Liquidation Advisory in Muscat: Navigating the Path with Legal and Financial Precision

Understanding Liquidation Advisory in Muscat

The foundation of a successful business closure

Liquidation advisory in Muscat plays a critical role for businesses seeking to close operations in a structured and compliant manner. Unlike simple business closure, liquidation involves legally winding up a company’s affairs, settling debts, and distributing remaining assets according to Oman’s regulatory framework. For SMEs and entrepreneurs in Muscat, understanding this process is essential to avoid legal complications and financial losses. The advisory services provide expert guidance on each stage, from initiating liquidation to final deregistration with authorities such as the Ministry of Commerce and Industry (MOCI). This ensures a smooth transition that preserves the owner’s reputation and mitigates risks associated with improper closure.

In Oman, liquidation is often a complex procedure due to strict compliance requirements involving creditors, shareholders, and government bodies. Liquidation advisory in Muscat helps companies navigate these complexities by offering tailored advice aligned with Omani commercial laws. This includes strategic planning to optimize asset realization, managing creditor negotiations, and ensuring tax obligations are accurately fulfilled. Effective liquidation advisory safeguards business owners and finance managers against unexpected liabilities and sanctions. Therefore, relying on expert advisory is not merely beneficial but a necessary step for responsible and legal business closure in Muscat.

Furthermore, liquidation advisory extends beyond compliance to financial clarity. Advisors assess the company’s financial health, cash flow status, and outstanding obligations to design a roadmap that maximizes value for stakeholders. This approach ensures that SMEs can make informed decisions, whether opting for voluntary liquidation due to insolvency or compulsory liquidation mandated by courts or regulators. For entrepreneurs operating in Oman, partnering with a knowledgeable advisor provides reassurance that their exit strategy is legally sound and financially optimized.

The Legal Framework Governing Liquidation Advisory in Muscat

Key regulations shaping the process

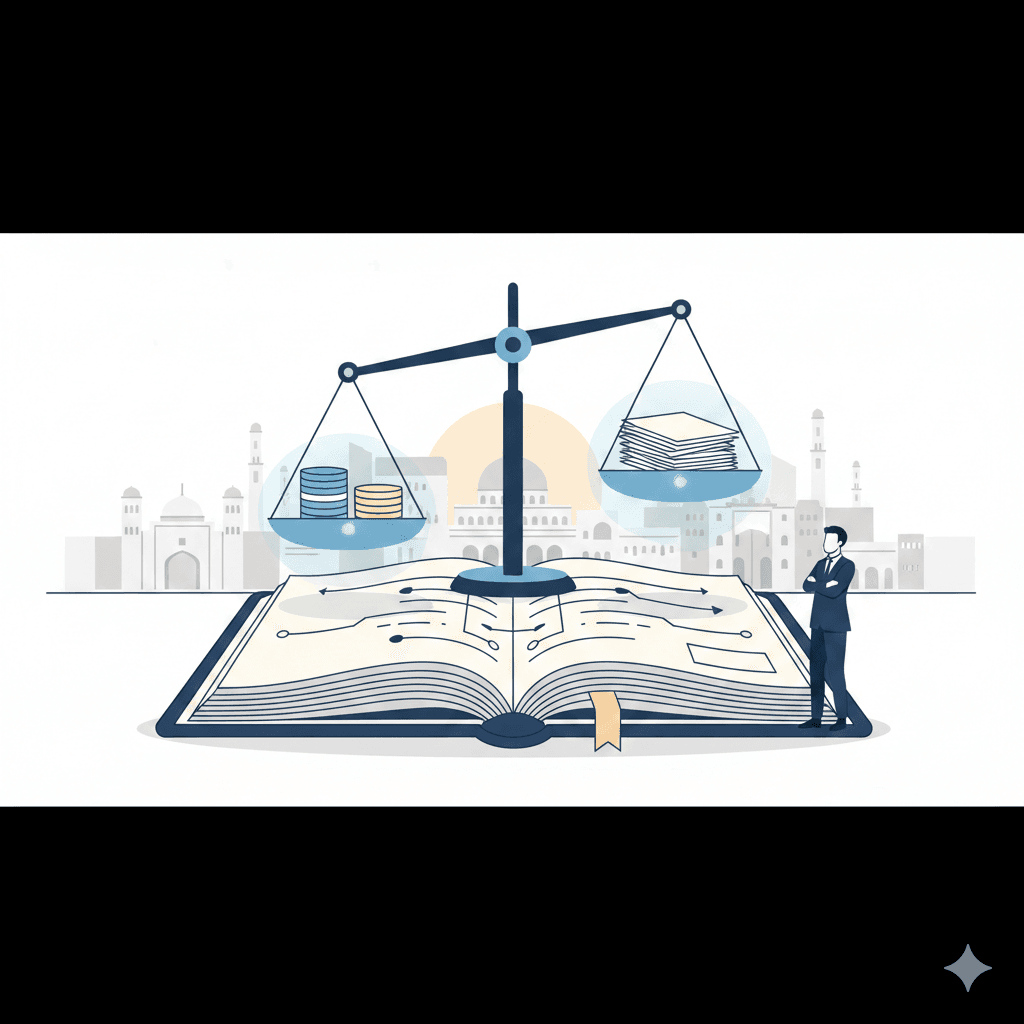

The legal environment in Muscat governing liquidation is anchored primarily in the Omani Commercial Companies Law and related regulations enforced by the MOCI. Liquidation advisory in Muscat offers detailed interpretation of these laws, which prescribe the procedural and documentary requirements for liquidation. This legal framework ensures protection for creditors while providing a clear exit for business owners. Advisors guide clients through the statutory requirements such as shareholder approvals, publication of liquidation notices, and submission of final financial statements to authorities.

Another important aspect of liquidation advisory in Muscat is the understanding of tax implications under Omani law. VAT and corporate tax considerations are integral during liquidation, as unresolved tax liabilities can result in penalties or prolonged legal entanglements. An advisor familiar with Oman’s evolving tax system can ensure accurate filings and negotiations with the Tax Authority to prevent costly disputes. Additionally, advisors keep clients abreast of new regulations, such as those related to corporate governance and anti-money laundering, which increasingly impact the liquidation process in Oman.

Moreover, advisors assist in managing relationships with creditors and other stakeholders. Oman’s liquidation law mandates transparent communication and equitable treatment of creditors, requiring detailed reporting and adherence to timelines. Through professional advisory, business owners in Muscat learn how to prepare liquidation committees and negotiate settlements, reducing the risk of litigation or claims after closure. Thus, legal compliance combined with strategic stakeholder management forms the core of effective liquidation advisory in Muscat, safeguarding the interests of SMEs and entrepreneurs.

Financial Planning and Valuation in Liquidation Advisory in Muscat

Ensuring maximum value recovery for SMEs

A critical dimension of liquidation advisory in Muscat is robust financial planning that underpins the entire liquidation strategy. Advisors conduct thorough assessments of the company’s assets, liabilities, and ongoing financial obligations. This valuation process is key to determining the feasible timeline for liquidation and the best approach for asset realization. In Oman’s SME landscape, where assets may range from tangible property to intangible goodwill, precise valuation ensures that owners receive a fair settlement and minimize losses.

Advisors also help design cash flow plans during liquidation to meet immediate creditor demands while sustaining essential operations for as long as necessary. This careful financial balancing prevents premature insolvency declarations and maximizes creditor recoveries. Additionally, liquidation advisory incorporates tax planning to manage VAT refunds, corporate tax clearances, and other financial settlements, ensuring that the company meets all fiscal responsibilities before deregistration.

Furthermore, detailed due diligence is essential to avoid hidden liabilities that could surface post-liquidation. Advisors in Muscat work closely with accountants and auditors to audit financial statements and validate asset ownership. This transparent approach protects SMEs from future disputes and contributes to a clean exit. By aligning financial planning with legal requirements, liquidation advisory in Muscat provides SMEs with a comprehensive framework that safeguards their financial and reputational standing throughout the closure process.

Practical Challenges in Liquidation Advisory for Muscat SMEs

Addressing common pitfalls and complexities

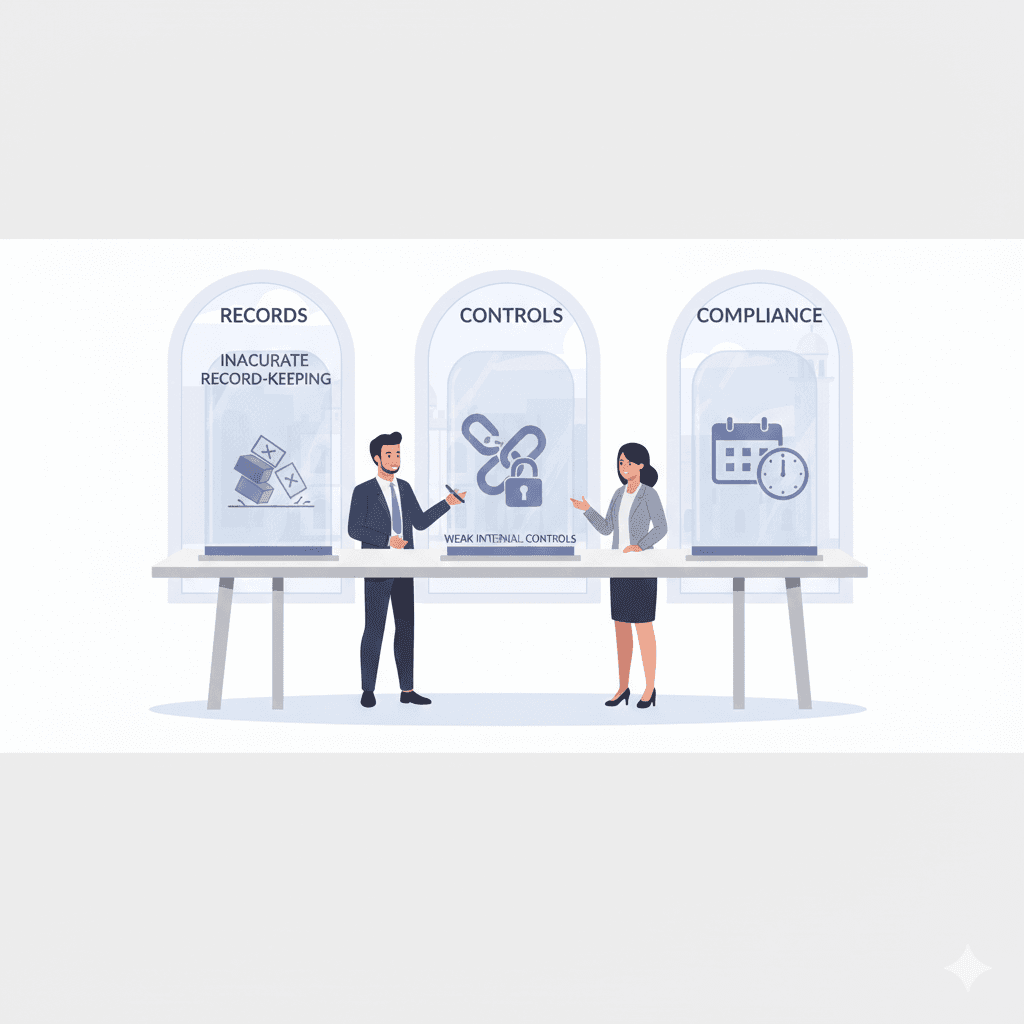

Despite the structured legal and financial frameworks, SMEs in Muscat often face practical challenges during liquidation that require expert advisory intervention. One major challenge is managing creditor expectations, especially in cases where liabilities exceed asset values. Advisors help by facilitating negotiations, structuring repayment plans, or guiding companies through insolvency procedures that comply with Omani law. This minimizes conflicts and potential litigation, which can drain resources and extend the closure timeline.

Another complexity is the administrative burden of documentation and approvals from multiple government bodies. Liquidation advisory in Muscat provides project management expertise, ensuring all filings, notifications, and statutory submissions are timely and accurate. This reduces the risk of administrative delays or penalties. The dynamic regulatory environment in Oman, with frequent updates to commercial and tax laws, also necessitates continuous legal and fiscal monitoring—a service that professional advisors are uniquely positioned to deliver.

Moreover, SMEs may struggle with internal communication and stakeholder coordination during liquidation. Advisory services include guidance on effective communication strategies to keep shareholders, employees, and suppliers informed and engaged. This transparency helps maintain goodwill and ensures smoother transitions for all parties involved. By anticipating and resolving these practical challenges, liquidation advisory in Muscat offers SMEs a comprehensive and actionable roadmap tailored to the realities of the Omani business environment.

The Role of Leaderly in Liquidation Advisory in Muscat

Expertise tailored for Oman’s SME ecosystem

Leaderly has established itself as a trusted partner for businesses navigating liquidation in Muscat by combining local expertise with comprehensive advisory services. Their team of specialists understands the nuances of Oman’s legal and financial systems, enabling them to craft personalized liquidation strategies that align with client objectives and regulatory demands. Leaderly’s advisory includes audit support, accounting clarity, tax compliance, and business valuation to ensure every aspect of the liquidation is managed meticulously.

By working closely with entrepreneurs, business owners, and finance managers, Leaderly provides practical solutions that not only meet statutory requirements but also maximize financial outcomes. Their advisory approach emphasizes transparency, accuracy, and timeliness—qualities essential for successful liquidation in Muscat’s competitive market. Furthermore, Leaderly’s holistic understanding of SME challenges ensures that advisory services extend beyond technical guidance to include strategic risk management and post-liquidation support.

Through its strong presence in Muscat, Leaderly also facilitates effective communication with government bodies and stakeholders, smoothing the administrative process for clients. Their integrated advisory model reflects the evolving needs of Oman’s business community, making them a valuable resource for SMEs facing the complexities of liquidation. Leaderly’s commitment to legal and financial excellence empowers businesses to exit with confidence, ensuring compliance, clarity, and control throughout the liquidation journey.

Preparing for Liquidation: Steps for SMEs in Muscat

A proactive approach to business closure

Effective liquidation advisory in Muscat encourages SMEs to prepare proactively for business closure by conducting early feasibility assessments. This includes evaluating financial health, identifying potential legal risks, and planning creditor negotiations well in advance. SMEs that engage advisory services early can avoid rushed decisions and costly errors, setting a solid foundation for smooth liquidation. Preparing all financial records, contracts, and statutory documentation beforehand also expedites the process and facilitates transparency.

Another critical preparatory step is understanding the tax implications of liquidation. Businesses in Muscat must settle outstanding VAT and corporate tax liabilities and ensure all filings are complete. Liquidation advisory services help identify tax benefits or reliefs available during closure, enabling SMEs to optimize their tax position. Early communication with tax authorities through advisors can prevent disputes and delays in deregistration.

Finally, SMEs should consider the human element during liquidation, including employee rights and obligations under Omani labor law. Advisors provide guidance on lawful termination processes, final settlements, and communication strategies to maintain goodwill. This holistic preparation reduces post-liquidation risks and ensures that all stakeholders are treated fairly. By taking a comprehensive, informed approach, SMEs in Muscat can navigate liquidation efficiently while preserving their financial and reputational integrity.

Liquidation advisory in Muscat offers SMEs and entrepreneurs a crucial pathway to exit their businesses with legal certainty and financial clarity. By understanding the local regulatory environment, managing practical challenges, and leveraging expert advisory from firms like Leaderly, companies can ensure compliance and maximize value recovery. This structured approach mitigates risks, enhances transparency, and facilitates a controlled closure process aligned with Oman’s commercial and tax laws.

For business owners in Muscat, proactive engagement with liquidation advisory services is more than a legal requirement; it is a strategic decision that safeguards their legacy and future ventures. With tailored financial planning, stakeholder management, and regulatory compliance, SMEs can confidently navigate the complexities of liquidation. This comprehensive advisory framework empowers entrepreneurs to close operations responsibly while positioning themselves for new opportunities in Oman’s evolving business landscape.

#Leaderly #LiquidationAdvisoryinMuscat #Oman #Muscat #SMEs #Accounting #Tax #Audit