Muscat SME internal control systems for simple, practical fraud prevention

Muscat SME internal control systems as a foundation for trust

Why internal controls matter in the Omani SME environment

Muscat SME internal control systems are often misunderstood as complex frameworks designed only for large corporations, yet in Oman’s SME landscape they are best viewed as simple, disciplined ways of working that protect owners from avoidable losses. Many founders in Muscat rely on trust, family involvement, and long-standing staff relationships, which are cultural strengths, but these should not replace basic control structures. Internal controls exist to ensure that no single individual has unchecked authority over cash, records, and approvals. In practice, this means separating responsibilities, documenting decisions, and creating visibility for owners who cannot be present every day. In Oman, where SMEs often scale quickly due to government incentives and private sector demand, growth without controls creates blind spots. These blind spots expose businesses to fraud, errors, and regulatory non-compliance, particularly in VAT reporting and financial disclosures. When controls are introduced early, they create a culture of accountability rather than suspicion. Staff understand expectations, management gains confidence in reported figures, and external stakeholders such as banks and auditors see a business that is managed responsibly. For Leaderly clients, this foundation often becomes the starting point for stronger financial discipline and sustainable expansion.

Designing practical Muscat SME internal control systems

Keeping controls simple and workable for small teams

Effective Muscat SME internal control systems are not built from templates copied from multinational companies; they are designed around the realities of small teams and limited resources. The key is proportionality. A trading SME in Muscat with five employees does not need layers of approvals, but it does need clarity on who raises invoices, who records payments, and who reviews bank reconciliations. Simple written procedures, even one-page guidelines, can dramatically reduce risk. Controls should focus on high-risk areas such as cash handling, procurement, payroll, and VAT documentation. For example, requiring dual review for supplier payments or periodic independent checks on inventory can prevent long-term losses. In Oman, many SMEs outsource bookkeeping, which adds another layer of control if managed correctly. Owners should ensure they receive monthly management reports and understand them at a high level. This is where advisory support becomes valuable, translating numbers into insights rather than just compliance outputs. Well-designed internal controls support accurate accounting records, smoother audits, and fewer surprises during tax reviews, all while remaining practical for daily operations.

Embedding Muscat SME internal control systems into daily operations

Turning controls into habits rather than obstacles

The success of Muscat SME internal control systems depends less on documentation and more on consistent application. Controls fail when they are seen as administrative burdens rather than business safeguards. For SMEs in Muscat, embedding controls into daily routines makes them sustainable. This could involve weekly cash position reviews by the owner, monthly reconciliation meetings, or quarterly reviews of expense patterns. Technology also plays a role, as cloud accounting systems and banking integrations reduce manual intervention and improve transparency. However, systems alone are not enough; people must understand why controls exist. Training staff on basic financial awareness fosters cooperation and reduces resistance. In Oman’s close-knit business environment, open communication about controls reinforces trust rather than undermining it. From an advisory perspective, internal controls also prepare SMEs for future milestones such as valuation exercises, due diligence for investors, or even business exit planning. Businesses with embedded controls are easier to assess and carry lower perceived risk. Over time, these habits create operational resilience and allow owners to focus on strategy rather than constant supervision.

Muscat SME internal control systems and fraud risk awareness

Understanding common fraud scenarios in local SMEs

Muscat SME internal control systems are most valuable when they address realistic fraud risks rather than hypothetical threats. In Oman, common issues include manipulation of petty cash, inflated supplier invoices, ghost employees, and unauthorized discounts to customers. These risks are not signs of poor character; they often arise from weak oversight and informal processes. SMEs that grow rapidly without updating controls inadvertently create opportunities for abuse. Fraud prevention starts with awareness. Owners should periodically assess where money enters and leaves the business and identify points where one person controls an entire process. Simple measures such as rotating duties, mandatory leave policies, and independent review of exception transactions can deter misconduct. Importantly, controls should be documented and communicated clearly so that expectations are understood. From an audit perspective, businesses with clear controls face fewer disruptions and faster audits. Tax authorities also view consistent records favorably during VAT or corporate tax reviews. By addressing fraud risk proactively, SMEs protect not only their finances but also their reputation within Muscat’s interconnected business community.

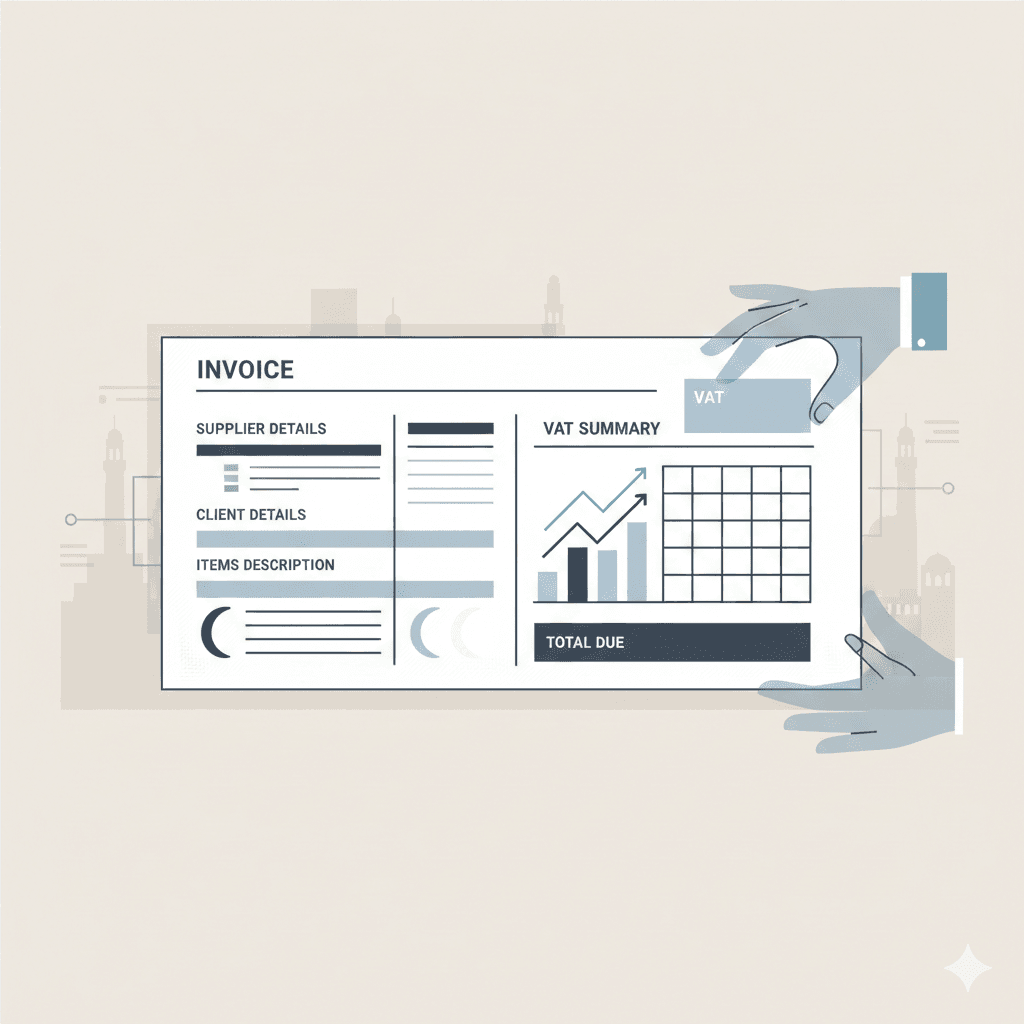

Aligning Muscat SME internal control systems with regulatory expectations

Supporting compliance without overcomplication

Muscat SME internal control systems play a critical role in meeting Omani regulatory requirements without overwhelming management. Compliance with VAT, corporate tax, and financial reporting depends on reliable source data, timely recording, and proper review. Internal controls ensure that transactions are captured accurately and supporting documents are retained. For SMEs, this reduces last-minute pressure before filing deadlines and minimizes the risk of penalties. Controls also support transparency when dealing with banks, investors, or government entities. Rather than reacting to compliance issues, businesses with strong controls anticipate them. Advisory support often focuses on aligning controls with regulatory changes, helping SMEs adjust processes as rules evolve. This alignment is not about rigid compliance checklists but about building systems that naturally produce compliant outcomes. In Muscat, where regulatory awareness among SMEs is improving, internal controls are becoming a marker of maturity. They signal that a business is serious about governance and long-term sustainability, which enhances credibility in competitive markets.

Scaling Muscat SME internal control systems as the business grows

Adapting controls to new risks and opportunities

Muscat SME internal control systems must evolve alongside business growth. Controls that work for a start-up may become inadequate once transaction volumes increase or operations expand beyond Muscat. Scaling controls does not mean adding bureaucracy; it means reassessing risks and reallocating responsibilities. As SMEs hire new staff or enter new markets, segregation of duties becomes easier and more effective. Periodic internal reviews, supported by external advisors, help identify gaps before they become costly issues. For businesses considering mergers, valuations, or liquidation planning, documented controls significantly improve outcomes. They provide confidence in financial data and reduce the time required for due diligence. Leaderly often supports SMEs at these transition points, helping them refine controls to match their strategic direction. By viewing internal controls as living systems rather than static rules, Omani SMEs can grow with confidence, knowing that their foundations remain strong.

Strong internal controls are not about mistrust or excessive formality; they are about clarity, discipline, and protection. For SMEs in Muscat, simple systems implemented early can prevent significant financial and operational damage later. When controls are practical and aligned with daily operations, they empower owners with reliable information and reduce dependence on constant oversight. This creates space for strategic thinking and informed decision-making.

As Oman’s SME sector continues to mature, businesses that invest in internal controls position themselves for resilience and credibility. Whether preparing for audits, managing tax obligations, or exploring future growth opportunities, well-designed controls deliver long-term value. With the right advisory perspective, internal controls become an asset rather than a constraint, supporting sustainable success in Muscat’s evolving business environment.

#Leaderly #MuscatSMEInternalControlSystems #Oman #Muscat #SMEs #Accounting #Tax #Audit