Ghala Accounting for Logistics: Strategies for Warehouse and Fleet Cost Control

Understanding Ghala Accounting for Logistics

Core financial challenges for logistics in Ghala

Ghala accounting for logistics presents unique financial challenges that SMEs operating in Muscat must navigate carefully. This area involves tracking and managing costs tied to warehouses, fleets, and the broader supply chain. Unlike typical business accounting, logistics demands precision in cost allocation across different operational segments. For SMEs in Ghala, a major commercial district known for warehousing and transport hubs, efficient accounting ensures that resource utilization, cash flow, and regulatory obligations are managed proactively. It’s crucial to understand how warehouse expenses—such as rent, utilities, and security—impact overall profitability. Likewise, fleet costs including fuel, maintenance, and insurance need accurate tracking to avoid hidden drains on working capital. Aligning these accounting practices with Oman’s VAT and emerging corporate tax frameworks also adds complexity that requires specialist financial oversight.

The Role of Warehouse Cost Accounting in Ghala

Why accurate warehouse expense allocation matters

Warehouse management forms the backbone of logistics operations in Ghala, making its accounting a vital focus area for SMEs. Unlike generic cost accounting, warehouse cost accounting involves detailed tracking of both fixed and variable expenses. Fixed costs might include long-term lease payments or depreciation of warehouse assets, while variable costs relate to energy consumption, maintenance, and staffing. SMEs in Ghala need to adopt accounting systems capable of distinguishing these costs to enable granular financial analysis. Proper warehouse cost accounting helps identify inefficiencies such as underutilized space or excessive energy use, which directly affect profit margins. Moreover, maintaining compliant records for VAT input credits related to warehouse expenses requires disciplined bookkeeping. Financial advisory services that specialize in logistics can guide SMEs in Ghala to develop reporting frameworks that provide clarity and enhance decision-making.

Fleet Cost Control: A Financial Imperative in Ghala

Managing vehicle expenses to optimize logistics profitability

In Ghala, fleet management is inseparable from logistics accounting due to the heavy reliance on transportation for moving goods. Fleet cost control is a financial imperative for SMEs to maintain operational efficiency and cost-effectiveness. Detailed accounting of fleet costs includes tracking fuel consumption, repairs, driver wages, insurance premiums, and vehicle depreciation. Overlooking any of these components can lead to distorted financial reports and poor budgeting. For example, unaccounted fuel inefficiencies or delayed maintenance can cause sudden cost spikes. Implementing integrated fleet accounting solutions allows SMEs to monitor expenditures in real time and plan preventive maintenance schedules. Furthermore, compliance with Oman’s taxation rules around fleet-related expenses, including VAT recovery on fuel and maintenance, demands thorough documentation. This attention to detail empowers business owners and finance managers to control overheads and improve the bottom line.

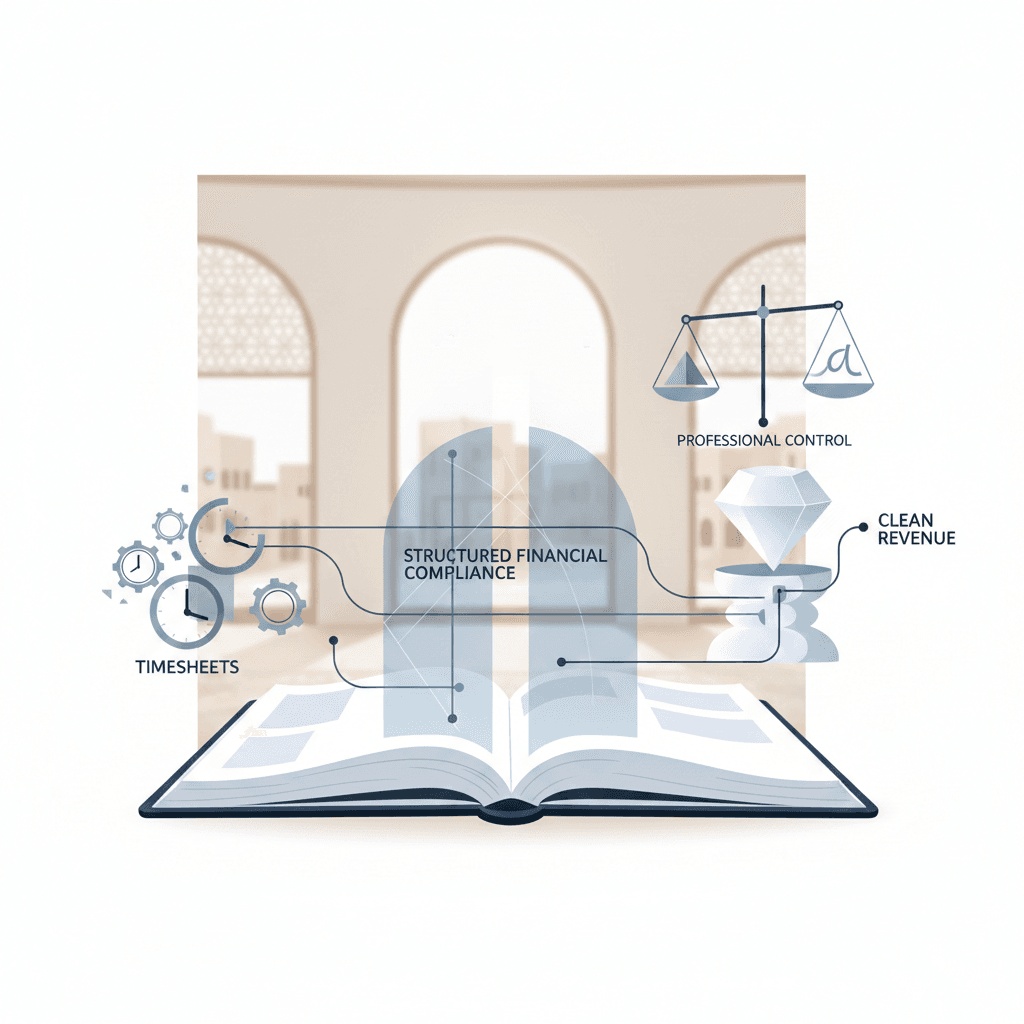

Integrating VAT Compliance in Ghala Logistics Accounting

Practical VAT considerations for warehouses and fleets

Incorporating VAT compliance within Ghala accounting for logistics is essential due to the structured tax environment in Oman. VAT applies to many costs related to warehouses and fleet operations, including rent, utility bills, vehicle repairs, and fuel. SMEs must ensure that their accounting systems capture and classify these expenses accurately to claim VAT input credits correctly. This task becomes challenging in logistics due to the diverse nature of costs and multiple suppliers involved. Poor VAT compliance can lead to costly audits and penalties. Businesses benefit from advisory support that provides tailored training and process improvements to ensure that logistics expenses are accounted for in line with Oman Tax Authority guidelines. Integrating VAT controls into daily bookkeeping streamlines tax reporting and strengthens financial transparency.

Advisory Insights: Feasibility and Valuation in Ghala Logistics

Strategic financial planning for SME logistics operations

Beyond bookkeeping and compliance, SMEs in Ghala can leverage financial advisory services to enhance their logistics operations. Feasibility studies help assess the viability of expanding warehouse space or upgrading fleet capacity by evaluating projected costs and returns. Valuation services provide an accurate financial picture of logistics assets, which is vital for securing loans or investment. These advisory functions support long-term planning and risk mitigation, enabling businesses to optimize capital allocation. SMEs often underestimate the financial complexity of logistics operations, but proactive advisory input ensures that decisions are backed by solid data and aligned with market realities. This strategic approach improves financial resilience and competitiveness in Muscat’s dynamic commercial environment.

Due Diligence and Liquidation: Preparing for Change in Ghala Logistics

Financial discipline in transition periods

In the event of restructuring or business transition, due diligence in Ghala accounting for logistics becomes paramount. Whether planning for liquidation, sale, or merger, SMEs must maintain transparent and comprehensive financial records covering warehouses, fleets, and associated costs. Due diligence processes involve verifying asset values, outstanding liabilities, and contractual obligations. In logistics, this often includes lease agreements, vehicle ownership documents, and supplier contracts. Accurate accounting ensures that businesses present a clear financial position to stakeholders and comply with Oman’s regulatory frameworks. Expert audit and advisory support facilitate smooth transitions, minimize risks, and maximize value recovery. Maintaining rigorous accounting discipline in these periods protects SME interests and sustains confidence among partners and investors.

Ghala accounting for logistics demands a holistic approach that integrates detailed cost tracking, VAT compliance, and strategic advisory. For SMEs operating in Muscat’s vibrant logistics sector, mastering warehouse and fleet accounting is not merely a technical task but a business imperative. By implementing robust financial systems and engaging expert support, businesses can control costs, enhance profitability, and navigate regulatory complexities with confidence. The practical value of such disciplined accounting extends beyond compliance, empowering SMEs to make informed decisions, attract investment, and scale sustainably within Oman’s growing economy.

Ultimately, the success of logistics SMEs in Ghala hinges on their ability to translate financial data into actionable insight. Effective accounting provides the transparency and control needed to optimize operations and seize new opportunities. Leaderly’s comprehensive expertise in audit, taxation, and advisory equips SMEs to meet these challenges head-on. In doing so, Ghala’s logistics businesses can build resilience and achieve long-term growth in one of Oman’s key commercial hubs.

#Leaderly #Ghalaaccountingforlogistics #Oman #Muscat #SMEs #Accounting #Tax #Audit