Business Valuation

Independent valuation and transaction support to help organisations make confident, value-driven decisions.

Overview

Leaderly’s team excels in navigating the complexities of modern business transactions. In today’s fast-evolving and competitive business environment, organisations continually seek new ways to create value—whether through internal growth initiatives or strategic collaborations such as mergers, acquisitions, divestitures, amalgamations, or business swaps.

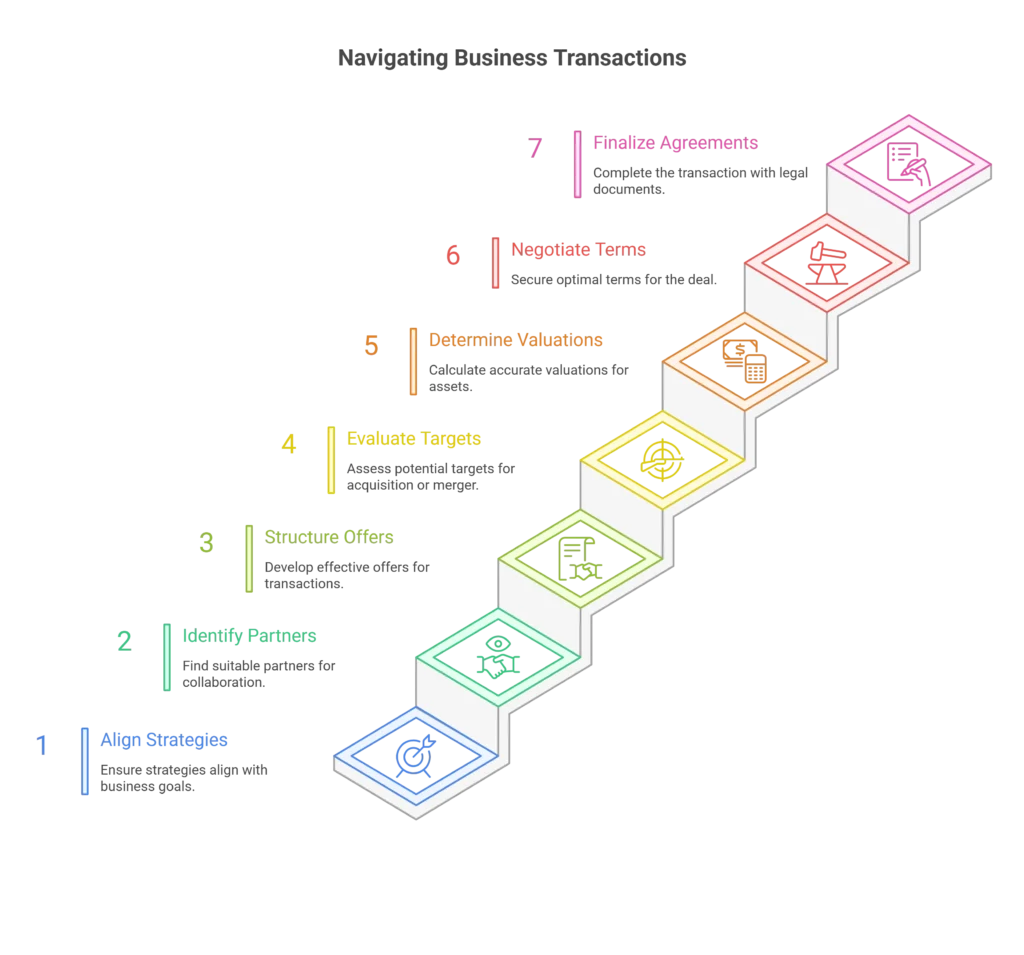

Our transaction support services span the full lifecycle of a deal, from aligning strategies with business objectives to identifying suitable partners, structuring offers, evaluating targets, determining accurate valuations, negotiating optimal terms, and finalising agreements. While internal teams may manage certain aspects of a transaction, Leaderly provides targeted expertise in critical areas including business valuation, due diligence, and target appraisals.

We deliver comprehensive and customised solutions tailored to each organisation’s strategic vision and specific requirements. Our Corporate Advisory Services are designed to support informed decision-making, manage risk, and maximise transaction value.

Corporate Advisory Services

Our full suite of Corporate Advisory Services includes:

- Business valuations

- Due diligence

- M&A transaction support

- Deal structuring

- Foreign GAAP conversions

- Merger integration services

- Acquisition strategy

- IT compatibility reviews

- Advice on negotiation strategies

- Holding company structure