Al Khuwair Multi-Branch Financial Controls for Sustainable SME Growth in Muscat

Al Khuwair Multi-Branch Financial Controls as the Foundation of Operational Stability

Why location-specific financial design matters in Al Khuwair

Al Khuwair Multi-Branch Financial Controls are becoming a decisive factor in whether service businesses in this district achieve sustainable expansion or remain trapped in operational chaos. Al Khuwair’s dense concentration of consulting firms, clinics, logistics providers, training centers, maintenance companies, and technology service providers creates intense competition, rapid client turnover, and complex cash movement between locations. Many growing SMEs attempt to manage this expansion using the same financial routines they used for a single office, unaware that multi-branch operations introduce entirely new risk profiles. Revenue recognition becomes fragmented, expenses duplicate across locations, approvals blur, and managers lose visibility over real profitability. In this environment, financial controls are not theoretical frameworks; they are practical tools that determine whether leadership can make decisions based on accurate data or unreliable assumptions. A well-designed control structure for Al Khuwair businesses begins by acknowledging the unique operational rhythm of this district, where branch managers handle sales, collections, payroll, procurement, and client contracts simultaneously. Without tailored controls, even profitable businesses experience cash flow stress, delayed supplier payments, VAT misreporting, and internal disputes over financial accountability.

Designing Financial Control Architecture for Multi-Location Service Models

From central oversight to branch-level accountability

Effective Al Khuwair Multi-Branch Financial Controls must balance centralized governance with branch-level execution. Central finance teams should define uniform policies for invoicing, expense recognition, payroll processing, and supplier payments, while each branch maintains documented procedures for day-to-day transactions. The objective is not to restrict operational speed but to ensure every rial flowing through the organization is traceable and properly classified. In service businesses, revenue often arrives through mixed channels such as corporate contracts, walk-in customers, subscription agreements, and retainer arrangements. When these revenues are collected at multiple locations, delays in consolidation distort cash flow forecasting and management reporting. A proper control architecture introduces standardized revenue codes, centralized client master files, and controlled bank account structures that feed directly into unified reporting. This structure supports management decisions on pricing, staffing, marketing investment, and expansion planning. When aligned with professional advisory input, including audit reviews and accounting supervision, these controls create a stable financial platform that allows leadership to scale confidently without losing visibility over business performance.

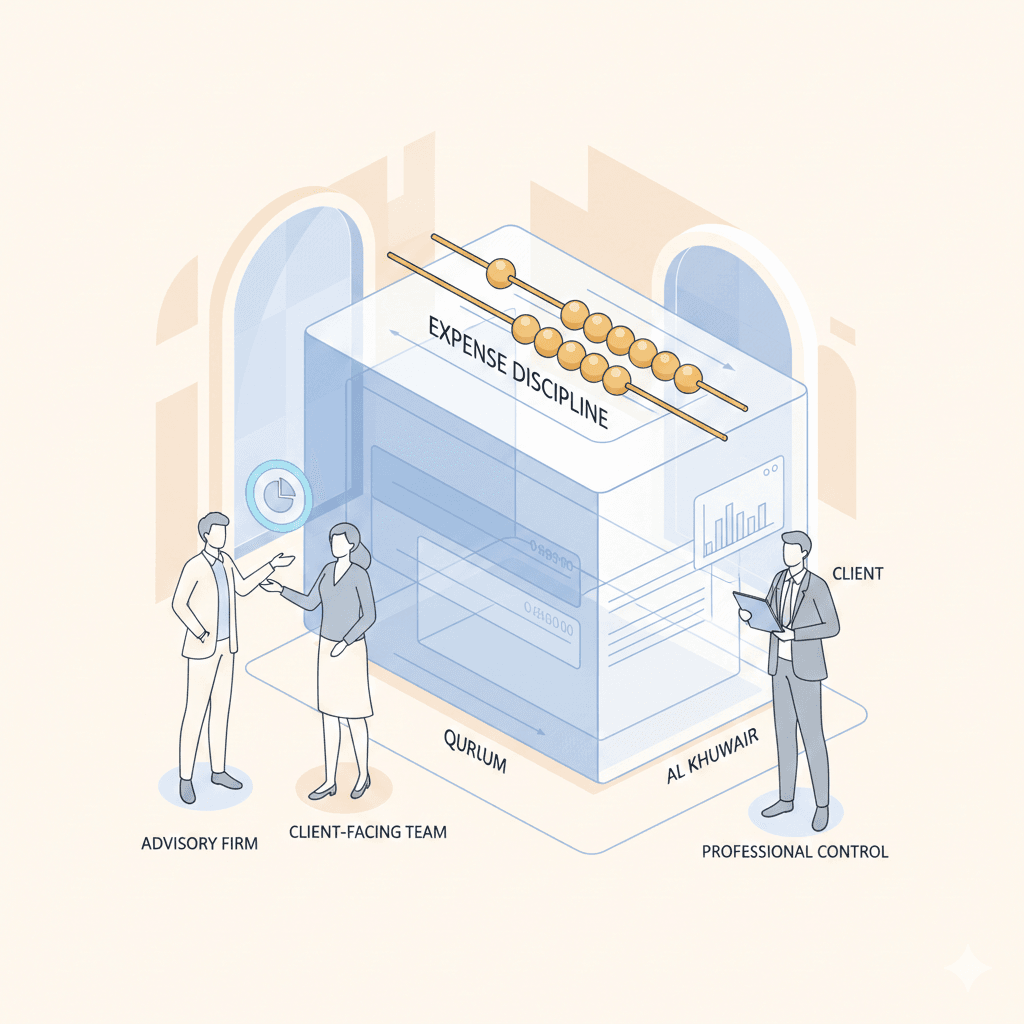

Managing Cost Discipline Across Branches in Al Khuwair

Preventing leakage before it becomes visible damage

Al Khuwair Multi-Branch Financial Controls play a critical role in cost governance, particularly in service enterprises where margins are sensitive to staff efficiency, facility expenses, and vendor management. Without consistent approval hierarchies and expenditure thresholds, branches often develop their own spending habits, resulting in uncontrolled procurement, redundant subscriptions, inflated maintenance costs, and payroll inefficiencies. Strong cost controls introduce defined authorization limits, vendor selection criteria, contract approval workflows, and monthly cost variance reviews. Each branch’s expense behavior becomes transparent and comparable, enabling management to identify inefficiencies early. In Al Khuwair’s competitive service market, even small improvements in cost control translate into meaningful profit stability. Moreover, accurate cost allocation supports reliable pricing models, contract negotiations, and client profitability analysis. Businesses that integrate these controls into daily operations find it easier to comply with regulatory requirements, prepare accurate financial statements, and support external advisory processes such as valuation, due diligence, and expansion feasibility studies.

Regulatory Alignment and Risk Management in Al Khuwair Operations

Embedding compliance into daily financial behavior

Al Khuwair Multi-Branch Financial Controls also serve as the backbone of regulatory compliance and risk management. With VAT obligations, corporate tax requirements, labor regulations, and commercial reporting obligations becoming increasingly structured in Oman, multi-branch service businesses cannot afford informal practices. Inconsistent invoicing, misclassified expenses, undocumented payroll arrangements, and weak documentation expose companies to penalties and reputational risk. A disciplined control framework integrates compliance checkpoints into routine operations rather than treating them as afterthoughts. VAT reporting, for example, becomes a natural extension of transaction recording when branches follow standardized documentation rules. Corporate tax readiness improves when profit allocation between branches is transparent and supported by consistent accounting treatment. This approach reduces reliance on corrective adjustments at year-end and enhances credibility with financial institutions, regulators, and potential investors. When supported by experienced advisory professionals, businesses develop internal cultures of financial responsibility that strengthen governance and long-term resilience.

Using Financial Controls to Support Strategic Expansion Decisions

Turning financial data into leadership intelligence

Strong Al Khuwair Multi-Branch Financial Controls transform raw transaction data into actionable leadership intelligence. When branch performance is measured using consistent metrics, management gains visibility over revenue productivity, client retention, staff utilization, and cost efficiency across locations. This insight informs strategic decisions such as opening new branches, closing underperforming units, restructuring service offerings, or pursuing partnerships. Expansion becomes evidence-based rather than intuition-driven. Financial controls also improve communication between owners, finance teams, and operational managers by creating a shared language of performance measurement. Over time, this transparency builds internal trust and accelerates decision-making. For SMEs in Al Khuwair, where growth opportunities emerge rapidly, the ability to respond with confidence and financial clarity becomes a competitive advantage. Advisory input related to feasibility analysis, valuation, and restructuring becomes significantly more reliable when grounded in robust internal financial systems.

Strengthening Leadership Discipline Through Financial Governance

From owner-managed to institutionally governed enterprises

Al Khuwair Multi-Branch Financial Controls represent a shift from founder-dependent management to institutionally governed business operations. Many service SMEs begin as owner-managed ventures where financial oversight is centralized in one individual. As branches multiply, this model becomes unsustainable. Effective financial governance distributes responsibility through documented policies, delegated authority, internal reporting structures, and independent review mechanisms. Leaders gain the freedom to focus on growth, client relationships, and strategic positioning rather than constant financial firefighting. Employees understand expectations, decision boundaries, and accountability standards. Over time, this governance maturity enhances business valuation, investor confidence, and exit readiness. It also simplifies complex processes such as business restructuring, partner onboarding, and liquidation scenarios when required. Businesses that invest early in governance infrastructure consistently outperform those that delay financial discipline until problems become visible.

In conclusion, Al Khuwair Multi-Branch Financial Controls are no longer optional administrative tools but core strategic assets for service businesses navigating Muscat’s demanding commercial environment. They provide the structure through which financial accuracy, operational consistency, regulatory compliance, and strategic intelligence converge. SMEs that implement these controls proactively protect themselves from cash flow instability, regulatory exposure, and internal misalignment while creating a foundation for disciplined growth.

For business owners and finance managers in Al Khuwair, the true value of financial controls lies in the confidence they provide: confidence in numbers, confidence in decisions, and confidence in the future of the enterprise. When supported by professional accounting, audit insight, and advisory guidance, these controls evolve into a living management system that supports sustainable profitability and long-term success across every branch of the organization.

#Leaderly #AlKhuwairMulti-BranchFinancialControls #Oman #Muscat #SMEs #Accounting #Tax #Audit