Muscat online sales reconciliation across payment gateways, fees, and financial controls

Muscat online sales reconciliation at the point of transaction capture

Muscat online sales reconciliation begins long before an invoice is issued or revenue is reported. For SMEs operating in Oman, the moment a customer completes an online purchase through a payment gateway is the moment financial risk is created. Sales platforms, mobile apps, and e-commerce websites capture commercial data differently, often without alignment to how finance teams later record revenue. If transaction values, VAT treatment, currency handling, or customer details are inconsistent at this stage, reconciliation becomes reactive and error-prone. Many Muscat-based businesses underestimate how gateway settings, checkout logic, and platform integrations influence downstream accounting outcomes. A transaction that appears correct on a dashboard may not align with settlement reports or bank receipts, creating unexplained variances that accumulate over time.

From a practical perspective, SMEs must ensure that online sales data is structured consistently with internal financial systems. This includes mapping product categories to the correct VAT logic under Omani regulations and ensuring that discounts, promotional codes, and delivery charges are captured transparently. Muscat online sales reconciliation depends on clean data inputs that finance teams can trust without manual reconstruction. When systems are not aligned, finance managers are forced to rely on spreadsheets and assumptions, increasing both compliance risk and operational cost.

Muscat online sales reconciliation with gateway fees and settlement delays

One of the most misunderstood aspects of Muscat online sales reconciliation is how payment gateway fees and settlement timelines affect reported revenue. Gateways operating in Oman typically deduct transaction fees, commissions, and sometimes withholding charges before funds reach the business bank account. These deductions rarely align neatly with individual transactions, as settlements are often batched and delayed. For SMEs, this creates confusion between gross sales, net receipts, and actual bank inflows. Without a structured reconciliation process, finance teams may incorrectly record revenue based on bank deposits rather than contractual sale values.

In practice, SMEs should treat gateway statements as financial documents rather than operational reports. Each settlement should be reconciled against underlying transaction records, with fees recorded separately as expenses. Muscat online sales reconciliation requires discipline in separating performance measurement from cash movement. This distinction becomes especially important when VAT is involved, as VAT is calculated on the value of the supply, not on the net amount received after fees. Businesses that fail to recognize this often understate VAT liabilities, exposing themselves to penalties during tax reviews or audits.

Muscat online sales reconciliation across multiple channels and currencies

As Muscat SMEs expand their digital reach, they frequently sell through multiple channels, including local websites, international marketplaces, and mobile applications. Each channel may use different gateways, currencies, and reporting formats. Muscat online sales reconciliation becomes exponentially more complex when foreign currency settlements are converted at different exchange rates or processed through intermediary banks. Finance teams must understand where value is lost or gained through conversion spreads and how these differences should be treated in financial records.

From an advisory standpoint, businesses benefit from designing reconciliation frameworks that accommodate scale rather than reacting to complexity later. This means standardizing transaction identifiers, settlement cycles, and reporting calendars across platforms. Muscat online sales reconciliation should not rely on institutional memory or individual expertise; it should be embedded in process design. When reconciliation logic is clear and repeatable, SMEs gain visibility into true profitability by channel, enabling informed decisions about pricing, promotions, and platform selection.

Muscat online sales reconciliation and VAT treatment in Oman

VAT compliance adds another layer of responsibility to Muscat online sales reconciliation. Oman’s VAT framework requires businesses to account for VAT at the time of supply, which in online sales typically coincides with transaction confirmation rather than cash receipt. This distinction is critical when settlements are delayed or partially refunded. SMEs that reconcile based solely on bank statements often misalign VAT reporting periods, leading to discrepancies between declared output tax and actual transaction volumes.

Effective reconciliation involves matching VAT charged on each transaction to the corresponding reporting period, regardless of when cash is received. Muscat online sales reconciliation therefore becomes a bridge between operational activity and statutory reporting. Finance managers must ensure that refund policies, chargebacks, and failed transactions are correctly reflected in VAT adjustments. This level of accuracy is increasingly expected by regulators and external advisors supporting SMEs in Oman’s evolving tax environment.

Muscat online sales reconciliation as a management control tool

Beyond compliance, Muscat online sales reconciliation serves as a powerful internal control mechanism. Regular reconciliation identifies unauthorized discounts, pricing errors, and system glitches that may otherwise go unnoticed. For owner-managed SMEs, this process provides confidence that reported revenue reflects real economic activity rather than optimistic assumptions. When reconciliation is delayed or ignored, small discrepancies can mask larger operational issues, including fraud or platform misconfiguration.

Embedding reconciliation into monthly management routines allows decision-makers to link financial outcomes with operational drivers. Muscat online sales reconciliation transforms raw transaction data into actionable insight, supporting budgeting, cash flow planning, and performance evaluation. This is where professional accounting and advisory support becomes valuable, not as an external obligation but as a strategic enabler for sustainable growth.

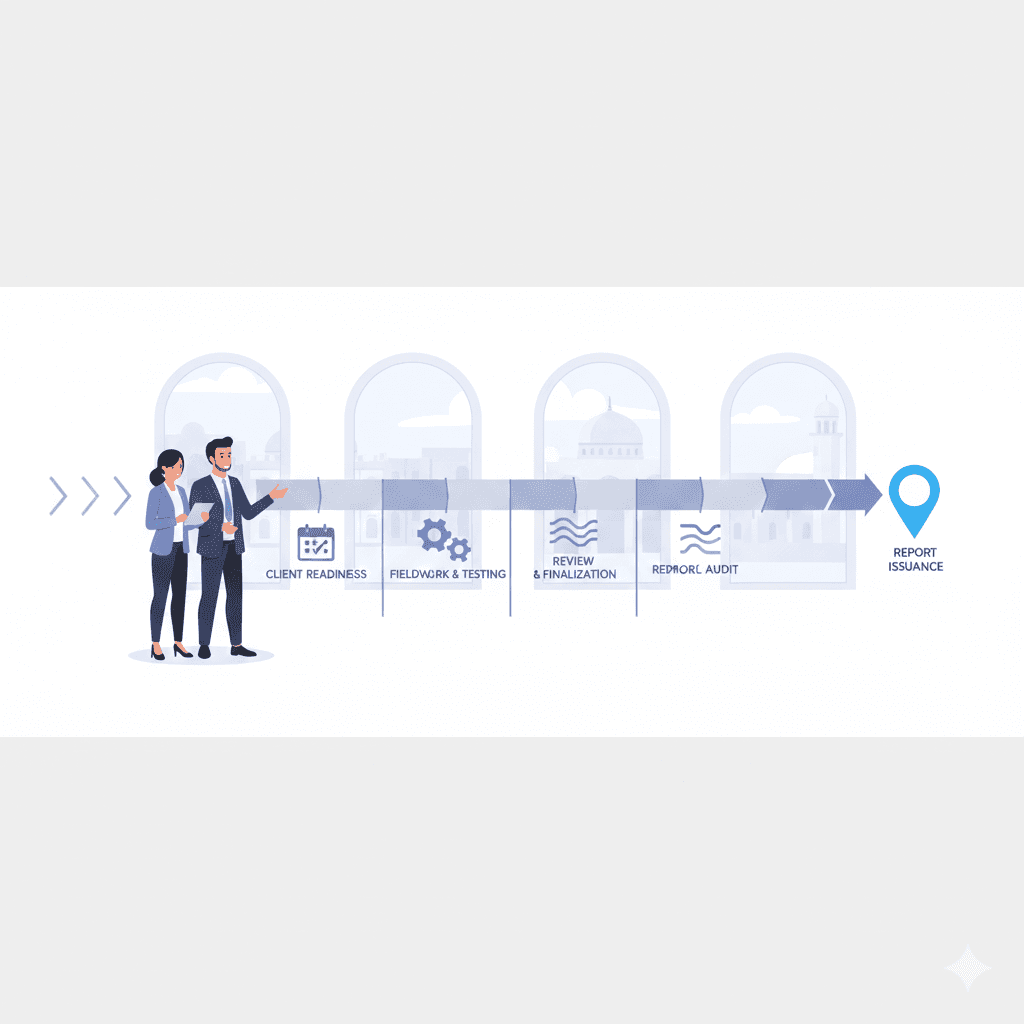

Muscat online sales reconciliation and readiness for audits and reviews

As SMEs in Muscat mature, they increasingly encounter external scrutiny from auditors, investors, or regulatory bodies. Online sales environments are often the first area reviewed due to their complexity and risk profile. Muscat online sales reconciliation provides the evidence trail needed to demonstrate control, accuracy, and compliance. Clear documentation of how transactions flow from customer payment to financial records reduces disruption during audits and shortens review timelines.

From a practical advisory perspective, businesses that invest early in reconciliation frameworks avoid costly remediation later. Muscat online sales reconciliation aligns operational systems with financial reporting expectations, making audits a confirmation exercise rather than an investigation. This readiness supports broader objectives such as valuation, due diligence, or strategic restructuring, all of which rely on credible financial data.

The discipline of Muscat online sales reconciliation sits at the intersection of technology, finance, and regulation. For SMEs operating in Oman, it is not merely a back-office task but a reflection of how well the business understands its own economic reality. When reconciliation processes are designed thoughtfully, they create transparency across gateways, fees, VAT, and cash flows, enabling owners and managers to make decisions based on facts rather than approximations.

Ultimately, SMEs that treat reconciliation as a continuous process rather than a periodic fix gain resilience and credibility. By aligning operational systems with financial oversight, Muscat businesses position themselves for compliant growth, smoother audits, and informed strategic planning. This clarity is what transforms online sales from a source of uncertainty into a reliable engine for sustainable value creation.

#Leaderly #Muscatonlinesalesreconciliation #Oman #Muscat #SMEs #Accounting #Tax #Audit