Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Vision 2040 Business Email Compromise Pr…

Vision 2040 Business Email Compromise Pr… Al Maabela Payroll Controls for Construc…

Al Maabela Payroll Controls for Construc… Al Bustan hotel financial controls for s…

Al Bustan hotel financial controls for s… MSQ Consultants Oman Profitability Track…

MSQ Consultants Oman Profitability Track… Darsait Inventory Audits for Retail Chai…

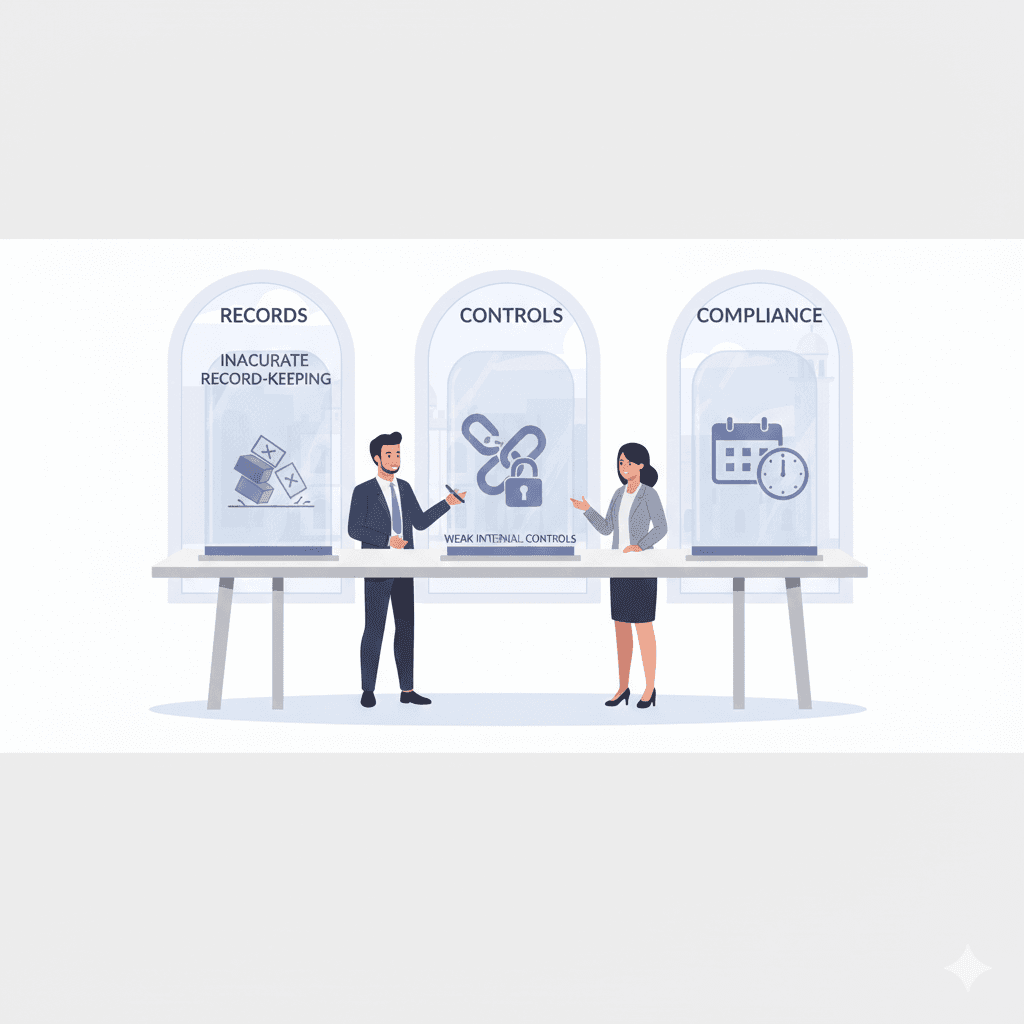

Darsait Inventory Audits for Retail Chai… Muscat SME audit findings that reveal th…

Muscat SME audit findings that reveal th… Vision 2040 Cyber Resilience for Omani B…

Vision 2040 Cyber Resilience for Omani B… Vision 2040 Secure Automation Transformi…

Vision 2040 Secure Automation Transformi… Finance Tech Stack for Muscat SMEs: Tool…

Finance Tech Stack for Muscat SMEs: Tool… Stock Audits in Muscat: Inventory Contro…

Stock Audits in Muscat: Inventory Contro… Muscat Digital Identity Compliance Why D…

Muscat Digital Identity Compliance Why D… Muscat Advisory: How Feasibility Studies…

Muscat Advisory: How Feasibility Studies… Oman Vision 2040 Digital Security Why It…

Oman Vision 2040 Digital Security Why It… Expense Claims in Oman: A Muscat Policy …

Expense Claims in Oman: A Muscat Policy … Muscat E-Invoicing Compliance Framework …

Muscat E-Invoicing Compliance Framework … Muscat Turnaround Advisory Framework Ear…

Muscat Turnaround Advisory Framework Ear… How to Fix Messy Books in Muscat: A Step…

How to Fix Messy Books in Muscat: A Step… Muscat Audit Kickoff Preparation

Muscat Audit Kickoff Preparation Feasibility Study for a New Shop in Ruwi…

Feasibility Study for a New Shop in Ruwi… Muscat E-Commerce Payment Reconciliation…

Muscat E-Commerce Payment Reconciliation…