Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Vision 2040 Cybersecurity Investment in …

Vision 2040 Cybersecurity Investment in … Expense Claims in Oman: A Muscat Policy …

Expense Claims in Oman: A Muscat Policy … Seeb Startups Accounting Solutions: From…

Seeb Startups Accounting Solutions: From… Muscat Security-by-Design Strategy: Oman…

Muscat Security-by-Design Strategy: Oman… Oman Vision 2040 Securing Customer Data …

Oman Vision 2040 Securing Customer Data … Muscat VAT Return Compliance: …

Muscat VAT Return Compliance: … E-Invoicing Security in Oman Preventing …

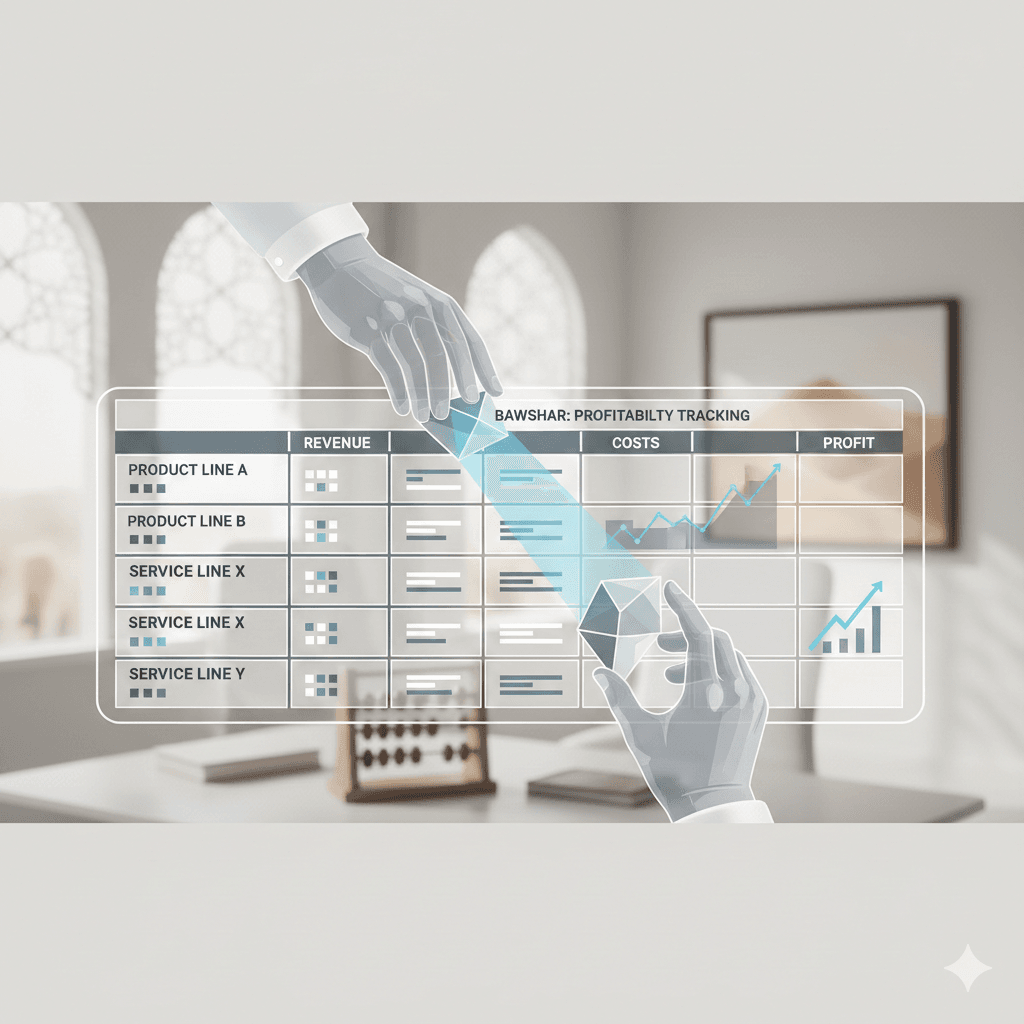

E-Invoicing Security in Oman Preventing … Bawshar Profitability Tracking by Produc…

Bawshar Profitability Tracking by Produc… VAT in Healthcare Muscat: Common Scenari…

VAT in Healthcare Muscat: Common Scenari… Muscat Payroll WPS Compliance for SMEs M…

Muscat Payroll WPS Compliance for SMEs M… Vision 2040 E-Invoicing Implementation P…

Vision 2040 E-Invoicing Implementation P… Vision 2040 Omani SMEs Digital Transform…

Vision 2040 Omani SMEs Digital Transform… Muscat supply chain cybersecurity compli…

Muscat supply chain cybersecurity compli… Muscat SME Identity Access Governance: T…

Muscat SME Identity Access Governance: T… Muscat Board Cybersecurity Governance 20…

Muscat Board Cybersecurity Governance 20… Muscat VAT registration process: a step-…

Muscat VAT registration process: a step-… How to Prevent Duplicate Payments in Mus…

How to Prevent Duplicate Payments in Mus… Petty Cash Controls in Muscat: Stop Leak…

Petty Cash Controls in Muscat: Stop Leak… Ghala Warehouse Stock Accuracy Governanc…

Ghala Warehouse Stock Accuracy Governanc… Oman Vision 2040 Digital Transformation:…

Oman Vision 2040 Digital Transformation:…