Oman Vision 2040 Secure Digital Onboarding: Transforming SME Customer and Employee Integration

The Strategic Importance of Oman Vision 2040 Secure Digital Onboarding

Driving Efficiency and Compliance in a Rapidly Digitalizing Economy

Oman Vision 2040 secure digital onboarding is becoming a critical focus for SMEs in Muscat and across the Sultanate. As Oman accelerates its transformation into a diversified, knowledge-driven economy, the ability to onboard customers and employees digitally — while ensuring security and regulatory compliance — stands as a key competitive advantage. For SMEs, which form the backbone of the Omani economy, adopting secure digital onboarding processes reduces operational bottlenecks and mitigates risks related to fraud, data breaches, and compliance violations. This aligns closely with Oman’s broader digital agenda, which emphasizes innovation, efficiency, and a robust regulatory framework.

Secure digital onboarding under Vision 2040 integrates identity verification, document authentication, and secure data handling into a streamlined workflow. This reduces the time and resources SMEs spend on manual verification processes while providing a better user experience for customers and employees alike. The approach also ensures adherence to Oman’s regulatory requirements around data protection and electronic transactions, thus safeguarding business continuity and fostering trust. For business owners and finance managers, this digital shift not only enhances operational security but also opens new avenues for scalable growth aligned with Vision 2040’s economic goals.

Moreover, secure digital onboarding reflects the heightened expectations of today’s digitally savvy customers and workforce in Muscat. As SMEs compete for market share and talent, offering a seamless and secure onboarding experience strengthens brand reputation and customer loyalty. It also helps entrepreneurs address critical compliance challenges, particularly with VAT, Corporate Tax regulations, and labor laws that increasingly require digital record-keeping and reporting. Hence, Oman Vision 2040 secure digital onboarding is not just a technological upgrade but a strategic imperative for SMEs looking to thrive in the Sultanate’s evolving business landscape.

Technological Foundations Enabling Secure Digital Onboarding

Leveraging Advanced Tools for Seamless Customer and Employee Integration

At the heart of Oman Vision 2040 secure digital onboarding lies the integration of advanced technologies such as biometric authentication, artificial intelligence (AI), and secure cloud platforms. These technologies work together to verify identities, validate documents, and monitor onboarding activities in real time. For SMEs in Muscat, this means being able to onboard customers and employees remotely without compromising security or compliance. Biometric tools such as facial recognition and fingerprint scanning provide an extra layer of verification that traditional methods cannot match, reducing identity fraud risks significantly.

Artificial intelligence plays a vital role in automating verification processes, detecting anomalies, and ensuring compliance with local regulatory frameworks. AI algorithms can cross-check submitted documents against government databases and flag inconsistencies instantly. This speeds up onboarding times, reduces manual errors, and enhances audit readiness—an essential factor for SMEs navigating Oman’s increasingly sophisticated VAT and Corporate Tax regimes. Cloud-based onboarding platforms further facilitate scalability and data security by enabling secure data storage with encryption and controlled access, compliant with Oman’s data protection laws.

For finance managers and SME founders, adopting these technologies means embracing a future-proof approach that aligns with Oman Vision 2040’s digital transformation targets. The technological foundation ensures that onboarding processes are not only secure and compliant but also flexible enough to adapt to evolving business needs. Leaderly’s advisory services can guide SMEs in selecting and implementing the right technology stack to support secure digital onboarding, balancing cost, efficiency, and regulatory requirements specific to the Omani market.

Regulatory and Compliance Considerations Under Oman Vision 2040 Secure Digital Onboarding

Navigating Oman’s Legal Landscape with Confidence

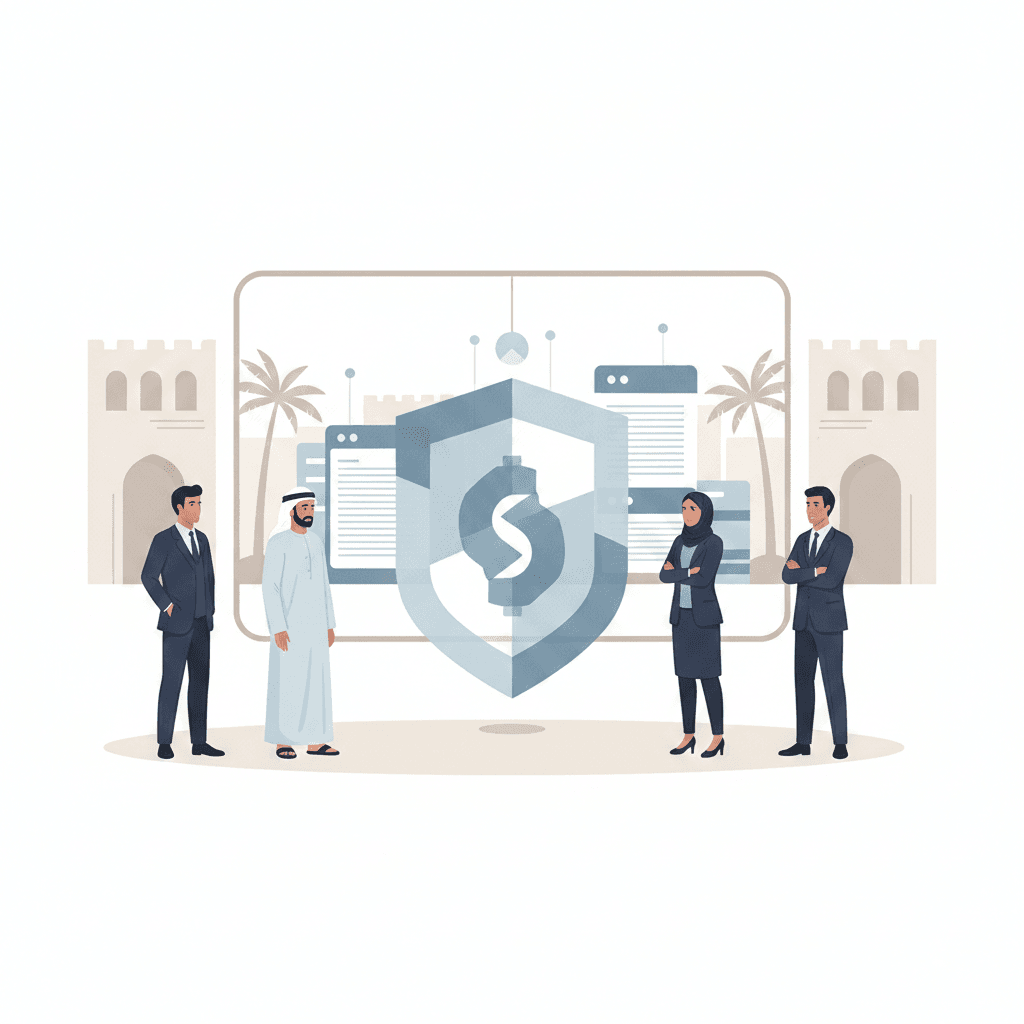

Oman Vision 2040 secure digital onboarding obliges SMEs to comply with a complex set of regulatory requirements that govern data privacy, anti-money laundering (AML), and electronic transactions. The Oman Data Protection Law, combined with directives from the Central Bank of Oman and tax authorities, mandates stringent controls on how customer and employee data is collected, stored, and processed. SMEs must ensure that their onboarding systems incorporate consent mechanisms, secure data transmission protocols, and audit trails to demonstrate compliance during inspections and audits.

Compliance with Oman’s VAT and Corporate Tax laws further elevates the importance of secure digital onboarding. Accurate identity verification and document validation reduce the risk of fraud and tax evasion, which are priorities under Vision 2040’s drive for transparent and efficient taxation. Moreover, adhering to AML guidelines requires SMEs to implement Know Your Customer (KYC) processes digitally, supported by real-time verification and ongoing monitoring. This helps businesses detect suspicious activity early and fulfill legal reporting obligations.

By integrating compliance into the onboarding workflow, SMEs not only avoid penalties but also build a reputation for reliability and governance—qualities that attract investors and partners in Oman’s evolving economy. Leaderly’s tax and audit expertise offers practical guidance to SMEs, ensuring that digital onboarding solutions meet Oman’s legal standards while supporting broader business objectives. This proactive compliance approach is essential for SMEs looking to secure sustainable growth and navigate the regulatory landscape confidently.

Enhancing Customer Experience Through Oman Vision 2040 Secure Digital Onboarding

Building Trust and Engagement in a Digital Economy

One of the most tangible benefits of Oman Vision 2040 secure digital onboarding for SMEs lies in transforming the customer experience. In a marketplace where convenience and security are paramount, offering a swift, transparent, and secure onboarding process is crucial to gaining customer trust and loyalty. Digital onboarding eliminates the need for physical paperwork, long wait times, and repeated visits, making it more appealing for Muscat’s digitally connected population. This not only increases customer satisfaction but also reduces abandonment rates during onboarding, a common challenge for SMEs.

Transparency is another cornerstone of a positive customer experience. Secure digital onboarding platforms provide real-time status updates, clear instructions, and accessible support channels, which empower customers to complete onboarding with confidence. The use of secure authentication methods reassures customers that their personal information is protected, reinforcing brand credibility. For SMEs, this translates into stronger customer relationships and the ability to capture and analyze onboarding data for continuous improvement and personalized service delivery.

Entrepreneurs and business owners must therefore view secure digital onboarding as a strategic tool to differentiate their offerings in Oman’s competitive SME landscape. Beyond compliance and security, a customer-centric onboarding approach drives business growth by fostering engagement and repeat business. Partnering with advisory experts like Leaderly can help SMEs tailor their onboarding strategies to meet customer expectations while maintaining operational excellence and regulatory adherence.

Empowering Employees with Oman Vision 2040 Secure Digital Onboarding

Streamlining Workforce Integration for SME Success

For SMEs in Oman, efficient employee onboarding is as vital as customer onboarding, directly impacting productivity and retention. Oman Vision 2040 secure digital onboarding provides a framework for smoothly integrating new hires into company systems, culture, and compliance requirements. Digital platforms facilitate the collection of necessary employee information, verification of qualifications, and delivery of induction training, all within a secure environment. This approach reduces administrative overhead and accelerates the time it takes for employees to become fully operational.

Secure digital onboarding also ensures compliance with Oman’s labor laws and regulations. Employers can automate the submission and storage of employment contracts, work permits, and health and safety documents, minimizing the risk of errors or omissions that could lead to legal complications. Additionally, digital systems can incorporate periodic compliance checks and updates, keeping both employees and management informed about changing regulations. This proactive management supports the SME’s commitment to legal and ethical standards, reinforcing its reputation in Oman’s business community.

By investing in secure digital onboarding for employees, SME founders and HR managers can focus more on strategic initiatives rather than paperwork. It fosters a positive onboarding experience that promotes employee engagement, reduces turnover, and enhances overall organizational performance. Leaderly’s advisory services can assist SMEs in selecting scalable onboarding platforms tailored to the unique needs of Omani businesses, ensuring that workforce integration aligns seamlessly with Vision 2040 objectives.

Conclusion

Oman Vision 2040 secure digital onboarding is a transformative enabler for SMEs seeking to thrive in the Sultanate’s evolving economic landscape. By adopting robust digital onboarding processes, businesses can streamline customer and employee integration, ensuring compliance with Oman’s regulatory frameworks while enhancing operational efficiency. This not only mitigates risks related to fraud and data breaches but also strengthens the overall trust and engagement that are crucial in today’s digital economy.

For business owners, entrepreneurs, and finance managers in Muscat and beyond, embracing secure digital onboarding is more than a compliance exercise—it is a strategic investment in sustainable growth and competitive advantage. Leaderly’s expertise in audit, taxation, and advisory services can guide SMEs in navigating this digital shift effectively, aligning technology adoption with Oman Vision 2040’s broader goals. Ultimately, secure digital onboarding empowers SMEs to build resilient, agile operations that confidently meet the demands of a dynamic market and a digitally empowered society.

#Leaderly #OmanVision2040SecureDigitalOnboarding #Oman #Muscat #SMEs #Accounting #Tax #Audit