Blog

Updates, insights, and commentary on audit, tax, advisory, and industry developments.

VAT on Real Estate in Muscat: Key Treatment and Documentation

VAT on Real Estate in Muscat: Essential Guidelines for Businesses Understanding VAT on Real Estate in Muscat The Landscape of Real Estate VAT Compliance VAT on real estate in Muscat represents a critical area of tax compliance for businesses and entrepreneurs...

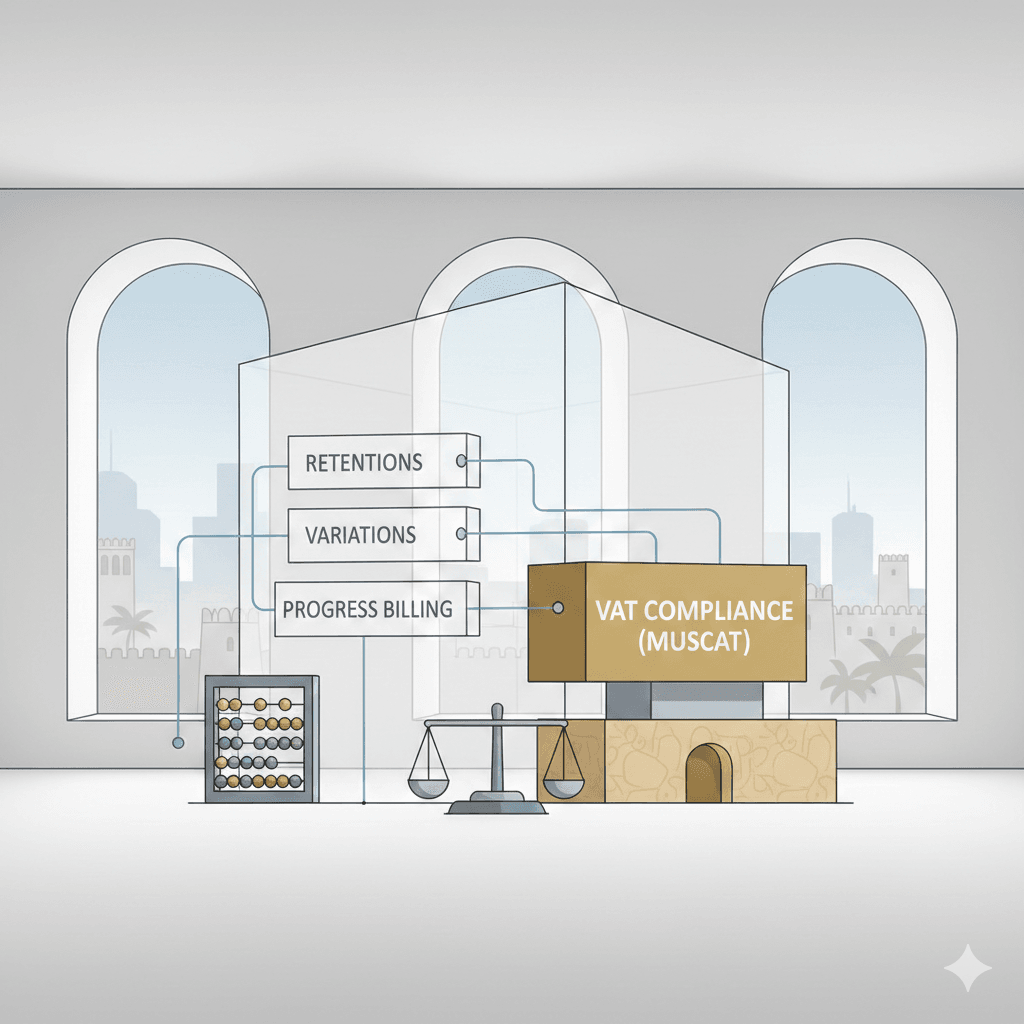

VAT in Construction Muscat: Retentions, Variations, and Progress Billing

VAT in Construction Muscat: Understanding Retentions, Variations, and Progress Billing Understanding VAT in Construction Muscat The Essentials of VAT in Construction Projects VAT in Construction Muscat presents unique challenges that require careful management by...

VAT in Healthcare Muscat: Common Scenarios and How to Record Them

VAT in Healthcare Muscat: Navigating Common Scenarios and Effective Record-Keeping Understanding VAT in Healthcare Muscat The Basics of VAT Application in Healthcare VAT in healthcare Muscat is a subject of growing importance for business owners, SME founders, and...

VAT for Education Providers in Muscat: Practical Compliance Notes

VAT for Education Providers in Muscat: Essential Compliance Guidelines Understanding VAT for Education Providers in Muscat Clarifying the VAT landscape in Oman’s education sector VAT for education providers in Muscat presents unique challenges and opportunities. As...

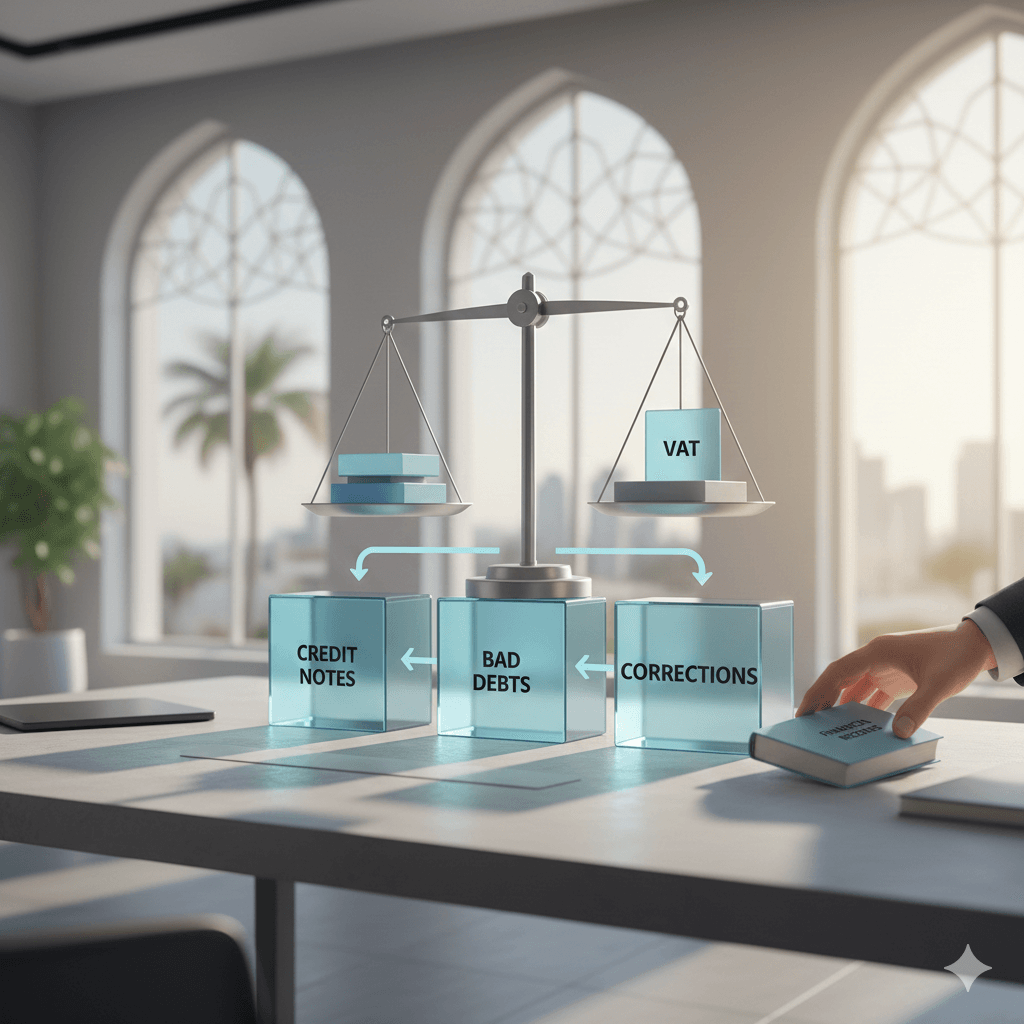

VAT Adjustments in Oman: Credit Notes, Bad Debts, and Corrections

VAT Adjustments in Oman: A Practical Guide for SMEs on Credit Notes, Bad Debts, and Corrections Understanding VAT Adjustments in Oman Why VAT Adjustments Matter to SMEs VAT adjustments in Oman are a critical aspect of maintaining accurate tax records and ensuring...

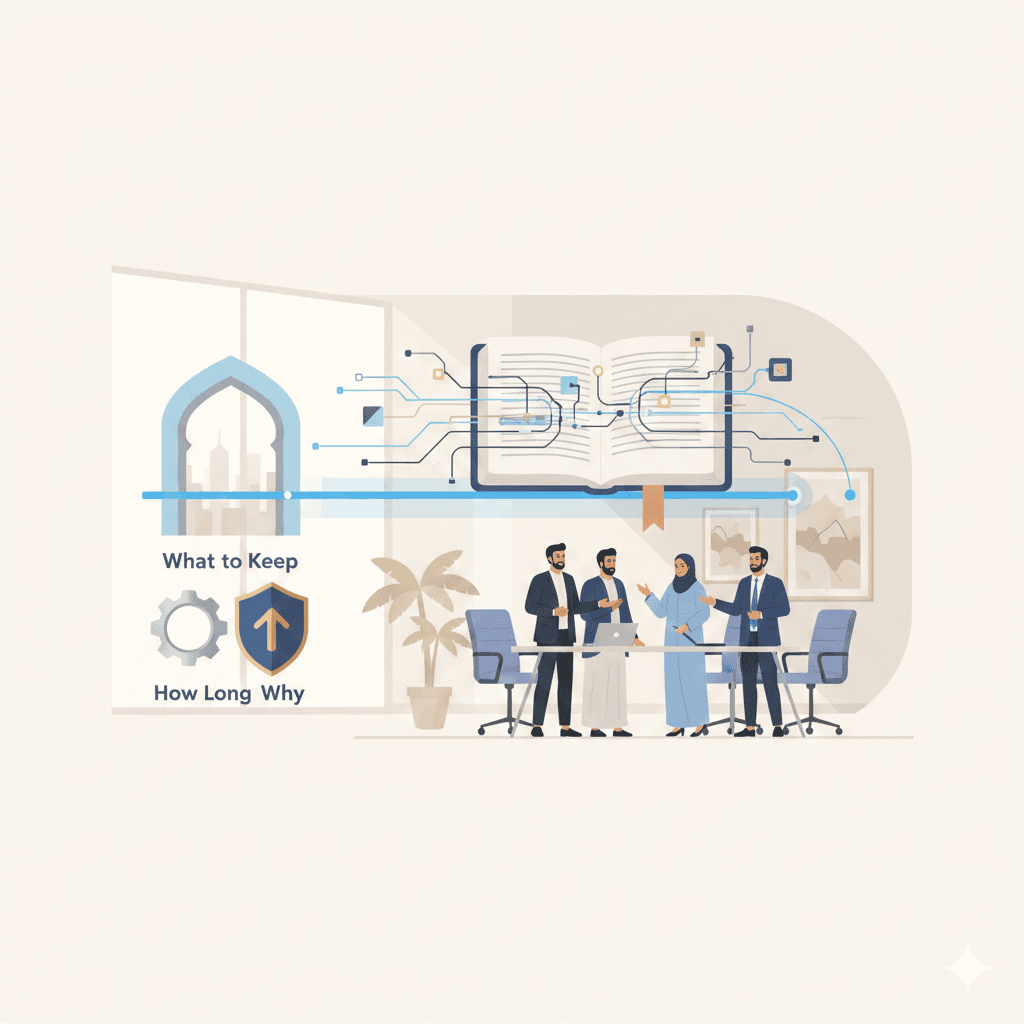

VAT Recordkeeping in Muscat: What to Keep, How Long, and Why

VAT Recordkeeping in Muscat: Essential Practices for SMEs Understanding VAT Recordkeeping Requirements in Muscat Why accurate recordkeeping is critical for VAT compliance VAT recordkeeping in Muscat is a fundamental responsibility for any business subject to Value...

VAT Fines in Oman: How Muscat Businesses Can Reduce Compliance Risk

VAT Fines in Oman: Practical Strategies for Muscat SMEs to Minimise Compliance Risk Understanding VAT Fines in Oman Value Added Tax (VAT) fines in Oman represent a significant risk for businesses operating in Muscat, especially for SMEs and entrepreneurs unfamiliar...

Muscat e-invoicing readiness for SMEs: A practical roadmap for finance teams

Muscat e-invoicing readiness for SMEs and what finance leaders should prioritise today Understanding Muscat e-invoicing readiness for SMEs in the Omani regulatory context Muscat e-invoicing readiness for SMEs is no longer an abstract compliance concept; it is becoming...

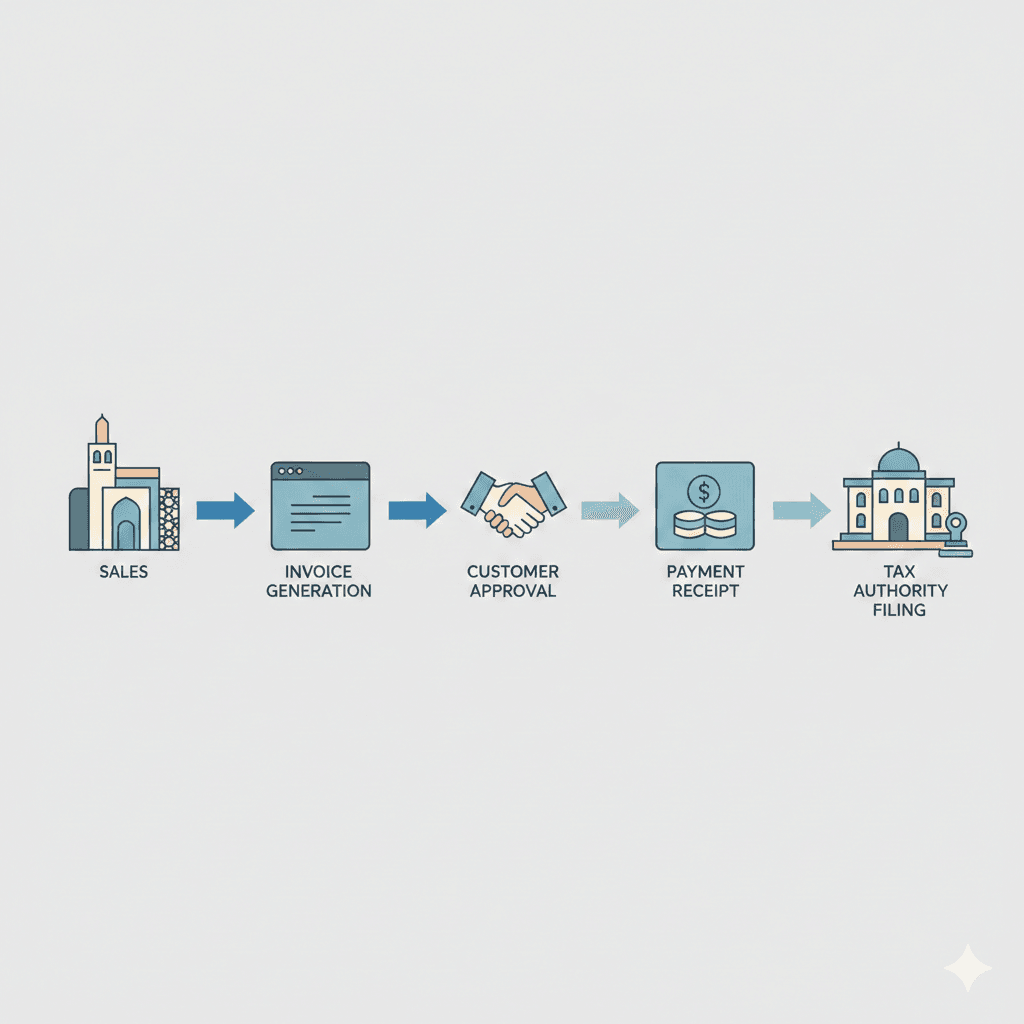

Muscat e-invoicing process map for SMEs from sales to VAT filing

Muscat e-invoicing process map explained for Muscat SMEs navigating digital compliance Muscat e-invoicing process map starting at the point of sale Muscat e-invoicing process map begins for many SMEs in Muscat at the moment a sale is agreed, not when the invoice is...

Disclaimer

Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.