Vision 2040 Secure Finance Data Lake Oman: Advancing SME Data Management in Muscat

Understanding Vision 2040 Secure Finance Data Lake Oman

The Foundation of Digital Financial Transformation

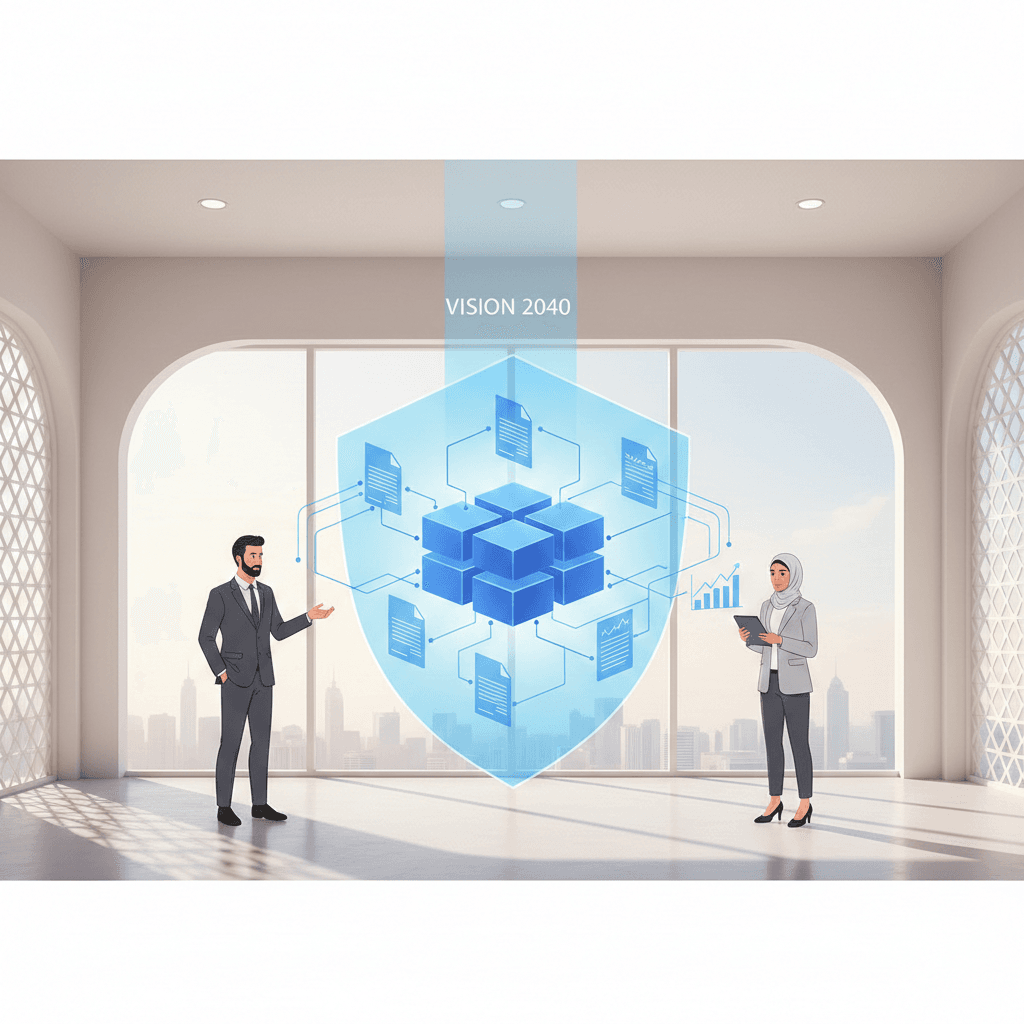

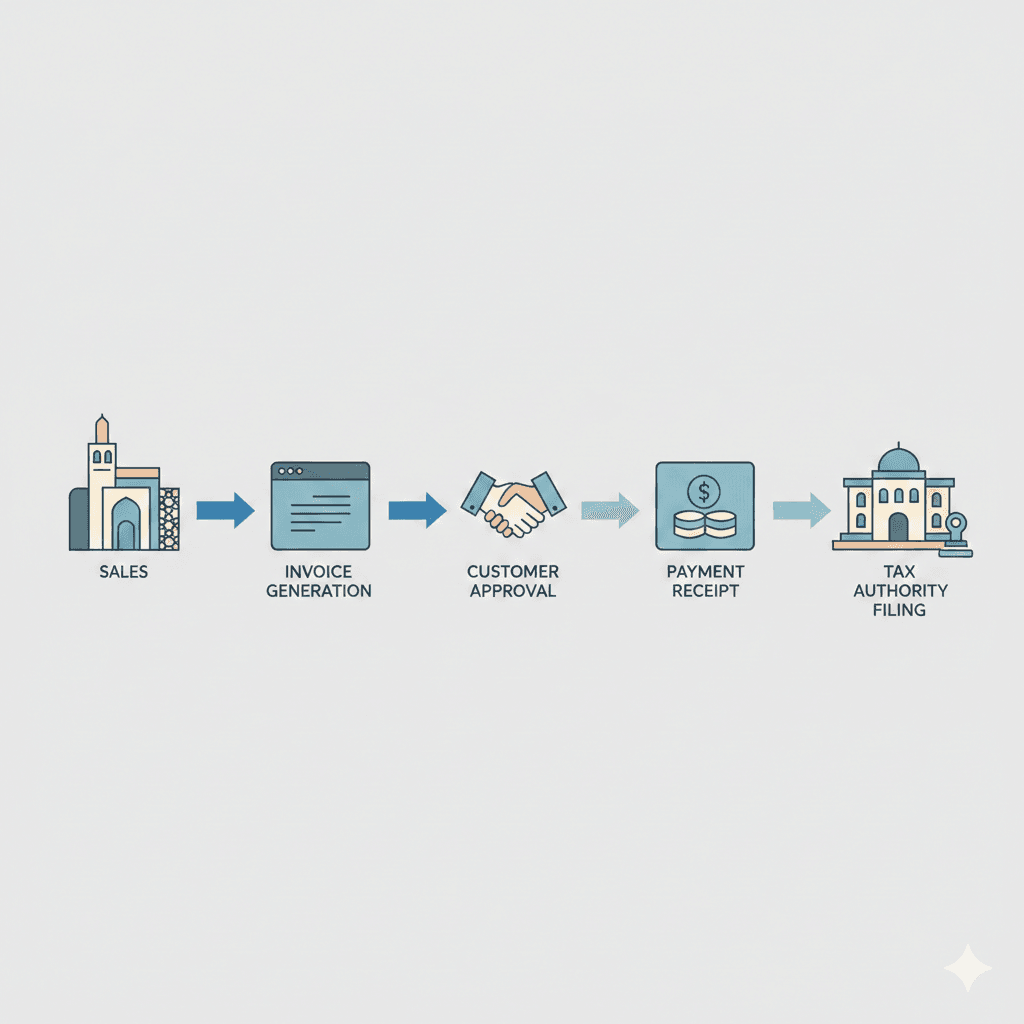

Vision 2040 Secure Finance Data Lake Oman represents a strategic initiative designed to modernize how financial data is collected, stored, and utilized within Oman’s rapidly evolving SME ecosystem. As Oman advances toward its Vision 2040 goals, fostering economic diversification and technological innovation, the creation of a secure finance data lake is a crucial step. This data lake is a centralized repository that aggregates financial information from multiple sources, including accounting systems, tax records, audit reports, and business transactions, enabling SMEs and entrepreneurs in Muscat to access a unified, real-time view of their financial health. This approach not only supports compliance with Oman’s evolving tax and corporate regulations but also empowers better decision-making through improved data accessibility and security.

In the context of Oman’s financial sector, security is paramount. The secure finance data lake framework under Vision 2040 ensures that sensitive financial information is protected against cyber threats and unauthorized access, leveraging advanced encryption and governance protocols. This aligns with Oman’s regulatory landscape, which increasingly demands stringent data privacy and integrity standards for businesses. SMEs, often vulnerable to data breaches and compliance risks, stand to benefit immensely from this architecture as it reduces operational risks and enhances transparency. By centralizing financial data securely, Vision 2040 not only promotes operational efficiency but also lays the groundwork for future-ready financial management practices that support sustainable growth in Oman’s competitive markets.

For business owners and finance managers in Muscat, the vision behind a secure finance data lake goes beyond technology—it represents a cultural shift towards data-driven management and accountability. It enables real-time financial oversight, better tax planning, and more efficient audit processes, all while maintaining full regulatory compliance. This transformation aligns naturally with Leaderly’s advisory and audit services, which increasingly rely on comprehensive, accurate data to provide actionable insights tailored to the unique needs of Oman’s SMEs. As Oman’s economy digitalizes, integrating secure financial data lakes into business operations becomes essential for staying ahead and ensuring resilience amid market uncertainties.

Building a Secure Finance Data Lake for SMEs in Oman

Implementing Infrastructure and Governance

The successful implementation of a Vision 2040 secure finance data lake requires robust infrastructure that accommodates Oman’s SME landscape. Businesses must invest in scalable cloud platforms capable of handling diverse financial data types—ranging from VAT filings to payroll and corporate tax reports—while ensuring compliance with Oman’s regulatory frameworks. Selecting the right technology partners and platforms is critical, with a strong focus on security features such as multi-factor authentication, role-based access control, and continuous monitoring to detect anomalies. These technologies enable SMEs in Muscat and beyond to build trust with stakeholders, including tax authorities, auditors, and investors.

Governance plays an equally critical role in maintaining the integrity of the data lake. Vision 2040 emphasizes clear policies defining data ownership, usage rights, and retention periods in alignment with Oman’s legal requirements. For SMEs, this means establishing internal controls that govern how financial data flows into the lake and who can access or modify it. Leaderly’s advisory services can assist businesses in designing and implementing these governance frameworks, ensuring they meet national standards while optimizing operational efficiency. Proper governance mitigates risks such as data leaks and non-compliance penalties, which are especially costly for smaller enterprises operating on tight margins.

Furthermore, ongoing training and awareness are vital for SMEs adopting this new model. Employees responsible for financial data management must understand the security protocols and compliance obligations that come with the data lake environment. Muscat’s business community benefits when enterprises foster a culture of security-mindedness, supported by expert guidance and practical tools. This cultural shift enhances not only data protection but also overall financial discipline, enabling SMEs to leverage their data strategically to secure funding, improve forecasting, and navigate Oman’s evolving tax landscape with confidence.

Advantages of Vision 2040 Secure Finance Data Lake Oman

Empowering SMEs Through Data-Driven Finance

The adoption of a Vision 2040 secure finance data lake provides Omani SMEs with numerous competitive advantages. First and foremost, it streamlines financial operations by consolidating disparate data sources into a single, easily accessible platform. This reduces manual reconciliation efforts and human error, freeing up finance teams to focus on analysis rather than data gathering. SMEs in Muscat can better manage VAT obligations and corporate tax compliance as their financial data is organized, accurate, and audit-ready, thereby minimizing risks of fines or reputational damage.

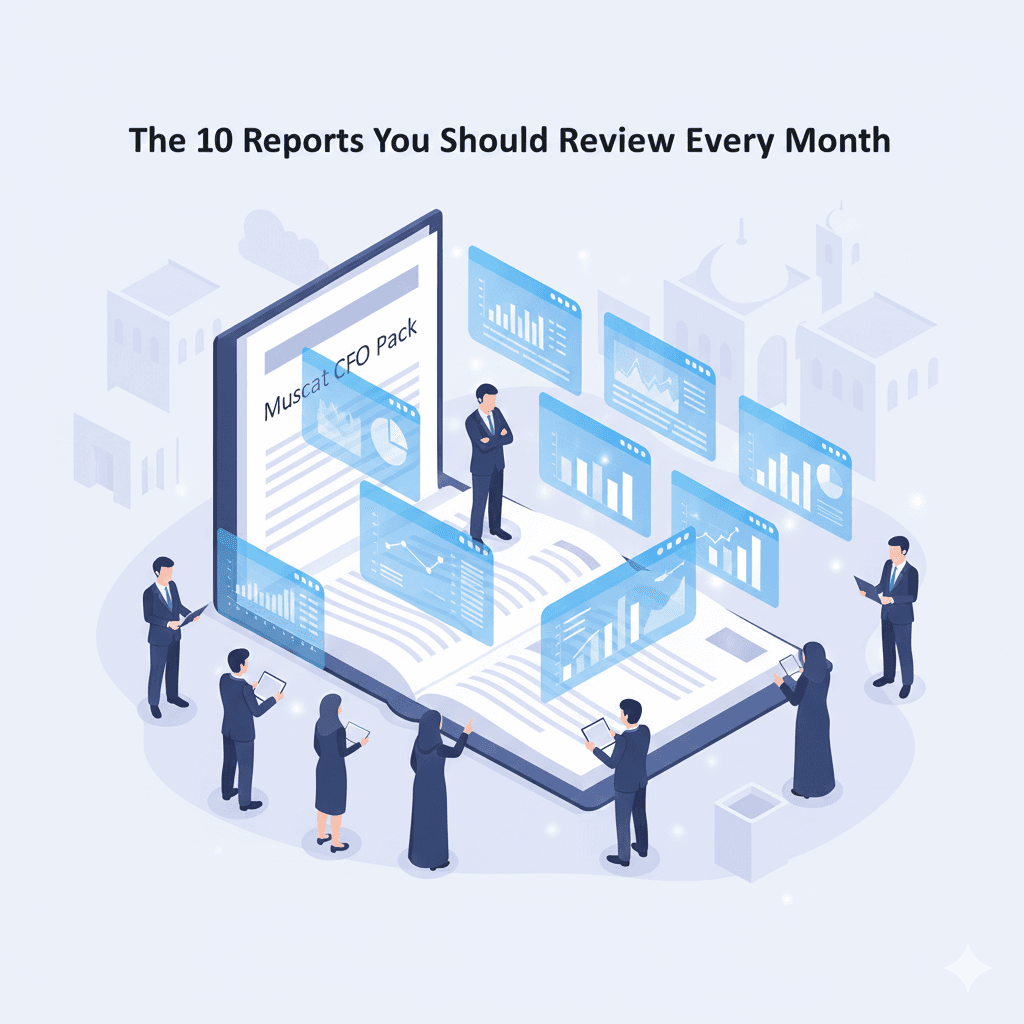

Secondly, the secure data lake enhances the quality and timeliness of financial reporting. By providing a centralized hub, SMEs can generate real-time insights into cash flow, profitability, and tax liabilities. This agility is crucial for entrepreneurs facing fluctuating market conditions and seeking to optimize working capital. Additionally, such financial transparency supports better due diligence processes when engaging with investors or partners, which is increasingly important in Oman’s growing startup and SME funding ecosystem. Leaderly’s audit and advisory teams are well-positioned to help businesses extract these insights, adding strategic value beyond traditional compliance roles.

Finally, the Vision 2040 framework encourages a future-proof approach to financial data management. As Oman continues to integrate emerging technologies such as AI and blockchain, a secure finance data lake provides a scalable foundation to adopt these innovations. SMEs will be better equipped to automate tax calculations, predict financial trends, and ensure data provenance for audits, all within a secure environment. This forward-thinking infrastructure not only supports current regulatory demands but also positions Oman’s SME sector for sustained digital growth aligned with Vision 2040’s economic goals.

Addressing Challenges in Secure Finance Data Lake Adoption

Overcoming Barriers for Omani SMEs

While the benefits of Vision 2040 secure finance data lakes are clear, SMEs in Oman face practical challenges in adoption. One major hurdle is the initial investment in technology and expertise required to build and maintain such a system. For smaller businesses with limited budgets, this can be a significant barrier. However, recognizing this, Oman’s digital transformation policies often include incentives and support programs to ease the financial burden. Engaging with trusted advisors like Leaderly ensures SMEs receive tailored guidance on cost-effective solutions that balance compliance and operational needs.

Data privacy concerns also pose challenges, particularly given the sensitive nature of financial records. SMEs must ensure that the data lake architecture complies with Oman’s Personal Data Protection Law and related cybersecurity mandates. This requires continuous updates to security protocols and active risk management strategies. Leaderly’s audit and advisory services help businesses implement these controls, conduct regular risk assessments, and stay abreast of regulatory changes, thus safeguarding SME interests in an evolving legal environment.

Lastly, the cultural shift toward digital finance management is not without resistance. Many SME owners and finance managers are accustomed to traditional bookkeeping and may feel apprehensive about adopting a centralized, cloud-based data system. Overcoming this requires not only technology deployment but also change management efforts, including staff training and ongoing support. Oman’s business community benefits when stakeholders foster collaboration and knowledge sharing around best practices for secure data lake usage, reinforcing a collective commitment to Vision 2040’s transformative objectives.

Future Outlook for Secure Finance Data Lakes in Oman

Driving Long-Term SME Competitiveness and Compliance

Looking ahead, the Vision 2040 secure finance data lake initiative is set to become a cornerstone of Oman’s SME ecosystem. As digital transformation accelerates across Muscat and the Sultanate, financial data lakes will increasingly underpin everything from tax automation to advanced analytics and risk management. This evolution will empower SMEs to operate with greater transparency, efficiency, and agility, all crucial for thriving in a competitive regional market.

Moreover, this data-centric approach aligns closely with Oman’s broader economic objectives, such as enhancing ease of doing business and attracting foreign investment. A secure and reliable financial data infrastructure strengthens investor confidence and fosters a stable business environment. Leaderly’s role in this future is vital, offering SMEs ongoing advisory, tax, and audit support to ensure they leverage these systems effectively, maintain compliance, and harness their data for strategic advantage. Ultimately, Vision 2040 secure finance data lakes represent not just a technological upgrade but a transformative opportunity for Omani SMEs to shape their financial futures with confidence.

Integrating Leaderly’s Expertise with Vision 2040 Goals

Practical Support for Oman’s SME Financial Transformation

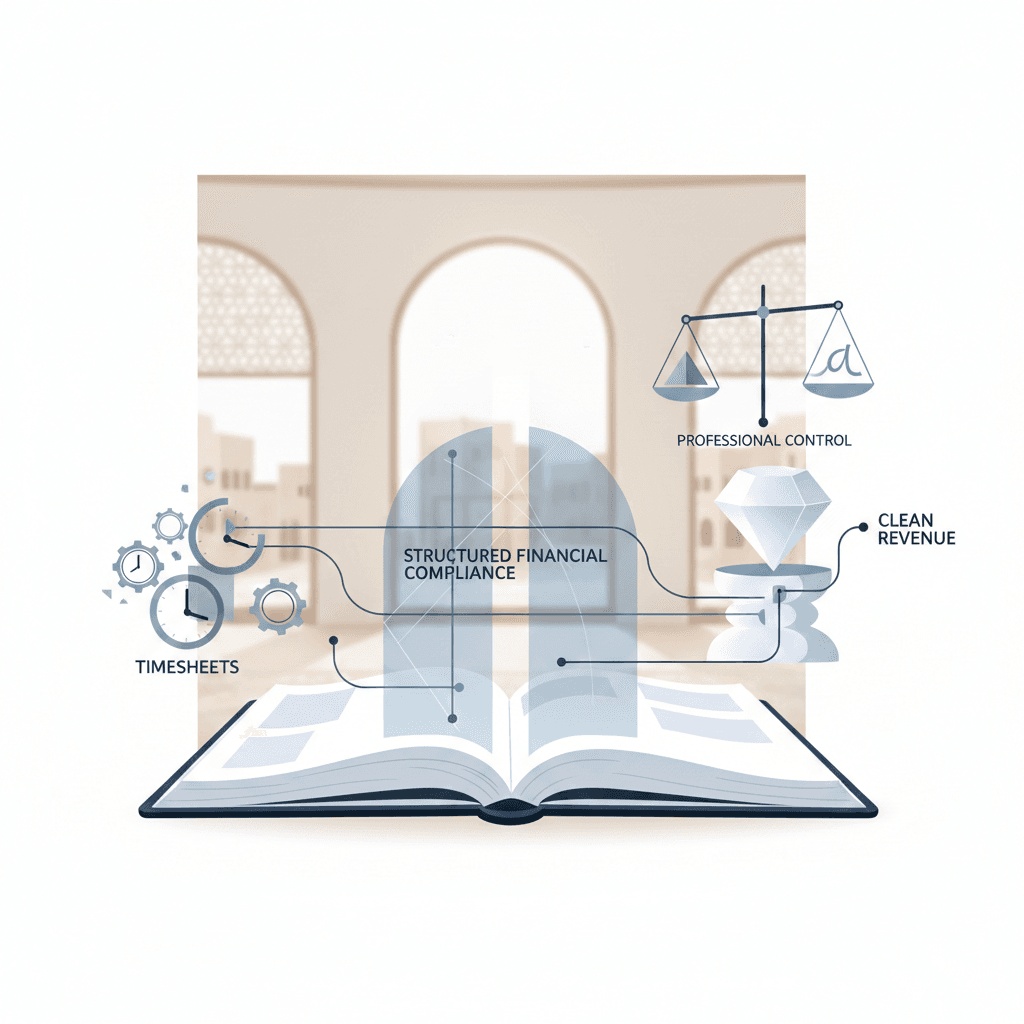

Leaderly’s comprehensive understanding of Oman’s financial landscape positions it uniquely to assist SMEs navigating the complexities of establishing a secure finance data lake. Beyond technical implementation, Leaderly’s services focus on the practical realities SMEs face: compliance with VAT and corporate tax regulations, audit readiness, and financial advisory that supports growth and sustainability. This alignment ensures that SMEs can not only adopt Vision 2040 initiatives but also maximize their operational and strategic outcomes.

In practical terms, Leaderly works closely with SME founders and finance managers in Muscat to tailor data governance frameworks, conduct feasibility studies on digital finance solutions, and provide due diligence for investment or liquidation scenarios. This hands-on approach translates Vision 2040’s ambitions into actionable steps, helping businesses manage risk and unlock value from their financial data. As Oman’s economy continues to digitize, partnerships between SMEs and expert advisors like Leaderly will be essential to fully realize the promise of a secure finance data lake environment and achieve sustainable success.

#Leaderly #Vision2040SecureFinanceDataLakeOman #Oman #Muscat #SMEs #Accounting #Tax #Audit