VAT Recordkeeping in Muscat: Essential Practices for SMEs

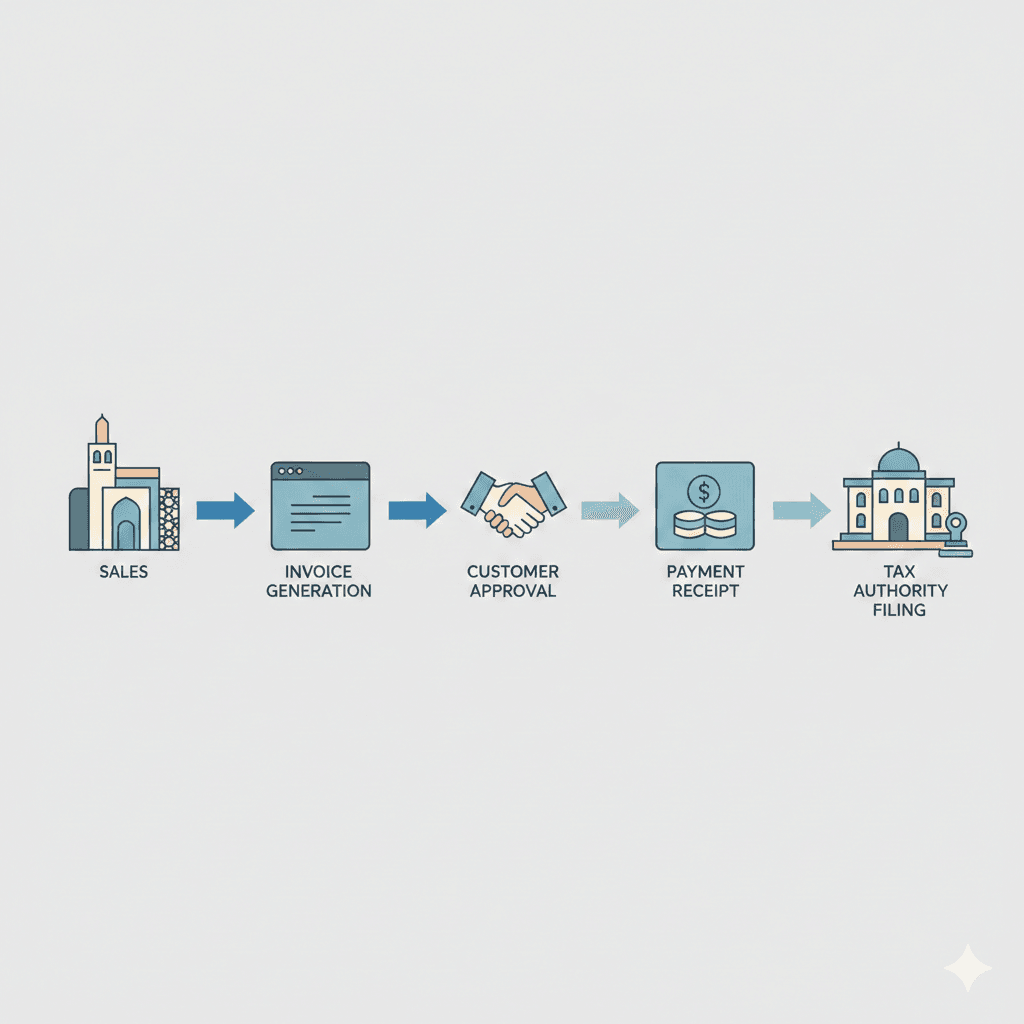

Understanding VAT Recordkeeping Requirements in Muscat

Why accurate recordkeeping is critical for VAT compliance

VAT recordkeeping in Muscat is a fundamental responsibility for any business subject to Value Added Tax (VAT) under Oman’s tax laws. Maintaining precise and comprehensive records ensures that businesses can accurately report VAT on taxable supplies, claim valid input VAT deductions, and meet regulatory obligations. The Oman Tax Authority mandates that all VAT-registered entities keep detailed records of their transactions, which form the basis for VAT returns and audits. For SMEs and entrepreneurs operating in Muscat, understanding exactly what documents to retain and how to organize them is critical to avoiding penalties or disputes. Effective VAT recordkeeping is not merely a bureaucratic formality but a strategic practice that supports accurate financial management and transparency.

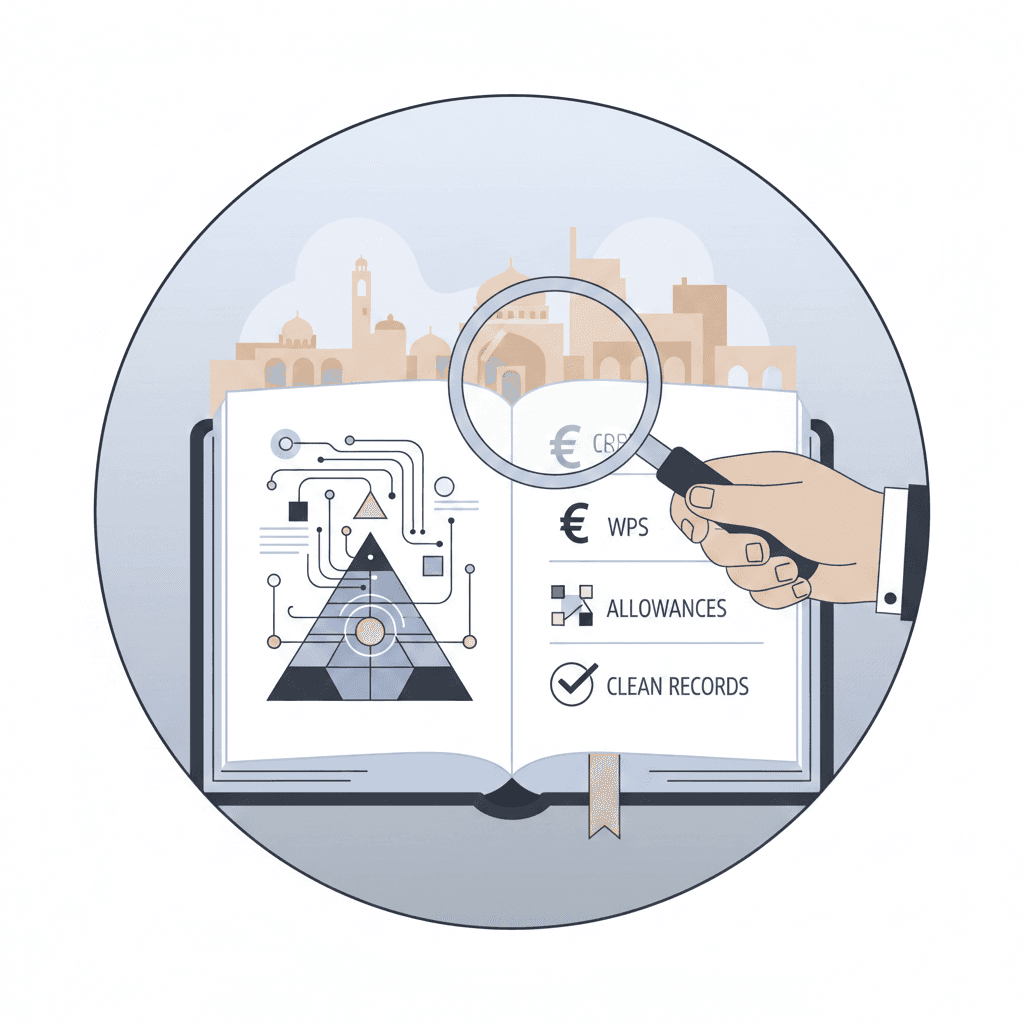

Types of Documents Businesses Must Retain

Comprehensive documentation for compliance and verification

For businesses in Muscat, VAT recordkeeping involves preserving a variety of documents that prove the occurrence and value of taxable transactions. These typically include sales invoices issued to customers, purchase invoices from suppliers, credit and debit notes, import and export documents, and receipts related to expenses. Each document must clearly state the VAT amount charged or paid and align with the details reported on VAT returns. Additionally, businesses should maintain bank statements, contracts, and accounting records that support the VAT figures declared. SMEs must ensure these records are legible, accurate, and stored in a manner that facilitates easy retrieval during audits or inspections by the Oman Tax Authority. Proper documentation reduces the risk of discrepancies and enhances confidence during tax reviews.

Retention Periods: How Long Must Records Be Kept?

Legal timelines for document retention under Omani VAT law

In Muscat, VAT recordkeeping rules specify a minimum retention period for all tax-related documents. According to the Oman Tax Authority guidelines, businesses must retain their VAT records for at least 10 years from the end of the tax period to which they relate. This extended timeframe reflects the Authority’s right to conduct retrospective audits and investigations, ensuring long-term compliance. For SMEs, this means that recordkeeping systems must be robust enough to securely store financial documents over a decade, either in physical or electronic form. Failure to comply with these retention requirements can lead to severe penalties, including fines and increased scrutiny. Therefore, adopting reliable archival practices early on safeguards businesses from future compliance risks.

Implementing Efficient VAT Recordkeeping Systems

Tools and processes tailored for Muscat’s SME landscape

Given the complexity and volume of documents required for VAT compliance, SMEs in Muscat should invest in structured recordkeeping systems. Many businesses benefit from integrating accounting software that automatically tracks invoices, payments, and VAT calculations, streamlining the process while reducing errors. Digital solutions not only facilitate compliance with retention rules but also improve accessibility during tax reporting periods. Leaderly’s advisory services emphasize the importance of adopting scalable recordkeeping frameworks aligned with Oman’s VAT regulations, tailored to the size and nature of each business. By establishing organized and automated workflows, companies can minimize administrative burdens and focus on core operations while staying audit-ready.

Risks of Poor VAT Recordkeeping and How to Mitigate Them

Financial and legal consequences of non-compliance in Oman

Inadequate VAT recordkeeping poses significant risks for businesses in Muscat, ranging from inaccurate tax filings to penalties imposed by the Oman Tax Authority. Errors or missing documents may trigger audits, adjustments, or fines, which can strain SMEs’ financial resources and damage reputations. Furthermore, poor recordkeeping compromises a company’s ability to claim legitimate input VAT refunds, directly impacting cash flow. To mitigate these risks, business owners must prioritize compliance by regularly reviewing their documentation practices, conducting internal audits, and seeking expert advice when necessary. Leaderly’s audit and taxation teams can support SMEs by identifying weaknesses in their recordkeeping and recommending corrective actions aligned with local regulations.

The Strategic Value of VAT Recordkeeping Beyond Compliance

How proper recordkeeping supports business growth and financial clarity

While VAT recordkeeping is a legal requirement in Muscat, it also offers practical benefits that extend beyond tax compliance. Well-maintained VAT records provide business owners and finance managers with detailed insights into cash flow, cost structures, and customer trends. This financial clarity supports more informed decision-making, budgeting, and forecasting, which are critical for SMEs aiming to scale operations. Additionally, accurate records simplify processes such as business valuation, due diligence for investments, or liquidation scenarios. Leaderly’s advisory expertise underscores that VAT recordkeeping is not just a compliance obligation but a valuable business tool that contributes to sustainable growth in Oman’s competitive marketplace.

In summary, VAT recordkeeping in Muscat is a multifaceted responsibility that demands diligence and strategic planning from SMEs and entrepreneurs. By understanding the specific documentation requirements, adhering to retention timelines, and implementing efficient systems, businesses can not only meet Oman’s tax obligations but also enhance their operational resilience. Robust VAT recordkeeping mitigates risks of penalties and supports clearer financial management, empowering SMEs to navigate the evolving tax landscape with confidence. With expert guidance and modern tools, companies can transform VAT compliance from a burdensome task into a competitive advantage that fuels growth and stability in Muscat’s dynamic business environment.

For business owners and finance professionals, embracing meticulous VAT recordkeeping is a practical investment in long-term success. Aligning with Leaderly’s audit, accounting, and advisory services provides tailored support to navigate these complexities seamlessly. Ultimately, effective VAT recordkeeping protects businesses from regulatory setbacks while unlocking valuable financial insights, enabling SMEs in Muscat to thrive sustainably and with clarity.

#Leaderly #VATRecordkeepinginMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit