Muscat SME Governance: Streamlined Board Reporting for Practical Leadership

Understanding the Essence of Muscat SME Governance

Defining governance in the local SME context

Muscat SME Governance is about creating a practical framework for small and medium-sized enterprises in Muscat to manage oversight and decision-making without the complexity often associated with large corporations. Many SMEs in Oman struggle with governance that balances accountability and operational agility. Governance here involves setting clear reporting structures, ensuring transparency, and providing reliable financial and operational data to decision-makers. Importantly, it must be achievable without heavy bureaucracy, which can drain resources and slow responsiveness in a competitive market. Good governance in Muscat SMEs empowers owners and finance managers to make informed decisions that align with business goals and regulatory expectations, especially in Oman’s evolving economic landscape.

In Oman, regulatory compliance around VAT and Corporate Tax has raised the bar for SME governance. Muscat SMEs must now provide more detailed and accurate reporting to meet legal standards while preserving efficiency. The role of governance is no longer a luxury but a necessity for sustainable growth and investor confidence. Muscat SME Governance, therefore, aims to bridge the gap between compliance demands and operational practicality, helping SMEs implement board-ready reporting systems that are tailored, lean, and actionable. Such frameworks foster trust among stakeholders and facilitate smoother advisory engagements, including audits and due diligence assessments led by professional firms like Leaderly.

At its core, Muscat SME Governance must be accessible to entrepreneurs and finance teams who are often multitasking across roles. Governance structures need not mimic large-scale corporate bureaucracy. Instead, they should be built on straightforward principles: clear communication, timely reporting, and accountability. Emphasizing clarity over complexity, SMEs can adopt governance practices that improve strategic oversight and risk management without overwhelming their internal capacities. This approach aligns with Oman’s SME ecosystem, where agility and compliance must coexist to maintain competitiveness and unlock new growth opportunities.

Practical Approaches to Board-Ready Reporting for Muscat SMEs

Building reports that drive decisions, not just compliance

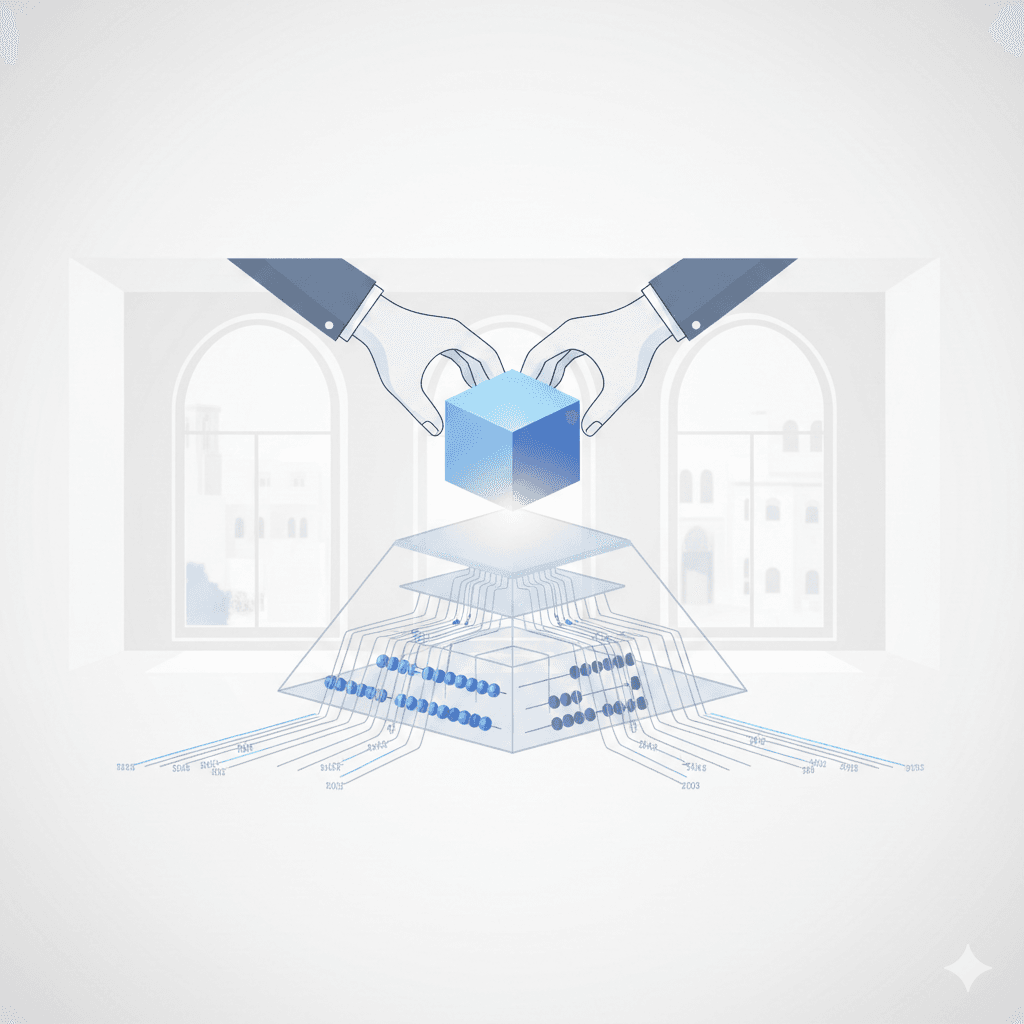

Muscat SME Governance requires developing reporting systems that are not only compliant but also meaningful to business owners and board members. Many SMEs in Muscat fall into the trap of producing voluminous reports full of raw data that confuse rather than clarify. The objective should be to create concise, insightful reports that highlight critical financial and operational metrics relevant to strategic decisions. This means focusing on cashflow trends, profitability analysis, cost controls, and compliance status—elements that provide a clear picture of business health. Such reports equip SME leaders with actionable intelligence, enabling them to steer the company confidently.

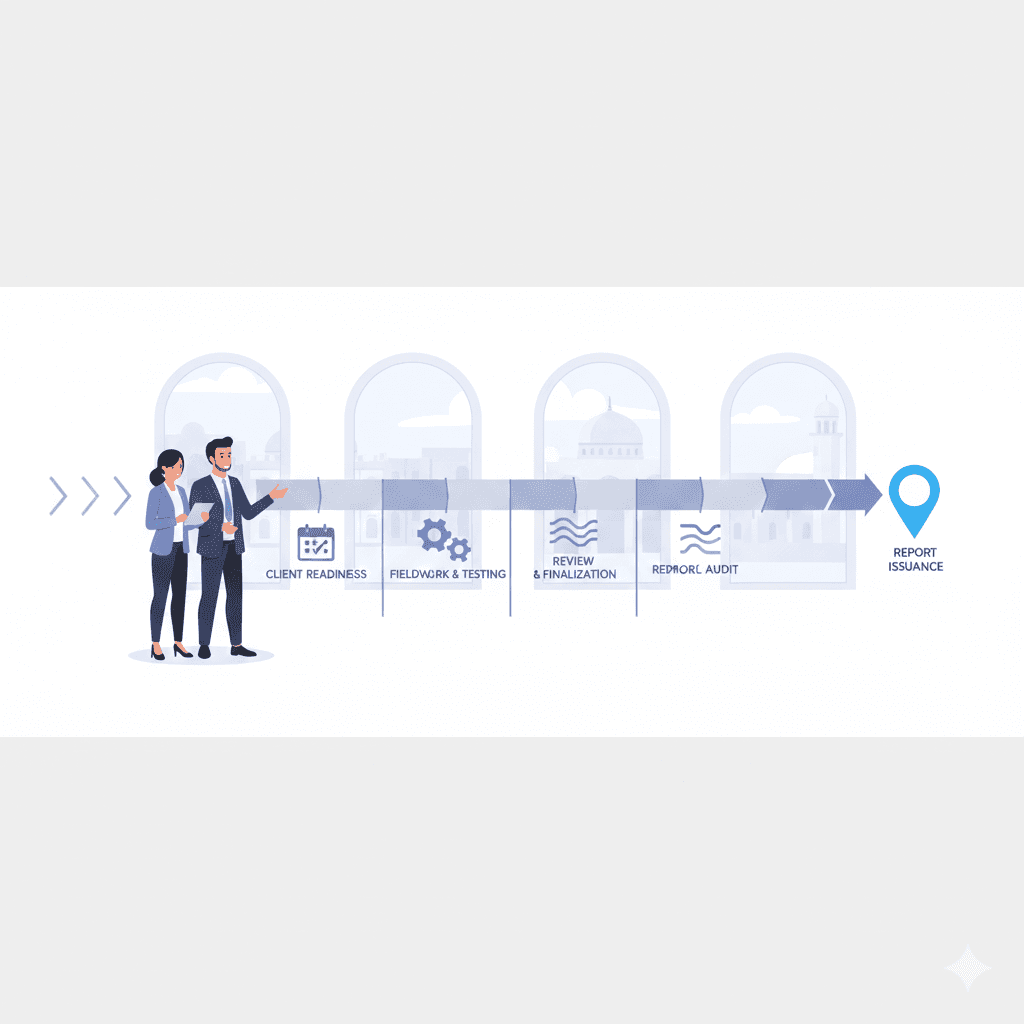

To achieve this, finance managers in Muscat SMEs can collaborate with trusted advisors to tailor report formats and frequency. Regular, standardized financial summaries combined with occasional deep-dive analyses create an ideal balance. Muscat SME Governance stresses the importance of leveraging audit and accounting expertise to ensure accuracy and regulatory alignment without burdening the internal team. Leaders in Oman’s SME community benefit greatly when advisory firms assist in structuring governance frameworks that embed reporting into routine business rhythm, rather than an annual scramble.

Technology also plays a pivotal role in simplifying board-ready reporting. Cloud-based accounting and ERP systems accessible in Oman enable real-time data updates and dashboard creation. This empowers SMEs to generate on-demand reports that reflect current financial status and VAT or tax obligations. With streamlined processes, governance becomes a living practice embedded in daily management, reducing delays and improving transparency. Such innovation aligns perfectly with Oman’s digital transformation agenda, allowing Muscat SMEs to remain both compliant and agile.

Embedding Governance into SME Culture in Muscat

From compliance to strategic value creation

Successful Muscat SME Governance transcends paperwork; it becomes part of the company culture. Embedding governance into everyday business practices means nurturing a mindset that values transparency, accountability, and continuous improvement. For business owners and entrepreneurs in Muscat, this shift can unlock more proactive risk management and operational discipline, which are essential in a market influenced by regulatory reforms and competitive pressures. When governance is seen as an enabler of strategic value, rather than a burden, SMEs position themselves for sustainable growth and investor confidence.

Leadership buy-in is critical in this cultural embedding. SME founders and board members must champion governance efforts and demonstrate commitment through consistent engagement with reporting and decision-making processes. Muscat SME Governance frameworks benefit from clear delegation of responsibilities to finance managers and internal teams, supported by ongoing training and advisory partnerships. Leaderly’s role in Oman’s SME ecosystem is often to provide this guidance, ensuring governance initiatives remain practical, relevant, and forward-looking without overwhelming SMEs’ limited resources.

Moreover, governance culture fosters better stakeholder relations in Muscat’s business environment, including banks, regulators, and potential investors. Transparent and timely board-ready reporting signals reliability and professionalism, which can ease financing negotiations and compliance audits. As Oman continues diversifying its economy, SMEs with strong governance frameworks will be better equipped to seize new opportunities, manage risks, and scale effectively. Governance thus becomes a strategic asset, not just a regulatory checkbox.

Optimizing Reporting Efficiency for Muscat SME Boards

Balancing detail and clarity in board communications

Muscat SME Governance requires an efficient approach to board communication that respects the time and expertise of SME leaders. Boards typically comprise busy entrepreneurs and external advisors who need high-impact information presented clearly and concisely. Overloading reports with excessive details or jargon can reduce their usefulness and slow decision-making. Instead, focus on key performance indicators, compliance summaries, and risk areas that matter most to Muscat SMEs operating under Oman’s legal frameworks. This targeted reporting helps boards provide timely guidance and oversight without drowning in data.

Adopting standardized templates aligned with Oman’s financial regulations and tax requirements also boosts reporting efficiency. Such templates ensure consistency across reporting periods and make it easier to spot trends and anomalies. Finance managers should work closely with auditors and advisors to refine these tools, ensuring they capture essential data without unnecessary complexity. This collaboration, a hallmark of Leaderly’s advisory services, helps Muscat SMEs maintain accuracy and regulatory compliance while avoiding bureaucratic overload.

Periodic reviews of governance and reporting processes are equally important. Muscat SMEs must remain flexible, adapting reporting frameworks to evolving regulatory requirements, business growth, or changes in ownership. Streamlined governance allows SMEs to respond quickly to challenges and opportunities, enhancing resilience. Ultimately, efficient board-ready reporting becomes a strategic enabler, improving transparency and decision quality, and reinforcing confidence among all stakeholders in Oman’s vibrant SME sector.

Leveraging Advisory Support for Governance Success in Muscat SMEs

Partnering for compliance and strategic insights

Muscat SME Governance benefits significantly from professional advisory support, which helps SMEs navigate Oman’s regulatory landscape and optimize reporting frameworks. Advisory firms like Leaderly provide tailored assistance in audit, tax compliance, valuation, and due diligence, helping SMEs implement governance practices that align with both legal obligations and business objectives. This partnership relieves internal teams of technical burdens and introduces expertise that ensures accuracy and relevance in board-ready reporting. Importantly, it allows SME leaders to focus on strategy and growth with confidence in their governance infrastructure.

Taxation and audit advisory form critical pillars in governance. With Oman’s recent Corporate Tax introduction and VAT regulations, SMEs must stay abreast of compliance complexities. Expert guidance ensures that governance processes integrate these obligations seamlessly, avoiding costly penalties and disruptions. Additionally, advisory services support governance by facilitating risk assessments and feasibility studies that enhance board decision-making. Such comprehensive support is particularly valuable for SMEs in Muscat, where the business environment is competitive and regulation is evolving.

By embedding advisory insights into governance, Muscat SMEs can elevate their financial health and operational transparency. This not only fosters stakeholder trust but also positions businesses for investment and expansion. Advisory partnerships underscore that governance is a dynamic, collaborative process rather than a static requirement. For SMEs aiming to thrive in Oman’s transforming economy, leveraging expert advisory services represents a practical and strategic approach to robust governance and sustainable success.

Muscat SME Governance is an essential, practical framework that empowers SMEs to manage oversight and reporting without cumbersome bureaucracy. By focusing on clear, actionable board-ready reports, embedding governance into company culture, optimizing communication, and leveraging expert advisory, Muscat SMEs can align compliance with operational agility. This balanced approach supports informed decision-making, builds stakeholder trust, and positions businesses for resilient growth within Oman’s evolving regulatory landscape. Ultimately, good governance is not a burden but a vital enabler of sustainable SME success in Muscat.

For business owners, finance managers, and entrepreneurs in Muscat, adopting governance practices that prioritize clarity, efficiency, and strategic insight is key to navigating the complexities of modern business. With the right frameworks and support, SMEs can transform governance from a compliance obligation into a competitive advantage. Leaderly’s expertise in audit, taxation, and advisory ensures that these governance frameworks remain practical, Oman-relevant, and aligned with the ambitions of SMEs seeking long-term growth and stability in the Sultanate’s dynamic market.

#Leaderly #MuscatSMEGovernance #Oman #Muscat #SMEs #Accounting #Tax #Audit