Muscat Digital Audit Transformation and the New Governance Era for Omani Enterprises

Muscat Digital Audit Transformation and the End of Traditional Recordkeeping

Oman’s business environment is undergoing a structural shift, and Muscat Digital Audit Transformation now sits at the centre of that change. Under Vision 2040, regulators are no longer interested in after-the-fact compliance supported by scattered paper records. They are building a forward-looking governance model where transactions, approvals, tax positions, and financial risks are visible, verifiable, and traceable in real time. For SMEs and mid-sized enterprises in Muscat, this shift fundamentally changes how management thinks about financial control. The finance function is no longer a reporting department; it has become an operational nerve system that connects compliance, cash flow, taxation, investor confidence, and strategic growth. What used to be a year-end scramble for documents is now a continuous audit environment. Companies that still rely on manual filing, disconnected spreadsheets, and fragmented approvals are finding themselves exposed. Delays in reporting, gaps in VAT documentation, and weak internal controls now translate directly into regulatory risk and reputational damage. Vision 2040 is effectively replacing the paper trail with a permanent digital audit trail that follows every rial from invoice to bank settlement. This is not a future concept; Muscat’s banking sector, tax authorities, and corporate registries are already aligned around this new reality.

How Muscat Digital Audit Transformation Reshapes Internal Controls and Risk Management

Building governance from the inside out

As Muscat Digital Audit Transformation matures, internal control is no longer a technical checklist prepared for auditors. It becomes the daily operating language of the business. Transaction approvals, segregation of duties, document retention, and reconciliation cycles are now embedded inside digital workflows. Every invoice, contract, payroll file, and tax submission creates an automatic evidence trail that regulators and auditors can evaluate with far greater precision than before. For SME owners, this requires a mindset shift: financial governance must be designed into operations, not added later. Weak controls are no longer hidden by time or paperwork. They are instantly visible. Cash flow leakage, VAT exposure, and compliance gaps surface early, allowing management to intervene before damage occurs. This improves decision quality as well. Management no longer relies on outdated monthly summaries; they see real-time risk indicators tied to actual transactions. Over time, this discipline strengthens business resilience, improves financing eligibility with banks, and reduces the cost and disruption of statutory audits. Firms that adapt early are discovering that stronger controls are not bureaucratic burdens; they are competitive assets in Muscat’s increasingly transparent market environment.

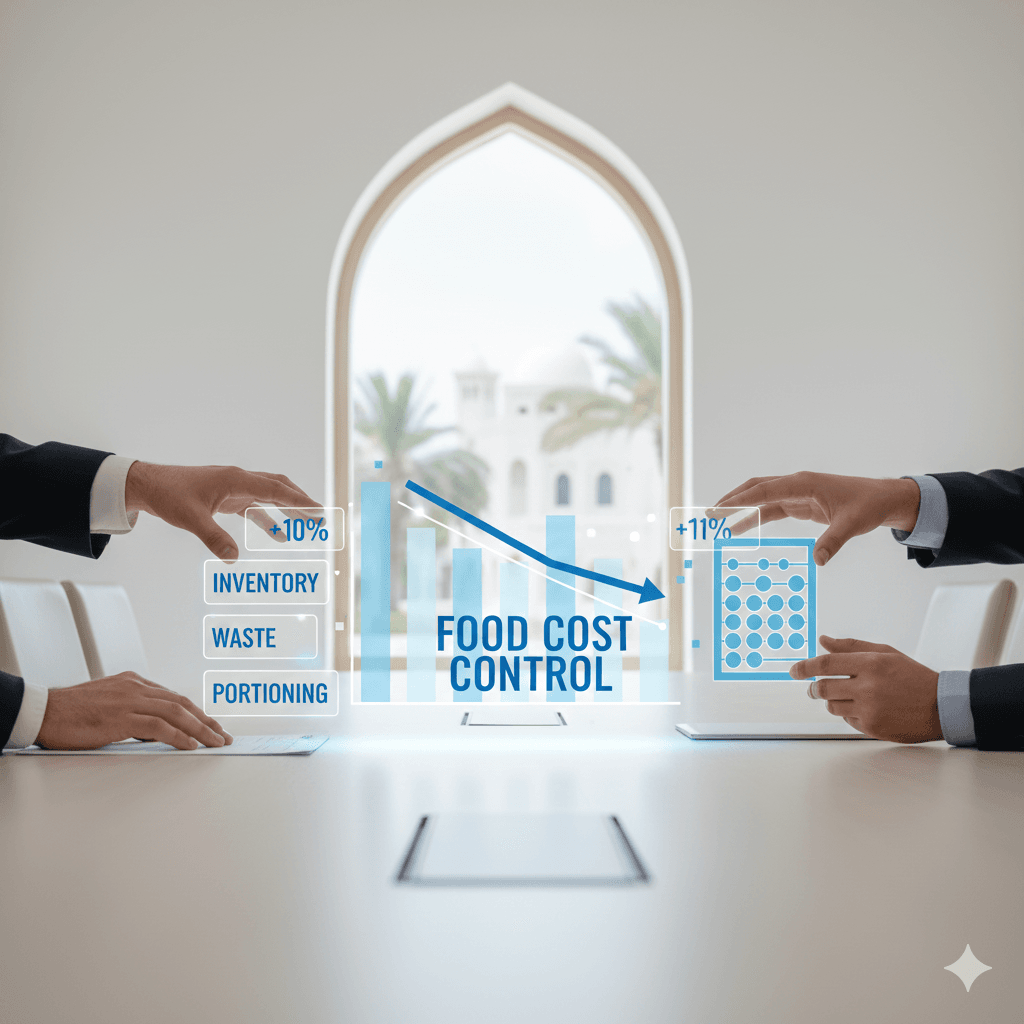

Muscat Digital Audit Transformation and the Evolution of Tax Compliance

The tax dimension of Muscat Digital Audit Transformation is one of its most powerful drivers. Oman’s VAT framework and the emerging corporate tax regime both depend on reliable, verifiable transaction data. Under the digital model, tax positions are no longer assembled manually at the end of a reporting period. They are continuously constructed from validated operational data. This significantly reduces errors, reduces disputes, and improves audit readiness. SMEs in Muscat that still rely on manual VAT tracking often struggle with inconsistencies between invoices, bank records, and filings. In contrast, firms that integrate digital audit trails create automatic tax alignment between sales, procurement, payroll, and treasury functions. This alignment does not merely satisfy regulators; it gives management far better insight into margins, cost structures, and working capital behaviour. Over time, the organisation develops a tax-aware culture where operational decisions reflect real financial consequences. This is where advisory support becomes critical. Proper system design, tax structuring, feasibility analysis, and periodic financial reviews ensure that digital transformation actually produces financial intelligence, not just compliance reports.

Muscat Digital Audit Transformation and Financial Transparency for Growth

Growth capital, banking relationships, and strategic partnerships increasingly depend on the credibility of a company’s financial information. Muscat Digital Audit Transformation enhances that credibility by making financial data more consistent, more traceable, and more defensible. Investors and lenders are no longer impressed by volume of paperwork; they look for reliability of data flows. When every transaction leaves a clean digital footprint, due diligence becomes faster, financing becomes cheaper, and negotiations become more balanced. For SMEs planning expansion, mergers, or restructuring, this transparency becomes decisive. Valuation processes rely on historical accuracy and future projections that only trustworthy systems can support. Without strong digital audit trails, even profitable companies face skepticism and valuation discounts. By contrast, firms that align with the Vision 2040 model present themselves as professionally governed, strategically managed, and institutionally ready. This is where accounting, audit, and advisory services intersect. Technical compliance must be combined with commercial understanding to translate clean data into actionable business strategy.

Muscat Digital Audit Transformation and the New Role of the Finance Leader

From bookkeeper to strategic architect

Under Muscat Digital Audit Transformation, the role of finance leadership is being redefined. The modern finance manager is no longer a record keeper; they are a systems architect, risk controller, and strategic advisor. They oversee data integrity, regulatory alignment, cash flow planning, tax optimisation, and long-term sustainability. They collaborate closely with operations, procurement, sales, and HR to ensure that every business decision is financially grounded and compliance-ready. For SME founders, this shift can be uncomfortable, but it is essential. Businesses that fail to elevate the finance function struggle with scaling, face frequent regulatory friction, and lose strategic clarity. Those that embrace it gain stronger control over performance, risk, and opportunity. Over time, finance becomes the backbone of enterprise governance rather than a reporting afterthought.

Muscat Digital Audit Transformation and the SME Transition Challenge

The transition into Muscat Digital Audit Transformation is not without challenges, especially for smaller enterprises with limited resources. Legacy systems, fragmented data, and informal processes cannot support the demands of the new regulatory ecosystem. However, incremental transformation is both possible and practical. SMEs that prioritise clean financial records, documented controls, integrated systems, and periodic professional reviews progress steadily toward full alignment with Vision 2040 expectations. The cost of inaction is rising. Regulatory penalties, financing obstacles, and operational inefficiencies accumulate quietly until they constrain growth. The businesses that thrive in Muscat’s next decade will not be the largest, but the best governed.

The shift from paper trails to digital audit trails represents more than technological change; it signals a permanent evolution in how Omani enterprises are governed. Muscat Digital Audit Transformation aligns financial integrity with strategic ambition, enabling SMEs to operate with confidence, resilience, and long-term vision.

For business owners and finance leaders, this transformation offers clarity: stronger controls, better decisions, improved access to capital, and sustainable growth. Those who invest early in proper governance, supported by professional accounting, audit, tax, and advisory expertise, position their companies not only for compliance but for leadership in Oman’s new economic era.

#Leaderly #MuscatDigitalAuditTransformation #Oman #Muscat #SMEs #Accounting #Tax #Audit