Blog

Updates, insights, and commentary on audit, tax, advisory, and industry developments.

Cashflow Forecasting in Oman: A Muscat Template You Can Copy

Cashflow Forecasting in Oman: A Muscat Template You Can Copy Understanding Cashflow Forecasting in Oman Cashflow forecasting in Oman is an essential financial practice for business owners and SME founders seeking to maintain operational stability and growth in the...

How to Reconcile Bank Accounts in Muscat: The Fast, Clean Method

How to Reconcile Bank Accounts in Muscat: A Practical Guide for SMEs Understanding Bank Reconciliation in Muscat’s Business Context The Foundation for Accurate Financial Management How to Reconcile Bank Accounts in Muscat is an essential process for SMEs,...

Muscat Receivables: How to Reduce Late Payments Without Burning Bridges

Muscat Receivables: Effective Strategies to Manage Late Payments While Preserving Client Relationships Understanding the Impact of Late Payments on Muscat Receivables Cash Flow Challenges in Omani SMEs Late payments present a critical challenge for businesses managing...

Payables in Muscat Vendor Controls That Prevent Surprise Liabilities

Payables in Muscat: Vendor Controls to Safeguard SMEs from Unexpected Liabilities Understanding Payables in Muscat: The Importance for SMEs Why Vendor Payables Require Strict Oversight in Oman Payables in Muscat represent one of the most critical aspects of managing...

Expense Claims in Oman: A Muscat Policy That Stops Leakage

Expense Claims in Oman: A Muscat Policy That Stops Leakage Understanding Expense Claims in Oman and Their Role in Financial Control Expense claims in Oman form a crucial part of how SMEs and businesses operating in Muscat manage their day-to-day expenditures. These...

Muscat assurance engagement choices explained for Omani SMEs

Muscat assurance engagement choices: understanding audit, review, and agreed-upon procedures in Oman Defining Muscat assurance engagement choices in the Omani business context Why assurance scope matters more than labels Muscat assurance engagement choices are often...

Muscat SME audit findings that reveal the real financial risks facing growing businesses

Muscat SME audit findings and what they mean for owners and finance managers in Oman Muscat SME audit findings linked to weak financial controls Muscat SME audit findings often begin with weaknesses in basic financial controls, especially in owner-managed businesses...

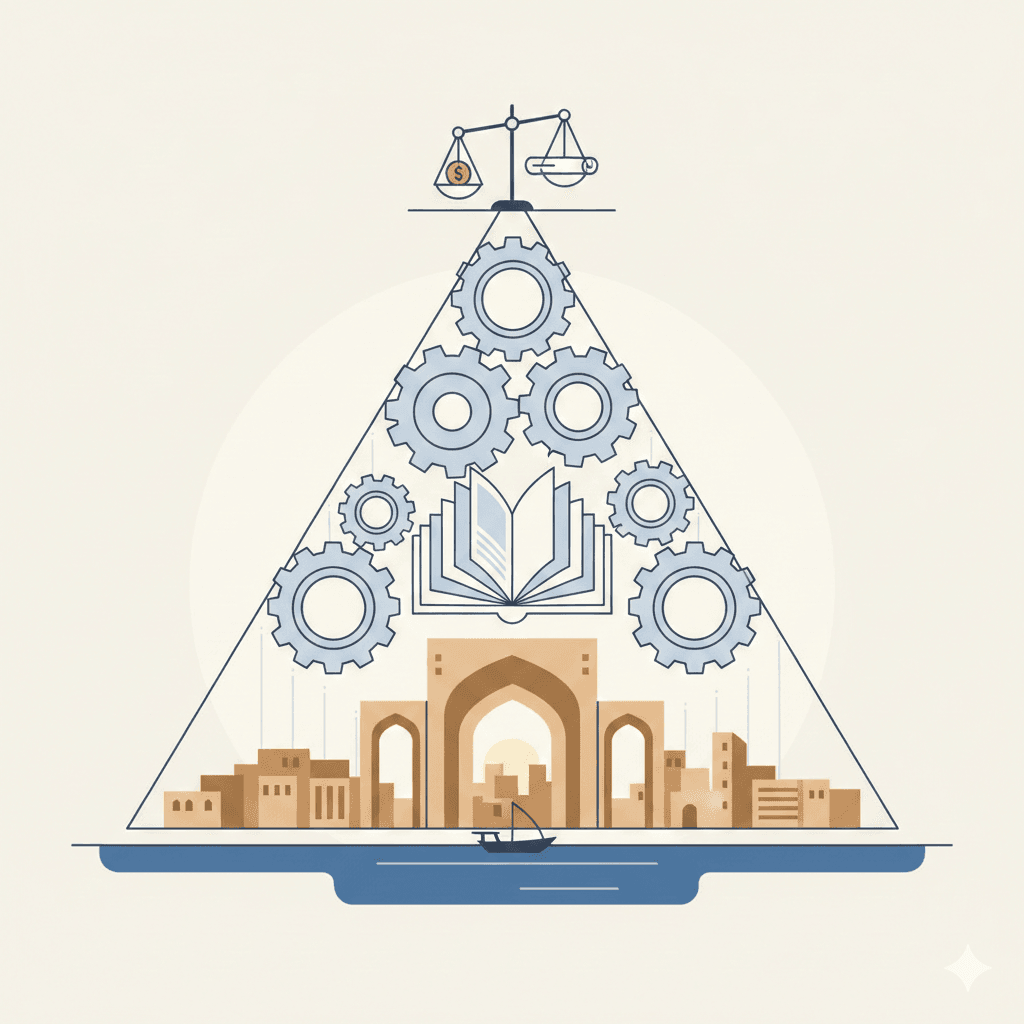

Muscat statutory assurance file for SME audit readiness and compliance

Muscat statutory assurance file as a practical framework for Oman-based SMEs Why a Muscat statutory assurance file matters for SME credibility Turning regulatory pressure into structured financial confidence Muscat statutory assurance file requirements have become...

Muscat Internal Audit Plan for SMEs Operating in Oman

Muscat Internal Audit Plan as a Practical Annual Control Program Muscat Internal Audit Plan as a Management Tool, Not a Compliance Burden A Muscat Internal Audit Plan is often misunderstood by SME owners as a formal document prepared only when regulators, banks, or...

Disclaimer

Leaderly blog posts are informational articles written by different authors from the broader Leaderly team. They do not constitute consultancy or professional advice and are not a substitute for tailored guidance. For advice specific to your circumstances, please contact us to arrange a formal engagement.