Muscat Year-End Close Framework: A Practical Oman Checklist for Business Owners

Understanding the Role of the Muscat Year-End Close Framework in Omani Business Stability

Why closing the year correctly defines next year’s success

For many Omani SMEs, year-end activities are treated as a race to submit documents rather than a strategic process. The Muscat Year-End Close Framework changes that mindset by transforming the close into a management discipline that supports audit readiness, tax accuracy, and business decision-making. In Muscat’s competitive commercial environment, banks, investors, and regulators increasingly demand reliable, structured financial records. Without a strong close framework, companies risk overstated profits, missing liabilities, and delayed audits. The framework is not simply about ticking boxes; it is about ensuring that every transaction of the year is properly recognized, classified, and supported. When leadership understands this, the closing process becomes a strategic advantage rather than an administrative burden. SMEs that apply the Muscat Year-End Close Framework correctly enter the new year with clean books, predictable tax outcomes, and financial confidence that directly improves access to financing and partnership opportunities. This is particularly critical in Oman’s current regulatory environment where VAT enforcement, corporate tax compliance, and audit scrutiny are becoming more sophisticated and less forgiving.

How the Muscat Year-End Close Framework Strengthens Financial Governance

Building internal discipline before external scrutiny

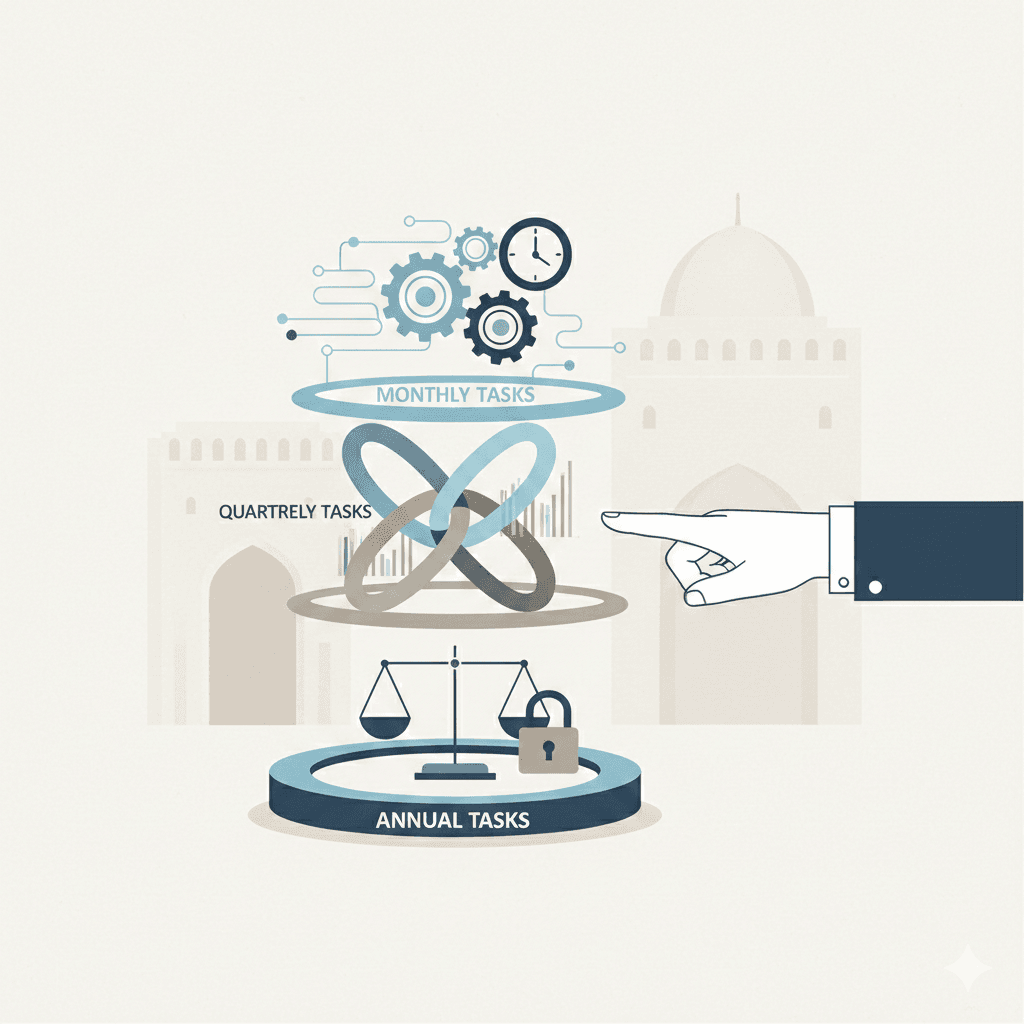

At its core, the Muscat Year-End Close Framework creates internal financial governance long before auditors arrive. It establishes structured responsibilities, timelines, and verification layers that prevent errors from accumulating throughout the year. Many Muscat-based SMEs operate with limited finance teams, often relying on one accountant who manages everything from invoicing to bank reconciliation. Without a framework, important items such as accruals, provisions, and revenue cut-off decisions are left to judgment at the last minute. The framework enforces consistency: supplier balances are confirmed, customer receivables are reconciled, inventory counts are validated, and fixed asset registers are updated. Each step is documented and reviewed. This discipline does more than satisfy auditors; it protects the owner from distorted profitability reports that can misguide pricing, hiring, and expansion decisions. Over time, businesses using the Muscat Year-End Close Framework develop financial credibility in the market, allowing advisory discussions on valuation, restructuring, and growth to be grounded in reliable numbers rather than assumptions.

Why Omani SMEs Cannot Afford Weak Year-End Closing Practices

The financial cost of disorganization

Weak closing processes quietly drain profitability. Missed expense accruals inflate profits and trigger higher corporate tax exposure. Unreconciled VAT accounts lead to penalties and reputational damage with the Tax Authority. Incomplete documentation delays audits, increasing professional fees and management distraction. The Muscat Year-End Close Framework protects SMEs from these risks by embedding controls that catch issues early. For example, reconciling VAT ledgers before closing ensures that every taxable transaction is properly supported, reducing the risk of future assessments. Confirming intercompany balances avoids disputes during audits. Reviewing loan covenants prevents accidental breaches that could trigger penalties from lenders. These practical safeguards allow leadership to focus on growth rather than firefighting. In Oman’s evolving compliance environment, the difference between stable growth and chronic stress often comes down to whether a company has adopted a disciplined year-end framework or continues to rely on ad-hoc corrections when auditors appear.

Implementing the Muscat Year-End Close Framework Step by Step

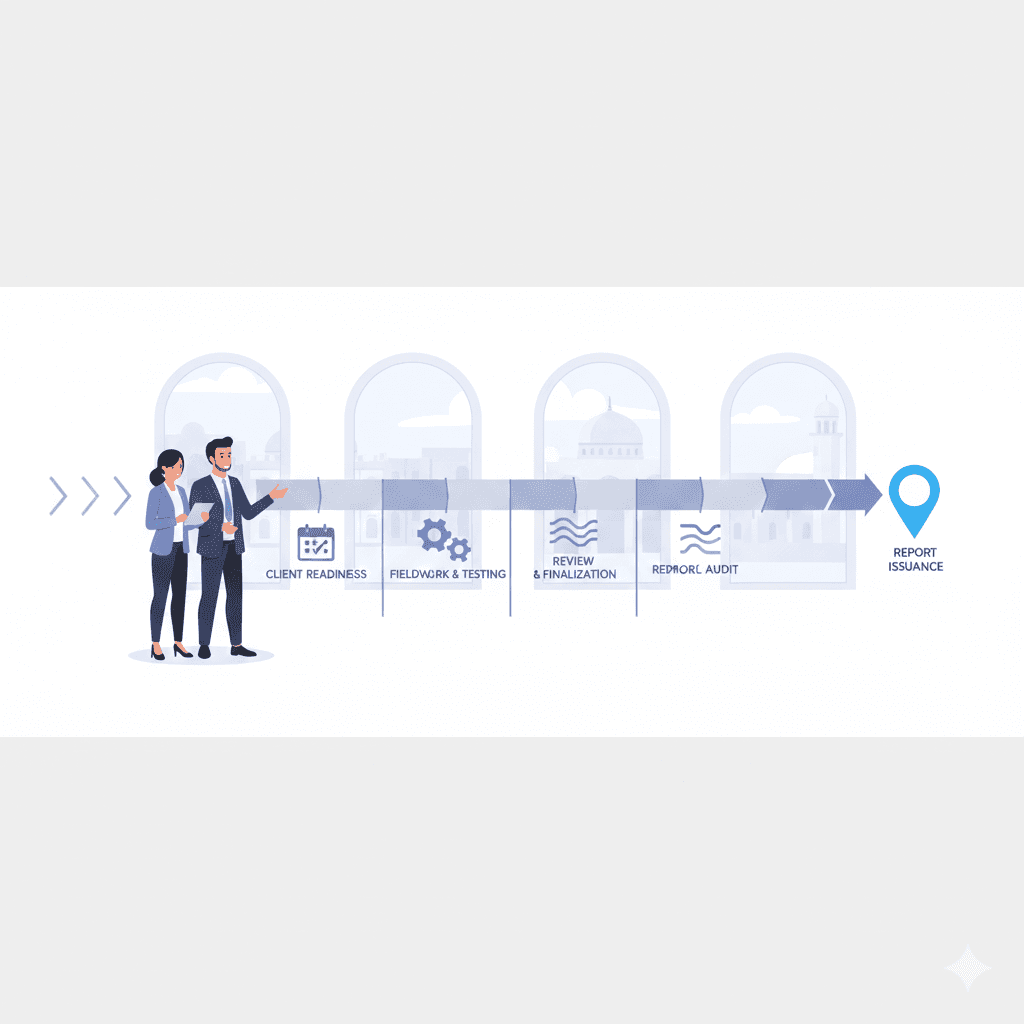

From daily records to final audit pack

Effective implementation of the Muscat Year-End Close Framework begins months before the actual year-end. Transaction recording must remain consistent, supported by proper documentation and approvals. As the year closes, management initiates structured reconciliations: bank, receivables, payables, inventory, payroll, VAT, and fixed assets. Adjustments such as accruals, provisions, and depreciation are calculated based on documented policies rather than guesswork. Once these adjustments are posted, financial statements are prepared for management review. Only after internal approval does the company finalize its audit file. This file includes reconciliations, supporting schedules, contracts, tax workings, and management representations. When auditors arrive, the process becomes verification rather than reconstruction. This is where professional advisory input, such as that provided by firms like Leaderly, becomes invaluable. Their experience across audit, taxation, valuation, and due diligence ensures that the framework is not merely compliant but strategically aligned with the company’s long-term objectives.

Linking the Muscat Year-End Close Framework with Tax and Audit Strategy

Compliance as a growth tool, not a constraint

Tax and audit should never be isolated activities. The Muscat Year-End Close Framework integrates corporate tax, VAT, and audit considerations into one coherent system. When year-end adjustments are aligned with tax regulations, businesses avoid unpleasant surprises after submission. VAT reconciliations performed within the framework ensure that declared amounts match underlying transactions, minimizing exposure during inspections. Corporate tax computations built from verified closing figures eliminate last-minute corrections that weaken credibility with authorities and financial partners. Auditors, in turn, gain confidence when documentation flows logically from the framework, reducing audit timelines and costs. Over time, this integrated approach transforms compliance from a reactive obligation into a proactive business asset. It supports accurate business valuation, smooth financing discussions, and successful due diligence during partnerships, acquisitions, or exit planning. In Oman’s growing investment landscape, such financial maturity directly influences a company’s attractiveness to serious investors.

Long-Term Business Impact of the Muscat Year-End Close Framework

From survival to strategic leadership

The most powerful benefit of the Muscat Year-End Close Framework is cultural. It shifts leadership thinking from short-term survival to long-term strategy. Financial statements stop being historical reports and become decision-making tools. Management gains visibility into cash flow trends, profit drivers, and operational inefficiencies. This clarity enables smarter expansion, more accurate pricing, and stronger negotiation positions with banks and suppliers. For growing Omani SMEs, the framework becomes the foundation for advanced advisory work such as feasibility studies, restructuring, liquidation planning, and valuation exercises. Companies that master their year-end close no longer fear audits or tax reviews; they leverage them as opportunities to demonstrate financial strength and governance maturity. In Muscat’s increasingly competitive SME sector, such discipline is no longer optional. It is a defining characteristic of sustainable success.

The true value of the Muscat Year-End Close Framework lies not in technical compliance but in the confidence it gives business leaders. When the financial year closes cleanly, owners begin the new year with clarity instead of uncertainty. They know their real profitability, understand their tax obligations, and possess credible financial statements that support negotiations with banks, investors, and partners. This confidence fuels growth decisions grounded in evidence rather than instinct. It also allows management to engage professional advisors more effectively, ensuring that audit, tax planning, valuation, and strategic restructuring are based on reliable information.

For Omani SMEs seeking stability and growth, the year-end close is no longer a routine exercise. It is the backbone of financial control, governance, and strategic leadership. Businesses that invest in building and maintaining a robust Muscat Year-End Close Framework position themselves ahead of regulatory demands, economic shifts, and market competition. In doing so, they transform their financial function from a reporting necessity into a powerful engine of sustainable success.

#Leaderly #MuscatYear-EndCloseFramework #Oman #Muscat #SMEs #Accounting #Tax #Audit