Muscat SME Tax Planning Strategy for Sustainable Growth and Compliance in Oman

Muscat SME Tax Planning Strategy as a Business Leadership Tool

Muscat SME Tax Planning Strategy is no longer a back-office technical function; it is a leadership responsibility that directly affects business stability, investor confidence, and long-term growth in Oman. Many SME owners in Muscat still approach tax as an annual event driven by deadlines rather than as a continuous management process. This mindset often results in avoidable penalties, inefficient cash flow, and missed opportunities to structure operations more effectively within Omani regulations. A well-designed Muscat SME Tax Planning Strategy begins with understanding how corporate tax, VAT, and regulatory reporting interact with everyday business decisions such as pricing, supplier selection, expansion timing, and financing. When tax is integrated into operational planning, owners gain visibility over future liabilities and can make informed decisions that protect liquidity while maintaining full compliance. This approach also allows management teams to anticipate regulatory changes, rather than reacting under pressure. In the Omani market, where enforcement and documentation standards are rising steadily, proactive planning has become a competitive necessity rather than a technical luxury.

Muscat SME Tax Planning Strategy and Corporate Tax Readiness

Muscat SME Tax Planning Strategy becomes particularly critical with Oman’s corporate tax framework now firmly embedded in daily business operations. Many SMEs underestimate the depth of preparation required to comply properly. Corporate tax is not just about calculating a final figure at year-end; it depends heavily on how revenues, expenses, asset purchases, intercompany transactions, and financing structures are recorded throughout the year. An effective strategy aligns accounting records with tax treatment from the moment transactions occur. This reduces reconciliation risks, avoids aggressive adjustments during audits, and ensures that taxable profit reflects the economic reality of the business. For Muscat-based entrepreneurs, corporate tax readiness also improves relationships with banks and investors, who increasingly demand clean financial statements supported by credible tax positions. When financial reporting and tax planning work together, SMEs gain stronger credibility and better access to financing. This integrated approach also simplifies compliance during audits, reducing management distraction and freeing leadership to focus on growth.

Building Muscat SME Tax Planning Strategy Into Daily Operations

Muscat SME Tax Planning Strategy only becomes effective when it is embedded into everyday decision-making. This means management must consider tax impact alongside operational and commercial factors whenever major choices are made. For example, structuring supplier contracts, selecting depreciation methods for equipment, determining employee benefit packages, or deciding whether to lease or purchase assets all carry tax implications. When these decisions are evaluated through a tax-aware lens, SMEs can legitimately reduce tax exposure while remaining fully compliant with Omani law. This does not require aggressive tactics or artificial structures; it requires disciplined financial management and accurate documentation. Clear accounting policies, consistent recordkeeping, and early consultation with qualified advisors ensure that the company’s tax position remains defensible and efficient. Over time, this approach strengthens internal controls, simplifies audits, and builds management confidence. In Muscat’s increasingly regulated business environment, SMEs that adopt this operational integration gain long-term resilience and strategic clarity.

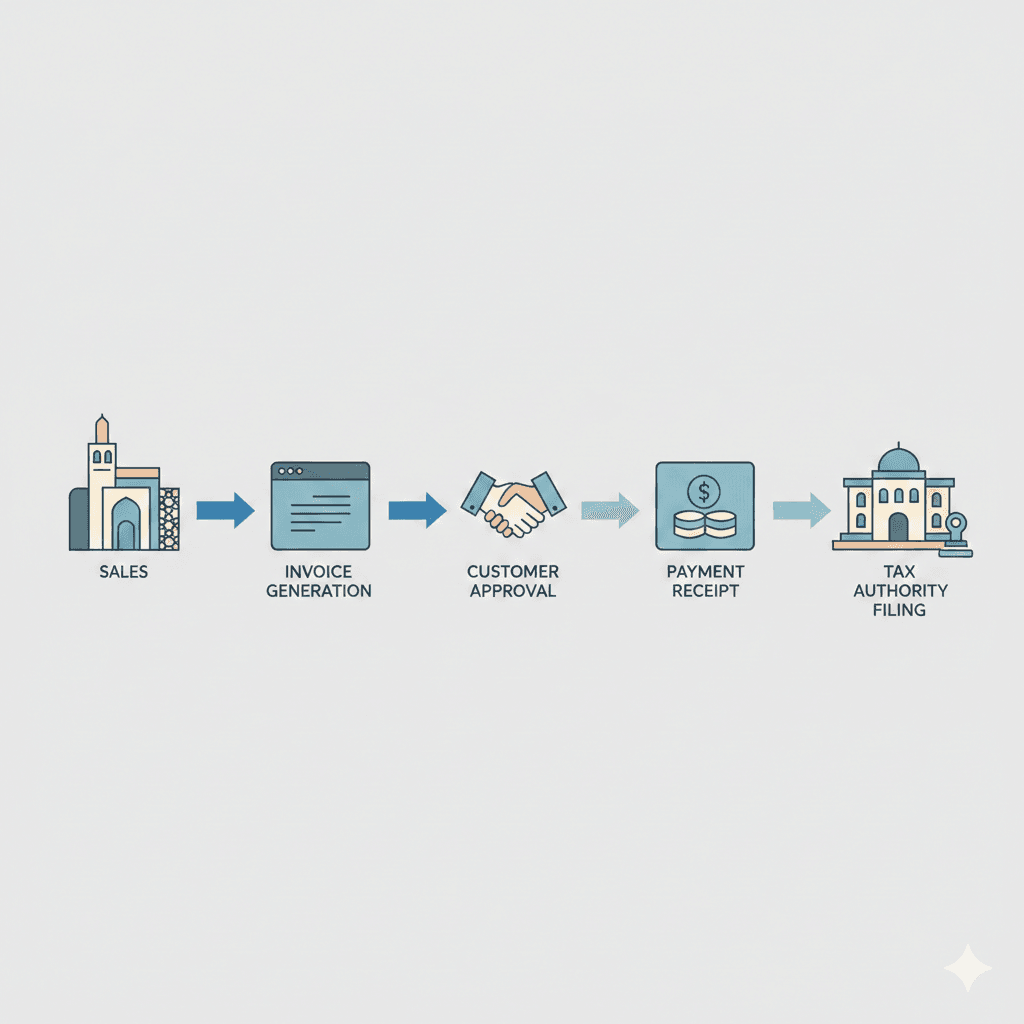

Muscat SME Tax Planning Strategy in the Context of VAT Management

Muscat SME Tax Planning Strategy must treat VAT as a continuous operational process rather than a periodic filing obligation. VAT affects cash flow, pricing structures, supplier relationships, and working capital management on a daily basis. Many Muscat SMEs experience liquidity stress not because VAT rates are high, but because they fail to forecast VAT movements accurately. Proper planning ensures that input VAT is captured systematically, output VAT is priced correctly into sales, and refund or payment cycles are anticipated well in advance. This allows management to avoid sudden cash shortages and maintain predictable financial planning. Moreover, accurate VAT treatment protects the business during audits, as authorities increasingly rely on transaction-level reviews rather than summary figures. When VAT controls are strong, SMEs reduce compliance risk while improving financial transparency. A well-managed VAT component within the overall Muscat SME Tax Planning Strategy directly supports business stability and investor confidence.

Risk Management Through Muscat SME Tax Planning Strategy

Muscat SME Tax Planning Strategy plays a critical role in managing regulatory and financial risk for growing businesses. In Oman’s current regulatory climate, tax authorities expect not only compliance but also consistency between accounting records, tax filings, and business substance. Discrepancies trigger audits, penalties, and reputational damage that can disrupt operations and strain management resources. By maintaining robust documentation, clear transaction trails, and defensible tax positions, SMEs significantly reduce these risks. Proper risk management also involves periodic internal reviews, early detection of potential exposure, and corrective action before issues escalate. Businesses that treat tax planning as part of enterprise risk management develop stronger governance structures and improve overall organizational discipline. This disciplined approach is increasingly valued by investors, lenders, and strategic partners. Over time, risk-aware SMEs in Muscat enjoy smoother audits, stronger market credibility, and greater strategic flexibility.

Long-Term Growth Supported by Muscat SME Tax Planning Strategy

Muscat SME Tax Planning Strategy ultimately supports long-term growth by creating financial predictability and strategic freedom. When tax obligations are clearly forecasted and efficiently managed, owners gain greater control over capital allocation, expansion timing, and investment planning. This clarity allows businesses to evaluate new projects, acquisitions, or restructuring options with confidence, knowing that tax consequences are already incorporated into financial projections. Strategic tax planning also plays a crucial role in business valuation, due diligence processes, and potential exit planning. Buyers and investors assess not only current profits but also the sustainability and credibility of tax positions. SMEs that demonstrate disciplined tax management command stronger valuations and smoother transaction processes. In Muscat’s evolving commercial landscape, this strategic advantage separates businesses that merely survive from those that scale responsibly and attract long-term partners.

As Omani SMEs continue to mature within a more structured regulatory environment, Muscat SME Tax Planning Strategy has become a core element of sound business leadership. By integrating corporate tax, VAT, accounting, and advisory perspectives into a unified management approach, entrepreneurs gain the financial clarity needed to navigate uncertainty with confidence. This strategic alignment strengthens internal controls, improves compliance outcomes, and enhances the quality of financial decision-making. Rather than viewing tax as a cost to be minimized reactively, forward-thinking businesses treat it as a management discipline that protects capital, stabilizes operations, and builds long-term credibility within the market.

For business owners in Muscat, the practical value of disciplined tax planning is measured not only in reduced risk and cleaner audits, but in stronger growth potential and greater strategic freedom. When financial records are reliable, tax positions are defensible, and advisory input is timely, management can focus on expansion, innovation, and value creation. In this environment, SMEs that adopt a structured Muscat SME Tax Planning Strategy position themselves as resilient, trustworthy, and investment-ready organizations capable of thriving in Oman’s next phase of economic development.

#Leaderly #MuscatSMETaxPlanningStrategy #Oman #Muscat #SMEs #Accounting #Tax #Audit