Oman Vision 2040 Sensitive Financial Data Protection: Securing the Future of SMEs in Muscat

The Rising Importance of Financial Data Protection in Oman

Understanding the Digital Economy Shift Under Vision 2040

Oman Vision 2040 Sensitive Financial Data Protection has become a critical priority as the rapid digital transformation reshapes how businesses operate across the Sultanate. For SMEs in Muscat, this shift goes beyond a simple technological upgrade—it represents a fundamental change in how critical financial information is safeguarded against increasingly sophisticated cyber threats. The Vision 2040 initiative drives innovation and economic diversification, accelerating the digital economy and moving more financial transactions, accounting, and tax processes onto cloud-based platforms and automated systems. As a result, sensitive financial data—ranging from payroll information and corporate tax records to supplier contracts and audit trails—requires enhanced protection. This financial data forms the backbone of business credibility and operational continuity, and any breach could lead to loss of trust, legal consequences, or significant financial setbacks that SMEs cannot afford.

Regulatory Framework Enhancing Data Security in Oman

Legal Mandates and Compliance for SMEs

Oman’s regulatory environment is progressively adapting to the digital economy demands, mandating stringent controls over financial data security to align with Vision 2040’s objectives. SMEs operating in Muscat are increasingly required to comply with data protection laws and financial regulations that ensure transparency, accuracy, and confidentiality. The introduction of Corporate Tax and the ongoing implementation of VAT regulations mean businesses must maintain accurate, secure records to withstand audits and due diligence reviews. This regulatory backdrop compels SMEs to adopt robust financial data classification and security protocols. Oman’s government agencies also emphasize cybersecurity frameworks to protect against data breaches and fraud, underlining the importance of encryption, secure cloud storage, and controlled data access. For SMEs, this means that adherence to these evolving regulations is no longer optional but a core element of financial and operational risk management.

Leadership Role in SME Data Protection Strategy

Building Resilience Through Strategic Advisory Services

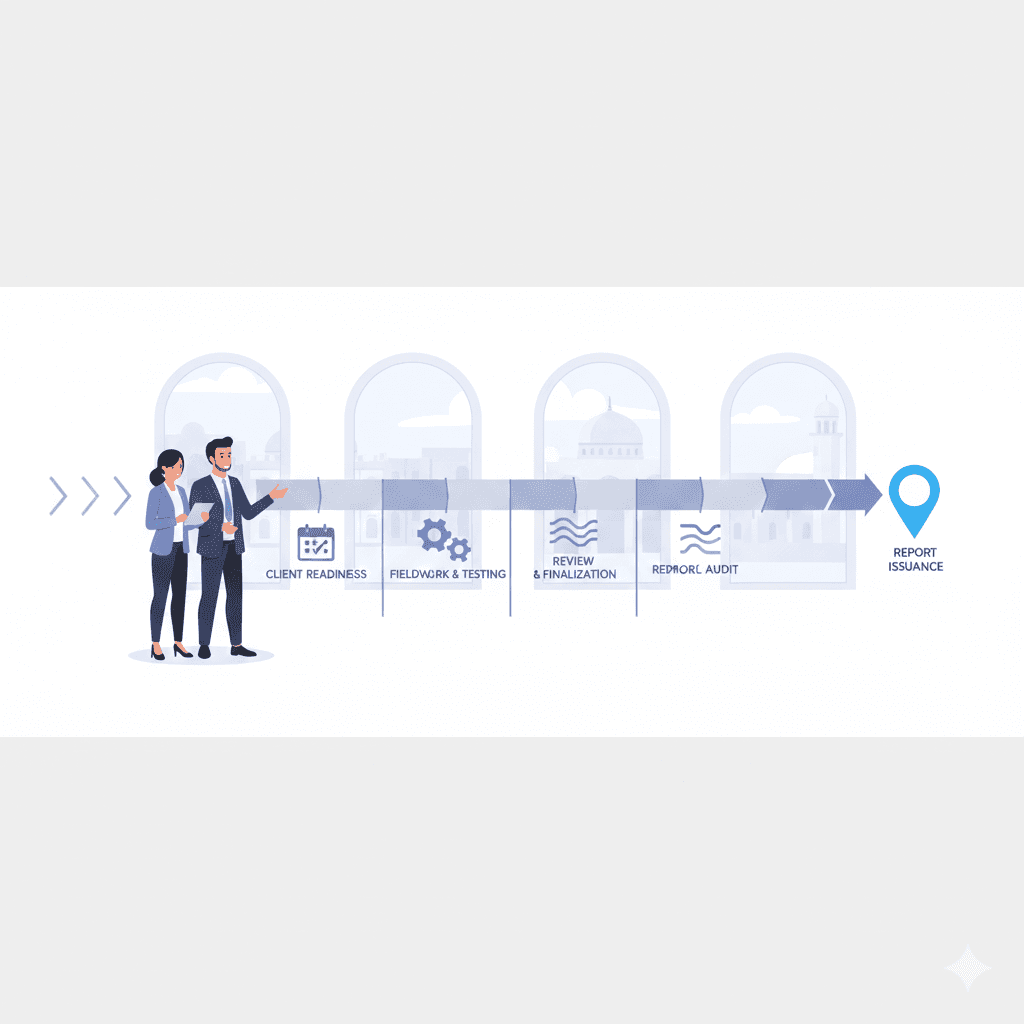

The responsibility of protecting sensitive financial data extends beyond compliance; it involves leadership commitment and strategic planning. SME founders and finance managers in Oman must proactively engage with expert advisory services that help tailor data protection frameworks suited to their unique business contexts. Leaderly’s advisory expertise in feasibility studies, valuation, and due diligence can provide crucial insights into establishing resilient financial data governance. Integrating audit and accounting services ensures continuous oversight and detection of anomalies, which is critical for early threat identification. These professional services facilitate a culture of vigilance, embedding data protection into everyday business processes. By prioritizing sensitive financial data security, SMEs can safeguard their reputations, strengthen investor confidence, and sustain growth in an increasingly competitive digital economy.

Emerging Technologies Empowering Data Security

How Digital Tools Align with Oman’s Economic Vision

Technological advancements play a pivotal role in advancing Oman Vision 2040’s goals, particularly in securing sensitive financial information within SMEs. Modern encryption techniques, cloud-based accounting solutions, and automated tax compliance software are becoming indispensable for Muscat-based enterprises. These tools not only improve operational efficiency but also provide layers of protection against cyber threats that can compromise financial data integrity. The use of blockchain technology for secure transaction records and artificial intelligence to detect fraudulent activity are gaining traction, enabling SMEs to stay ahead of risks. Leaderly’s integration of these technologies in audit and advisory services ensures SMEs benefit from cutting-edge solutions tailored to Oman’s regulatory and economic environment. This synergy of technology and professional guidance equips businesses to meet the expectations of Vision 2040 effectively.

Challenges Facing SMEs in Financial Data Protection

Resource Constraints and Knowledge Gaps

Despite the clear advantages, many SMEs in Oman confront significant hurdles in implementing comprehensive sensitive financial data protection. Limited budgets, shortage of skilled IT personnel, and insufficient awareness of cybersecurity best practices often impede effective data governance. SMEs frequently struggle to balance the costs of adopting sophisticated digital tools with other pressing operational expenses. Moreover, rapid regulatory changes require continuous education and adaptation, which can overwhelm smaller enterprises. This environment underscores the need for accessible, tailored advisory and audit services that can guide SMEs through compliance complexities and security challenges without compromising business agility. Leaderly’s hands-on approach focuses on empowering SMEs with practical, Oman-specific solutions that bridge these gaps and foster sustainable digital resilience.

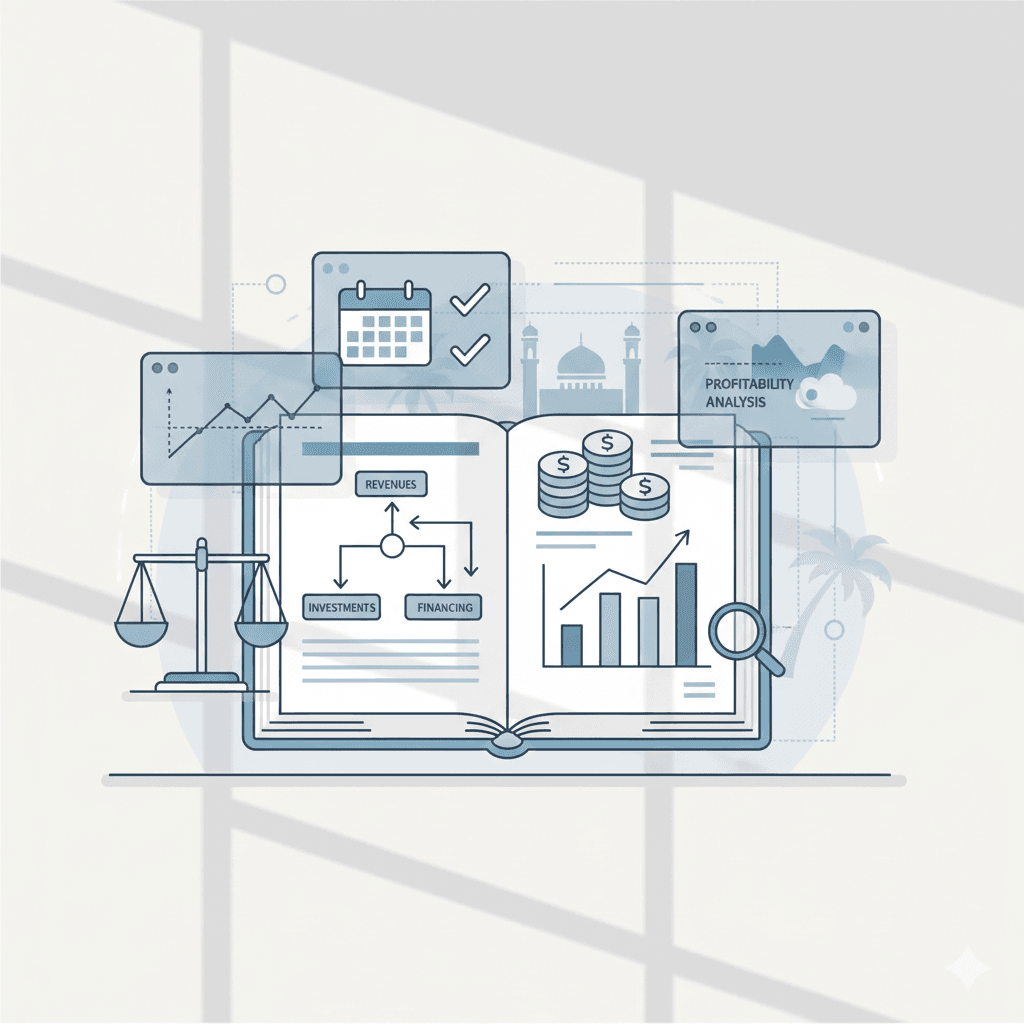

Future Outlook: Strengthening Oman’s SME Ecosystem

Vision 2040 as a Catalyst for Secure Growth

Looking ahead, the protection of sensitive financial data will remain a cornerstone of Oman Vision 2040’s broader economic ambitions. As Muscat’s SME ecosystem matures, the integration of secure financial data practices will not only comply with regulations but will serve as a competitive advantage in attracting investments and partnerships. Enhanced data security facilitates smoother audits, more accurate tax reporting, and effective financial planning, which are vital for long-term sustainability. The ongoing collaboration between SMEs, financial advisors, and government entities promises a more resilient business environment where innovation thrives without compromising data integrity. Leaderly’s commitment to supporting SMEs in this journey reinforces the Sultanate’s vision of a diversified, knowledge-based economy powered by secure digital foundations.

The ongoing digital transformation in Oman requires SMEs to adopt a proactive and strategic approach to sensitive financial data protection. This commitment is essential not only for compliance with Vision 2040 regulations but also for building trust, ensuring operational continuity, and driving sustainable growth. By leveraging expert advisory, audit, and taxation services, SMEs in Muscat can navigate the evolving landscape confidently, turning data security challenges into opportunities for competitive differentiation.

Ultimately, the safeguarding of financial data under Oman Vision 2040 is a shared responsibility that empowers SMEs to contribute meaningfully to the Sultanate’s economic diversification and digital economy success. With the right tools, knowledge, and partnerships, Omani businesses can secure their financial future while embracing innovation and growth.

#Leaderly #OmanVision2040SensitiveFinancialDataProtection #Oman #Muscat #SMEs #Accounting #Tax #Audit