Business Valuation in Muscat: Practical Insights for SMEs and Entrepreneurs

Understanding the Importance of Business Valuation in Muscat

Why Accurate Valuation Matters for SMEs

Business valuation in Muscat is a critical process for SMEs, entrepreneurs, and finance managers who seek to understand the true worth of their enterprises. Whether preparing for a sale, securing investment, or assessing growth potential, a clear valuation provides a factual foundation for decision-making. In Oman’s evolving market, valuation is not just about numbers; it reflects the business’s sustainability, market position, and strategic prospects. For SMEs operating in Muscat, a proper valuation helps mitigate risks associated with underpricing or overestimating value, which can impact negotiations, financing, and tax planning. Given the growing sophistication of Oman’s economy, owners must rely on sound valuation methods tailored to local business conditions, rather than generic or imported models.

Beyond financial transactions, valuation also informs operational improvements and long-term planning. Leaders can identify underperforming assets or segments, optimize resource allocation, and set realistic targets. This holistic view is particularly important in Muscat, where SMEs face dynamic regulatory and economic factors. Ultimately, understanding the nuances of business valuation empowers entrepreneurs to build resilient companies that attract the right partners and funding.

The relevance of professional advisory services cannot be overstated in this context. Accurate business valuation in Muscat demands expertise in accounting standards, taxation laws (including VAT and corporate tax), and local market trends. Finance teams and business owners benefit from tailored advice that integrates valuation with audit readiness and compliance, ensuring that financial statements and tax filings reflect true business health. Leaderly’s advisory expertise supports SMEs through these complexities, making valuation a strategic tool rather than a mere accounting exercise.

Key Valuation Methods Used in Muscat’s SME Sector

Comparative, Income, and Asset-Based Approaches

Business valuation in Muscat typically involves three main approaches: the market (or comparative) approach, the income approach, and the asset-based approach. Each has unique advantages and is chosen based on the nature of the SME and the availability of data. The market approach looks at comparable businesses or transactions in Oman’s market to derive a fair value. This method is popular for companies with active market presence or where relevant multiples exist. However, SMEs often lack direct comparables, making this approach challenging without local advisory support.

The income approach focuses on future cash flows, discounted to present value. It requires detailed financial forecasting and an understanding of local economic risks, which may include currency fluctuations, regulatory changes, and sector-specific trends in Muscat. This method suits businesses with predictable earnings but demands rigorous analysis and professional guidance to ensure accuracy and credibility with stakeholders.

The asset-based approach calculates net asset value, subtracting liabilities from total assets. While straightforward, it may undervalue companies with strong intangible assets such as brand reputation or customer loyalty—important factors in Oman’s competitive SME environment. Often, a blended method combining elements from these approaches offers the most reliable valuation, emphasizing the need for specialist advisory services that understand Muscat’s unique business landscape.

Common Valuation Multiples and Their Application in Muscat

Interpreting Multiples to Reflect Local Market Realities

In business valuation in Muscat, multiples are often used as quick reference points to estimate value relative to financial metrics like revenue, EBITDA, or net profit. Common multiples include price-to-earnings (P/E), enterprise value-to-EBITDA (EV/EBITDA), and price-to-sales (P/S). These multiples, derived from comparable transactions or listed companies, help benchmark an SME’s worth against peers.

However, applying multiples in Oman requires careful adjustment to local market conditions. Many SMEs in Muscat operate in sectors with limited public data, making it necessary to rely on regional insights and sector-specific nuances. Factors such as business scale, growth potential, and operational risks must influence the chosen multiples. For example, a retail SME in Muscat might command a different multiple compared to a manufacturing firm due to differing market dynamics and asset structures.

Advisory professionals assist by calibrating multiples to reflect Oman’s economic environment and tax frameworks. This ensures valuation outcomes are realistic and defendable during negotiations or audits. Overreliance on standard multiples without adjustment can lead to inaccurate valuations, potentially causing financial or reputational harm to SME owners. Incorporating comprehensive financial and operational analysis alongside multiples creates a balanced valuation approach tailored to Muscat’s business ecosystem.

Common Pitfalls in Business Valuation for SMEs in Muscat

Avoiding Mistakes That Undermine Valuation Accuracy

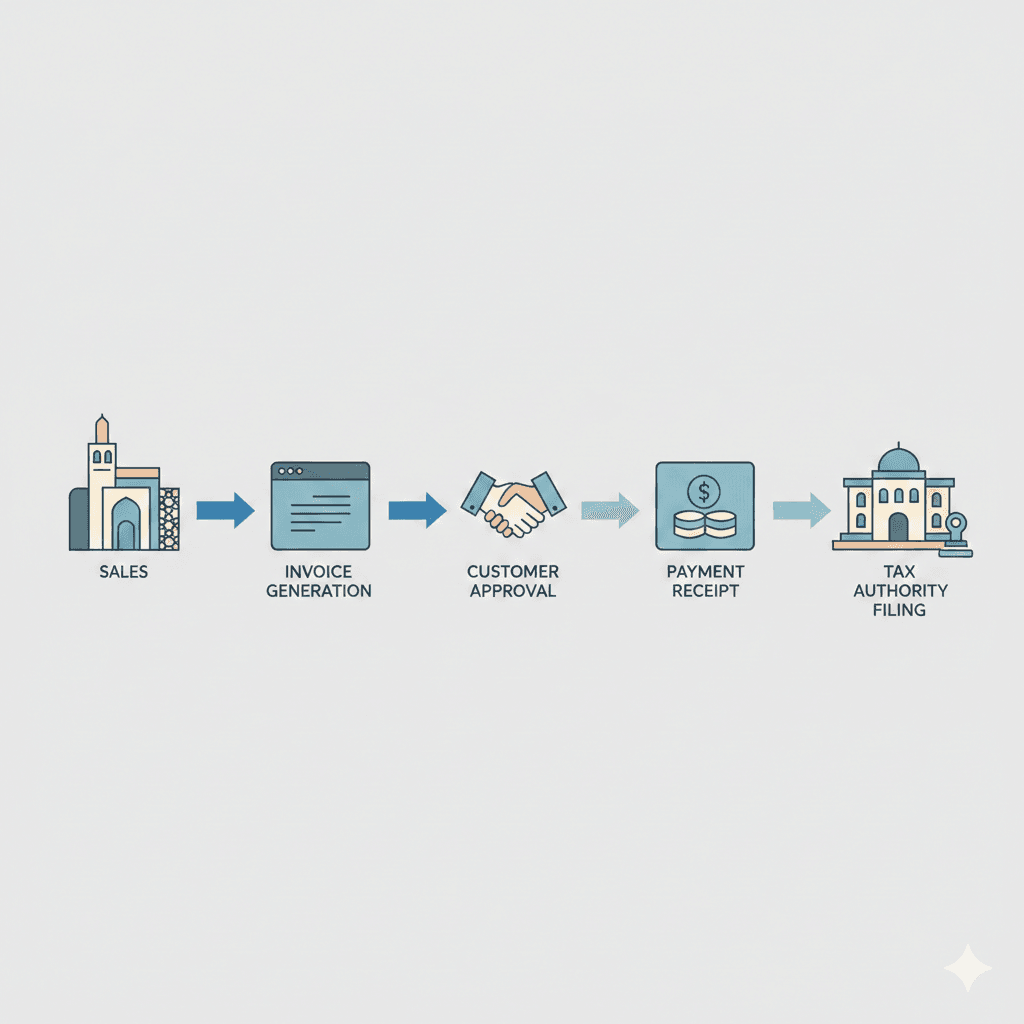

One frequent pitfall in business valuation in Muscat is the misuse of incomplete or outdated financial data. SMEs sometimes rely on cash flow statements or balance sheets that do not fully capture liabilities or contingent obligations, leading to inflated valuations. Ensuring up-to-date, audited financial statements aligned with Oman’s regulatory requirements is essential for credible valuation outcomes.

Another challenge is ignoring Oman’s specific tax implications during valuation. VAT and corporate tax regimes can materially impact cash flows and profitability, yet some valuations fail to incorporate these effects accurately. This oversight can mislead stakeholders about the business’s true economic benefit and cause unexpected tax liabilities post-transaction. Integrating tax advisory within the valuation process safeguards against such risks.

Finally, SMEs often underestimate the value of intangible assets like intellectual property, customer relationships, or brand equity—elements crucial in Oman’s growing digital and service sectors. Overlooking these assets results in undervaluation, diminishing negotiation leverage and investment appeal. Leaderly’s advisory expertise helps businesses in Muscat identify and appropriately value intangible assets, ensuring comprehensive and fair valuation reports.

The Role of Due Diligence and Audit in Strengthening Valuation

Ensuring Transparency and Trust Through Professional Scrutiny

Due diligence and audit services play a pivotal role in reinforcing the integrity of business valuation in Muscat. By rigorously reviewing financial records, compliance with Oman’s tax laws, and operational data, auditors help verify that valuation inputs are accurate and reliable. This process builds trust among investors, buyers, and regulatory authorities, minimizing the risk of disputes.

For SMEs, preparing for due diligence requires transparent documentation and consistent accounting practices, both areas where Leaderly’s audit and advisory teams provide essential support. Early engagement with audit professionals ensures that potential valuation issues are identified and addressed before formal transactions, saving time and costs.

Moreover, audit-readiness aligns with Oman’s increasing regulatory scrutiny, particularly with the introduction of corporate tax and expanded VAT requirements. A robust audit trail enhances valuation credibility and facilitates smoother negotiations and compliance. Thus, integrating audit and due diligence processes into valuation strategies is a prudent approach for Muscat-based SMEs seeking growth or exit opportunities.

Strategic Advisory to Navigate Valuation Complexities in Muscat

Leveraging Expert Guidance for Optimized Outcomes

Given the complexities of business valuation in Muscat, strategic advisory services are invaluable for SMEs. Expert advisors assist in selecting appropriate valuation methods, interpreting multiples, and identifying pitfalls specific to the Omani market. This guidance helps entrepreneurs make informed decisions that align with their growth objectives and regulatory environment.

Leaderly’s advisory services extend beyond valuation to include feasibility studies, liquidation analysis, and tax planning. This holistic approach ensures that valuation is embedded within broader business strategy, optimizing financial outcomes and minimizing risks. SMEs benefit from practical advice that demystifies technical valuation concepts and tailors solutions to Muscat’s business climate.

Furthermore, advisory professionals help SMEs prepare for future challenges by integrating valuation insights into operational improvements and financial controls. This forward-looking perspective enables business owners to enhance value proactively rather than reactively. By partnering with local experts, SMEs in Muscat can unlock the full potential of their business valuation efforts, positioning themselves strongly in competitive markets.

Business valuation in Muscat is a nuanced and essential exercise for SMEs seeking sustainable growth and successful transitions. By understanding methods, adjusting multiples for local realities, avoiding common pitfalls, and leveraging audit and advisory support, business owners and finance managers can confidently navigate this complex process. Proper valuation not only reflects current worth but also serves as a strategic compass guiding long-term business success in Oman’s dynamic economic landscape.

#Leaderly #BusinessValuationInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit