Vision 2040 Secure Integrations Oman: The Future of SME Financial Processes

Understanding Vision 2040 Secure Integrations Oman

A transformative framework for SMEs

Vision 2040 Secure Integrations Oman represents a strategic leap towards harmonizing key financial processes—accounting, VAT compliance, and e-invoicing—within the evolving business landscape of Oman. This integration aligns with the Sultanate’s broader Vision 2040 goals that emphasize digital transformation, economic diversification, and enhanced regulatory compliance. For SMEs, this means more than adopting new technologies; it’s about creating a secure, streamlined ecosystem that supports business growth while reducing operational risks. Integrating accounting systems with VAT and e-invoicing platforms facilitates real-time data accuracy, ensuring that SMEs can confidently meet Oman’s evolving tax and audit requirements without disruption.

This secure integration fosters transparency and builds trust with regulatory authorities such as the Oman Tax Authority (OTA). It reflects a shift from traditional manual processes to automated, compliant frameworks, minimizing human error and strengthening financial reporting integrity. For entrepreneurs and finance managers in Muscat and across Oman, embracing these integrations is essential to staying competitive, enhancing efficiency, and future-proofing their operations against increasing compliance demands. Leaderly’s advisory services naturally support SMEs in navigating this transformation, providing practical guidance tailored to Oman’s regulatory environment.

Moreover, Vision 2040 Secure Integrations Oman underscores the necessity for SMEs to adopt robust cybersecurity measures alongside financial integration. As digital systems become interconnected, safeguarding sensitive financial data is paramount. This calls for SMEs to partner with trusted advisors who understand local challenges and can implement secure frameworks that meet both business needs and regulatory expectations, reinforcing Oman’s reputation as a digitally progressive economy.

The Impact of VAT and E-Invoicing Integration on SME Accounting

Streamlining tax compliance through technology

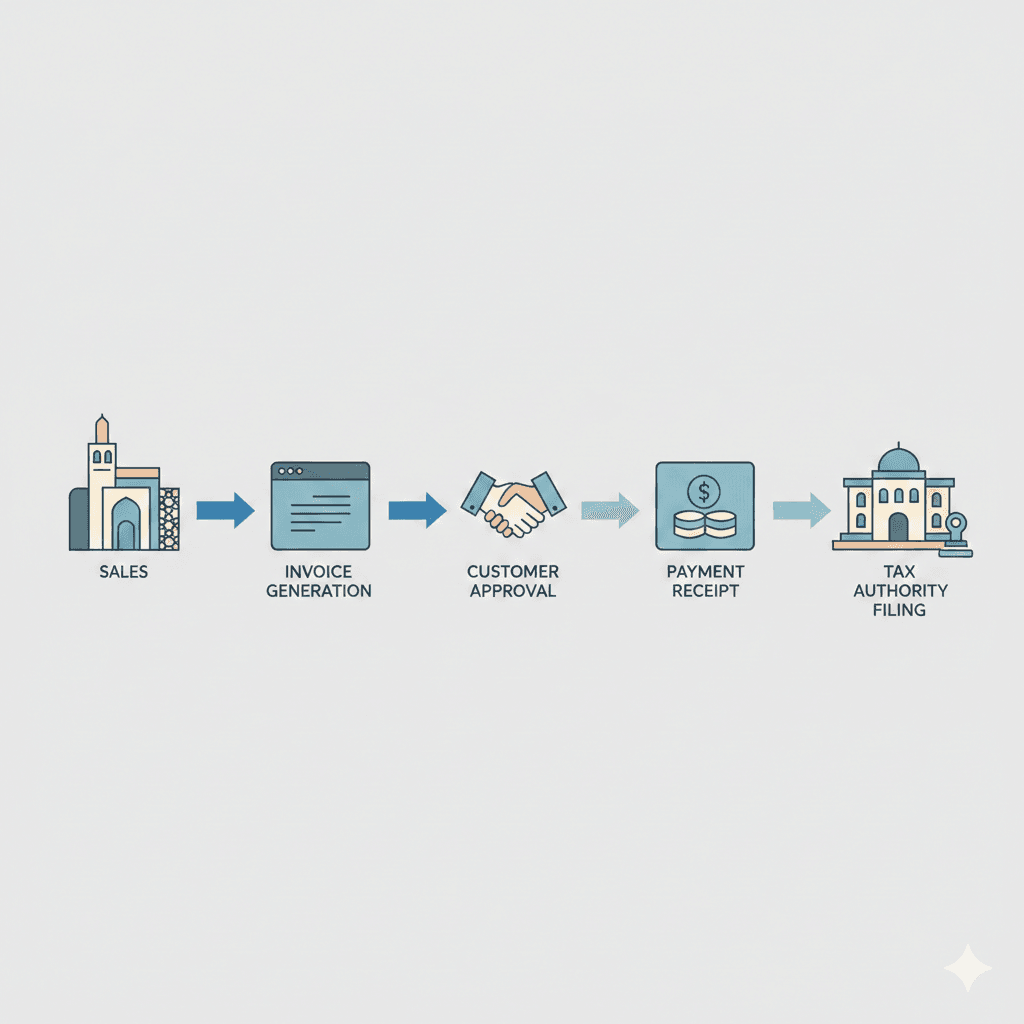

The integration of VAT processes with e-invoicing and accounting systems fundamentally changes how SMEs in Oman manage tax compliance. Since VAT’s introduction, SMEs have faced increasing pressure to ensure timely and accurate tax reporting. The e-invoicing mandate, part of Oman’s tax modernization efforts under Vision 2040, requires all taxable transactions to be invoiced electronically and securely transmitted to the Oman Tax Authority. This policy aims to eliminate invoice fraud, reduce tax evasion, and improve overall tax collection efficiency.

For SMEs, this means their accounting systems must seamlessly communicate with VAT and e-invoicing platforms. By linking these processes, SMEs achieve automated VAT calculations, real-time invoice validation, and faster submission of tax returns. This reduces administrative burdens and the risk of costly penalties resulting from manual errors or non-compliance. The integration also enhances audit readiness by creating a transparent, traceable financial record, simplifying external audits or tax inspections.

Finance managers and business owners should view this integration as an opportunity to optimize cash flow management and budgeting. Automated VAT reclaim processes enabled by e-invoicing can improve working capital by accelerating tax refunds. This level of financial clarity supports strategic decision-making, empowering SMEs to reinvest savings into business growth. Leaderly’s expertise in VAT advisory and audit services ensures SMEs can maximize these benefits while adhering strictly to Oman’s tax laws.

Driving Operational Efficiency Through Integrated Accounting Solutions

Reducing complexity and operational risks

Beyond compliance, Vision 2040 Secure Integrations Oman emphasizes the operational advantages of unifying accounting, VAT, and e-invoicing systems. Traditional disjointed financial processes often lead to duplicated work, inconsistent data, and delays in financial close cycles. By integrating these systems, SMEs experience a more cohesive workflow that reduces manual data entry, minimizes errors, and accelerates financial reporting timelines.

This operational efficiency is particularly critical for SMEs in Muscat’s competitive markets, where agility and accuracy can dictate business success. Integrated financial systems provide management with timely insights into cash flows, profit margins, and tax obligations, enabling more proactive financial governance. These insights are crucial for SMEs seeking external funding or planning expansions, as they demonstrate strong internal controls and fiscal responsibility.

Moreover, secure integrations enhance data security by limiting points of vulnerability across systems. With increasing cyber threats targeting financial data, a unified platform with robust security protocols mitigates risks of data breaches and fraud. SMEs can thus focus more on growth and innovation, confident their financial backbone is resilient. Leaderly’s advisory approach supports SMEs in designing and implementing these secure integration strategies tailored to Oman’s business environment.

Overcoming Challenges in Implementing Secure Financial Integrations

Addressing technical and regulatory hurdles

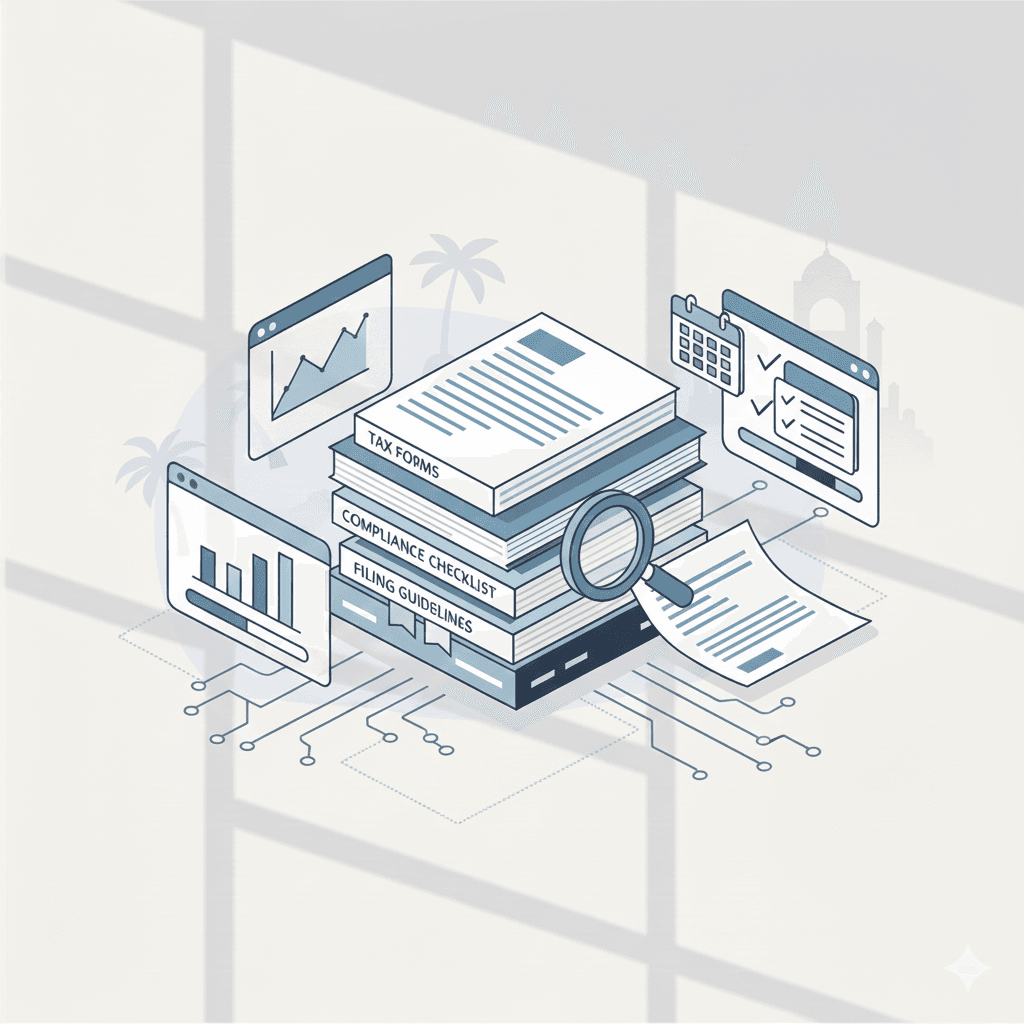

While the benefits of Vision 2040 Secure Integrations Oman are clear, SMEs face practical challenges in adopting these advanced systems. Integration requires technical expertise to ensure compatibility between accounting software, VAT modules, and e-invoicing platforms. Many SMEs, particularly smaller firms, may lack in-house IT capabilities or the resources to manage complex implementations, making professional advisory indispensable.

Additionally, navigating Oman’s evolving regulatory landscape demands continuous updates and compliance checks. VAT rates, e-invoicing standards, and reporting formats can change, requiring SMEs to adapt swiftly. Failure to do so risks penalties or operational disruptions. Leaderly’s role is vital in providing ongoing compliance advisory and feasibility assessments, ensuring SMEs remain aligned with legal requirements while benefiting from the latest technological advances.

Change management also plays a crucial role. Employees must be trained to use integrated systems effectively, and business processes may need realignment. Resistance to change or underestimating the complexity of integration can delay benefits realization. Strategic planning, coupled with expert guidance, ensures a smooth transition. For SMEs in Oman, partnering with experienced auditors and consultants bridges these gaps and transforms compliance challenges into competitive advantages.

The Role of Leaderly in Supporting Oman’s SME Digital Transformation

Bridging expertise with local insight

Leaderly stands at the forefront of Oman’s Vision 2040 financial transformation by offering SMEs tailored services that facilitate secure integration of accounting, VAT, and e-invoicing systems. Beyond compliance, Leaderly provides comprehensive advisory solutions—from feasibility studies to due diligence and valuation—that empower business owners to make informed decisions based on integrated financial data.

Leaderly’s audit and accounting services are designed to meet the specific demands of Omani SMEs, ensuring that digital integrations do not compromise financial transparency or accuracy. Their tax advisory services help SMEs optimize VAT processes, mitigating risks and uncovering savings opportunities inherent in streamlined e-invoicing systems. This practical approach aligns perfectly with Vision 2040’s aim of building a resilient, diversified SME sector supported by modern financial infrastructure.

In a market where digital adoption is accelerating, SMEs partnering with Leaderly gain a trusted ally who understands both global best practices and local market nuances. This blend of expertise ensures that Vision 2040 Secure Integrations Oman is not just a regulatory requirement but a catalyst for sustainable growth, operational excellence, and enhanced competitiveness in Oman’s evolving economy.

Future Outlook: Embedding Secure Integrations into Oman’s SME Culture

Long-term benefits beyond compliance

As Oman’s SME sector continues to evolve under Vision 2040, secure integration of accounting, VAT, and e-invoicing will become a foundational business practice rather than a regulatory burden. The growing adoption of cloud-based financial platforms and AI-driven analytics will further enhance these integrations, offering SMEs predictive insights and smarter decision-making tools tailored to Oman’s economic landscape.

This future-ready approach encourages SMEs to build stronger financial resilience, improve stakeholder confidence, and attract investment. By embedding secure financial integrations into daily operations, SMEs in Muscat and across Oman will better manage risk, optimize resources, and contribute to national economic diversification goals. Continued collaboration with advisory partners like Leaderly will be key in navigating this dynamic environment and sustaining momentum towards Vision 2040’s ambitious targets.

Ultimately, Vision 2040 Secure Integrations Oman is not only about technology adoption but also about fostering a culture of transparency, accountability, and innovation within Oman’s SME community. This cultural shift will empower SMEs to thrive amid global challenges and seize emerging opportunities, solidifying their role as pillars of Oman’s sustainable economic future.

In summary, the secure integration of accounting, VAT, and e-invoicing systems is a critical enabler for SMEs aspiring to succeed in Oman’s fast-changing business environment. With practical guidance, strategic advisory, and robust audit support from experienced partners like Leaderly, Omani SMEs can confidently embrace this transformation, unlocking new levels of efficiency, compliance, and growth.

#Leaderly #Vision2040SecureIntegrationsOman #Oman #Muscat #SMEs #Accounting #Tax #Audit