How to Build a Business Plan in Muscat That Stands Up to Scrutiny: A Practical Guide for SMEs

Understanding the Muscat Business Environment

Contextualizing Planning for Local Realities

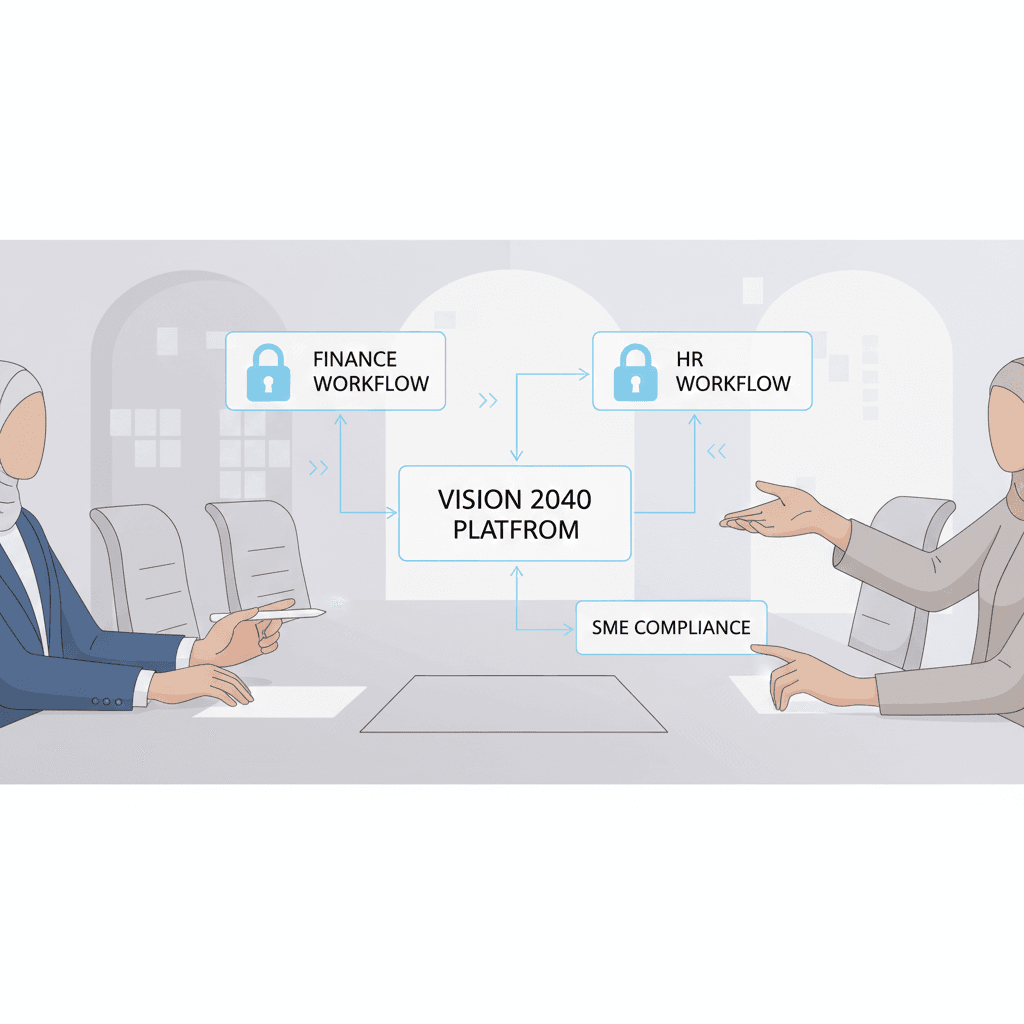

How to build a business plan in Muscat that stands up to scrutiny begins with a clear understanding of the local business environment. Muscat’s SME sector operates within a unique blend of economic diversification efforts, regulatory frameworks, and cultural expectations. Unlike generic business plans designed for broader markets, those in Muscat must reflect the realities of Oman’s Vision 2040, which emphasizes innovation, entrepreneurship, and economic sustainability. Business owners must factor in the evolving regulatory landscape, including Oman’s VAT and corporate tax regimes, which affect financial projections and operational planning. Additionally, the local market’s competitive nature requires detailed analysis of customer segments, supplier networks, and potential partnerships specific to Muscat’s economic zones and free trade areas.

In practical terms, SMEs should begin their planning process by researching local market data and regulatory updates to ensure their assumptions are grounded in Muscat’s economic context. Engaging local advisory experts familiar with Muscat’s economic policies and legal requirements can further refine a plan’s realism and reliability. This foundational step creates a business plan that speaks directly to investors, banks, and government bodies, demonstrating awareness of local risks and opportunities.

Moreover, Muscat entrepreneurs must anticipate the scrutiny business plans will face, especially during funding or due diligence processes. These stakeholders expect clarity on how a business aligns with local economic goals and sustainability standards. Without addressing these factors, even well-structured plans may falter under review. Therefore, grounding the business plan in Muscat-specific economic, legal, and cultural conditions is non-negotiable for SMEs seeking to build credibility and trust.

Crafting Clear Financial Projections Tailored to Muscat SMEs

Financial Transparency and Local Compliance

How to build a business plan in Muscat that stands up to scrutiny heavily depends on crafting precise and compliant financial projections. Financial statements and forecasts are often the focal point during audits and investor evaluations, making accuracy paramount. Muscat SMEs must incorporate VAT compliance, corporate tax implications, and realistic revenue and cost assumptions based on local market data. Using conservative estimates that consider Muscat’s inflation trends, supply chain specifics, and labor costs demonstrates a mature financial understanding.

Integrating financial discipline aligned with Oman’s regulatory requirements also helps business owners anticipate cash flow challenges and tax obligations, reducing the risk of surprises post-launch. Many SMEs in Muscat underestimate the complexity of tax laws and their impact on profitability, which can undermine the plan’s credibility. Professional accounting and audit support, like that provided by Leaderly, ensures that financial forecasts are prepared with rigor and aligned with accepted accounting principles.

Furthermore, clear articulation of funding needs, break-even points, and return on investment helps attract local banks and investors familiar with Oman’s market. Transparent financial modeling backed by credible assumptions reassures stakeholders that the business is both viable and well-managed. This step is essential not only for initial approvals but also for sustaining investor confidence as the business grows within Muscat’s competitive ecosystem.

Aligning Strategy with Muscat’s Economic Vision

Embedding Growth Plans into Oman’s Development Goals

How to build a business plan in Muscat that stands up to scrutiny is incomplete without strategic alignment to Oman’s broader economic development objectives. Vision 2040 and related national initiatives prioritize sectors such as tourism, manufacturing, logistics, and renewable energy. SMEs that clearly position their business within these priority areas are more likely to gain support from government programs and strategic investors.

This alignment goes beyond surface-level statements. Business plans must demonstrate how the enterprise contributes to job creation, innovation, and sustainability in Muscat. Highlighting potential collaborations with local institutions or participation in economic zones signals strategic awareness. Including market entry strategies that reflect Oman’s regulatory incentives or leveraging government-backed feasibility studies further strengthens the plan.

Strategic clarity also addresses risk management by recognizing external economic pressures and regulatory shifts. Plans that proactively integrate scenario planning and contingency measures signal to advisors and investors that management is prepared for Muscat’s dynamic business climate. Thus, embedding local economic priorities into strategic objectives transforms the business plan from a generic roadmap into a compelling, context-driven document.

Detailing Operations with Muscat-Specific Realities

Operational Planning Grounded in Local Logistics and Workforce

How to build a business plan in Muscat that stands up to scrutiny demands operational details reflecting the realities of local supply chains, infrastructure, and workforce availability. SMEs must account for the particularities of Muscat’s transport networks, port access, and vendor relationships, all of which influence cost and delivery timelines. A plan that overlooks these nuances risks presenting an unrealistic operational blueprint.

Labor market conditions in Muscat, including the availability of skilled expatriates and Omanisation policies, must also be factored into staffing and wage projections. Companies that illustrate how they will meet Oman’s regulatory requirements regarding employment demonstrate a commitment to compliance and social responsibility. This attention to detail reassures banks and government entities reviewing the plan during due diligence processes.

Additionally, integrating operational risk assessments, such as contingency planning for supply disruptions or compliance with environmental regulations, makes the business plan more robust. Leaderly’s advisory services can support SMEs in mapping these operational challenges, helping founders visualize practical workflows and cost structures within the Muscat business environment. The result is an operational section that stands up to rigorous examination and prepares the business for smooth execution.

Building a Marketing and Sales Approach for the Muscat Market

Targeting Local Customers with Cultural Insight

How to build a business plan in Muscat that stands up to scrutiny requires a marketing and sales strategy that is deeply informed by local consumer behavior and cultural nuances. Effective business plans demonstrate not only who the target customers are but how the business will reach and retain them in Muscat’s diverse and evolving market. This involves segmenting the market by demographics, preferences, and purchasing power relevant to Oman’s capital region.

Marketing strategies must reflect Oman’s digital adoption rates, social media habits, and traditional outreach channels. Plans should explain how branding and messaging will resonate with local values and the multicultural population. Additionally, understanding competitive dynamics in Muscat’s SME sector allows entrepreneurs to articulate differentiators that will drive customer loyalty.

Sales approaches that include partnerships with local distributors, participation in trade fairs, and government procurement channels often receive positive attention during due diligence. Incorporating measurable KPIs and customer acquisition costs tied to Muscat’s context reinforces the plan’s practicality. Through this localized focus, SMEs can present a sales and marketing blueprint that aligns with Oman’s unique business landscape and gains investor confidence.

Preparing for Due Diligence with Leaderly’s Advisory Lens

Ensuring Robustness Through Expert Review

How to build a business plan in Muscat that stands up to scrutiny culminates in preparing the document for rigorous due diligence by investors, banks, or partners. This phase involves reviewing assumptions, verifying compliance, and stress-testing financial and operational models. Engaging advisory services like Leaderly provides SMEs with the expert perspective necessary to identify gaps and strengthen weak points.

Leaderly’s holistic approach, encompassing audit, accounting, taxation, and advisory, ensures that business plans are not only compliant with Oman’s regulatory frameworks but also aligned with best practices in valuation and risk management. This comprehensive review reduces the likelihood of costly surprises during negotiations or audits.

The value of professional advisory in this phase cannot be overstated. It equips business owners in Muscat with confidence and clarity, helping them present a plan that withstands scrutiny and accelerates access to capital. Ultimately, this thorough preparation transforms a business plan from a hopeful projection into a strategic tool that drives sustainable SME growth in Oman’s dynamic market.

In the competitive SME landscape of Muscat, a business plan that stands up to scrutiny must be more than aspirational—it must be rooted in local reality and expert insight. From understanding the business environment to precise financial planning, from aligning with national economic goals to detailing operations and marketing strategies, every element plays a critical role. This rigorous approach equips business owners and entrepreneurs with a credible, actionable roadmap that can secure funding, guide execution, and support sustainable growth.

By embracing the practical steps outlined and leveraging trusted advisory partnerships, SMEs in Muscat can confidently navigate the complexities of building a business plan. This readiness not only enhances their chances of success but also contributes to Oman’s broader vision of a diversified, resilient economy. With clarity, discipline, and local relevance, your business plan can truly stand up to scrutiny and become a foundation for lasting achievement.

#Leaderly #HowToBuildABusinessPlanInMuscatThatStandsUpToScrutiny #Oman #Muscat #SMEs #Accounting #Tax #Audit