Leaderly Accounting Services in Muscat: Comprehensive Solutions for SME Success

Understanding the Scope of Leaderly Accounting Services in Muscat

Leaderly accounting services in Muscat represent far more than traditional bookkeeping. For SMEs and entrepreneurs operating in Oman’s vibrant economic landscape, “full-service” accounting encompasses an integrated approach to financial management that adapts to local regulatory and business needs. Beyond recording transactions, it involves comprehensive support across audit readiness, taxation, and advisory. This broad scope is essential to ensure compliance with Oman’s VAT and newly introduced corporate tax frameworks, both of which require meticulous attention to detail and ongoing updates as legislation evolves. For SMEs, partnering with a service provider like Leaderly means access to professional expertise that translates complex regulations into practical actions, enabling businesses to focus on growth rather than compliance risks.

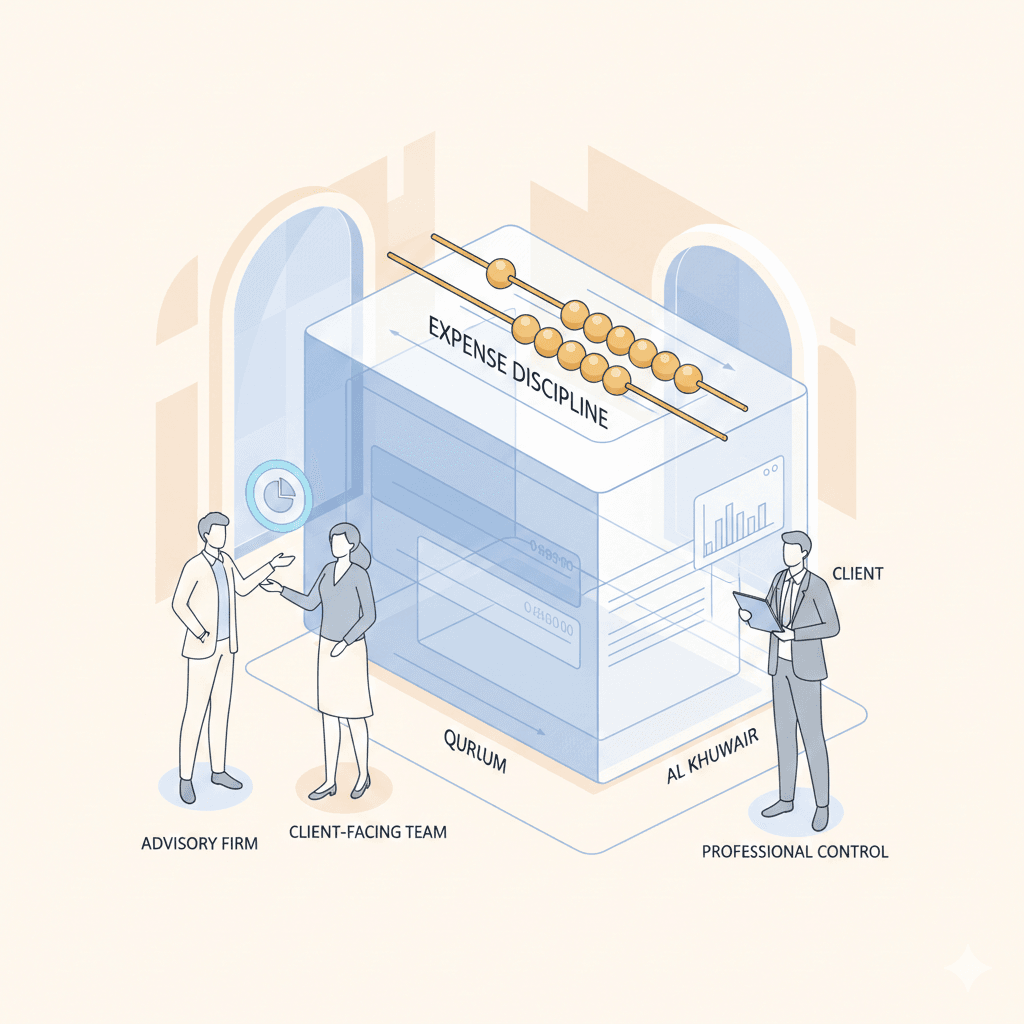

One of the defining elements of Leaderly accounting services in Muscat is the emphasis on personalized, client-focused solutions. SMEs often face resource constraints and fluctuating business volumes, making standardized approaches insufficient. Leaderly’s full-service model integrates customized financial reporting, internal controls, and audit preparedness. This means that businesses are not only prepared for official audits but also benefit from periodic financial health assessments. Such evaluations can identify inefficiencies and opportunities, enabling SMEs to make data-driven decisions. This proactive stance transforms accounting from a mere operational task into a strategic asset, enhancing overall business resilience in a competitive market.

Another critical aspect of Leaderly accounting services in Muscat is seamless VAT and corporate tax management. With Oman’s VAT system still relatively new and corporate tax regulations recently implemented, many SMEs find themselves navigating uncharted territory. Leaderly’s expertise ensures accurate VAT filings, adherence to deadlines, and optimization of tax liabilities. Additionally, they provide advisory support to structure transactions efficiently and maintain compliance without sacrificing operational agility. This holistic approach reduces risks of penalties or audits while reinforcing transparent financial practices that build credibility with stakeholders and financial institutions alike.

Key Components of Full-Service Accounting Tailored to Muscat’s SME Market

At the heart of Leaderly accounting services in Muscat is a structured approach that covers core accounting, audit readiness, taxation, and business advisory, all calibrated to the specific challenges faced by SMEs. The first pillar involves comprehensive bookkeeping and financial reporting that not only comply with Oman’s regulations but also deliver meaningful insights. Leaderly’s team ensures timely preparation of management accounts, cash flow statements, and balance sheets, supporting informed decision-making and financial stability. This foundation is indispensable for SMEs looking to secure financing, plan expansions, or optimize operations.

Audit readiness is a second fundamental pillar, especially for SMEs subject to regulatory audits or seeking external funding. Leaderly’s services in Muscat encompass detailed internal control reviews and pre-audit checks that identify and rectify discrepancies early. This approach minimizes surprises during official audits, safeguarding business continuity. Furthermore, the expertise in local audit requirements and standards allows SMEs to align internal processes with regulatory expectations. This results in enhanced transparency, improved governance, and greater investor confidence.

The third core element lies in taxation and advisory services. Leaderly’s comprehensive tax management in Muscat spans VAT compliance, corporate tax planning, and advisory on business feasibility and valuation. These services help SMEs optimize their tax positions while ensuring full compliance. Advisory offerings also include due diligence for mergers or acquisitions and support during liquidation processes, which are critical during significant business transitions. This spectrum of services ensures SMEs have a trusted partner capable of addressing complex financial scenarios and strategic growth challenges within Oman’s regulatory framework.

The Strategic Value of Partnering with Leaderly for Accounting in Muscat

Choosing Leaderly accounting services in Muscat means more than outsourcing financial tasks; it means gaining a strategic partner deeply familiar with the local business environment. This local insight is vital because Oman’s economic policies and tax frameworks are evolving rapidly. Leaderly’s team stays ahead of regulatory changes, helping SMEs adapt quickly and avoid compliance pitfalls. Their hands-on approach also includes training and capacity building for internal finance teams, strengthening SMEs’ financial governance from within.

Additionally, Leaderly’s advisory services go beyond compliance to include feasibility studies and business valuations tailored for the Muscat market. These insights assist SMEs in evaluating new projects or investments with a clear understanding of financial risks and potential returns. This strategic foresight supports sustainable growth and helps businesses attract investors or secure bank financing. For many SMEs, such advisory services are invaluable in navigating the complexities of business expansion and market competition.

Finally, the integration of technology in Leaderly’s accounting services enhances accuracy and efficiency. Utilizing cloud-based accounting systems and automated VAT filing tools enables real-time financial monitoring and faster reporting cycles. For SMEs in Muscat, where agility can be a competitive advantage, such technological adoption allows them to stay current with financial obligations while freeing resources for core business activities. This technology-driven approach aligns perfectly with Oman’s digital transformation goals and positions Leaderly as a forward-thinking accounting partner.

Conclusion

Leaderly accounting services in Muscat offer SMEs and entrepreneurs a comprehensive, locally attuned solution that extends well beyond basic bookkeeping. By integrating audit readiness, meticulous VAT and corporate tax management, and strategic business advisory, Leaderly empowers businesses to navigate Oman’s regulatory landscape confidently and focus on growth. The tailored approach, combined with deep local knowledge and modern technology, ensures SMEs are well-prepared for financial challenges and opportunities alike.

In today’s dynamic economic environment, full-service accounting is an essential pillar of business success. Partnering with Leaderly means gaining not only compliance and control but also strategic insights that foster resilience and expansion. For SMEs in Muscat, this partnership is a vital step towards sustainable growth and financial clarity, enabling them to thrive amid the evolving business and regulatory climate of Oman.

#Leaderly #LeaderlyAccountingServicesinMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit