Darsait Inventory Audits: Enhancing Retail Chains and Mini-Mart Efficiency in Oman

Understanding the Importance of Darsait Inventory Audits

Darsait inventory audits are essential for retail chains and mini-marts in this vibrant commercial area of Muscat, serving as a key driver of business success. For SMEs competing in this dynamic market, maintaining precise and reliable stock records goes beyond routine operations—it becomes a vital strategic asset. These audits deliver a comprehensive review of stock quantities, identify discrepancies, and assess valuation accuracy, helping retailers minimize losses due to shrinkage, errors, or fraud. In addition to safeguarding profit margins, Darsait inventory audits ensure that businesses meet Oman’s stringent regulatory obligations, particularly as VAT and new corporate tax regulations require increasingly detailed inventory documentation.

Retailers in Darsait often juggle multiple outlets and product lines, making manual inventory tracking prone to errors. Audits conducted by professionals bring objectivity and expertise, identifying gaps in inventory control systems and suggesting improvements. With Oman’s tax authorities placing greater emphasis on accurate stock valuation during tax filings, regular inventory audits become indispensable. They enable businesses to substantiate their reported figures, thereby reducing the risk of penalties and audits from tax authorities.

Moreover, inventory audits in Darsait contribute to better decision-making for retail chains and mini-marts. By uncovering patterns such as excess stock, slow-moving items, or potential supply chain inefficiencies, these audits empower owners to optimize ordering, pricing, and promotional strategies. Thus, Darsait inventory audits serve not only as a compliance tool but also as a critical element in driving operational excellence and business growth within Oman’s retail sector.

Common Challenges Faced by Retail Chains and Mini-Marts in Darsait

Operating retail chains and mini-marts in Darsait comes with specific challenges that complicate inventory management. One major issue is stock shrinkage, caused by theft, damage, or administrative errors. In a densely populated commercial area, the risk of pilferage increases, and without systematic audits, such losses can go unnoticed for extended periods. This directly erodes profitability and distorts financial reporting, creating a need for rigorous inventory checks tailored to local market conditions.

Another challenge lies in the complexity of product assortment. Many mini-marts in Darsait carry a wide range of fast-moving consumer goods alongside specialty items. Managing diverse inventories across multiple locations without automated or standardized systems often leads to discrepancies between physical stock and accounting records. This not only affects cash flow management but also undermines compliance with Oman’s VAT regulations, which require precise tracking of taxable goods.

Finally, small and medium enterprises in Darsait often lack dedicated inventory specialists, relying instead on operational staff who may not have the technical expertise to implement effective inventory controls. This human resource limitation increases the risk of errors and delays in stock reconciliation. Inventory audits performed by qualified auditors help bridge this gap, offering objective insights and practical recommendations that align with Oman’s evolving business compliance landscape.

Implementing Effective Inventory Audit Practices in Darsait

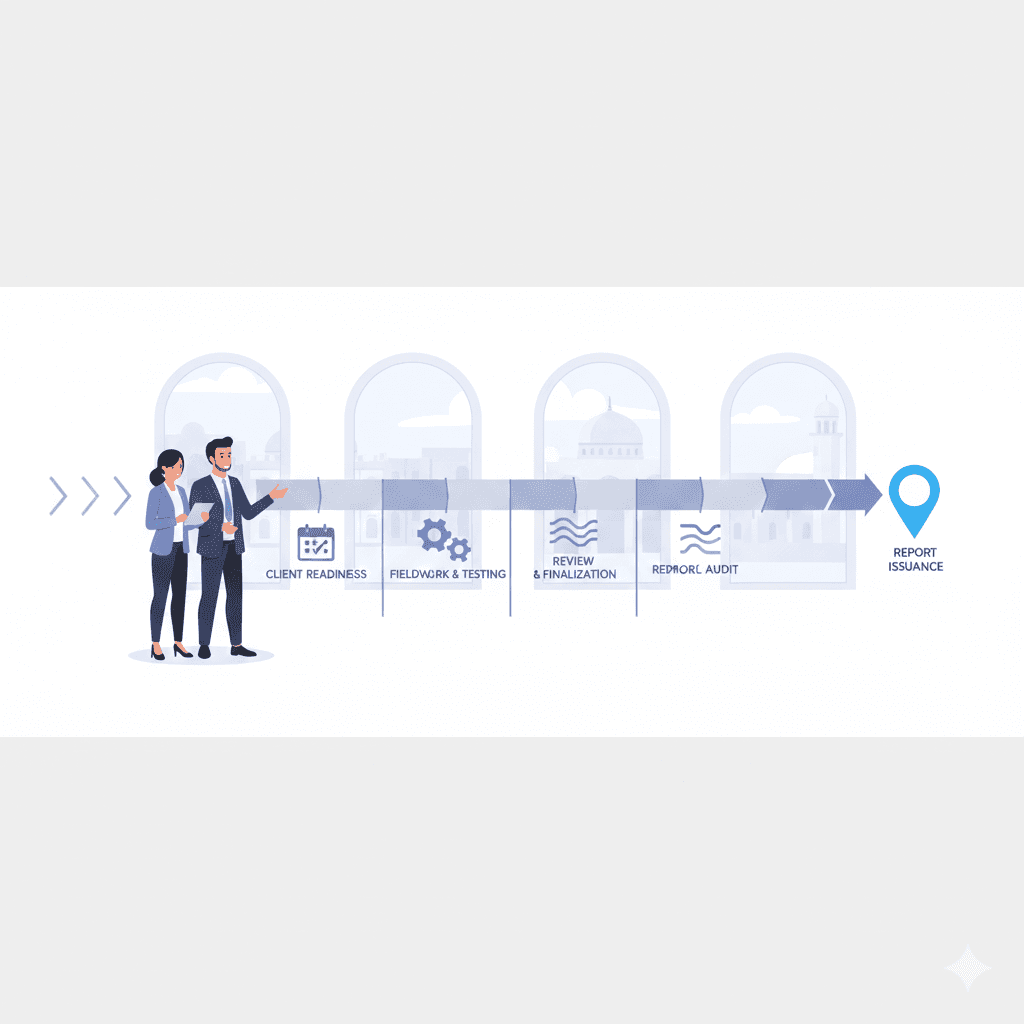

For retail chains and mini-marts in Darsait, establishing a robust inventory audit process starts with setting clear objectives aligned with business goals and regulatory requirements. This involves defining audit scopes that cover physical stock counts, valuation methods, and compliance with VAT and corporate tax laws. Partnering with experienced audit professionals, such as those at Leaderly, ensures adherence to Oman-specific financial standards and industry best practices.

Technology integration plays a pivotal role in enhancing audit effectiveness. Utilizing inventory management software equipped with barcode scanning and real-time data updates facilitates accurate stock tracking. During audits, such systems streamline verification processes and help identify discrepancies more swiftly. Retailers in Darsait benefit from combining these tools with periodic professional audits to maintain continuous control over their inventories.

Additionally, ongoing training for store staff and management about inventory control principles is vital. Auditors often recommend implementing internal controls such as segregation of duties, regular cycle counts, and reconciliation procedures tailored to the local retail environment. These measures not only improve data reliability but also foster a culture of accountability, ultimately strengthening financial reporting and tax compliance in line with Oman’s regulatory frameworks.

Financial and Tax Implications of Inventory Audits for Darsait SMEs

Inventory audits directly impact the financial health of retail chains and mini-marts in Darsait by ensuring accurate valuation of stock, which is a critical component of the cost of goods sold (COGS) and, consequently, profitability. Errors or inconsistencies in inventory reporting can misstate profits, affecting tax liabilities and potentially leading to disputes with Oman’s tax authorities. By performing detailed audits, SMEs can confidently present their financial statements, backed by verifiable stock data.

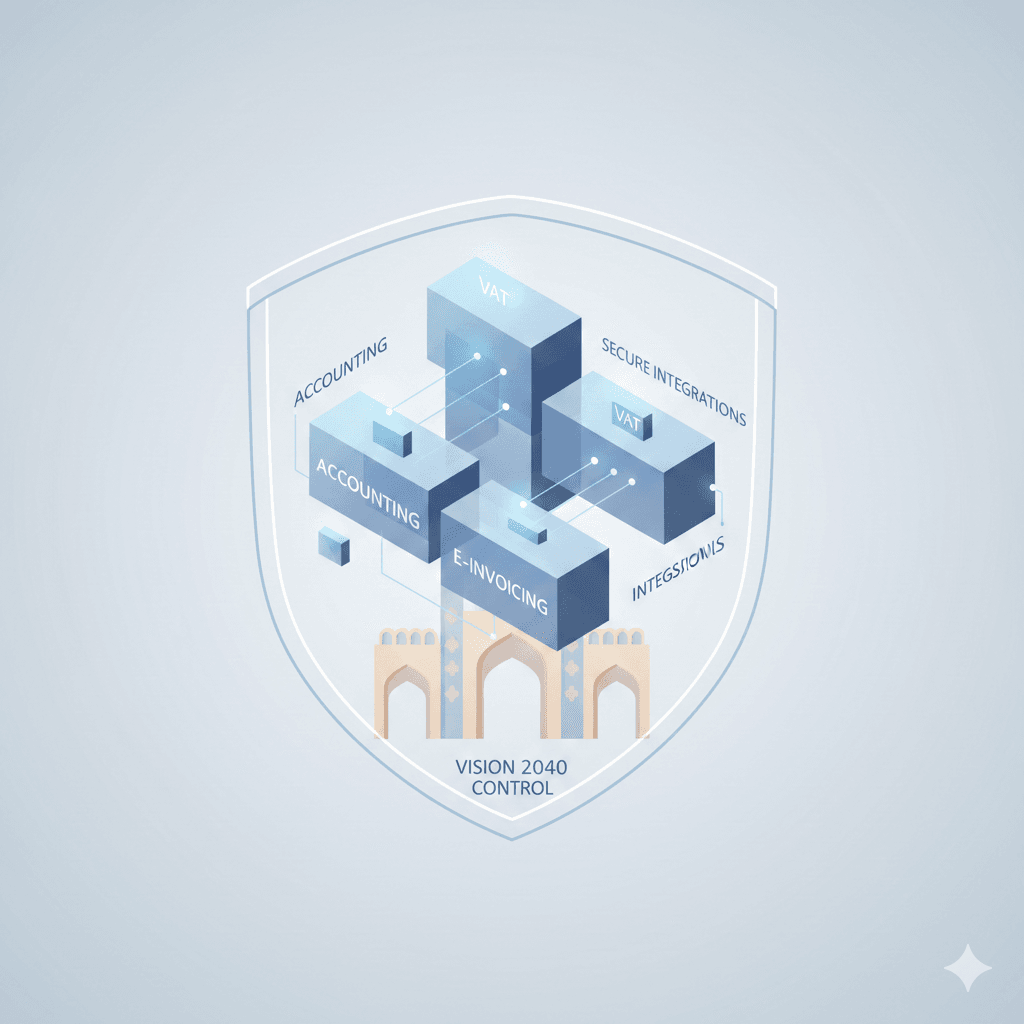

Moreover, with the implementation of VAT in Oman at a 5% rate, maintaining precise inventory records has become more complex yet crucial. VAT on purchases and sales requires correct documentation, and discrepancies in inventory figures can trigger tax audits or penalties. Inventory audits provide the documentation trail needed to reconcile VAT returns, minimizing risks and ensuring smooth compliance for retail businesses in Darsait.

Corporate tax regulations, which are evolving in Oman, further underline the importance of inventory accuracy. As taxable income calculations include inventory adjustments, SME owners must rely on audit-verified stock valuations to avoid underreporting profits or overpaying taxes. Professional advisory services offered by firms like Leaderly support SMEs in navigating these financial and tax complexities, offering assurance that their inventory data withstands scrutiny from tax authorities.

Enhancing Business Performance Through Strategic Inventory Audits

Beyond compliance, Darsait inventory audits serve as strategic tools that enhance overall business performance for retail chains and mini-marts. By identifying inefficiencies and areas of stock loss, audits enable business owners to optimize their inventory turnover rates, reduce holding costs, and improve cash flow management. This is particularly important in Darsait’s competitive retail market, where margins can be tight and agility is key.

Audits also contribute to better supplier relationships. Accurate inventory data helps retailers in Darsait negotiate more effectively with suppliers, ensuring timely replenishment and reducing the risk of stockouts or overstocking. This operational efficiency translates to improved customer satisfaction and higher sales, both essential factors for sustainable growth in Oman’s retail landscape.

Finally, incorporating regular inventory audits into business planning provides SMEs with reliable data for financial forecasting and investment decisions. It enables retail owners to evaluate product performance objectively and make informed choices regarding expansion or diversification. This proactive approach aligns with Leaderly’s advisory services, which emphasize feasibility and valuation studies to support confident decision-making within Oman’s evolving economic context.

Fostering Sustainable Growth with Expert Inventory Audit Support

For SMEs in Darsait, collaborating with professional audit and advisory firms brings a significant advantage in managing inventory complexities. Expert auditors bring technical knowledge and Oman-specific regulatory awareness, ensuring that inventory audits deliver maximum value beyond routine compliance. This partnership allows business owners to focus on core operations while mitigating risks related to stock mismanagement.

Leaderly’s integrated audit, tax, and advisory services offer tailored solutions that address the unique challenges faced by retail chains and mini-marts in Darsait. From VAT compliance to corporate tax preparation and operational feasibility assessments, their expertise supports SMEs in building resilient, transparent, and growth-oriented businesses. Such collaboration fosters a sustainable retail environment in Darsait, encouraging innovation and professionalism within Oman’s SME sector.

Ultimately, Darsait inventory audits are not merely a regulatory necessity but a strategic investment in long-term success. By adopting rigorous audit practices, retail chains and mini-marts can enhance financial accuracy, optimize operations, and confidently navigate Oman’s evolving tax landscape — all of which are essential for sustainable growth in the competitive Muscat market.

#Leaderly #DarsaitInventoryAudits #Oman #Muscat #SMEs #Accounting #Tax #Audit