Muscat Payroll WPS Compliance as a Practical Guide to Allowances and Accurate Records

Muscat Payroll WPS Compliance and the Role of WPS in Oman

Understanding why payroll discipline matters for SMEs

Muscat Payroll WPS Compliance is often misunderstood by small and medium-sized businesses as a purely technical banking requirement, when in reality it is a core governance obligation under Omani labour regulations. The Wage Protection System exists to ensure that employee salaries are paid in full, on time, and through approved financial channels. For SMEs in Muscat, this means that payroll is no longer an informal monthly exercise but a regulated process that leaves a clear digital trail. When salaries are uploaded incorrectly, delayed, or mismatched against contracts, the issue quickly escalates from an internal error to a compliance risk. Many business owners discover this only when faced with blocked MOL services or employee complaints. Muscat Payroll WPS Compliance therefore begins with understanding that WPS files are not isolated spreadsheets but formal declarations of how your company treats its workforce. Clean data, correct employee identifiers, and alignment with labour contracts are essential. From an advisory perspective, disciplined payroll also supports accurate accounting, as salary costs feed directly into financial statements, VAT considerations, and future corporate tax assessments. SMEs that treat WPS seriously from day one build credibility with regulators, banks, and potential investors.

Muscat Payroll WPS Compliance in Structuring Salaries and Allowances

Balancing flexibility with regulatory clarity

Muscat Payroll WPS Compliance becomes more complex when allowances enter the picture, particularly in Oman where salary packages often include housing, transport, or other fixed benefits. For SMEs, the challenge is not offering allowances but documenting them clearly and paying them consistently. Each allowance must be defined in the employment contract and reflected accurately in the WPS salary file. Problems arise when businesses pay part of the compensation off-cycle or outside the WPS channel, assuming flexibility is acceptable. In Muscat, this practice exposes companies to disputes and audit findings, as the WPS record becomes the authoritative reference. Muscat Payroll WPS Compliance requires that basic salary and allowances are structured in a way that matches labour contracts, payroll registers, and bank files. From a financial management standpoint, well-structured allowances also support clean expense classification and realistic cost forecasting. Advisors frequently see SMEs overstating profitability simply because payroll components are inconsistently recorded. By aligning allowances properly within WPS, business owners gain clearer visibility into their true employment costs and avoid corrective adjustments later during audits or due diligence exercises.

Muscat Payroll WPS Compliance and Monthly Payroll Execution

Reducing errors through process discipline

Executing payroll on a monthly basis is where Muscat Payroll WPS Compliance is either reinforced or undermined. SMEs often rely on a single individual to prepare salaries, upload WPS files, and process payments, increasing the risk of error if controls are weak. Simple issues such as incorrect IBANs, misapplied leave deductions, or outdated salary figures can cause WPS rejections. Each rejection delays payment and creates employee dissatisfaction, while repeated issues attract regulatory scrutiny. Muscat Payroll WPS Compliance depends on having a repeatable process that includes data verification, approval checkpoints, and reconciliation after payment. This is not about bureaucracy but about protecting the business. When payroll execution is disciplined, salary expenses reconcile cleanly with accounting records, reducing year-end surprises. From an advisory lens, SMEs with strong payroll execution are easier to support during audits or tax reviews because their salary data is reliable. Consistency also builds trust internally, as employees see that payments are predictable and transparent, reinforcing stability in growing Muscat-based businesses.

Muscat Payroll WPS Compliance and Clean Payroll Records

Why documentation matters beyond payment

Muscat Payroll WPS Compliance does not end once salaries are paid; it extends into how payroll records are maintained and stored. Clean payroll records include employment contracts, salary breakdowns, WPS confirmation reports, leave balances, and end-of-service calculations. For SMEs, these documents are often scattered across emails and spreadsheets, making retrieval difficult when required by auditors or authorities. In Oman, payroll records support multiple regulatory touchpoints, from labour inspections to financial audits and corporate tax reviews. Muscat Payroll WPS Compliance is strengthened when payroll documentation is organized, consistent, and aligned with accounting entries. This level of discipline reduces the cost and stress of compliance events, as information is readily available and defensible. From a practical advisory standpoint, clean records also enable better business decisions. Owners can assess staff costs accurately, plan hiring, and evaluate productivity without relying on assumptions. Payroll records, when properly maintained, become a management tool rather than a compliance burden.

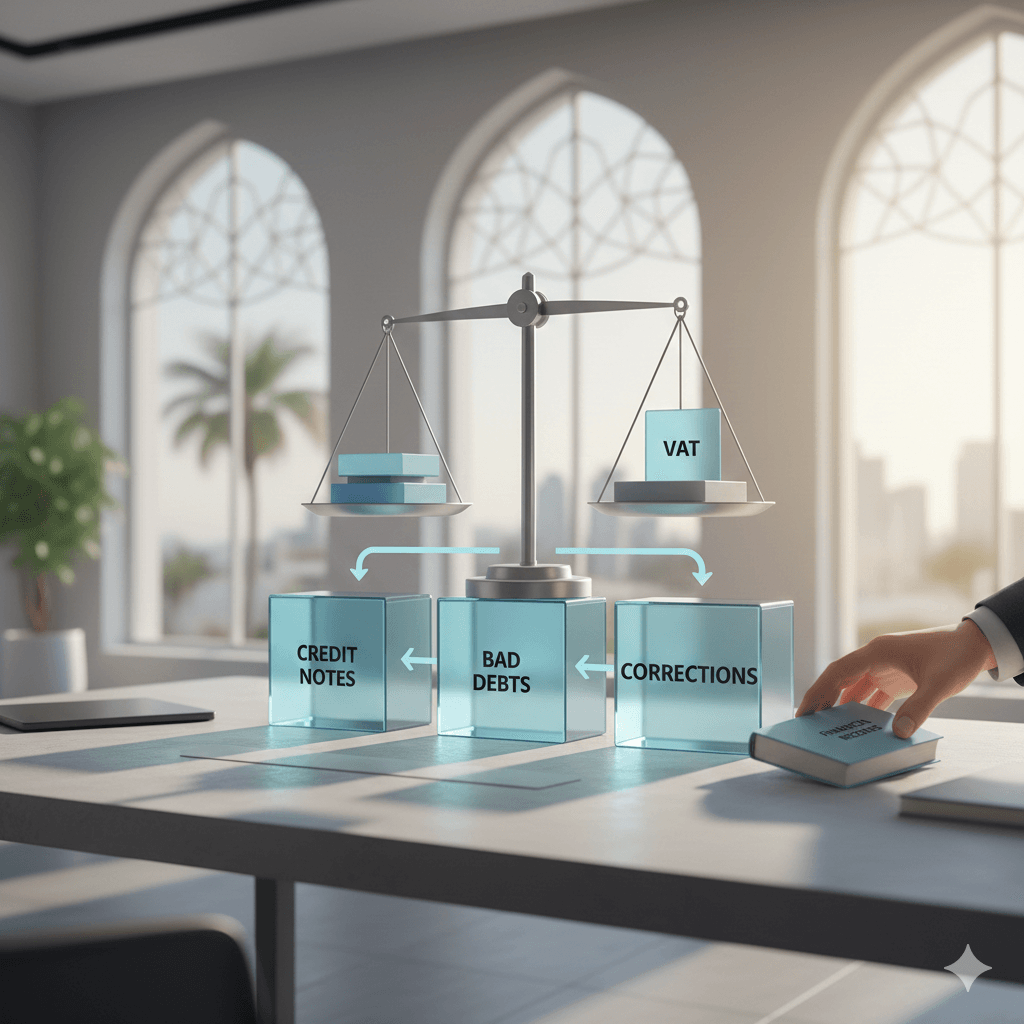

Muscat Payroll WPS Compliance and SME Risk Management

Connecting payroll to wider financial health

Muscat Payroll WPS Compliance plays a subtle but critical role in overall risk management for SMEs. Payroll is often the largest recurring expense, and errors in this area can distort financial statements and misinform decision-making. Inconsistent payroll records may lead to overstated profits, incorrect tax provisioning, or flawed cash flow forecasts. For Muscat-based entrepreneurs, these distortions become evident during financing discussions, valuations, or due diligence exercises. Advisors frequently identify payroll inconsistencies as early warning signs of deeper control weaknesses. Muscat Payroll WPS Compliance helps mitigate these risks by enforcing structure and transparency. When payroll data is accurate and timely, it supports reliable management accounts and smoother external reviews. This alignment becomes especially important as Oman’s regulatory environment evolves and expectations around financial reporting increase. SMEs that integrate payroll compliance into their broader financial controls position themselves for sustainable growth rather than reactive fixes.

Muscat Payroll WPS Compliance as a Foundation for Scalable Growth

Preparing SMEs for audits and expansion

For growing businesses, Muscat Payroll WPS Compliance is not just about meeting today’s requirements but about preparing for tomorrow’s complexity. As headcount increases, payroll errors multiply if systems and processes are not scalable. What works for five employees often fails at twenty. SMEs in Muscat that invest early in structured payroll processes reduce future disruption when expanding operations, seeking investors, or undergoing audits. Muscat Payroll WPS Compliance supports scalability by standardizing how salaries are calculated, approved, and recorded. From an audit and advisory perspective, scalable payroll systems reduce the time and cost of reviews, allowing management to focus on strategy rather than corrections. Clean payroll also strengthens the credibility of feasibility studies, valuations, and restructuring plans. By viewing payroll as a strategic function rather than an administrative task, SMEs create a stable platform for long-term growth within Oman’s competitive business environment.

Muscat Payroll WPS Compliance ultimately reflects how seriously an SME treats its people, finances, and regulatory responsibilities. When payroll is handled with clarity and discipline, it strengthens trust with employees and regulators alike while supporting accurate financial reporting. For business owners in Muscat, this approach reduces uncertainty and creates a predictable operating environment where decisions are based on reliable data rather than assumptions.

By aligning WPS processes, allowance structures, and recordkeeping practices, SMEs gain more than compliance; they gain control. Payroll becomes a source of insight rather than risk, supporting audits, tax reviews, and advisory engagements with confidence. In a market where transparency and accountability are increasingly expected, Muscat Payroll WPS Compliance stands as a practical foundation for resilient and well-managed businesses.

#Leaderly #MuscatPayrollWPSCompliance #Oman #Muscat #SMEs #Accounting #Tax #Audit