Muscat SME Identity Access Governance as a Practical Growth Framework for Omani Businesses

Muscat SME Identity Access Governance and the New Reality of Omani Business Operations

Why identity is now a financial issue, not just an IT concern

Muscat SME Identity Access Governance is rapidly becoming one of the most overlooked foundations of financial stability for businesses operating under Oman Vision 2040. In simple terms, it refers to how a company controls who can access its systems, data, applications, bank platforms, customer records, and internal financial tools. For many SMEs in Muscat, Sohar, Nizwa, and Salalah, access is still managed informally, often relying on shared passwords, undocumented permissions, and trust-based controls that grew organically as the company expanded. What Vision 2040 introduces, however, is an environment where trust must be backed by structure. Regulatory bodies, banks, auditors, and tax authorities increasingly expect businesses to demonstrate clear control over sensitive financial information. When access is poorly governed, errors in VAT filings, payroll records, inventory reporting, and management accounts become far more likely. The cost is not only technical. It affects cash flow, tax exposure, audit readiness, and even the credibility of management decisions. SMEs often discover these risks only when a problem surfaces during a bank facility review, an investor discussion, or a regulatory inquiry. At that stage, correcting weak identity controls becomes expensive, disruptive, and stressful. Building Muscat SME Identity Access Governance early offers stability, not bureaucracy, and protects both financial accuracy and management confidence.

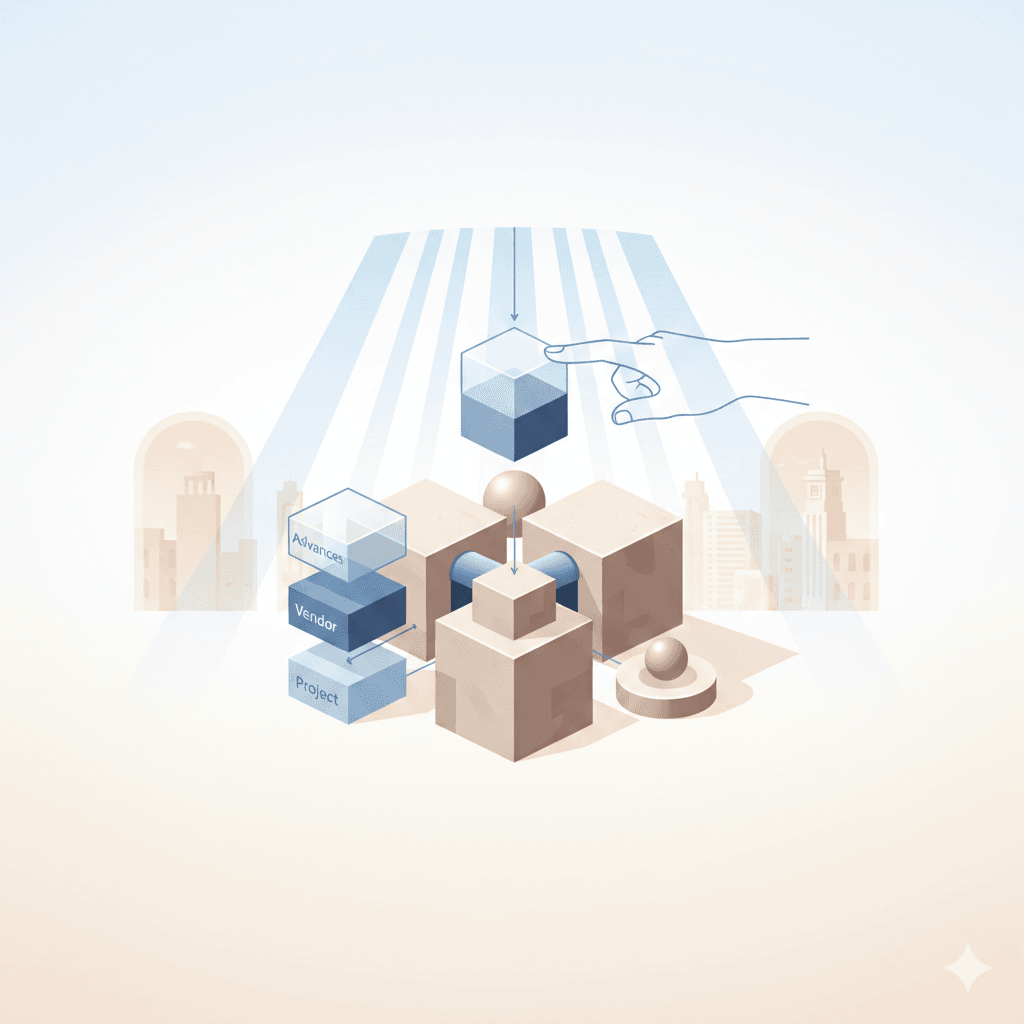

Muscat SME Identity Access Governance as a Shield Against Internal Risk

How access discipline reduces financial leakage and compliance stress

In Oman’s evolving compliance landscape, Muscat SME Identity Access Governance now functions as an internal insurance policy against financial and operational risk. Many SME owners believe their primary threats come from cyber criminals or external fraud, yet the most damaging incidents usually arise internally: former employees retaining access, staff exceeding their authority, errors caused by overlapping permissions, or sensitive reports being altered without traceability. When access rights are not documented and regularly reviewed, the company cannot prove who approved what, who changed what, and when. This directly weakens financial statements, audit trails, and VAT documentation. As Oman tightens corporate tax reporting and strengthens audit expectations, businesses with weak access governance will face growing scrutiny. From a financial advisory perspective, the impact is measurable: delayed audits, increased professional fees, qualification risks, and prolonged bank negotiations. By structuring access based on job roles, approval hierarchies, and periodic reviews, SMEs protect the integrity of their financial data. This makes audits smoother, strengthens relationships with banks and investors, and significantly reduces compliance anxiety. Leaderly’s experience with Omani SMEs consistently shows that companies implementing disciplined access controls early enjoy lower advisory costs and fewer regulatory disruptions over time.

Muscat SME Identity Access Governance and Strategic Decision Quality

Why better access controls improve management thinking

Beyond risk protection, Muscat SME Identity Access Governance directly influences the quality of business decisions. In many SMEs, management dashboards, sales forecasts, cost analysis, and cash flow projections are built from data that passes through multiple hands and systems. When access permissions are loosely defined, the reliability of that data declines quietly. A junior employee may overwrite pricing files, a former manager may still export sensitive customer data, or outsourced accountants may operate without proper supervision boundaries. These weaknesses distort performance reports and undermine management confidence. Vision 2040 places strong emphasis on data-driven leadership and corporate professionalism, pushing even small businesses to operate with enterprise-level discipline. When access is governed clearly, data becomes trustworthy. Owners can rely on their numbers, investors can evaluate performance confidently, and financial advisors can provide sharper strategic recommendations. Feasibility studies, valuations, due diligence, and liquidation planning all depend on reliable records. Muscat SME Identity Access Governance therefore becomes not only a technical safeguard but a strategic enabler that strengthens the entire decision-making ecosystem of the business.

Muscat SME Identity Access Governance in Day-to-Day Financial Operations

From accounting software to banking platforms

In daily operations, Muscat SME Identity Access Governance quietly touches every financial function. Accounting systems, payroll software, ERP platforms, online banking, supplier portals, and tax filing tools all contain sensitive information that must be controlled precisely. Yet many SMEs in Oman grant access on convenience rather than principle. Temporary staff receive permanent credentials, managers retain access long after role changes, and external consultants operate without defined scope. These practices inflate operational risk and weaken compliance. Practical governance does not require expensive software or complex frameworks. It begins with documenting who has access to what, aligning permissions to job roles, and scheduling periodic reviews. From there, approvals for sensitive functions such as payment release, VAT submission, or financial closing should always require dual control. This structure supports stronger internal controls, simplifies audits, and reinforces financial discipline. As Leaderly often advises its SME clients, the strength of accounting and tax compliance is inseparable from the quality of access governance that supports the data behind those reports.

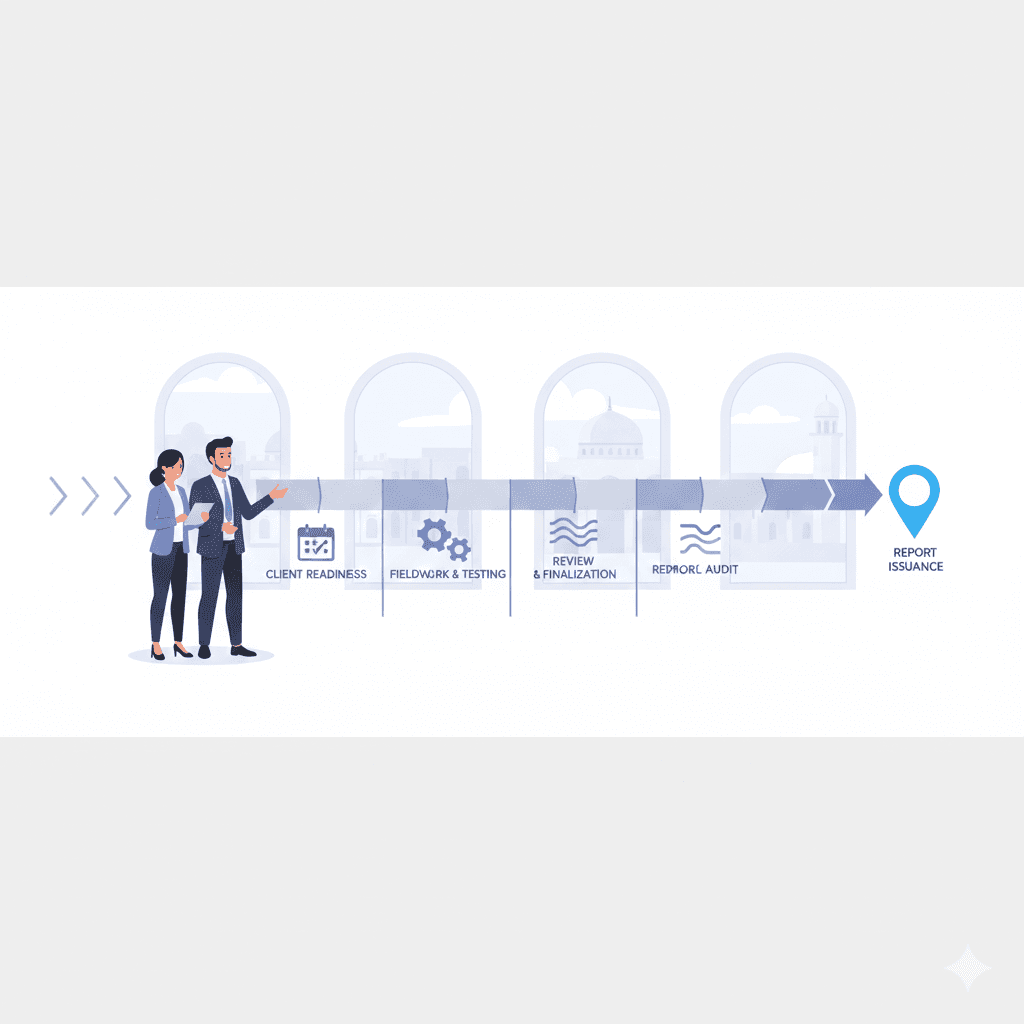

Muscat SME Identity Access Governance as a Growth Accelerator

Why banks and investors increasingly care about access controls

Growth in Oman increasingly requires external confidence. Banks, investors, and strategic partners want assurance that a company’s financial and operational foundations are reliable. Muscat SME Identity Access Governance has become a subtle but powerful signal of management maturity. During financing negotiations or investment due diligence, questions about internal controls, data protection, and system access arise more frequently. Companies that can clearly explain their governance model progress faster through approval processes. Those that cannot often face extended reviews, higher risk premiums, or reduced valuation. For SMEs planning expansion, acquisitions, or succession, access governance also simplifies integration and transition. New leadership can step in with confidence, systems remain stable, and financial history remains credible. In this way, identity and access management quietly fuels growth by reducing friction, lowering perceived risk, and improving business valuation outcomes under Oman’s evolving corporate environment.

Muscat SME Identity Access Governance and the Culture of Accountability

Building discipline without damaging trust

Perhaps the most underestimated benefit of Muscat SME Identity Access Governance is cultural. When access is structured transparently, employees understand their responsibilities, authority, and accountability. This clarity reduces conflict, prevents blame shifting, and strengthens professional behavior. In SMEs, where teams are close-knit and trust-based, formalizing access may feel uncomfortable at first. Yet over time it reinforces fairness and stability. Employees know decisions are traceable, approvals are documented, and performance is measured accurately. This aligns perfectly with the professional standards Oman Vision 2040 seeks to cultivate across the private sector. Companies that adopt this culture early position themselves as credible, reliable partners in an increasingly regulated economy. From accounting accuracy to tax compliance, from advisory planning to audit readiness, access governance becomes the invisible framework supporting sustainable success.

As Oman Vision 2040 reshapes the national business environment, Muscat SME Identity Access Governance stands out as a practical, achievable discipline that delivers immediate financial and operational benefits. It protects SMEs from internal risk, strengthens compliance, improves decision quality, and enhances credibility with banks, regulators, and investors. More importantly, it transforms data from a fragile asset into a dependable foundation for growth. In an economy where transparency, professionalism, and accountability are no longer optional, access governance becomes an essential management responsibility rather than a technical afterthought.

For SME owners and finance managers, the message is clear: strong access governance is no longer about technology alone, but about building resilient businesses capable of navigating audits, taxation, expansion, and succession with confidence. When integrated thoughtfully alongside sound accounting, tax planning, and strategic advisory support, Muscat SME Identity Access Governance becomes one of the most powerful tools available for achieving long-term stability and sustainable growth in Oman’s evolving economy.

#Leaderly #MuscatSMEIdentityAccessGovernance #Oman #Muscat #SMEs #Accounting #Tax #Audit