Delegation of Authority Matrix Muscat: Essential for SME Financial Governance

Understanding the Delegation of Authority Matrix Muscat

Defining Authority in Omani SMEs

The Delegation of Authority Matrix Muscat is a structured framework that defines and allocates financial decision-making powers within organizations operating in Muscat, particularly among small and medium-sized enterprises (SMEs). In Oman’s evolving business environment, clarity on who holds authority over financial commitments, approvals, and expenditures is critical to prevent bottlenecks, reduce risks, and foster accountability. This matrix sets clear boundaries for decision-making based on roles and responsibilities, ensuring that every financial transaction passes through appropriate checks and balances tailored to the company’s size and structure. By codifying authority limits, SMEs in Muscat can avoid unauthorized spending and maintain stronger internal controls, which in turn supports compliance with Oman’s tax and corporate regulations.

The Critical Role of Authority Matrices in Muscat’s Finance Control

Building Trust Through Clear Financial Oversight

Implementing a Delegation of Authority Matrix Muscat enhances the transparency and reliability of financial operations within SMEs. When owners and finance managers explicitly assign approval levels for purchases, contracts, and payments, the risk of fraud or error diminishes significantly. Moreover, it speeds up routine approvals by empowering managers to act without awaiting senior executive consent for every decision. This streamlined workflow is vital in Muscat’s competitive market, where quick and informed financial decisions can impact growth and profitability. The matrix also fosters a culture of responsibility, where employees understand the scope of their financial power and consequences, thereby aligning everyday actions with the organization’s broader governance and regulatory compliance goals.

Customizing the Matrix for Muscat SMEs’ Unique Needs

Adapting Controls to Scale and Sector

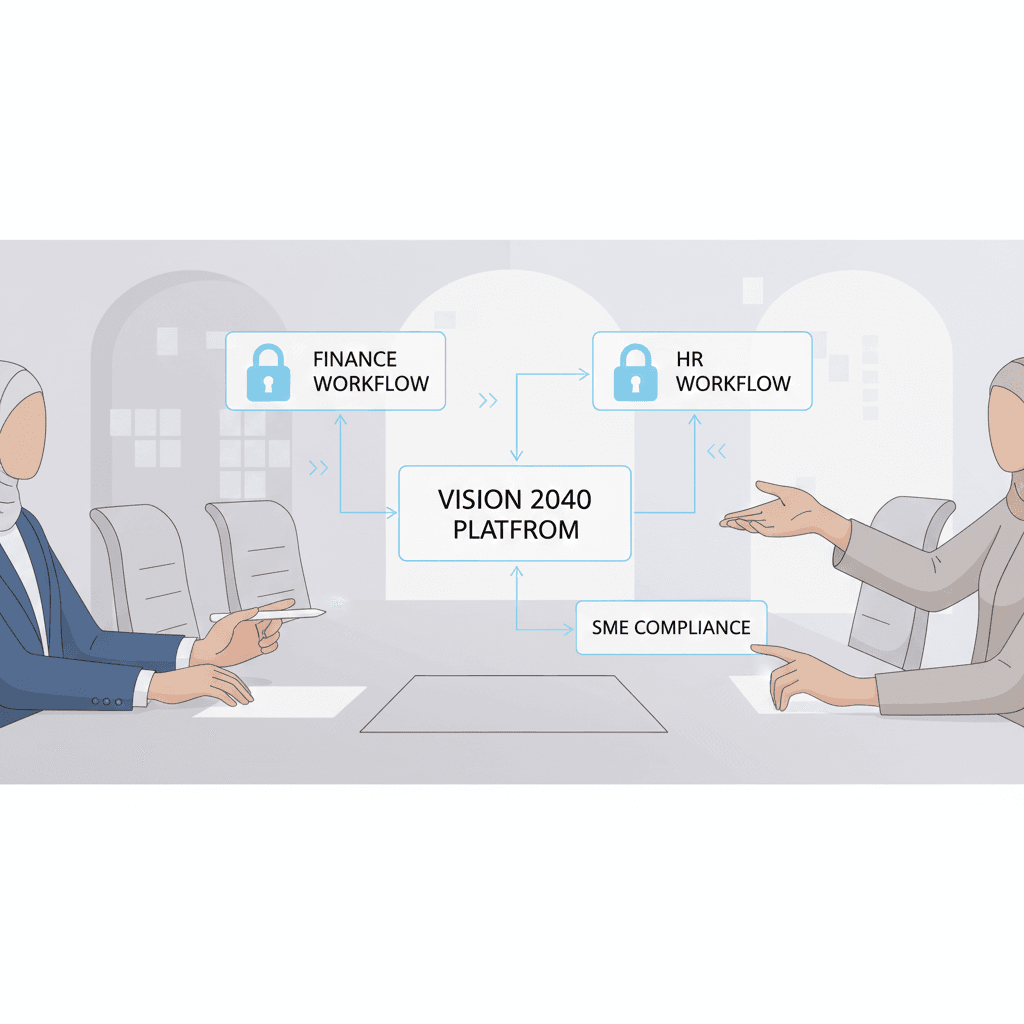

Every SME in Muscat faces unique challenges depending on industry, business model, and size, making the Delegation of Authority Matrix Muscat highly customizable. For instance, a tech startup may require a different set of spending limits and approval processes than a manufacturing firm or a trading company. Leaderly’s advisory services assist SMEs in tailoring their authority matrices to fit operational realities, ensuring the matrix is neither overly restrictive nor too lenient. Key considerations include the delegation thresholds for procurement, contract sign-offs, and capital expenditures, aligned with Oman’s VAT and corporate tax frameworks. Through periodic review and adjustment, the matrix remains relevant as businesses grow or pivot, thereby continuously supporting sound financial governance and compliance within the Muscat business context.

Designing an Effective Delegation of Authority Matrix Muscat

Defining Clear Approval Limits and Responsibilities

A fundamental step in designing a Delegation of Authority Matrix Muscat involves setting explicit monetary limits for approvals at various organizational levels. For example, junior managers might have authority to approve petty cash expenses, while larger contracts require executive-level sanction. This tiered approach prevents operational delays and minimizes risk by restricting high-value decisions to experienced personnel. In Muscat SMEs, the matrix should also specify documentation requirements, such as purchase orders or budget alignment, to enforce accountability. Leaderly’s audit and accounting expertise helps organizations implement these controls systematically, facilitating regulatory audits and ensuring that all financial approvals are traceable and verifiable under Omani law.

Integrating the Matrix with Oman’s Regulatory Requirements

Ensuring Compliance with VAT and Corporate Tax

The Delegation of Authority Matrix Muscat plays an important role in meeting Oman’s evolving tax landscape, particularly concerning VAT and corporate tax compliance. Accurate approval processes embedded in the matrix help maintain proper financial records, which are essential for tax reporting and audit readiness. By controlling who can authorize transactions, SMEs reduce the risk of errors or omissions in invoicing, tax deductions, and expense claims. Leaderly’s taxation advisory ensures that the matrix aligns with Oman’s legal frameworks, helping SMEs not only avoid penalties but also optimize tax planning strategies. A well-integrated matrix supports transparency and builds credibility with tax authorities, investors, and financial institutions operating in Muscat.

Maintaining and Reviewing the Delegation of Authority Matrix Muscat

Continuous Improvement for Financial Control

The effectiveness of a Delegation of Authority Matrix Muscat depends on regular monitoring and updates to reflect changes in business operations or regulatory environments. SMEs in Muscat benefit from periodic reviews that address emerging risks, growth milestones, or shifts in leadership roles. Leaderly’s advisory services include feasibility assessments and due diligence to evaluate whether existing delegation limits remain appropriate and effective. Adjustments to the matrix should be communicated clearly to all relevant staff to reinforce a culture of compliance and control. Through this ongoing process, the matrix evolves from a static document into a dynamic tool that strengthens financial governance, enhances operational efficiency, and supports sustainable business growth in the Muscat market.

Conclusion

In Muscat’s competitive SME landscape, the Delegation of Authority Matrix Muscat is not merely a governance formality but a practical necessity that underpins robust financial management. By clarifying who can approve what, SMEs protect themselves from financial missteps and build an environment of trust and accountability. This clarity empowers businesses to make swift, well-informed decisions that align with Oman’s regulatory demands and market expectations.

Integrating a carefully designed matrix with tax compliance and internal audit practices offers SMEs a strong foundation for sustainable growth and resilience. Leaderly’s expertise in advisory, audit, and taxation enables SMEs to customize and maintain their delegation frameworks, ensuring they remain relevant and effective in Muscat’s evolving economic environment. Ultimately, the matrix is a vital control tool that fosters transparency, compliance, and confidence for business owners, finance managers, and stakeholders alike.

#Leaderly #DelegationOfAuthorityMatrixMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit