and provides real-time insights into cost behaviors, essential for agile decision-making. Leaderly’s audit and advisory teams guide SMEs through technology assessments and implementation plans that align with Oman’s regulatory framework and business environment.

Training and capacity building for finance and operations teams ensure that costing processes are maintained accurately and consistently. This ongoing commitment is crucial for adapting to changing cost drivers and market conditions in Muscat’s manufacturing sector. Leaderly supports this through practical advisory, helping businesses embed best practices and continuous improvement in their costing methodologies.

The Role of Leaderly in Enhancing Manufacturing Costing in Muscat

Leaderly plays a pivotal role in supporting manufacturing SMEs in Muscat to refine their costing systems and improve pricing decisions. By combining deep expertise in audit, accounting, and taxation, Leaderly offers integrated solutions that address the full spectrum of costing challenges unique to Oman. This holistic approach ensures SMEs not only meet regulatory obligations but also gain competitive advantages through strategic financial management.

Leaderly’s advisory services extend beyond compliance, focusing on feasibility studies, valuation, and due diligence that inform investment and pricing strategies in manufacturing. This insight helps businesses identify profitable product lines, optimize resource allocation, and prepare for market fluctuations. In a rapidly evolving business environment like Muscat, Leaderly’s partnership empowers SMEs to build resilient costing frameworks that support growth and sustainability.

Through personalized consulting and hands-on support, Leaderly guides manufacturing clients in navigating Oman’s tax system, enhancing audit readiness, and leveraging costing data for strategic decisions. This comprehensive service model reinforces confidence in pricing accuracy, operational efficiency, and long-term financial health for Muscat’s manufacturing sector.

Manufacturing in Muscat Costing Basics equips SMEs with the critical knowledge and practical tools necessary to thrive in a competitive and regulated marketplace. Accurate costing combined with expert advisory empowers businesses to set prices that reflect true costs, ensure profitability, and sustain compliance—key ingredients for success in Oman’s industrial landscape.

Investing in robust costing practices supported by Leaderly’s expertise enables manufacturing SMEs in Muscat to transform challenges into opportunities, aligning financial discipline with strategic ambition. This approach lays the foundation for stronger market positioning, enhanced operational performance, and enduring business growth.

#Leaderly #ManufacturingInMuscatCostingBasics #Oman #Muscat #SMEs #Accounting #Tax #Audit