How to Set Up Approval Workflows in Muscat: Streamlining Purchases to Payments

Understanding Approval Workflows in Muscat’s SME Landscape

Why Approval Workflows Matter for Business Control

How to Set Up Approval Workflows in Muscat is a crucial step for SMEs aiming to strengthen their financial management from purchases to payments. Approval workflows involve a structured process where purchase requests, expense authorizations, and payment approvals follow specific hierarchical stages before being executed. This systematic approach minimizes errors, curbs unauthorized spending, and ensures that expenditures align with company policies. For SMEs operating in Oman, where financial discipline and regulatory compliance are paramount, implementing a robust workflow helps prevent cash flow leaks and enforces accountability. Additionally, tailoring these workflows to suit the local business environment and comply with VAT and corporate tax regulations mandated by Oman’s Tax Authority is essential for sustainable financial control.

Key Components of an Approval Workflow Tailored for Muscat SMEs

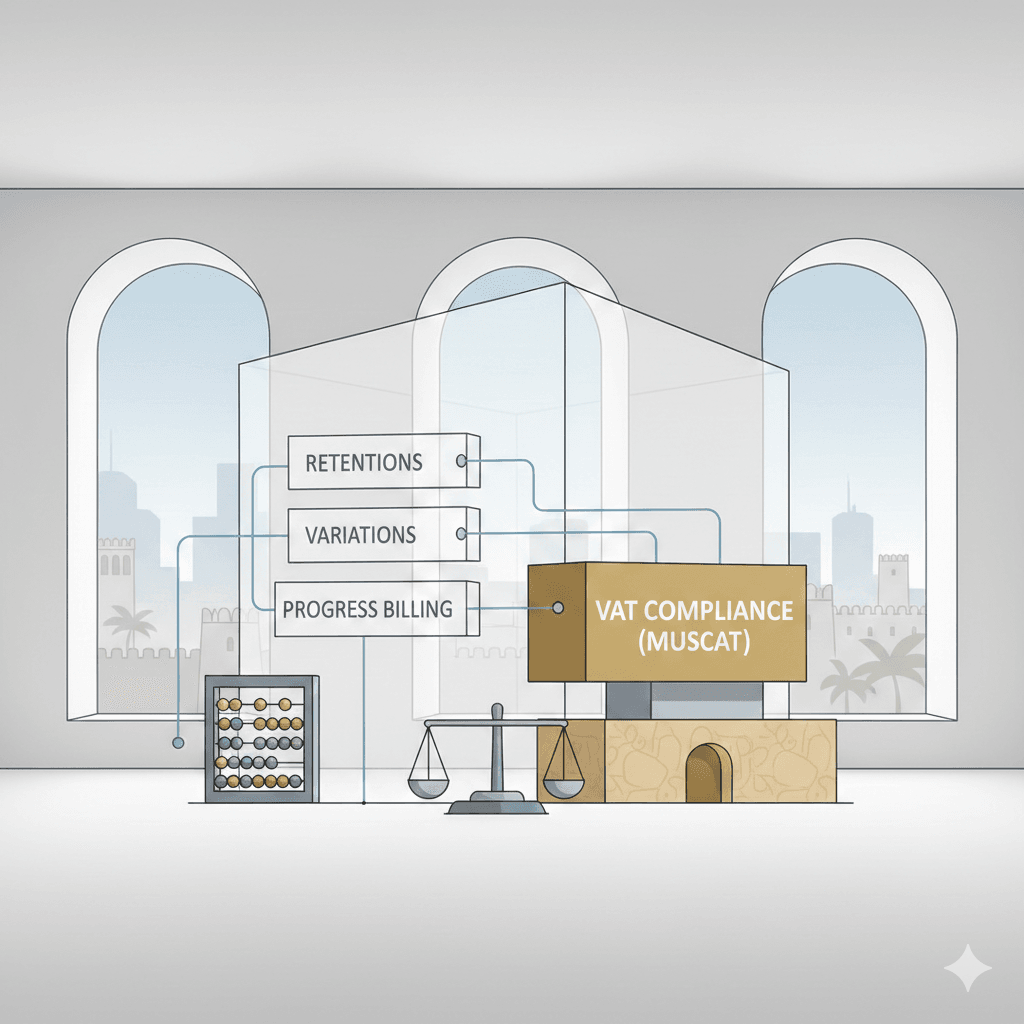

Effective approval workflows in Muscat integrate three core components: request initiation, approval routing, and final payment execution. Purchase requests should start with clear documentation including vendor details, cost estimates, and business justification. These requests then move through designated approvers, often segmented by monetary thresholds aligned with company policy. In Oman, compliance with VAT invoicing and documentation adds an additional layer to approval, ensuring tax legitimacy. The final step is payment processing, which requires reconciliation with approved requests and invoices. Integrating technology tools that support these steps can streamline the workflow, reduce human errors, and provide audit trails critical during financial reviews or tax audits. Such alignment with Leaderly’s advisory on financial controls strengthens SME governance.

Implementing Digital Solutions for Purchase to Payment Workflows

Modern SMEs in Muscat are increasingly adopting digital platforms to automate their approval workflows, enhancing transparency and efficiency. Cloud-based accounting and ERP solutions tailored for Omani SMEs can automate routing, flag exceptions, and integrate with tax reporting tools. This automation reduces the manual burden on finance teams, accelerates approvals, and ensures consistent policy enforcement. Moreover, digital audit trails created through these tools facilitate compliance with Oman’s regulatory authorities, especially for VAT and corporate tax submissions. However, successful digital adoption requires clear role definitions, training, and change management aligned with business scale and complexity. Expert advisory services such as those offered by Leaderly can guide SMEs in selecting and customizing these platforms to meet both operational and regulatory demands.

Defining Clear Roles and Responsibilities Within the Workflow

A key pillar for successful approval workflows in Muscat’s SMEs is defining clear roles for each participant in the purchase-to-payment cycle. From the purchasing officer who initiates requests to the finance manager responsible for final payments, clarity in responsibilities prevents bottlenecks and confusion. Roles must align with company size and organizational hierarchy, ensuring that authorization limits are respected. For example, low-value purchases might require only department head approval, while high-value transactions could demand senior management sign-off. Defining such thresholds is vital for risk management and internal control, particularly in Oman’s evolving tax landscape where transparency is essential to withstand scrutiny during audits. Establishing these roles also enables better segregation of duties, a principle recommended by Leaderly’s audit services for mitigating fraud risks.

Balancing Compliance and Operational Efficiency

While approval workflows enhance financial control, they must also be designed to avoid unnecessary delays that impede operational agility. For SMEs in Muscat, where market responsiveness can define success, approval workflows should strike a balance between compliance and speed. This can be achieved by setting clear timelines for approvals, leveraging digital alerts and reminders, and incorporating escalation procedures for stalled requests. Ensuring compliance with Oman’s VAT regulations means that every purchase and payment must be documented correctly, but this should not create cumbersome processes that frustrate employees or suppliers. Expert advisory can help SMEs customize workflows that satisfy both regulatory requirements and business efficiency goals, strengthening overall financial health and supplier relationships.

Monitoring, Reporting, and Continuous Improvement of Workflows

Establishing an approval workflow is not a one-time effort; continuous monitoring and improvement are essential for sustained success. SMEs in Muscat should regularly review workflow performance metrics such as approval times, exceptions, and compliance gaps. Reporting tools integrated with accounting systems can highlight bottlenecks and unusual transactions, enabling proactive management. Regular audits, whether internal or supported by external experts like Leaderly, ensure that workflows remain aligned with evolving tax laws and business needs. Continuous feedback loops involving finance teams, approvers, and operational staff encourage adaptation and refinement. This dynamic approach ensures that workflows remain robust, compliant, and efficient, ultimately contributing to stronger cash flow management and reduced financial risks.

Approval workflows designed specifically for SMEs in Muscat provide critical controls that protect financial integrity and ensure compliance with Oman’s regulatory framework. By understanding the unique business context and leveraging technology, SMEs can transform purchase-to-payment cycles into transparent, efficient processes that support sustainable growth.

Strategically implemented workflows that define clear roles, balance operational needs, and incorporate ongoing improvements enable business owners and finance managers in Muscat to mitigate risks while enhancing financial visibility. This foundational financial discipline, aligned with expert advisory services, equips SMEs to thrive in Oman’s competitive market, turning routine approvals into a strategic advantage rather than a hurdle.

#Leaderly #HowToSetUpApprovalWorkflowsInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit