Clinic Accounting in Muscat: Streamlining Patient Billing and Financial Controls

Understanding Clinic Accounting Challenges in Muscat

The Unique Financial Landscape for Clinics

Clinic accounting in Muscat requires a nuanced approach, given the region’s specific healthcare environment and regulatory frameworks. Clinics in Muscat face the challenge of managing patient billing accurately while complying with Oman’s VAT and corporate tax regulations. The volume and diversity of services provided by clinics—ranging from general consultations to specialized treatments—make billing complex. Each transaction needs precise documentation to satisfy regulatory scrutiny and to ensure proper financial reporting. Additionally, many clinics operate on tight margins, making effective financial controls essential to maintaining profitability. Errors in patient billing or receipt management can lead to revenue leakage or compliance issues, which is why a clear, systematic accounting process is critical.

For SMEs and private clinics, the balance between delivering quality healthcare and maintaining sound financial health hinges on well-established accounting systems. Such systems must track all revenue streams, including direct patient payments, insurance reimbursements, and other ancillary charges. Clinics must also be able to handle partial payments, refunds, or deferred payments gracefully within their accounting systems to maintain cash flow stability and avoid disputes. For Muscat-based clinics, this means aligning billing and accounting practices with local tax authorities and ensuring transparency with patients to build trust.

Muscat’s healthcare providers increasingly rely on integrated digital systems for patient billing and receipts. Automation in clinic accounting reduces manual errors and expedites financial reconciliation, enabling faster closure of accounts. Clinics should prioritize software solutions that facilitate real-time tracking of patient accounts, VAT calculations, and detailed financial reports. This empowers managers and finance teams with insights to optimize operations and ensure compliance with Oman’s financial regulations.

Patient Billing Processes Tailored for Muscat Clinics

Ensuring Accuracy and Compliance in Billing

A robust patient billing system is foundational to effective clinic accounting in Muscat. Clinics must issue accurate, itemized bills that comply with Oman’s VAT law, reflecting the correct application of the 5% VAT on taxable healthcare services or exempt treatments where applicable. Clear patient billing not only supports compliance but also enhances the patient experience by providing transparency. Clinics should train staff on invoicing best practices, including capturing patient details, service descriptions, and payment terms.

Another key aspect is integrating billing with clinical workflows. When patient visits are recorded electronically, the corresponding charges should flow seamlessly into the billing system, minimizing delays and discrepancies. This reduces administrative burdens and ensures that revenue is recognized promptly and accurately. Moreover, clinics need to accommodate various payment methods common in Muscat, such as cash, bank transfers, credit cards, or insurance claims, and reflect these correctly in their accounting records.

Muscat clinics must also plan for scenarios such as cancellations, no-shows, or partial treatments that affect billing. Establishing clear policies and automated billing adjustments helps avoid disputes and supports smoother revenue management. In all cases, detailed billing records must be maintained to support audits, tax reporting, and financial analysis. Effective patient billing ultimately safeguards the clinic’s financial health and reinforces its professional reputation within the Muscat healthcare market.

Best Practices for Managing Receipts and Financial Documentation

Maintaining Transparent and Organized Records

Receipts in clinic accounting serve as vital proof of transactions between healthcare providers and patients. In Muscat, clinics are required to issue receipts that conform to VAT regulations, displaying key information such as clinic details, VAT number, payment date, and amount paid including VAT. Proper receipt management is crucial for tax compliance and internal control purposes. Maintaining organized receipt records helps clinics during audits or inspections by the Oman Tax Authority.

Digitizing receipt storage enhances accessibility and security, especially for SMEs that may lack extensive physical filing infrastructure. Electronic receipts can be systematically linked to patient accounts and financial ledgers, simplifying reconciliation and reporting processes. Clinics should ensure receipts are issued promptly at the point of payment and are accurate reflections of the billed services. Furthermore, consistent receipt issuance helps build patient trust, showing professionalism and transparency in all financial dealings.

For effective financial control, clinics must periodically review receipt and payment data to detect anomalies such as duplicate payments, unrecorded transactions, or missing receipts. These controls help mitigate risks of fraud or revenue leakage. Muscat clinics should incorporate routine financial checks and reconciliations into their accounting cycles to maintain accuracy and integrity in their books. By combining detailed receipt management with robust internal controls, clinics can sustain financial health and comply fully with Oman’s regulatory environment.

Implementing Financial Controls for Clinics in Muscat

Safeguarding Revenue and Ensuring Compliance

Financial controls are the backbone of effective clinic accounting in Muscat. These controls include segregation of duties, approval hierarchies, and regular audits to prevent errors and fraud. For clinics, controlling cash flows, patient billing, and receipt handling requires clearly defined processes and responsibilities. SME clinics should adopt control measures that are scalable, balancing thoroughness with operational efficiency.

Internal controls extend to the validation of billing data before invoicing and the cross-checking of receipts against bank deposits and cash registers. Regular reconciliations between patient records and financial statements are essential to identify discrepancies early. Technology plays a crucial role, enabling clinics to set automated alerts for unusual transactions or payment delays. Such controls also help ensure that VAT obligations are met accurately and timely, reducing the risk of penalties from Oman’s tax authorities.

Muscat clinics should foster a culture of accountability among their staff, emphasizing the importance of transparency in all financial matters. Training finance teams on regulatory updates, fraud detection, and control best practices is key. Furthermore, advisory services from specialized firms like Leaderly can assist clinics in designing and implementing tailored internal controls, enhancing their operational resilience and compliance posture. Robust financial controls empower clinics to confidently navigate the complexities of healthcare finance in Muscat.

Leveraging Advisory Services for Enhanced Clinic Financial Management

Strategic Support for Sustainable Growth

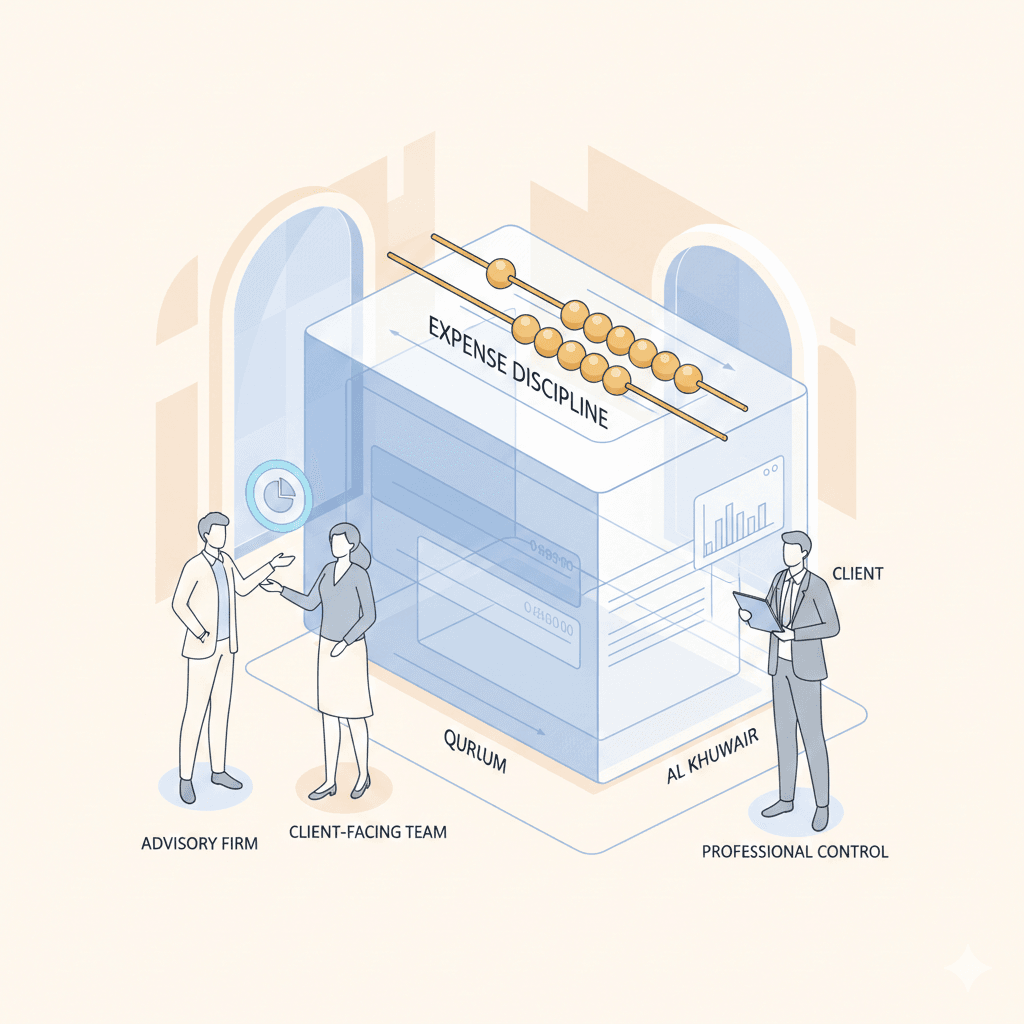

Beyond operational accounting and controls, clinics in Muscat benefit from strategic advisory services that guide long-term financial planning. Feasibility studies, valuation assessments, and due diligence support can help clinic owners and entrepreneurs make informed decisions about expansion, partnerships, or investment opportunities. These advisory services are vital in Oman’s evolving healthcare sector, where regulatory and market conditions are dynamic.

Leaderly’s advisory expertise enables clinics to align their financial strategies with business goals, ensuring sustainability. Clinics can gain insights into cash flow optimization, cost management, and risk mitigation through tailored financial analysis. Such guidance is particularly important for SMEs in Muscat, where resource constraints demand prudent management and forward-thinking approaches. Advisory support also includes navigating complex corporate tax implications, structuring financial transactions, and preparing for potential audits or regulatory changes.

Engaging with professional advisors enhances a clinic’s capability to adapt to challenges and seize growth opportunities. For Muscat clinics, this means building resilient financial systems that not only comply with Oman’s tax and accounting frameworks but also drive competitive advantage. Advisory services complement the foundational accounting and control processes, providing a holistic approach to clinic financial management in the region.

Building a Future-Ready Clinic Accounting System in Muscat

Integrating Technology and Expertise for Optimal Results

The future of clinic accounting in Muscat lies in the seamless integration of technology and professional expertise. Clinics must invest in advanced accounting software tailored to the healthcare sector, capable of handling patient billing complexities, VAT compliance, and financial reporting. Such systems improve data accuracy, reduce manual intervention, and generate actionable insights.

Incorporating cloud-based solutions offers flexibility and scalability for growing clinics, allowing real-time access to financial data and facilitating collaboration with external advisors like Leaderly. Muscat clinics also need to focus on cybersecurity measures to protect sensitive patient and financial information, ensuring compliance with Oman’s data protection regulations.

Ultimately, combining technology with sound advisory support empowers clinics to build resilient financial operations that can adapt to changing regulatory landscapes and market demands. This future-ready approach positions Muscat’s clinics to deliver excellent healthcare services while maintaining financial health and compliance, reinforcing their trustworthiness and competitiveness in Oman’s healthcare market.

Clinic accounting in Muscat demands meticulous attention to patient billing, receipt management, and internal financial controls to safeguard revenues and comply with tax regulations. For SMEs and private clinics, integrating technology with expert advisory services offers a pathway to enhanced operational efficiency and sustainable growth. By adopting these practices, clinics can confidently navigate the complexities of healthcare finance in Oman’s evolving regulatory environment.

As Muscat’s healthcare landscape continues to develop, clinics that prioritize robust accounting and control systems, supported by strategic financial advisory, will be better equipped to meet patient needs and regulatory expectations. This combination not only ensures compliance but also strengthens the financial foundation necessary for long-term success in Oman’s competitive healthcare sector.

#Leaderly #ClinicAccountingInMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit