Disclaimer: Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.

Ruwi to Mutrah Finance Controls for Mult…

Ruwi to Mutrah Finance Controls for Mult… Azaiba Hospitality Finance Daily Sales R…

Azaiba Hospitality Finance Daily Sales R… Scenario Planning in Oman Muscat Finance…

Scenario Planning in Oman Muscat Finance… Azaiba SMEs Service Pricing How to Price…

Azaiba SMEs Service Pricing How to Price… Muscat E-Invoicing Compliance Framework …

Muscat E-Invoicing Compliance Framework … Mutrah Traders’ Guide: VAT Records and C…

Mutrah Traders’ Guide: VAT Records and C… Azaiba VAT for Restaurants: Navigating V…

Azaiba VAT for Restaurants: Navigating V… Segregation of Duties in Small Muscat Te…

Segregation of Duties in Small Muscat Te… Payroll Errors in Oman The Most Common I…

Payroll Errors in Oman The Most Common I… Al Ghubrah Payroll Controls for Fast-Gro…

Al Ghubrah Payroll Controls for Fast-Gro… Muscat Vendor Portal Security 2040: Buil…

Muscat Vendor Portal Security 2040: Buil… How to Set Up Approval Workflows in Musc…

How to Set Up Approval Workflows in Musc… Muscat supply chain cybersecurity compli…

Muscat supply chain cybersecurity compli… Oman Vision 2040 Cybersecurity Risks

Oman Vision 2040 Cybersecurity Risks Digital Transformation in Oman: How to M…

Digital Transformation in Oman: How to M… Muscat Tax & VAT Compliance: How to…

Muscat Tax & VAT Compliance: How to… Manufacturing in Muscat Costing Basics f…

Manufacturing in Muscat Costing Basics f… Muscat Stock Audits: How to Set Up Annua…

Muscat Stock Audits: How to Set Up Annua… Vision 2040 Cybersecurity Investment in …

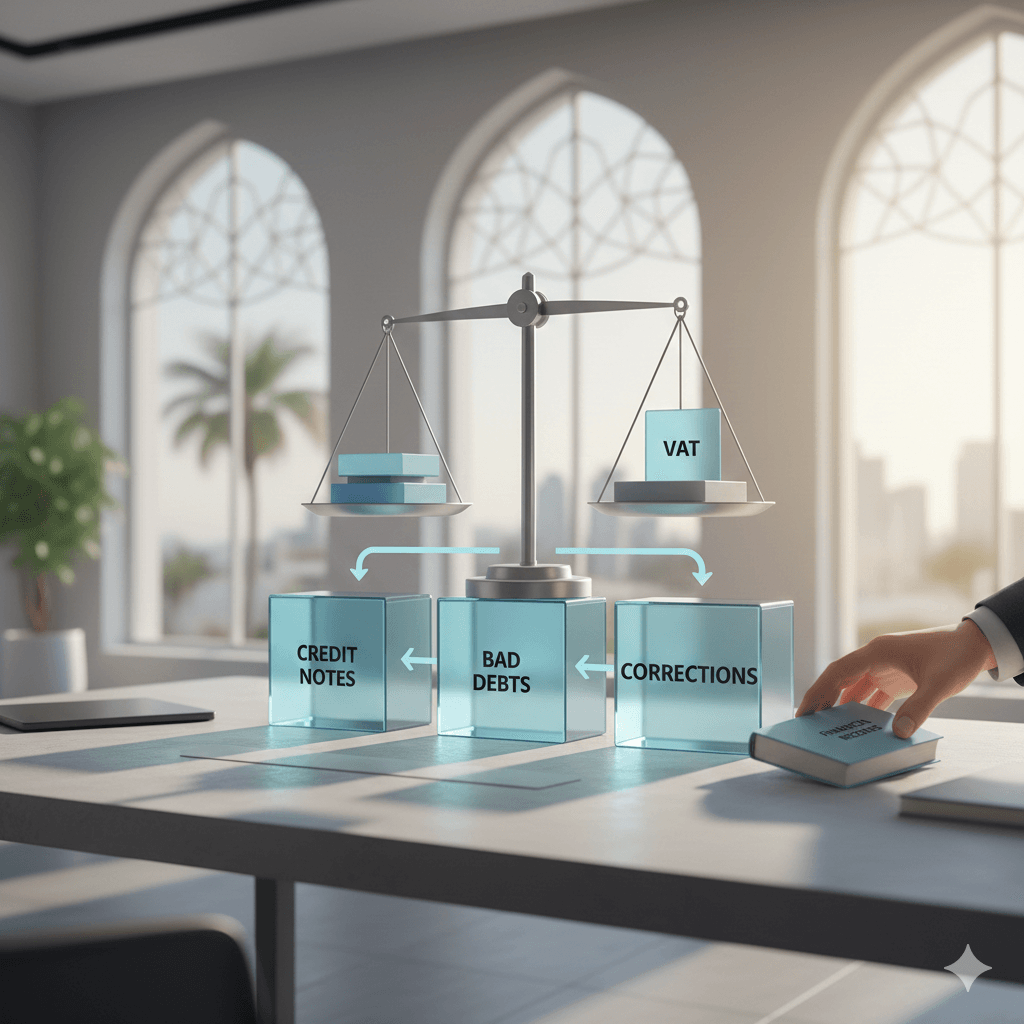

Vision 2040 Cybersecurity Investment in … VAT Adjustments in Oman: Credit Notes, B…

VAT Adjustments in Oman: Credit Notes, B…