Accounting for Customs & Duties in Muscat: Proper Treatment and Proof

Understanding Customs and Duties in Muscat

The Regulatory Landscape and Its Impact on SMEs

Accounting for customs & duties in Muscat requires a clear understanding of Oman’s regulatory environment surrounding imports and taxation. Customs duties are taxes levied on goods imported into the Sultanate, and they directly affect the cost structure of SMEs engaged in trading or manufacturing. For business owners and finance managers, accurately recording these costs is vital to maintain financial clarity and regulatory compliance. Oman imposes customs duties based on the type and origin of goods, with rates varying widely. Additionally, the introduction of VAT has added complexity to the customs accounting process, requiring careful differentiation between duties and VAT to avoid errors. This makes it essential for SMEs to not only track duties paid but also to integrate this information properly into their financial statements.

Muscat’s customs framework is governed by the Royal Oman Police Customs Department, which enforces strict rules on classification, valuation, and payment of customs duties. The duties paid must be documented with proper invoices and customs declarations to serve as proof for accounting and tax reporting. Misclassification or incomplete documentation can lead to penalties and audit risks. SMEs must therefore establish internal controls that ensure customs costs are accurately captured and substantiated with legal paperwork. Integrating customs accounting practices with VAT filings and corporate tax calculations further enhances compliance and avoids costly adjustments later.

For SMEs, understanding how customs duties impact overall pricing and profitability is crucial. Businesses importing raw materials or finished goods must consider these duties when budgeting and setting prices. Proper accounting treatment ensures that customs duties are either capitalized into inventory costs or expensed correctly, influencing cost of goods sold and gross margins. This approach also aligns with international accounting standards and helps SME owners present a true picture of their financial position when seeking financing or investment. Leaderly’s advisory services can support SMEs by providing clarity on these accounting treatments and ensuring compliance with Oman’s customs and tax regulations.

Correct Accounting Treatment for Customs Duties

Capitalization vs Expense: What SMEs Need to Know

The core accounting principle when dealing with customs duties is whether to capitalize these costs as part of inventory or to treat them as expenses. For most SMEs in Muscat importing goods for resale or manufacturing, customs duties should be capitalized as part of the cost of inventory. This means the duty paid is added to the purchase cost of the goods and recognized as part of inventory value on the balance sheet. When the goods are sold, the customs duty cost then flows through to the cost of goods sold, matching revenue with associated expenses accurately. This treatment aligns with IFRS and Omani Generally Accepted Accounting Principles (GAAP) applicable to SMEs.

Conversely, customs duties paid on assets not intended for resale, such as machinery or equipment, should be capitalized as part of the fixed asset cost. This capitalization influences depreciation and tax deductions over the asset’s useful life. SME finance managers must carefully differentiate customs duties on capital assets versus inventory to apply correct accounting policies. Incorrectly expensing customs duties that should be capitalized can distort profitability and tax positions. Proper accounting software and internal controls are essential to segregate these costs accurately in the financial records.

Additionally, SMEs must consider the treatment of VAT on customs duties. While customs duties themselves are not VAT, VAT is typically applied on the total customs value including duties. This VAT paid at import can often be reclaimed depending on the business’s VAT registration status and input tax recovery policies. Accurate record-keeping and proof of payment are crucial for VAT returns. Leaderly’s taxation advisory can guide SMEs through these complexities, ensuring customs duties and associated VAT are accounted for correctly and reflected properly in financial reporting.

Proof and Documentation Requirements for Customs Accounting

Ensuring Compliance Through Proper Record-Keeping

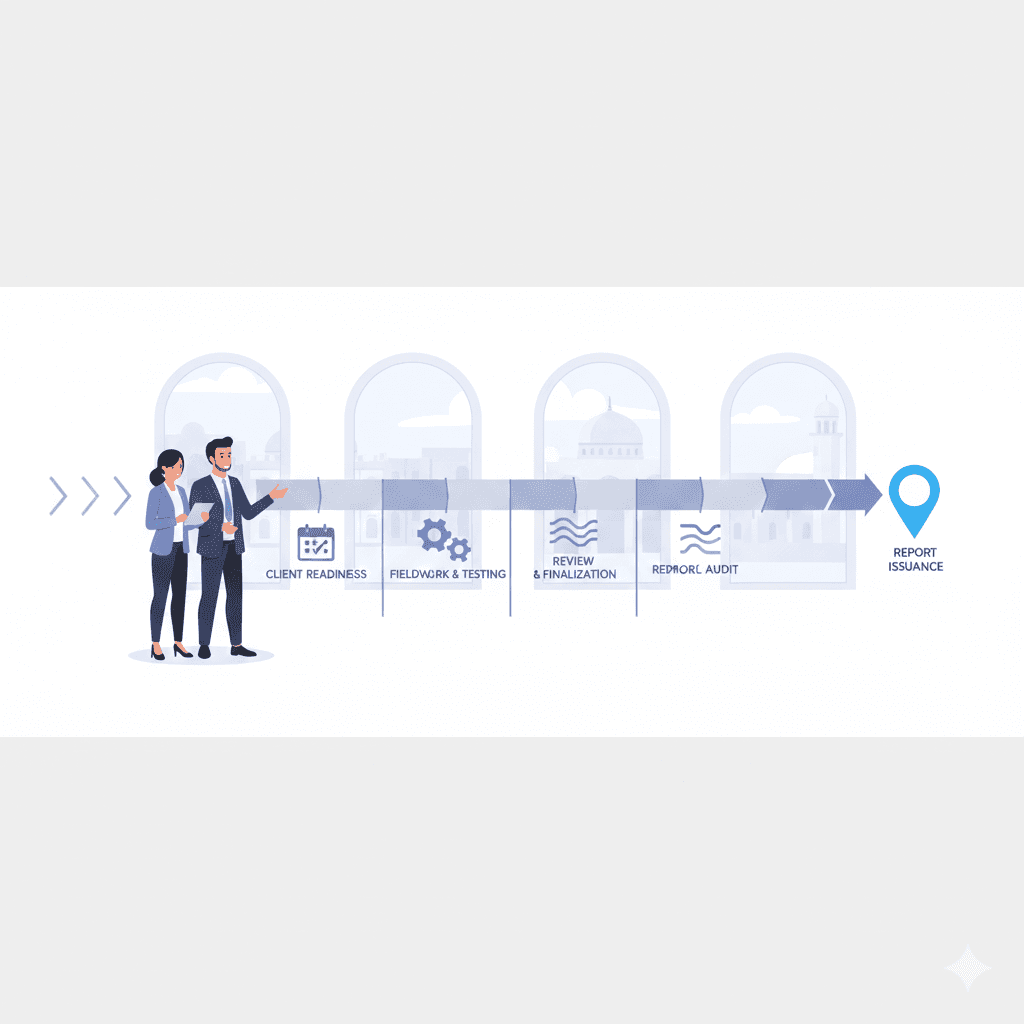

Maintaining proper proof and documentation is paramount when accounting for customs & duties in Muscat. The Oman Customs Authority mandates that businesses retain detailed records of all import transactions including customs declarations, payment receipts, invoices from suppliers, and proof of payment of duties. These documents serve as primary evidence during audits and inspections and are essential for justifying the accounting treatment of customs duties and related VAT. SMEs must establish organized filing systems to ensure these proofs are readily available and verifiable.

In practice, proof of customs duties includes the original customs clearance documents, known as the Single Administrative Document (SAD), along with receipts issued by customs authorities confirming payment. Without these, SMEs risk non-compliance penalties and tax disallowances. The documentation also supports the correct recognition of costs on financial statements and substantiates input VAT claims where applicable. Digitization of customs records integrated with accounting software can streamline compliance and reduce the risk of errors or lost documents.

Furthermore, SMEs should be aware of the retention period for customs documentation under Omani tax and commercial laws, which typically extends to at least five years. During this time, businesses may face government audits or requests for evidence. Proper documentation also aids in due diligence processes during business valuations or financing. Leaderly’s advisory services can help SMEs develop robust compliance frameworks, ensuring that customs and duties documentation supports both regulatory requirements and sound financial management.

Integrating Customs Duties Accounting with VAT and Corporate Tax

Optimizing Financial Management for SMEs in Muscat

The integration of customs duties accounting with VAT and corporate tax filings is a critical consideration for SMEs in Muscat. When goods enter Oman, VAT is levied on the customs value plus duties, creating an input VAT credit that eligible businesses can claim. Accurately accounting for these figures requires SMEs to reconcile customs duty payments with VAT returns. Failure to do so can result in underpaid VAT or missed recoveries, impacting cash flow. Finance managers must ensure the customs and VAT entries are matched and supported by relevant documentation.

From a corporate tax perspective, customs duties included in inventory costs affect the calculation of taxable profit through the cost of goods sold. SMEs need to keep detailed records of customs costs to justify expense deductions and manage tax audits effectively. Proper accounting treatment of customs duties also supports fair financial reporting, giving SME owners and investors a transparent view of the business’s true costs and profitability. The complexities of combining customs, VAT, and corporate tax underscore the need for professional guidance and reliable accounting systems.

Leaderly’s holistic advisory approach helps SMEs navigate these intersecting financial requirements. By aligning customs duties accounting with broader tax strategies, SMEs can optimize compliance, avoid penalties, and improve financial clarity. This integrated perspective empowers business owners and finance managers to make informed decisions regarding pricing, procurement, and tax planning, ultimately strengthening their competitive position in Muscat’s market.

Practical Tips for SME Finance Managers on Customs Duties

Streamlining Processes and Enhancing Compliance

For SME finance managers in Muscat, managing customs duties effectively means implementing practical processes that ensure accuracy and compliance without excessive complexity. First, it is important to collaborate closely with customs brokers and suppliers to verify correct classification and valuation of goods, preventing costly misstatements. Finance teams should reconcile customs duty payments regularly against invoices and customs declarations to detect discrepancies early.

Second, leveraging technology is key. Integrated accounting software that links customs data with inventory and VAT modules reduces manual errors and facilitates real-time tracking of customs costs. Automating reminders for documentation retention and audit preparation helps maintain compliance without straining resources. Training finance personnel on Oman’s customs regulations and accounting standards ensures the team understands the nuances of duty treatment and proof requirements.

Lastly, seeking professional advice periodically ensures that accounting treatments and tax positions reflect the latest regulations and best practices. Leaderly’s expertise in audit, taxation, and advisory services supports SMEs in refining customs accounting processes, helping to build internal controls that withstand regulatory scrutiny. These steps empower SMEs to confidently manage customs duties while maintaining focus on growth and operational efficiency.

The Role of Leaderly in Supporting Customs Duties Accounting

Expertise That Drives Financial Confidence for Omani SMEs

Leaderly plays a crucial role in assisting SMEs in Muscat with the complex accounting and regulatory challenges related to customs duties. Through comprehensive audit and accounting services, Leaderly ensures that financial statements accurately reflect customs costs in accordance with Omani standards. This reliability builds trust with stakeholders and supports smooth tax audits.

On the taxation front, Leaderly advises SMEs on VAT treatment at customs and corporate tax implications, helping optimize input VAT recovery and ensuring compliance with evolving Oman tax laws. Advisory services extend to feasibility studies and due diligence related to import-heavy businesses, where customs duties impact valuation and liquidity. By providing tailored solutions, Leaderly helps SME owners and finance managers navigate customs accounting with clarity and confidence, ultimately supporting sustainable business growth in Muscat’s competitive environment.

Leaderly’s hands-on approach enables SMEs to integrate customs duties accounting seamlessly into their financial processes while maintaining regulatory compliance. This partnership reduces the administrative burden on SMEs and enhances their ability to make informed financial decisions, driving long-term success in Oman’s evolving market landscape.

#Leaderly #AccountingforCustomsandDutiesinMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit