Azaiba SMEs Service Pricing: A Strategic Guide to Activity-Based Costing

Understanding Azaiba SMEs Service Pricing Challenges

Why Accurate Pricing Matters for SMEs in Azaiba

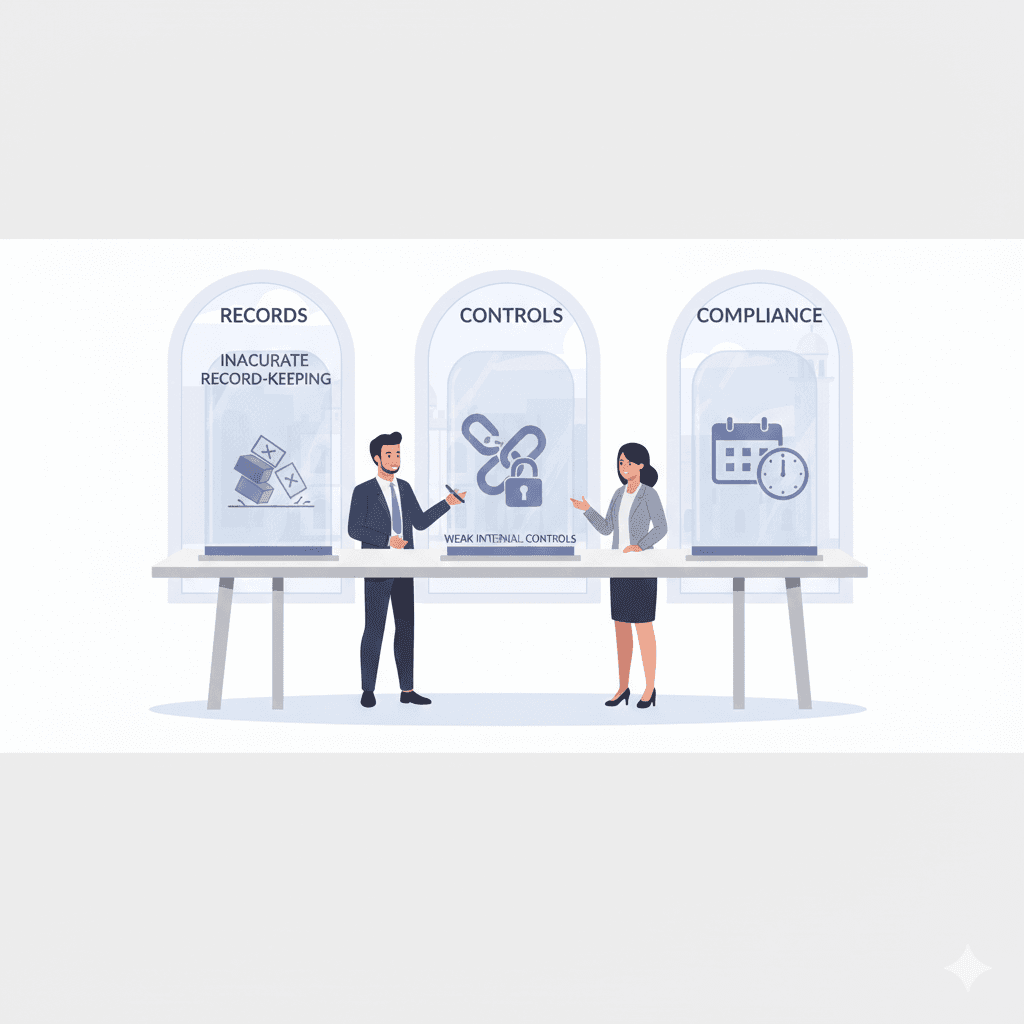

For SMEs operating in Azaiba, setting the right price for services is more than just a competitive move; it is essential for survival and growth. Many entrepreneurs struggle with pricing because traditional costing methods often oversimplify the complexities of service delivery. These oversights can result in either undervaluing services or pricing too high, which affects profitability and customer retention. In the dynamic market of Muscat and its surroundings, understanding precise cost drivers behind each service is critical. Activity-Based Costing (ABC) emerges as a powerful approach that breaks down costs at a granular level, enabling SMEs in Azaiba to align prices more closely with the actual consumption of resources. This method supports sustainable business models and facilitates better financial planning.

The challenge is heightened by the specific business environment in Oman, where factors like VAT, corporate tax introduction, and increasing competition require businesses to be both agile and exact in cost analysis. Many SMEs are unaware of how activity-based costing can illuminate hidden expenses, such as indirect labor, administrative overhead, or process inefficiencies. For finance managers and SME founders in Azaiba, adopting ABC means gaining clearer insight into the economics of service delivery and building a competitive edge that is both transparent and justifiable to clients.

Azaiba SMEs service pricing becomes a critical tool for these enterprises to move beyond guesswork or blanket markups. By understanding their cost structure through activity-based costing, SMEs can better negotiate contracts, forecast margins, and improve decision-making. It also allows business owners to anticipate tax liabilities and compliance costs effectively, incorporating these into pricing without sacrificing competitiveness or profitability.

Principles of Activity-Based Costing for Service Pricing

How ABC Differs from Traditional Costing Methods

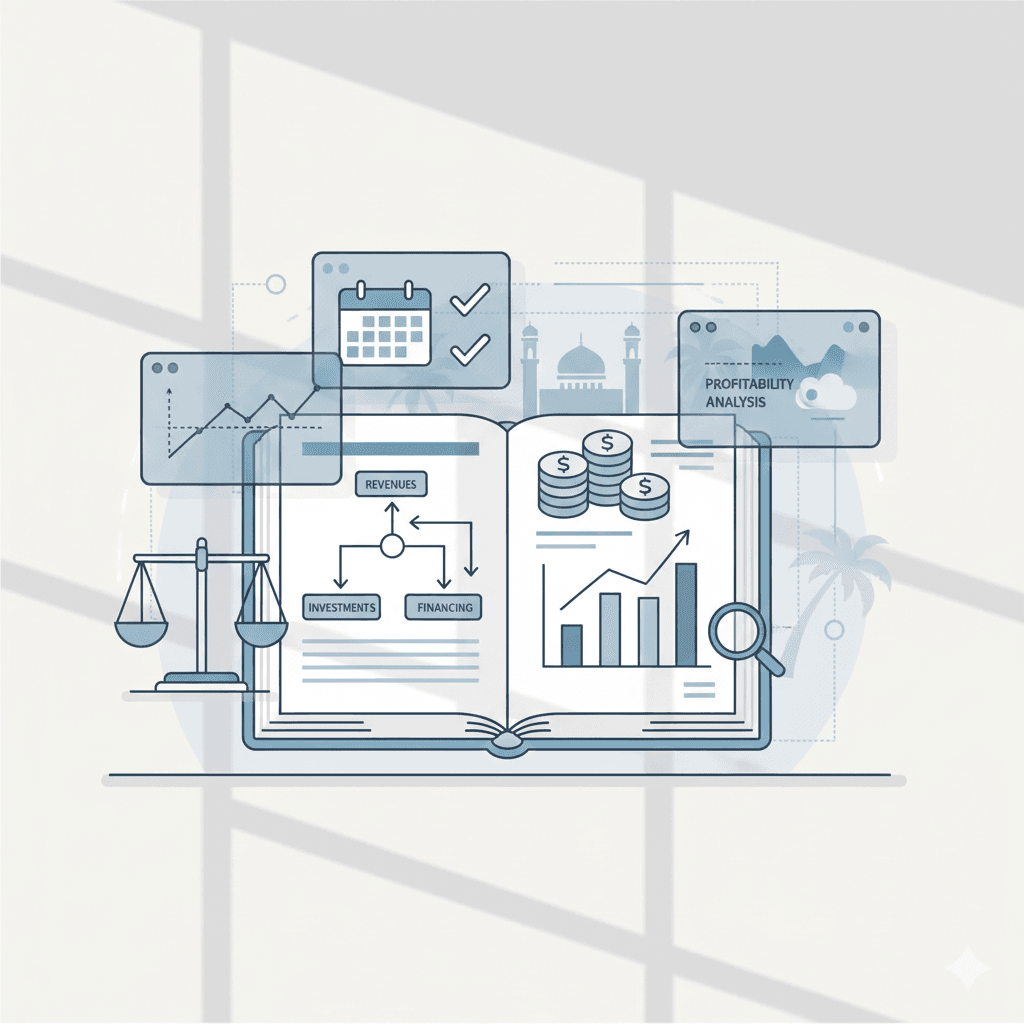

Activity-Based Costing is an accounting methodology that assigns costs to services based on the actual activities that drive those costs, rather than spreading overhead uniformly across products or services. For SMEs in Azaiba, this means allocating costs more precisely by identifying key cost drivers such as time spent on client communication, technical support, and quality control. Unlike traditional costing, which often uses simplistic metrics like labor hours or direct material costs, ABC dives deeper into operational realities, highlighting inefficiencies and cost-intensive steps in service delivery.

By mapping out each activity involved in providing a service, ABC allows SMEs to calculate the true cost per service unit, offering clarity on where resources are consumed and where savings might be achieved. This detailed view is particularly valuable for service-oriented businesses in Azaiba, where intangible inputs such as expertise, customer service, and process complexity play a significant role. ABC supports more accurate pricing strategies, enabling SMEs to align prices with value delivered rather than cost assumptions or market guesswork.

Moreover, activity-based costing is an effective tool for managing indirect costs and compliance expenses, which are increasingly relevant in Oman’s evolving tax landscape. With VAT and corporate tax considerations, understanding how these taxes impact cost allocation helps SMEs prepare better financial statements and set service prices that maintain profitability while ensuring tax compliance. For business owners and finance managers, embracing ABC translates to better control over costs, improved margins, and a foundation for strategic growth.

Implementing Activity-Based Costing in Azaiba SMEs

Steps to Integrate ABC into Your Pricing Strategy

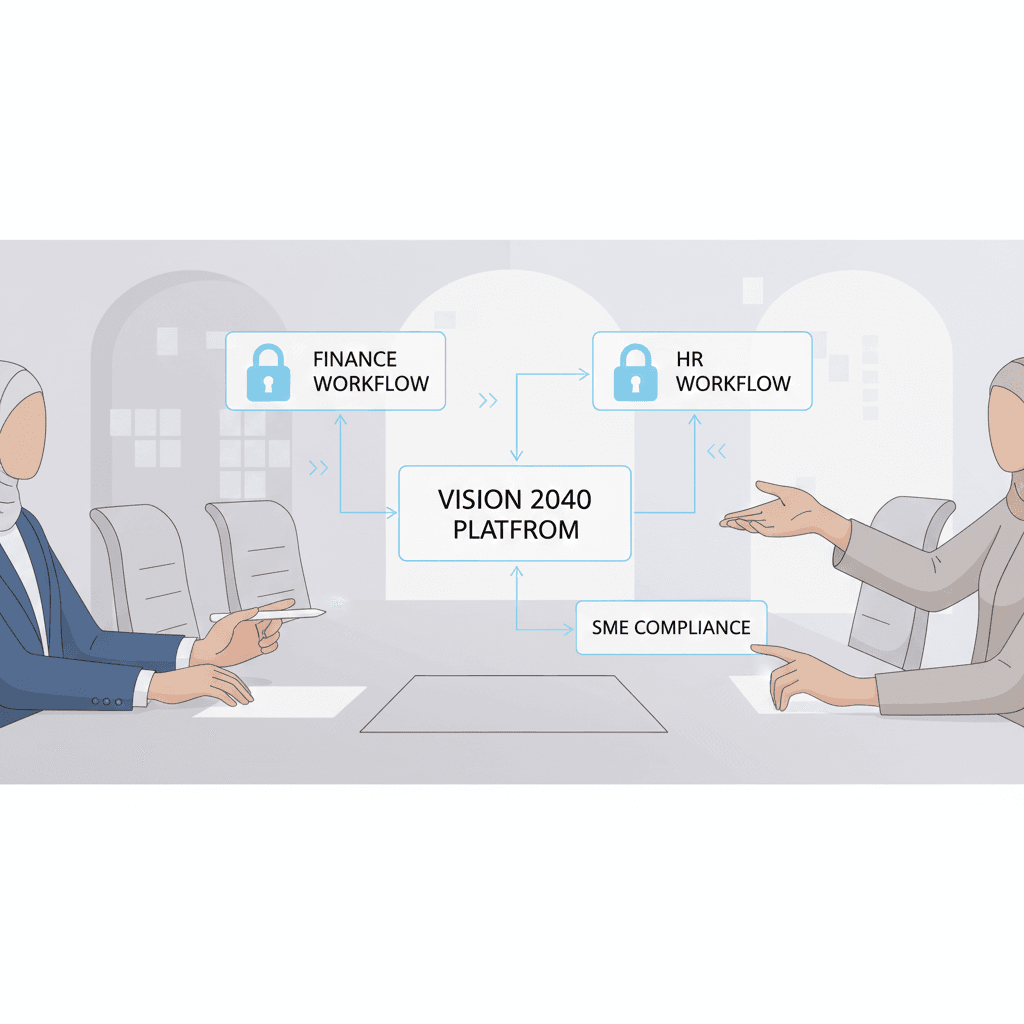

For SMEs in Azaiba ready to adopt activity-based costing, the implementation process begins with a thorough analysis of business activities. The first step involves identifying and categorizing all activities involved in service delivery, from client onboarding to post-service support. This step requires collaboration between finance teams, managers, and operational staff to ensure accuracy and completeness. It is important to focus on activities that consume significant resources or impact customer satisfaction to prioritize costing efforts effectively.

Next, SMEs must assign cost drivers to each activity. Cost drivers could be the number of service hours, transactions processed, or customer interactions, depending on the nature of the service. Collecting data on these drivers requires robust tracking and reporting mechanisms, which may involve software tools or manual logs adapted to the business size and capacity. For Azaiba SMEs, leveraging digital tools or partnering with advisory services, such as those offered by Leaderly, can ease this transition and ensure compliance with local regulations.

Finally, SMEs calculate the cost per activity and aggregate these to determine the total service cost. This granular cost data enables setting prices that cover expenses, include profit margins, and account for taxes such as VAT or corporate tax. Integrating ABC into pricing also supports dynamic adjustments, allowing SMEs to respond to changing costs or market conditions swiftly. When executed effectively, ABC becomes a continuous improvement tool that drives efficiency, profitability, and strategic decision-making.

Optimizing Profitability for Azaiba SMEs through ABC

Maximizing Margins with Informed Pricing Decisions

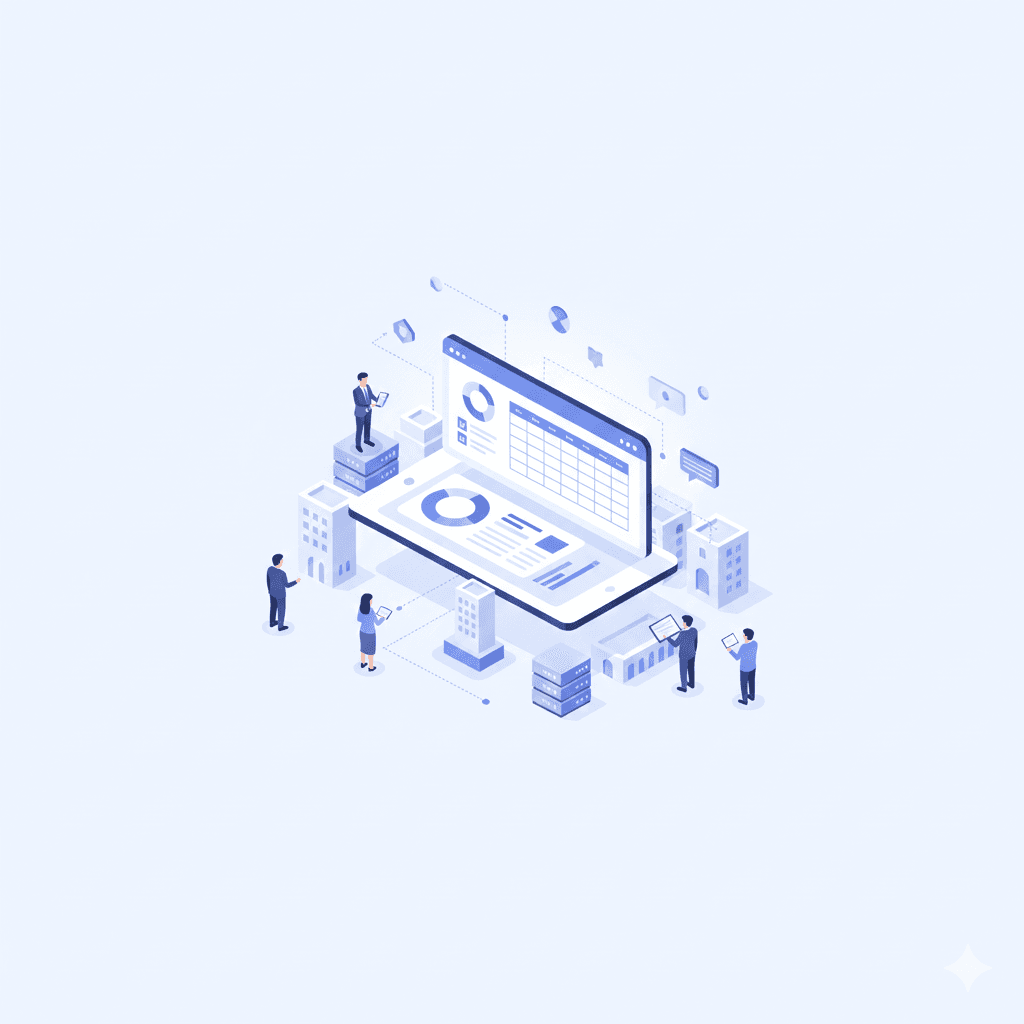

Activity-Based Costing empowers Azaiba SMEs to optimize profitability by revealing where money is spent and where improvements can be made. Understanding cost drivers in detail helps SMEs identify high-cost activities that may not add proportional value, offering opportunities to streamline processes or outsource non-core functions. This level of insight also supports targeted pricing strategies that reflect the true cost of complex services, ensuring that margins are preserved or enhanced without compromising competitiveness.

Furthermore, SMEs can leverage ABC to evaluate service portfolios critically. By comparing the profitability of different services based on activity costs, business owners can decide which offerings to expand, modify, or discontinue. This strategic view is essential for Azaiba SMEs aiming to navigate a competitive landscape and evolving customer expectations. More accurate pricing also reduces the risk of undercharging, which is a common pitfall for growing businesses struggling to balance cash flow and cost recovery.

Incorporating tax considerations into the ABC framework strengthens financial resilience. With Oman’s VAT system and corporate tax regulations, SMEs must ensure that tax costs are factored into pricing to avoid margin erosion. ABC helps disentangle tax impacts from operational costs, supporting clearer financial forecasting and audit readiness. Ultimately, Azaiba SMEs using ABC are better positioned to maintain sustainable growth and fulfill compliance requirements confidently.

Leveraging Advisory Services to Enhance ABC Implementation

How Expert Guidance Accelerates SME Financial Management

While activity-based costing offers significant benefits, implementing it can be complex for many SMEs in Azaiba, especially those without dedicated financial expertise. Engaging with advisory professionals, such as those at Leaderly, provides valuable support in navigating both the technical and regulatory aspects of ABC. Advisory services can help SMEs conduct feasibility studies, perform valuations, and carry out due diligence that aligns costing and pricing strategies with business objectives.

Experts also provide critical guidance on incorporating VAT and corporate tax into the costing process, ensuring that SMEs comply with Oman’s tax laws without compromising operational efficiency. Advisory support extends to audit and accounting services that reinforce transparency and accuracy in financial reporting. For SME owners and finance managers, this partnership reduces risks and builds confidence in pricing decisions informed by comprehensive data and local market knowledge.

Moreover, advisory teams can assist with continuous monitoring and adjustment of costing models, helping SMEs respond to market fluctuations and internal changes. This ongoing collaboration is vital in a dynamic environment like Azaiba, where evolving tax regulations and competitive pressures require agility. With expert support, SMEs can unlock the full potential of activity-based costing to drive profitability, compliance, and strategic growth.

Integrating Activity-Based Costing into SME Growth in Azaiba

A Practical Path to Sustainable Success

For SMEs in Azaiba, service pricing using activity-based costing is not just an accounting exercise but a strategic enabler for sustainable business growth. By understanding and managing costs at a detailed level, SMEs can develop pricing models that reflect the true value of their services, ensuring profitability and market relevance. This financial clarity supports better decision-making, stronger negotiation positions, and improved resource allocation across the business.

As Oman’s SME landscape grows increasingly competitive and regulated, adopting activity-based costing equips businesses with tools to thrive amid challenges. It complements VAT and corporate tax management, enhances audit readiness, and fosters a culture of financial discipline. Ultimately, Azaiba SMEs that embrace ABC position themselves for long-term resilience and success, transforming pricing from a challenge into a strategic advantage.

The journey toward effective ABC implementation requires commitment and expert support but yields dividends in profitability, compliance, and business agility. For SME founders, business owners, and finance managers in Azaiba, this approach represents a forward-thinking pathway to mastering service pricing and driving growth confidently in Oman’s vibrant economy.

#Leaderly #AzaibaSMEsServicePricing #Oman #Muscat #SMEs #Accounting #Tax #Audit