Seeb Finance Setup: Essential Strategies for Entrepreneurs in Muscat’s Expanding Business Hub

Understanding Seeb’s Strategic Importance in Oman’s Economic Landscape

The Gateway for Growing SMEs in Muscat

Seeb finance setup is crucial for new entrepreneurs launching SMEs in one of Muscat’s fastest-growing economic zones. Its strategic location near the international airport and major highways ensures seamless logistics and connectivity, making it a prime area for business operations in Oman. Entrepreneurs establishing finance functions in Seeb must grasp the zone’s unique economic environment. The area hosts a diverse range of industries—from light manufacturing and warehousing to professional services and retail—each demanding customized financial management approaches. This variety calls for finance setups tailored to specific cash flow patterns, cost structures, and regulatory requirements. Additionally, the government’s emphasis on infrastructure development and SME support in Seeb brings both opportunities and compliance challenges that founders must carefully manage. Therefore, an effective Seeb finance setup must reflect local market conditions while aligning with broader economic growth trends across Muscat.

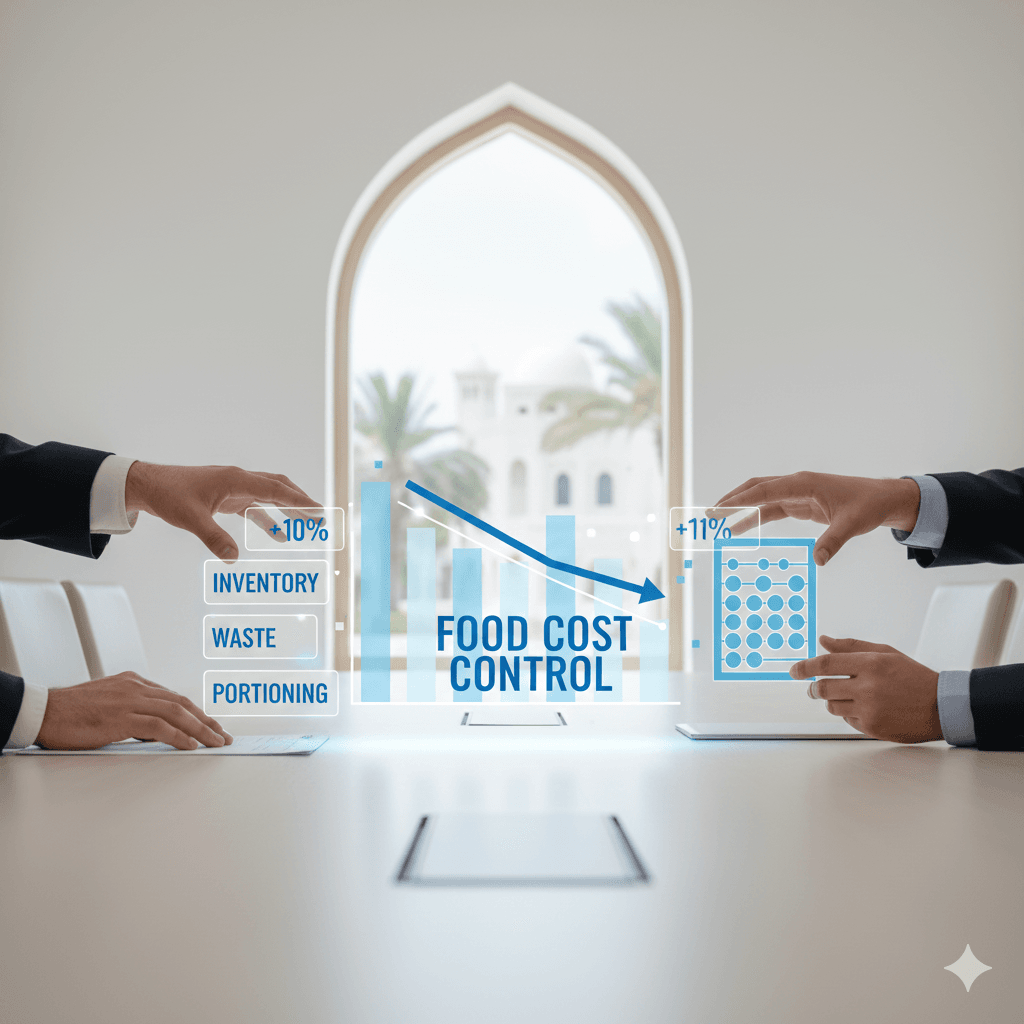

The Role of Finance Setup in Enabling Sustainable Business Growth

Building Robust Financial Foundations from Day One Setting up finance operations correctly from the outset is a fundamental step for any entrepreneur in Seeb aiming to scale sustainably. The finance setup encompasses not only accounting systems but also budgeting, cash flow management, taxation compliance, and internal controls—all tailored to the specific realities of Oman’s business environment. A common pitfall for new SMEs in Muscat’s growth corridor is underestimating the complexity of VAT regulations and corporate tax implications, which can disrupt cash flow if not properly managed. Implementing sound finance policies early ensures accurate tracking of revenues and expenses, enabling entrepreneurs to make informed decisions. It also prepares SMEs for external audits or due diligence processes, which are increasingly prevalent as businesses seek investment or partnership opportunities. Leaderly’s advisory services highlight that a customized, compliant finance framework is indispensable for entrepreneurs to avoid costly errors and maintain healthy working capital in Seeb’s competitive marketplace.

Practical Steps for Entrepreneurs to Establish Finance Functions in Seeb

From Systems to Staff: A Pragmatic Approach For entrepreneurs in Seeb, practical finance setup begins with selecting appropriate accounting software that complies with Oman’s VAT requirements and supports multi-currency transactions if dealing internationally. Beyond technology, SMEs need to establish clear internal financial controls to prevent mismanagement or fraud, especially when cash transactions are frequent. Hiring or contracting finance professionals familiar with local tax laws and reporting standards is essential to navigate Oman’s evolving regulatory landscape efficiently. Entrepreneurs should also develop financial policies covering invoicing, payment terms, and expense approvals tailored to their operational model. Leaderly’s expertise stresses the importance of integrating finance setup with business planning, ensuring that budgeting, forecasting, and performance monitoring become routine practices. These steps help SMEs in Seeb stay agile and financially disciplined, positioning them well to leverage growth opportunities within Muscat’s expanding commercial ecosystem.

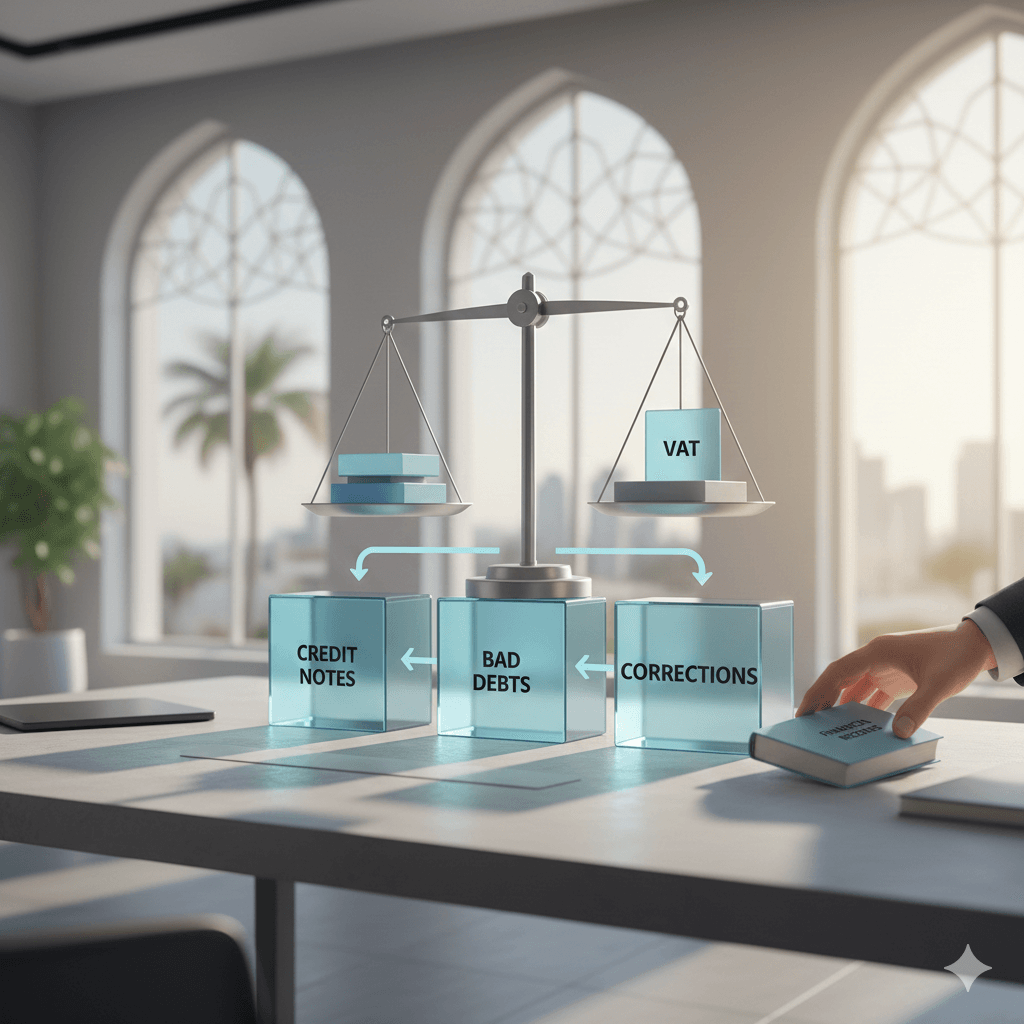

Aligning Finance Setup with Oman’s Taxation Landscape in Seeb

Ensuring Compliance and Optimizing Tax Efficiency

Oman’s introduction of VAT and the recent implementation of corporate tax frameworks have created new challenges and opportunities for SMEs in Seeb. Proper finance setup must integrate comprehensive tax planning and compliance measures to avoid penalties and maximize financial efficiency. This involves systematic recording of all taxable supplies and purchases, timely VAT filings, and maintaining detailed documentation to withstand regulatory scrutiny. Entrepreneurs must be aware of the nuances such as zero-rated supplies, exemptions, and input tax recovery rules that apply to their specific industries in Seeb. Corporate tax considerations, including registration thresholds and permissible deductions, also require attention from the earliest stages of finance setup. Leaderly’s tax advisory services help new businesses in Seeb interpret these regulations pragmatically, ensuring that finance functions are not just compliant but also strategically aligned with the company’s growth objectives in Oman’s shifting tax landscape.

The Value of Financial Advisory for New Entrepreneurs in Seeb

Beyond Numbers: Strategic Guidance for Business Success Establishing a robust finance function is not solely about bookkeeping but about gaining insights that drive business performance. Entrepreneurs in Seeb benefit significantly from advisory support that combines financial expertise with local market knowledge. Leaderly’s advisory approach focuses on feasibility assessments, cash flow optimization, and risk mitigation strategies tailored to Seeb’s entrepreneurial environment. This helps new ventures avoid common pitfalls such as undercapitalization, inefficient cost structures, and unpreparedness for audit or valuation processes. Financial advisory also plays a key role during key business milestones like expansion, restructuring, or exit planning, all of which demand sound financial foundations. By integrating advisory services with core finance setup, entrepreneurs can build resilience and agility in their businesses, positioning themselves for long-term success amid Muscat’s evolving economic corridor.

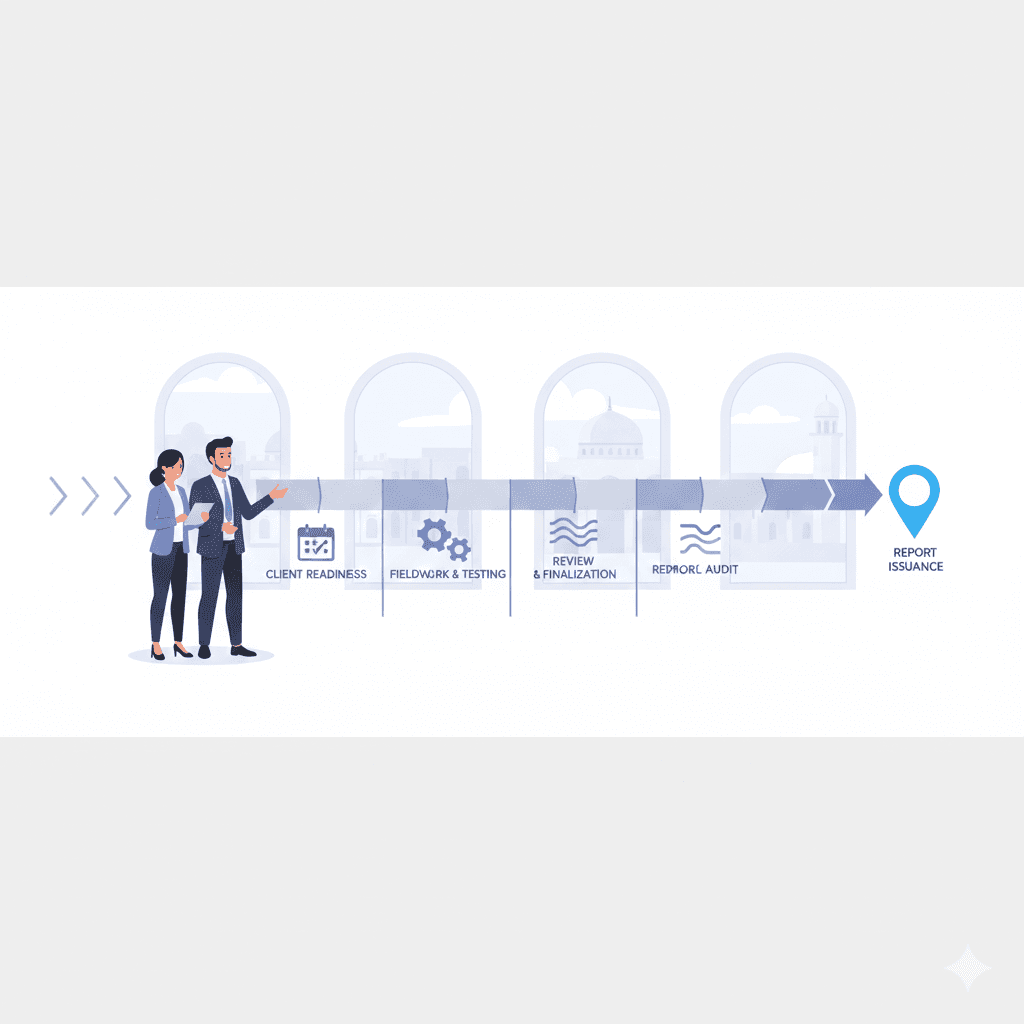

Integrating Financial Controls and Audit Readiness in the Seeb SME Setup

Establishing Transparency and Accountability from the Start In a growth corridor like Seeb, where SMEs face increasing scrutiny from investors, partners, and regulators, embedding strong financial controls and audit readiness is critical. Finance setup should include policies that govern transaction approvals, segregation of duties, and reconciliation processes to minimize errors and potential fraud. Preparing for periodic audits—whether internal or statutory—requires maintaining well-organized financial records and a culture of compliance. Leaderly’s audit and accounting services emphasize proactive readiness, enabling SMEs to meet regulatory requirements without disruption. This not only safeguards business integrity but also enhances credibility with banks and stakeholders. For entrepreneurs in Seeb, investing early in these controls creates a solid financial backbone that supports transparency and builds trust in a competitive market.

Seeb finance setup represents more than just an administrative necessity; it is a strategic enabler for entrepreneurs navigating Muscat’s vibrant growth corridor. By understanding Seeb’s unique economic conditions, aligning finance operations with Oman’s tax frameworks, and embedding strong financial controls, new SMEs can build sustainable, compliant, and agile businesses. This approach minimizes risks and maximizes opportunities, ultimately empowering entrepreneurs to thrive in a dynamic commercial environment.

For business owners and founders, the right finance setup lays the foundation for confident decision-making and scalable growth. When combined with expert advisory and audit readiness, it transforms financial management from a reactive task into a proactive business asset. As Muscat’s Seeb district continues to develop as a commercial hub, those entrepreneurs who invest thoughtfully in their finance infrastructure will be best positioned to lead Oman’s SME sector forward with resilience and clarity.

#Leaderly #SeebFinanceSetup #Oman #Muscat #SMEs #Accounting #Tax #Audit