Cash vs. Accrual in Muscat: Choosing the Right Accounting Basis for Your SME

Understanding Cash vs. Accrual Accounting in Muscat

A foundational choice for SME financial management

Cash vs. Accrual in Muscat is a fundamental choice that every SME and business owner must carefully consider in the city’s dynamic business environment. The cash basis accounting method records transactions only when cash physically changes hands—income is recognized when received, and expenses when paid—offering simplicity and clear visibility of cash flow, which appeals to many smaller enterprises. In contrast, the accrual basis recognizes income and expenses when they are earned or incurred, regardless of when the payment occurs. This method provides a more accurate reflection of business activity, giving a comprehensive view of profitability over a given period. For business owners and finance managers in Muscat, grasping these differences is essential for making informed decisions that foster sustainable growth while ensuring compliance with Oman’s evolving financial regulations.

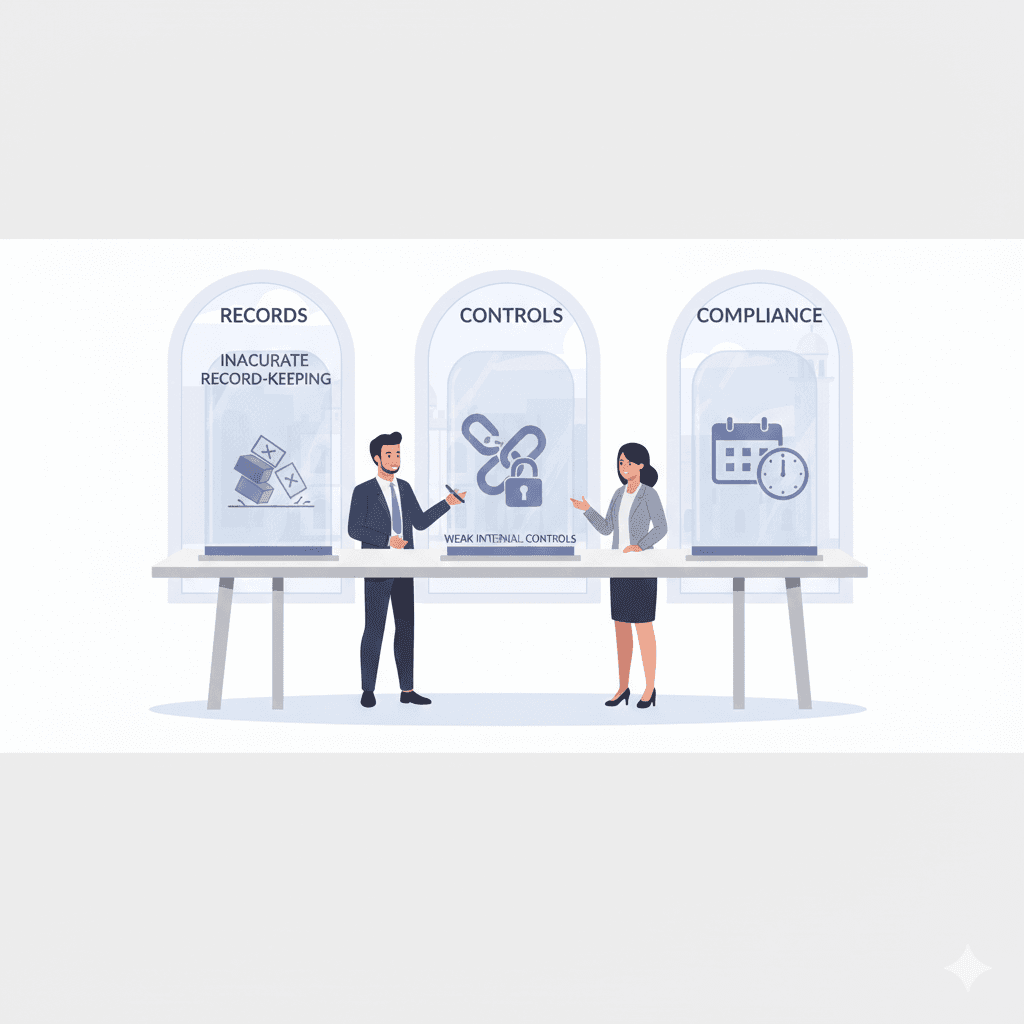

Implications of Cash Accounting for Muscat SMEs

Benefits and limitations in everyday operations

Cash accounting’s straightforward nature often appeals to new SMEs or those with minimal inventory and straightforward sales cycles in Muscat. By focusing solely on cash transactions, businesses gain immediate clarity on available liquidity—a vital metric in a market where timely supplier payments and managing working capital are essential. However, this simplicity comes at a cost. Cash basis accounting can obscure the true financial health of a business, particularly when outstanding receivables or payables are significant. For example, a Muscat-based trading company might show strong cash flow during a period but fail to account for unpaid customer invoices, leading to over-optimistic financial planning. Furthermore, the method may limit the ability to attract certain investors or qualify for credit facilities that require a more nuanced financial overview, emphasizing the need for professional advisory on the optimal accounting approach.

Accrual Accounting: A Strategic Tool for Muscat Businesses

Why many growing SMEs prefer the accrual method

Accrual accounting is often the preferred choice for SMEs in Muscat aiming for scalability and accuracy in financial reporting. By recognizing income and expenses as they occur, this method provides a realistic snapshot of business performance, which is essential when preparing for tax obligations like VAT or corporate tax in Oman. This approach allows finance managers to track sales made on credit, monitor outstanding debts, and forecast cash needs effectively, enabling better decision-making. Additionally, accrual accounting supports compliance with international accounting standards increasingly adopted in Oman, which can benefit companies seeking cross-border partnerships or external investment. While more complex and resource-intensive, accrual accounting’s advantages in transparency and financial control can outweigh its challenges, particularly when supported by professional audit and advisory services.

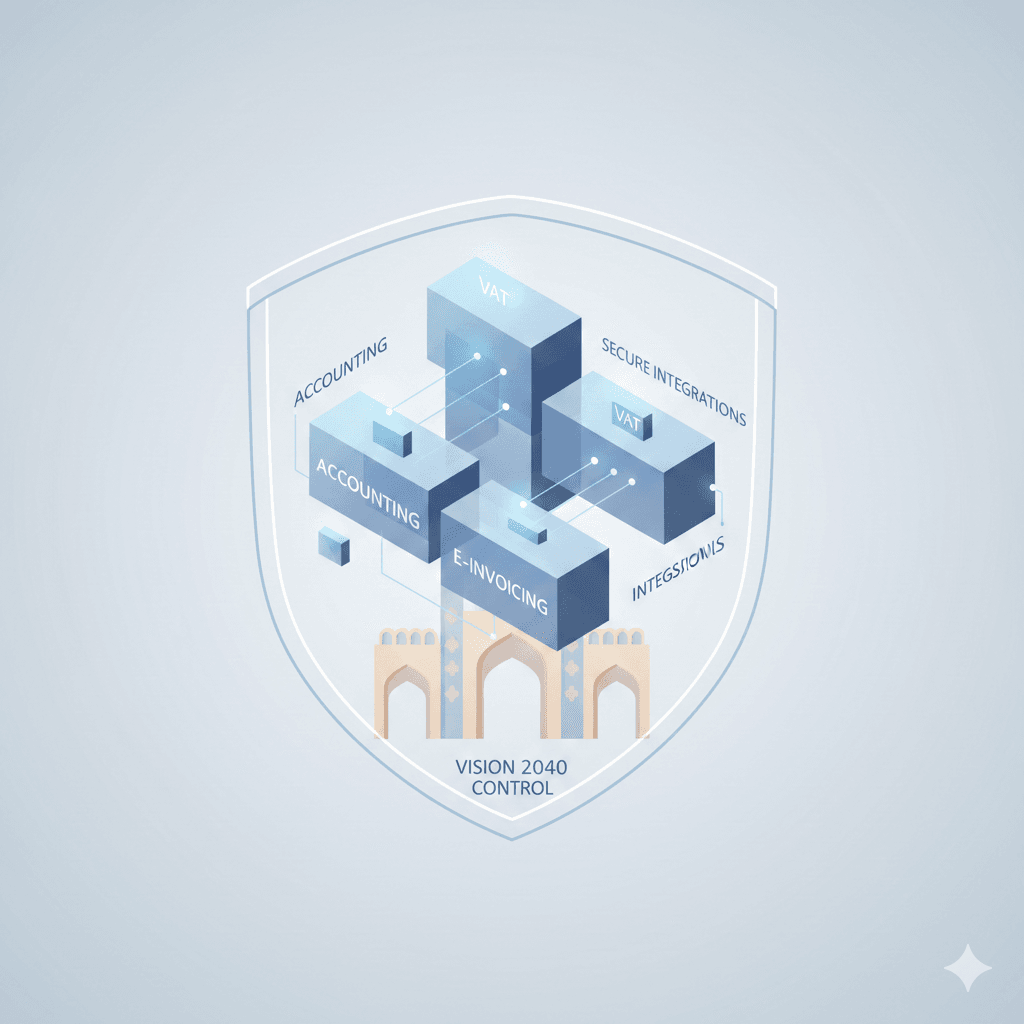

Taxation and Regulatory Considerations in Oman

Aligning accounting practices with Oman’s tax environment

For Muscat SMEs, choosing between cash and accrual accounting is not only an operational decision but a tax compliance matter. Oman’s introduction of VAT and the evolving corporate tax framework necessitate precise financial records to accurately calculate tax liabilities. Accrual accounting typically aligns better with tax requirements, as it matches revenues and expenses within the same period, helping avoid discrepancies that could trigger audits or penalties. However, smaller businesses with limited transactions might still qualify to use cash accounting under certain conditions, easing their administrative burden. SMEs should engage advisory experts like Leaderly to navigate these nuances, ensuring their accounting basis supports both compliance and efficient tax planning tailored to Oman’s specific regulations.

Financial Reporting and Decision-Making Benefits

Leveraging accounting choices for better business insights

Accurate financial reporting is crucial for Muscat business owners to make informed strategic decisions. The accrual method’s comprehensive data helps forecast profitability, manage budgets, and evaluate operational efficiency over time. It equips entrepreneurs with a clear view of outstanding obligations and anticipated revenues, essential for negotiating with banks or investors. Cash accounting, while less detailed, provides immediate insights into liquidity status, helping businesses stay on top of daily cash flows. Both methods have distinct roles, and some SMEs may even transition from cash to accrual as they grow. Partnering with financial advisory professionals can ensure that the chosen accounting basis supports reliable reporting, aids audit processes, and ultimately strengthens business resilience in Muscat’s competitive market.

Choosing the Right Accounting Basis for Your Muscat SME

Practical guidance tailored to business size and goals

When deciding between cash and accrual accounting, Muscat SMEs should consider factors such as business complexity, growth aspirations, and regulatory demands. Startups or service-oriented companies with straightforward cash flows might benefit from the simplicity of cash accounting. Conversely, SMEs with inventory, credit sales, or plans to expand will find accrual accounting more beneficial despite its complexity. It is essential to assess how each method impacts tax reporting, financial transparency, and stakeholder confidence. Working with a trusted financial advisor ensures that the transition between methods, if needed, is seamless and compliant with Oman’s accounting standards. Ultimately, the right choice enhances financial control, supports tax compliance, and positions Muscat businesses for sustainable success.

The accounting basis a business adopts in Muscat profoundly influences its financial management and regulatory compliance. Understanding the distinctions between cash and accrual accounting allows business owners and finance managers to select a method that reflects their operational realities and strategic ambitions.

By aligning accounting practices with Oman’s tax framework and leveraging advisory expertise, SMEs can ensure clarity, compliance, and readiness for growth. Whether opting for the straightforward cash basis or the detailed accrual approach, informed decisions around accounting will fortify the foundation for enduring business success in Muscat.

#Leaderly #CashVsAccrualInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit