Muscat Strategic Advisory Framework for Building Smarter, Stronger Omani Businesses

Understanding Why the Muscat Strategic Advisory Framework Matters for Growing SMEs

Moving beyond transactions toward decision intelligence

In today’s competitive commercial environment, the Muscat Strategic Advisory Framework has become essential for Omani SMEs that want to progress from survival to structured growth. Many business owners initially rely on bookkeeping to track cash and expenses, which is important, but this alone cannot guide expansion, investment, or risk management. The Framework shifts attention from simply recording history to interpreting that history and using it to shape the future. For entrepreneurs in Muscat, this transition is often triggered when margins tighten, working capital becomes unpredictable, or new financing discussions arise. At this stage, management decisions require more than ledger balances; they require integrated financial insight, regulatory awareness, and long-term planning discipline. The Framework provides that structure, enabling leaders to connect operational reality with financial strategy. It becomes the language that aligns owners, managers, banks, and advisors around the same objectives. Without it, SMEs operate reactively, responding to problems after they appear rather than designing systems that prevent them. With it, companies gain clarity on profitability drivers, cost behavior, and sustainable growth potential within Oman’s evolving regulatory and commercial landscape.

How the Muscat Strategic Advisory Framework reshapes financial leadership

From reporting to proactive management

The real power of the Muscat Strategic Advisory Framework lies in how it transforms the role of finance inside the organization. Instead of finance being a back-office function focused on closing the books and filing returns, it becomes the core of executive decision-making. Management begins to evaluate projects through structured feasibility, risk assessment, and scenario modeling rather than instinct alone. In Muscat’s market, where VAT compliance, corporate taxation, and banking requirements are becoming more sophisticated, this transformation is no longer optional. Financial leadership under the Framework connects operational data with regulatory obligations and commercial opportunities. It ensures that pricing, investment, hiring, and expansion decisions are evaluated against cash flow projections, tax consequences, and funding capacity. SMEs that adopt this mindset find themselves negotiating more confidently with lenders and partners because their numbers tell a coherent, forward-looking story. The Framework does not replace bookkeeping; it builds on it, elevating raw data into a management system that actively guides the company toward its objectives while maintaining full compliance with Oman’s financial environment.

Why Muscat entrepreneurs adopt the Muscat Strategic Advisory Framework earlier

Lessons from Oman’s changing business environment

In Muscat, many SME founders discover the need for the Muscat Strategic Advisory Framework sooner than expected because the pace of regulatory and market change leaves little room for informal management. Corporate tax implementation, stricter audit expectations, and increasing investor scrutiny have compressed the margin for error. What once could be managed with basic records now demands structured planning and documentation. Entrepreneurs who adopt the Framework early gain an advantage: they identify inefficiencies, uncover hidden risks, and strengthen their financial credibility before problems escalate. This proactive posture allows businesses to seize opportunities such as expansion into new markets, joint ventures, or restructuring of operations with confidence. Conversely, companies that delay advisory discipline often face costly corrections later, whether through tax adjustments, liquidity crises, or failed investments. The Framework encourages leadership to think beyond the current quarter, designing systems that support stability and growth over multiple years within Oman’s regulatory and commercial context.

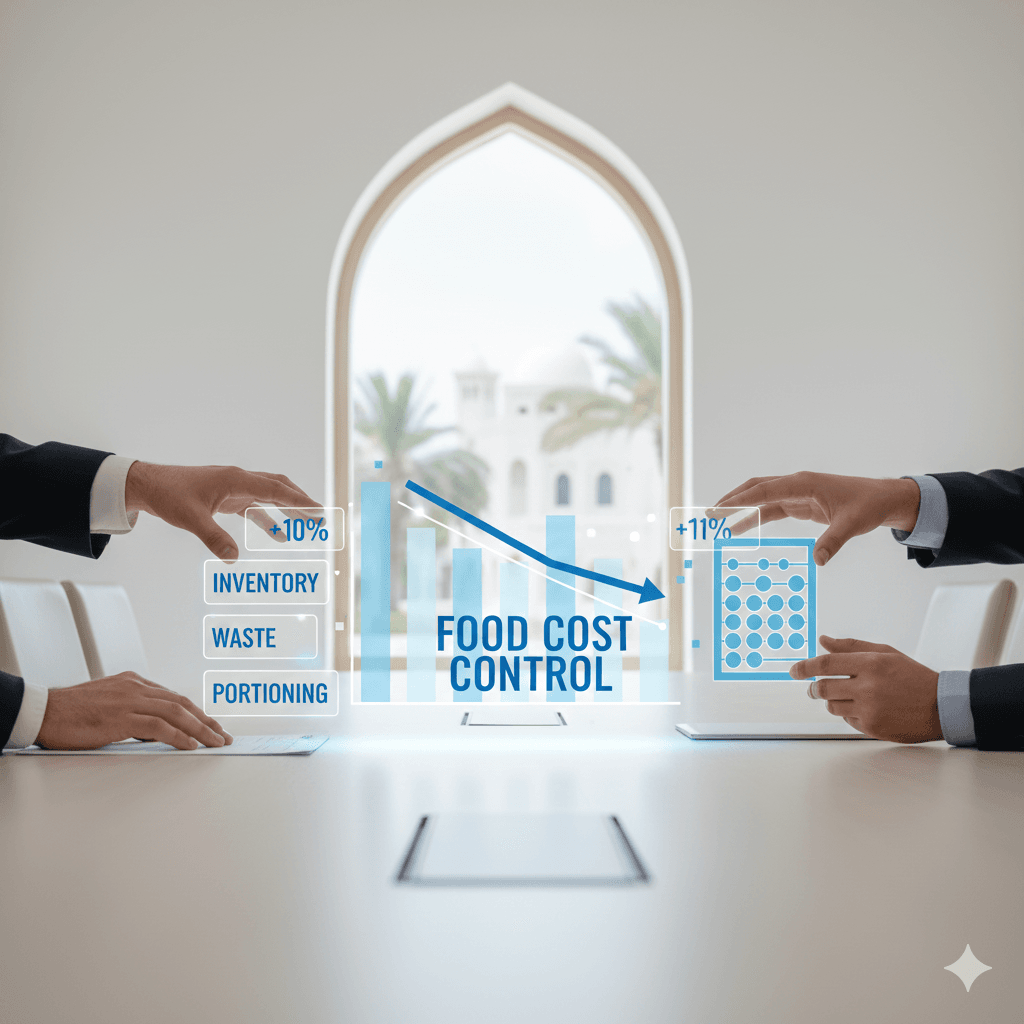

Applying the Muscat Strategic Advisory Framework to operational decisions

Aligning daily activity with long-term goals

Once implemented, the Muscat Strategic Advisory Framework becomes embedded in everyday management decisions. Pricing strategies are evaluated not only on competitiveness but also on margin sustainability and tax impact. Inventory policies are adjusted based on working capital cycles and demand forecasting. Hiring plans are shaped by productivity analysis and long-term cost commitments. In Muscat’s SME environment, these decisions determine whether growth strengthens the company or quietly undermines its financial foundation. The Framework introduces discipline into these choices, replacing guesswork with structured evaluation. Business owners begin to view each operational action as part of a financial system that must remain balanced and resilient. This alignment reduces stress at year-end, minimizes unpleasant surprises during audits, and improves discussions with banks and stakeholders. More importantly, it creates a culture where leadership understands the financial consequences of strategic decisions before committing resources. That awareness is what separates sustainable enterprises from those that simply grow until their systems collapse under the weight of unmanaged complexity.

Integrating advisory thinking with compliance under the Muscat Strategic Advisory Framework

Turning regulation into strategic advantage

Compliance in Oman is no longer a narrow technical exercise; it is a strategic component of the Muscat Strategic Advisory Framework. VAT reporting, corporate tax planning, audit readiness, and regulatory documentation now influence how companies structure transactions, contracts, and investments. When advisory thinking is integrated with compliance, SMEs transform regulation from a burden into a competitive advantage. They design operations that minimize tax leakage, improve transparency, and strengthen trust with regulators and financial institutions. This integration allows management to anticipate regulatory changes and adjust strategy proactively rather than reactively. Over time, businesses that master this approach enjoy smoother audits, fewer disputes, and stronger reputations. They also attract higher-quality investors and partners because their governance systems signal reliability and professionalism. The Framework ensures that advisory insight and compliance discipline operate as one coherent system, supporting both daily operations and long-term strategic goals.

Using the Muscat Strategic Advisory Framework to prepare for major transitions

Growth, restructuring, and succession planning

Major business transitions test the true value of the Muscat Strategic Advisory Framework. Whether preparing for expansion, restructuring, partial exit, or succession, SMEs in Muscat require comprehensive financial clarity. Advisory discipline supports valuation analysis, due diligence preparation, financing structuring, and risk management during these critical periods. Without the Framework, transitions become chaotic, driven by urgency rather than strategy. With it, leadership can evaluate options calmly, negotiate from a position of strength, and protect the company’s long-term interests. The Framework also supports succession planning, helping founders design ownership and management structures that preserve continuity and stability. As Oman’s SME sector matures, these transitions are becoming more common, making structured advisory systems indispensable. Companies that invest early in advisory frameworks navigate change with confidence and emerge stronger, more resilient, and better positioned for sustained success.

In conclusion, the Muscat Strategic Advisory Framework represents a fundamental shift in how Omani SMEs manage their businesses. It moves organizations from transactional bookkeeping toward integrated financial leadership that informs every strategic decision. By connecting operational activity with financial planning, regulatory awareness, and long-term objectives, the Framework provides clarity in an increasingly complex business environment. For entrepreneurs and managers, this clarity reduces risk, improves performance, and creates the confidence needed to pursue growth opportunities within Oman’s evolving market.

Ultimately, SMEs that adopt the Framework discover that advisory discipline is not an optional luxury but a core pillar of sustainable success. It strengthens financial credibility, enhances decision quality, and ensures that growth is supported by solid systems rather than fragile assumptions. For Muscat’s business community, the Framework offers a practical path toward resilience, compliance, and long-term prosperity grounded in sound financial strategy and informed leadership.

#Leaderly #MuscatStrategicAdvisoryFramework #Oman #Muscat #SMEs #Accounting #Tax #Audit