Virtual CFO

Strategic financial oversight and advisory support to help organisations strengthen decision-making, control costs, and improve financial performance.

Virtual CFO Services

Virtual CFO services provide an effective and flexible solution for small businesses and growing organisations seeking professional financial leadership without the cost of a full-time executive. These services support improved financial reporting, planning, forecasting, and strategic decision-making.

Virtual CFO support enables businesses to access experienced financial expertise tailored to their size, stage, and operational needs.

Benefits of Virtual CFO Services

Virtual CFO services help organisations strengthen financial oversight while maintaining cost efficiency. By leveraging external financial leadership, businesses gain structured insight into financial performance and future planning.

Key benefits include improved financial clarity, enhanced forecasting capabilities, and access to senior-level financial expertise without the overhead associated with permanent executive appointments.

Empowering businesses with digital foresight and financial wisdom, the Virtual CFO blends expertise and innovation to guide organisations toward sustainable growth in an increasingly digital economy.

Discover the Advantages of Virtual CFO Support

The demand for virtual CFO services continues to grow, particularly among small and medium-sized businesses seeking scalable and cost-effective financial management solutions.

Engaging a virtual CFO allows organisations to avoid the fixed costs of employing a full-time Chief Financial Officer while benefiting from services that are aligned with specific operational and strategic requirements. Service scope and engagement levels can be adjusted to match business needs as they evolve.

For business owners, this approach offers access to professionals with experience across multiple industries and organisational structures. Flexible engagement models and tailored support ensure alignment with business priorities, growth plans, and reporting requirements.

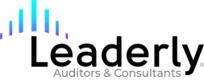

Services Offered by Virtual CFOs

Virtual CFOs provide a structured range of financial services designed to support strategic objectives and operational efficiency. These services position virtual CFOs as long-term financial partners while maintaining cost effectiveness.

Financial Strategy

Development of tailored financial strategies, including budgeting frameworks, financial risk management, and long-term financial planning to support sustainable profitability.

Budgeting and Forecasting

Preparation of budgets, implementation of cost-control measures, and cash flow forecasting to support informed financial decision-making.

Financial Reporting

Preparation and analysis of financial reports, including financial statements and balance sheets, to assess overall financial performance and position.

Board Meeting Preparation

Support with board meeting preparation through financial analysis, reporting, and clear communication of current financial performance.

Financial Systems and Process Implementation

Establishment and optimisation of accounting software, bookkeeping processes, and payroll systems to improve operational efficiency.

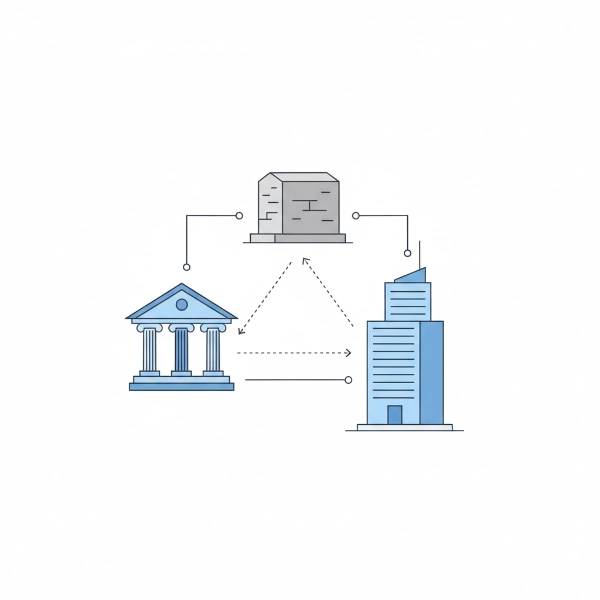

External Relationship Management

Liaison with auditors, banks, and investors to ensure accurate and timely communication regarding the organisation’s financial position.