Qurum Al Khuwair Expense Governance for Sustainable Client Operations in Muscat

Understanding Qurum Al Khuwair Expense Governance in Muscat’s Client Economy

Qurum Al Khuwair Expense Governance sits at the center of how modern Muscat businesses manage the delicate balance between client service quality and financial control. For firms operating between Qurum’s premium commercial environment and Al Khuwair’s dense professional clusters, expense discipline is no longer a back-office exercise; it directly shapes competitiveness, reputation, and profitability. Client-facing teams today incur diverse costs including travel, hospitality, marketing activations, digital subscriptions, commissions, and partner engagements. Without a structured approach, these costs quietly erode margins. In Oman’s evolving regulatory climate, where VAT compliance, corporate tax planning, and audit readiness are increasingly interconnected, expense behavior has become a strategic management issue. Leaders in Muscat are discovering that strong expense governance allows them to scale sales operations confidently while maintaining clean financial records and predictable cash flow. Unlike rigid cost-cutting, effective governance builds clarity: who can spend, how much, under what conditions, and how each rial spent links to business outcomes. This clarity empowers sales managers, account executives, and business development teams to operate proactively, knowing boundaries are fair, transparent, and aligned with company strategy.

Why Client-Facing Expenses Behave Differently in Qurum and Al Khuwair

Although separated by only a few kilometers, Qurum and Al Khuwair generate very different expense patterns. Qurum’s hospitality-driven business culture encourages premium client meetings, networking events, and relationship building, all of which carry higher discretionary costs. Al Khuwair, by contrast, supports dense corporate operations, service firms, and regulatory institutions, creating frequent travel, documentation, and administrative expenses. Qurum Al Khuwair Expense Governance therefore cannot rely on a single generic policy. It must recognize that client acquisition in Qurum may justify different spending thresholds than client servicing in Al Khuwair. The challenge for SME owners is ensuring consistency without suffocating flexibility. Successful firms design expense frameworks that classify spending categories, set approval hierarchies, and define acceptable ranges while allowing department heads to respond to real market conditions. This approach reduces conflict between finance teams and client teams, because everyone understands the economic logic behind each decision. Over time, this shared understanding builds internal trust, operational speed, and financial resilience.

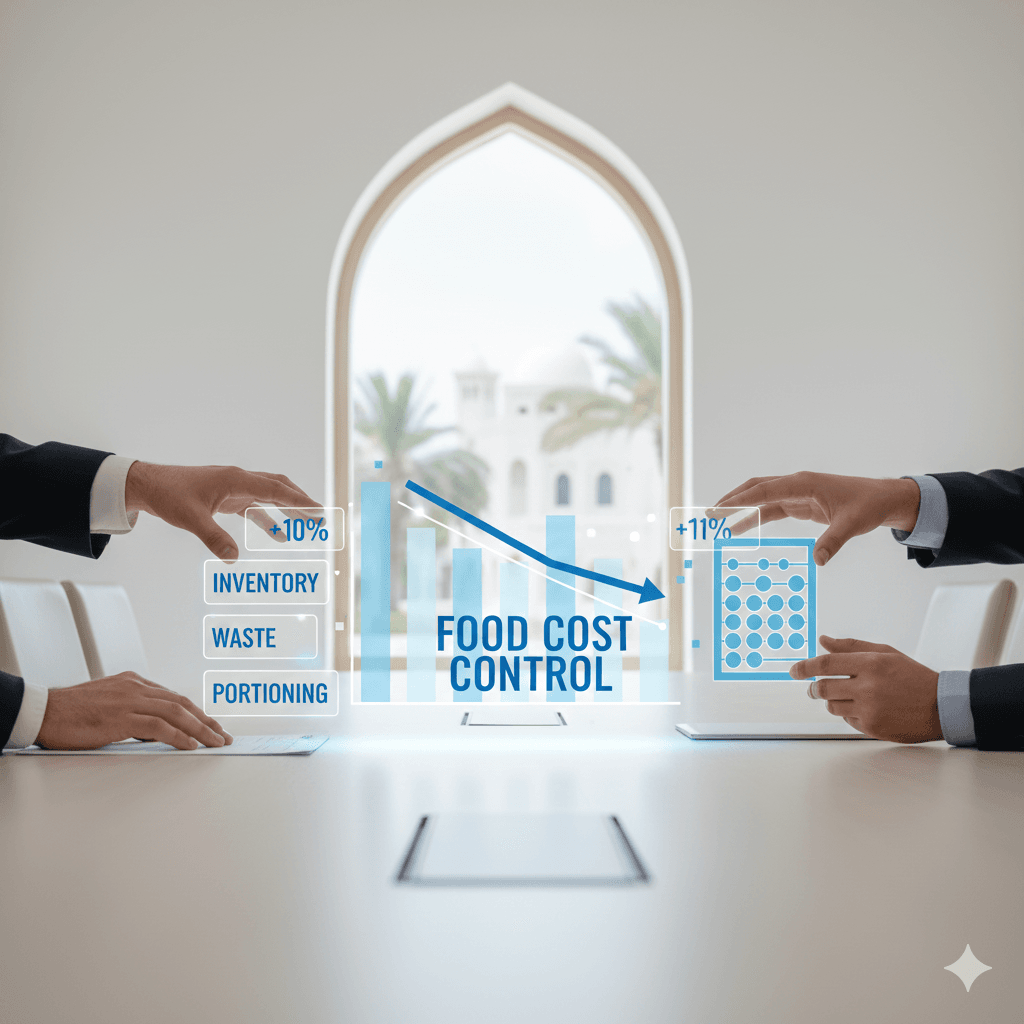

Linking Expense Discipline to Revenue Predictability and Cash Health

Many Muscat entrepreneurs focus on revenue growth but overlook the stabilizing power of disciplined expenses. Qurum Al Khuwair Expense Governance provides the missing link between sales ambition and financial sustainability. When client-facing costs are mapped against actual revenue conversion rates, managers can see which activities deliver measurable returns and which simply create financial noise. This insight supports smarter budgeting cycles, more accurate forecasting, and better cash management. For SMEs facing payment delays, project volatility, and fluctuating working capital, expense predictability becomes a survival tool. Structured expense controls allow companies to plan VAT liabilities, allocate reserves for corporate tax, and remain prepared for audit reviews. Importantly, disciplined expense behavior signals financial maturity to banks, investors, and strategic partners, strengthening access to financing and partnership opportunities. In Muscat’s competitive SME landscape, this credibility can be the difference between stagnation and sustained growth.

Designing Practical Expense Frameworks for Client Teams

Building effective Qurum Al Khuwair Expense Governance begins with simple, practical frameworks rather than complex manuals. Business owners should start by categorizing client-facing expenses into core groups such as acquisition, servicing, retention, and expansion. Each category requires its own spending philosophy and performance benchmarks. For example, acquisition expenses may tolerate higher short-term costs, while servicing expenses should emphasize efficiency and retention value. Clear policies must define who approves what level of spending, how reimbursements are processed, and which documents are required for compliance. In Oman’s regulatory context, these records later support VAT filings, audit evidence, and tax calculations. The framework should be communicated openly to client teams so expectations remain consistent. When employees understand that expense discipline protects long-term job security and company stability, resistance declines and cooperation improves.

Using Technology to Reinforce Expense Accountability

Modern expense governance relies heavily on digital systems that provide transparency without bureaucracy. Qurum Al Khuwair Expense Governance becomes significantly more effective when SMEs adopt expense tracking platforms, digital approvals, and automated reporting. These tools allow finance managers to monitor patterns in real time and intervene early when deviations appear. For client teams, mobile expense capture reduces administrative frustration and shortens reimbursement cycles, improving morale and productivity. For leadership, consolidated dashboards support data-driven decisions rather than assumptions. Over time, these systems generate valuable insights for advisory reviews, feasibility planning, and even valuation exercises when companies prepare for expansion or restructuring. In Muscat’s increasingly digital business ecosystem, technology-supported expense governance is becoming the operational standard rather than an optional upgrade.

Cultural Leadership and the Psychology of Expense Behavior

Policies and software alone do not guarantee expense discipline. Qurum Al Khuwair Expense Governance ultimately depends on leadership culture. When senior management models responsible spending, transparency, and accountability, client teams naturally follow. Conversely, inconsistent behavior at the top quickly undermines any policy. Leaders should treat expense discussions as strategic conversations rather than policing exercises. Regular reviews, feedback sessions, and performance linkages reinforce that expense management is part of professional excellence. Over time, employees begin to associate financial discipline with career growth, performance recognition, and organizational pride. This cultural alignment becomes a powerful competitive advantage in Muscat’s relationship-driven business environment.

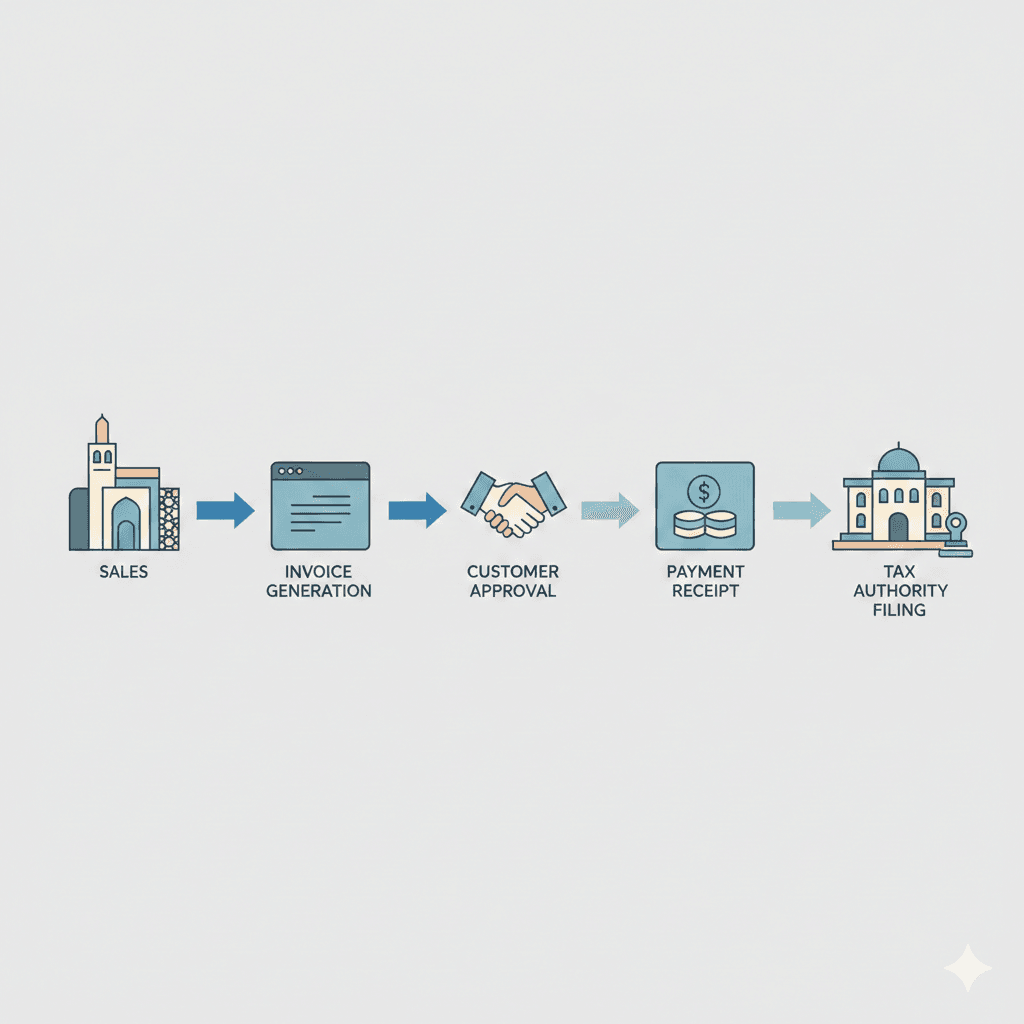

Aligning Expense Governance with Compliance and Risk Management

As Oman strengthens regulatory oversight, Qurum Al Khuwair Expense Governance now intersects directly with compliance risk. Poor documentation, unclear expense classifications, and inconsistent approvals expose SMEs to audit complications, tax disputes, and reputational damage. Well-governed expense systems create clean audit trails, accurate VAT calculations, and defensible financial statements. This discipline also supports corporate restructuring, due diligence processes, and potential liquidation scenarios when necessary. For business owners, knowing that their financial house is in order reduces stress and allows them to focus on growth, innovation, and client relationships rather than reactive problem-solving.

Expense Governance as a Growth Enabler, Not a Constraint

One of the most misunderstood aspects of Qurum Al Khuwair Expense Governance is the belief that it restricts growth. In reality, structured discipline accelerates growth by removing uncertainty. When client teams know their spending boundaries, they negotiate with confidence and plan activities more strategically. Finance managers gain visibility, enabling proactive cash management and smarter investment decisions. Entrepreneurs can scale operations, enter new markets, and pursue partnerships with a clear understanding of cost behavior and profitability thresholds. In Muscat’s dynamic commercial environment, this clarity transforms expense management from a reactive function into a proactive growth engine.

Long-Term Impact on Business Valuation and Strategic Options

Over time, consistent expense governance strengthens every financial metric that influences company valuation. Investors and partners look for predictable margins, transparent reporting, and disciplined management. Qurum Al Khuwair Expense Governance supports these expectations by stabilizing earnings, reducing financial volatility, and improving forecasting reliability. When businesses later pursue mergers, external investment, or strategic restructuring, this financial maturity significantly enhances negotiating power. Even in challenging scenarios, such as business exits or liquidation processes, strong expense records simplify execution and protect stakeholder interests.

The experience of Muscat’s most resilient SMEs demonstrates that disciplined expense governance is not merely an accounting exercise but a strategic leadership tool. Qurum Al Khuwair Expense Governance integrates financial control with human behavior, regulatory compliance, and long-term business planning. It empowers client-facing teams to perform at high levels without jeopardizing financial stability, while giving leadership the confidence to pursue expansion with measured risk.

For business owners, entrepreneurs, and finance managers across Oman, mastering expense discipline offers a durable foundation for sustainable growth. As competition intensifies and regulatory complexity increases, firms that embrace structured governance will navigate uncertainty with greater control and clarity. In the evolving commercial corridors of Qurum and Al Khuwair, the organizations that thrive will be those that understand expense governance not as restriction, but as the architecture of lasting success.

#Leaderly #QurumAlKhuwairExpenseGovernance #Oman #Muscat #SMEs #Accounting #Tax #Audit